Foreign Exchange Rates, 1913-1941: Just Looking At the Data

March 30, 2014

Although there is plenty going on today to talk about, not to mention my perennially neglected Traditional City stuff, I seem to be getting drawn back again and again to the 1914-1941 period in economic history. A great many misconceptions today stem from that time. It is like a childhood trauma that needs to be dealt with to resolve issues in the present adult. Although a lot has been said about that time, most of it is alas garbage. I find it is often best to start by just looking at what is available, and coming to some basic and obvious conclusions, rather than trying to shoehorn the historical evidence into some preconceived agenda, which is what most other works consist of.

I’ve mentioned this before:

April 15, 2012: Foreign Exchange Rates 1914-1941

September 30, 2012: Currency Devaluations of the 1930s

The source is the same: the Federal Reserve’s Banking and Monetary Statistics, which you can get from clicking on the above link. I’m surprised at how many people have downloaded this, and continue to do so, which indicates continuing interest in what is certainly a very wonky topic.

So, I dug into it. This is slow, laborious work but perhaps I’ll be able to chew through it over time.

Let’s start by reviewing what was going on with the two major international currencies of that time, the British pound and the U.S. dollar.

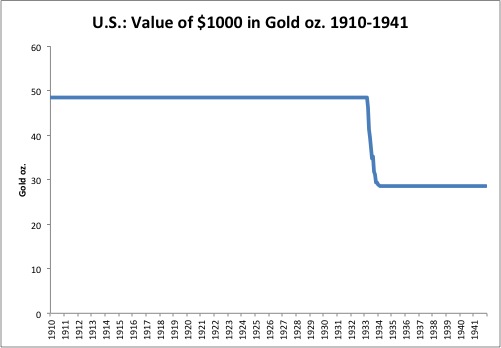

I’m making some assumptions here, such as that the value of the dollar was $20.67/oz. (officially) in the wartime period and through the 1920s, although that was certainly not the actual case, as we looked at previously. There were a lot of capital controls during wartime and soon afterwards.

December 23, 2012: The Federal Reserve in the 1920s 4: The Historical Record

December 16, 2012: The Federal Reserve in the 1920s 3: Balance Sheet and Base Money

November 25, 2012: The Federal Reserve in the 1920s 2: Interest Rates

November 18, 2012: The Federal Reserve in the 1920s

March 25, 2012: The U.S. Dollar During WWI and the Recession of 1920

Of course we can see the dollar devaluation of 1933, and the resumption of the dollar gold standard at $35/oz. from 1934.

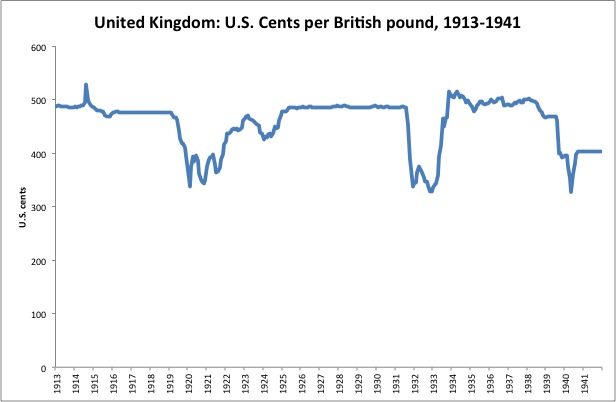

Here is Britain. The devaluation of the British pound after floatation in 1914 is not really apparent here due to forex capital controls during wartime. It becomes more apparent after those controls are lifted after the war’s end. The pound was returned to its prewar gold parity in 1920-1925. We see the British devaluation in September 1931 — remember, this was the world’s premier international currency at the time, so it was a big deal. The dollar devaluation of 1933 really returned the pound/dollar exchange rates to their previous levels. Unlike the dollar, the British pound floated after 1931, although it didn’t lose much value until just before the war. Nevertheless, the fact that the U.S. dollar returned to a gold standard system and the British pound remained a floating currency pretty much cemented the transition of international currency leadership from Britain to the U.S. during this time, further solidified during WWII and soon afterwards.

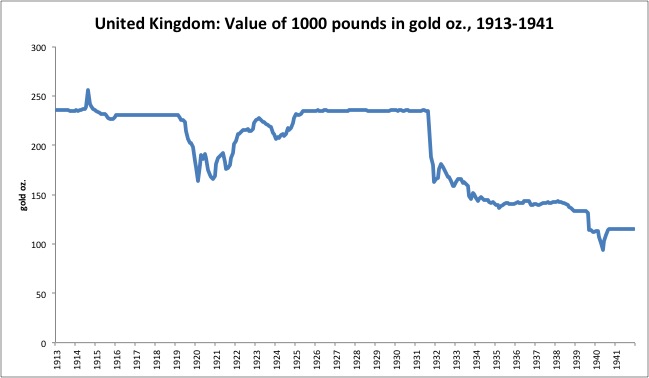

Here’s the value of the British pound in terms of gold. Again, we are assuming that the dollar’s value was $20.67/oz. during WWI, which wasn’t really the case. But, that’s the only data I have.

What I am referring to “capital controls” below is a notation in the data that the rates are “nominal for at least five days during the month.” There may have been various forms of capital controls previous, and further measures afterwards. But, when a foreign exchange rate becomes “nominal,” you can bet things are locked down pretty tight.

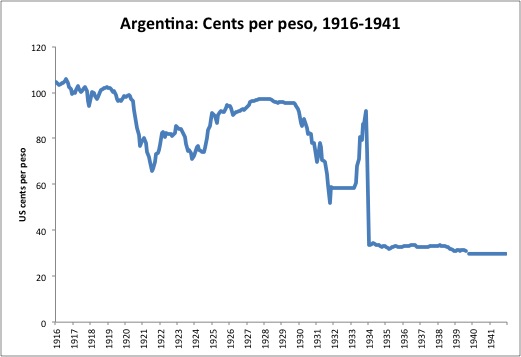

Argentina:

Here is the exchange rate between the Argentine Peso and the US dollar, from 1916-1941, as represented in U.S. cents per peso. Obviously, we begin in the middle of World War I, when most all currencies in the world were floating. The peso here provides an interesting view because it is apparently a freely floating rate, while it seems that a lot of forex rates were heaving managed using capital controls during that wartime period. During the early 1920s, there is an effort to correct for some of the wartime devaluation by raising the value of the currency, along the lines of what was happening in both Britain and the U.S. at that time.

Here’s what it looks like compared to gold. (Here we are again assuming that the dollar’s value was linked to gold at $20.67/oz. during the WWI period, which wasn’t really the case.)

Argentina transitions from a “gold peso” (obviously it wasn’t pegged to gold during this time) to a “paper peso” on December 10, 1933. The “gold peso” was stabilized vs. gold in 1932. However, as the U.S. dollar was devalued in 1933, the forex rate between the gold peso and the dollar rose, which introduced negative trade influences. This led to a devaluation of the peso (“paper peso”) soon afterwards, not only adjusting for the U.S. dollar devaluation but exceeding it. This was the “competitive devaluation” or “beggar-thy-neighbor devaluation” approach popular during that time period. After that 1933 devaluation, the peso is quite stable vs gold for the remainder of the period, although there is some variation. Capital controls were imposed after April 1933, through 1941. In effect, thse forex rate becomes an “official” rate rather than the “free” rate, because the point of capital controls is that foreign exchange isn’t “free” anymore, but rather controlled.

Note that I am extrapolating the gold value of the peso (and other currencies) by using average US dollar/gold ratios for 1933 and also average foreign exchange rates. This naturally leads to a bit of wiggle. If the line is mostly flat but has a bit of wiggle in 1933, that probably means the currency was linked to gold (without the wiggle) during that time.

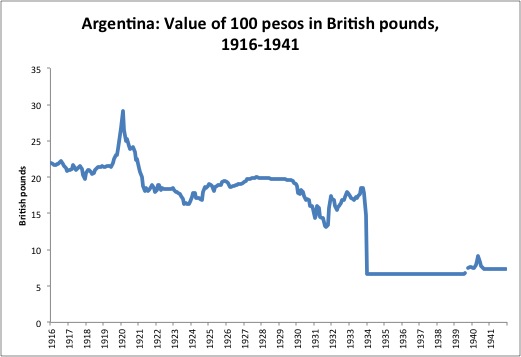

Because this was the time of transition from the British pound to U.S. dollar for international currency leadership, it is worthwhile to look at peso/pound rates as well. As we can see, the peso was kept in a fairly tight (for Argentina) range with the pound. After 1933, the peso is basically linked to the pound, via capital controls as previously mentioned. So, in Argentina’s case, the British pound remained the reference currency (as was predominant pre-1913), although the pound floated while the dollar remained gold-linked.

Australia:

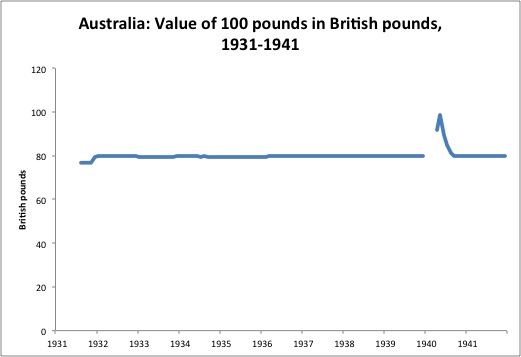

The Australian pound basically remained linked to the British pound after the British devaluation in 1931.

Capital controls were imposed beginning in May 1934, through to 1941 and beyond.

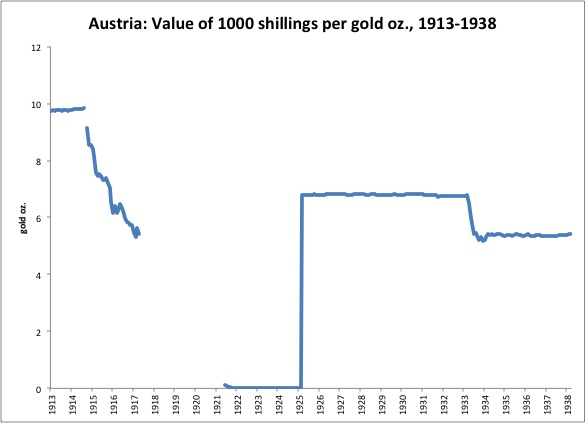

Austria:

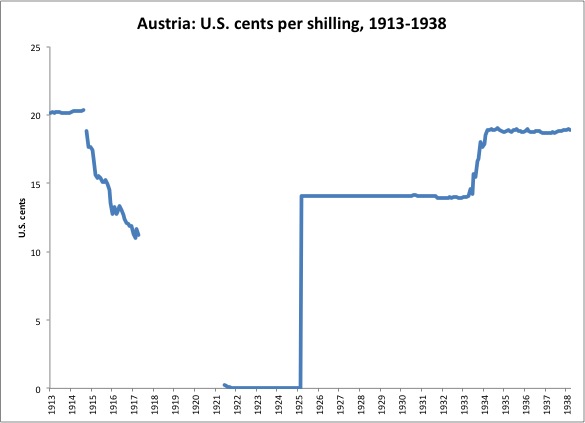

Like Germany, Austria had hyperinflation after WWI. The Austrian krone was actually repegged to gold in September 1922, at the devalued rate. In March 1925, the krone was replaced with the shilling, which was basically the same with four fewer zeros. As befits a country that had just experienced a hyperinflation, Austria did not follow the British pound lower in 1931.

However, when the U.S. devalued in 1933, the Austrian shilling was apparently devalued alongside somewhat, although the degree of devaluation was not as great as for the U.S. dollar. The trade pressures of the time pushed even hard-money-loving Austria to devalue. This is common when the major international currencies devalue. The same thing happened to the Swiss Franc during the 1970s.

Germany’s annexation of Austria in March 1938 ends our story here.

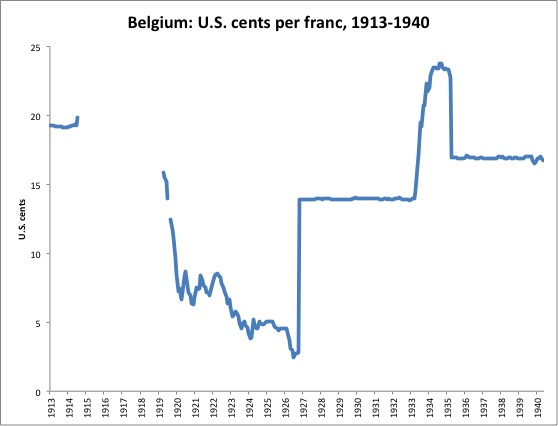

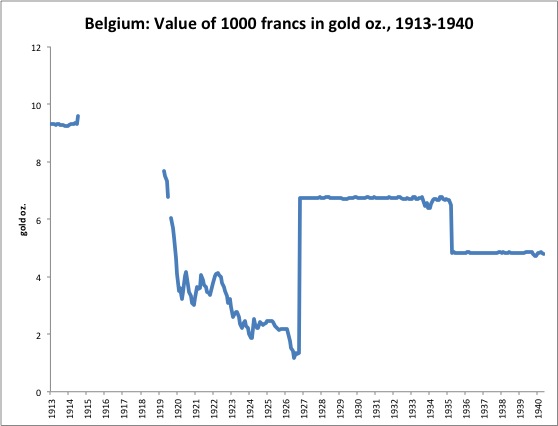

Belgium:

Belgium also experienced devaluation during WWI and a few years afterward (probably following the French franc). In October 1926, the franc was retired and replaced with the gold-linked Belgian belga. The belga was worth five francs; the gold link was basically at the prevailing value of the franc when it was repegged to gold. (All of this mirrors France.) Belgium did not follow the British pound devaluation in 1931.

However, the devaluation of the U.S. dollar in 1933 put competitive trade pressures upon Belgium, which responded with a devaluation in April 1935. Belgium remained on a gold standard system afterwards, unlike others who continued to float. World War II intervened in 1940.

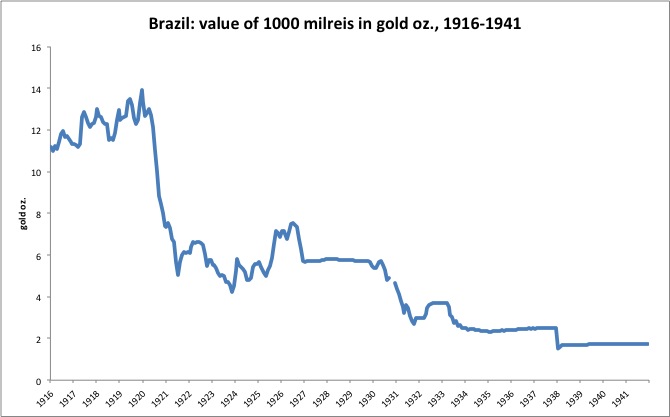

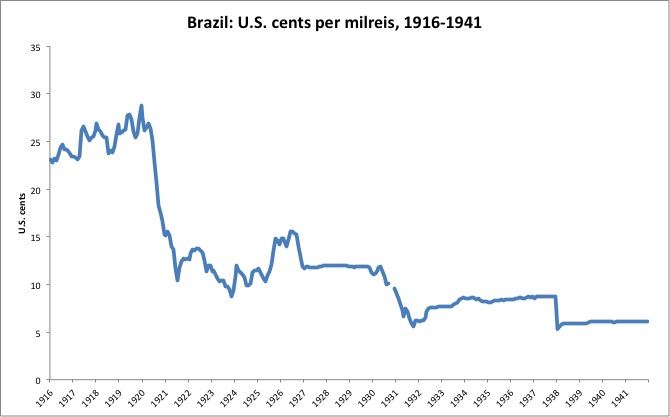

Brazil:

We begin Brazil’s story in the middle of WWI. The value is stabilized (by Brazilian standards) in the early 1920s and linked to gold in December 1926. However, Brazil pre-empts Britain and begins to devalue in November 1929 (quick!), although modestly at first in a slow slide. During the U.S. devaluation in 1933, Brazil follows the U.S. dollar lower, maintaining almost-fixed exchange rates. Another devaluation follows in 1938.