Getting More Depressing All the Time

May 31, 2009

The U.S. government’s response to the situation — and also that of other governments, because they all play monkey-see-monkey-do — is looking more and more like that of the Great Depression.

It didn’t start out that way. We started with the fallout of a huge housing bubble, not a global tariff war. At first, the U.S. government seemed to be fairly committed to not raising taxes in the face of recession. The lefty Obama even talked about a tax cut in the election (promptly forgotten as usual).

But, over time, things have been getting more and more Depression-like.

I’ve said before that a government’s primary avenues of action are spending, taxing and regulating. Plus, messing with the currency.

Spending is clearly UP, although not so at the state and local levels. This is not such a bad thing, especially the welfare-type stuff, but if it is pursued excessively it can create large deficits, which lead to …

Taxes going UP. The fear of budget deficits, always and everywhere, is what led mostly conservative leaders to enact ridiculous tax hikes around the world, notably a huge leap in the top income tax rate to 63% from 25% in 1932. Herbert Hoover also tried to institute a national sales tax, but this was blocked in favor of a grab-bag of excise taxes. Taxes look like they’re headed higher today. Unfortunately, with the combination of the cancellation of the Bush tax cuts, plus state and local income taxes, a lot of people face near-50% marginal tax rates today anyway, and that doesn’t count payroll taxes (which didn’t exist in 1932). So, Herbert Hoover’s sales tax (today’s VAT) is making a reappearance, and right on time too.

I don’t think politicians today care too much about deficits. Republicans and Democrats together have embraced Dick Cheney’s “deficits don’t matter” idea. Cheney was probably first exposed to this idea in December 1974, as part of his discussion with Art Laffer about enacting a major tax cut to deal with the economic problems of the time. The idea was to counter the knee-jerk conservative notion that the recession-caused deficits needed to be countered with tax hikes. The benefits of the tax cut were worth the risk of a larger deficit, and in the long run, the improved economy would result in more government revenue, not less. That was the idea. Politicians today have taken it to mean it’s OK to blow a lot of taxpayer dough on whatever your pet project happens to be (war in Iraq, “stimulus” spending etc.).

However, even Democratic politicians are getting the idea that maybe their ambitious spending schemes and attendant mega-deficits (mostly foreign financed) aren’t working out so well. The bond market is clearly choking on the new issuance. Does that mean that — just maybe — their strategy of vomiting money all over the landscape (and into bankers’ pockets) needs reconsideration? Of course not. Politicians are never wrong. It means that taxes have to go up!

Currency is being DEVALUED. Most countries in the world devalued their currencies in 1931, and the laggards (U.S. and France notably) caught up in 1933 and 1936. Governments always reach to currency devaluation in hard times. Today is no different. And, they always pay the price. “You can’t devalue yourself to prosperity,” it is said. How could any country possibly become wealthy just by fooling with the value of their currency? If there was even one example of success, everyone would emulate it. However, it is possible to devalue yourself to a short-term improvement in economic statistics.

Governments in the 1930s had at least a little discipline. They contented themselves with a one-time devaluation, which wasn’t really all that effective. Today’s economists have built their careers on the idea that the devaluation was ineffective because it wasn’t nearly big enough — not because it is inherently ineffective. It looks like Ben Bernanke wants to run a little experiment in that regard.

I’ve said before that this sort of thing is entirely contrary to the principles of economic success, which we know as the Magic Formula:

Low Taxes

Stable Money

November 10, 2008: “Austerity”

November 2, 2008: “Stimulus”

September 21, 2008: The “Lowering Interest Rates” Boondoggle

September 14, 2008: Depression Economics

December 10, 2006: The Magic Formula

In the early 1930s, economists pointed to the example of the 1920 recession as a situation where the economy quickly righted itself, apparently with no government involvement. See, we can just do nothing and it fixes itself! Even today, some conservative-leaning economists are again pointing to the 1920 example.

But, if you look a little closer, the 1920 situation was not just about “doing nothing.” It was actually an example of a government lowering taxes and making money more stable.

After World War I (ending in 1918), the economy was going to go through a period of adjustment in any case, as war-related demand disappeared and soldiers were demobilized (“fired”). In addition, at the end of the war, the top U.S. income tax rate was a whopping 77%!

Also, the newly-created Federal Reserve was being pressured by the U.S. Treasury to undertake a new project. The federal government had added a lot of new debt during the war, and wanted to keep its interest payments on the debt low. So, it instructed the Fed to engage in open-market operations to keep a lid on interest rates. (I don’t know if this was done on the short end or through buying long-dated debt. Probably both.) This caused the dollar’s value to sag compared to its promised gold parity. The Fed eventually said: “Sorry, we’re not playing this game anymore.” It then contracted the monetary base to bring up the value of the dollar to its gold parity at $20.67/oz., roughly its value since 1789.

(You’ll remember that the same thing happened after World War II as well, until the Fed refused in the Accord of 1951.)

The monetary base fell from a peak of $7.330 billion in October 1920 to a low of $6.085 billion in January 1922. A decline of 17%!

This was, of course, a monetary deflation, but it was only to correct the relatively small inflation that took place during the war and soon afterwards. The dollar was only returned to its long-term value at $20.67/oz.

So, although there were certainly short-term “deflationary” effects, it was more in the nature of a “disinflation.” Certainly, the Fed was abiding by the principle of Stable Money.

President Woodrow Wilson cut the top tax rate to 73% in 1919. In the 1920 election — the depths of the 1920 recession — Warren Harding promised a “return to normalcy” regarding the tax system. Since the top income tax was 7% before the war started, this could be interpreted as a whopping big tax cut. Of course he was elected.

Thus, although it was still just the election, in 1920 people heard the Fed promising to abide by the gold standard, and Harding promising a huge tax cut.

Nonfarm unemployment reached 20% in 1921, but it was back under 5% in 1922. Harding managed a reduction in the top tax rate to 57% in 1921, and an elimination of an excess-profits tax. In 1923 and 1924, more tax cuts reduced the top tax rate to 46%, and in 1925 it was cut to 25%. The economy began to roar.

Think about what might have happened in 1920 if:

a) The Fed was encouraged to “lower interest rates” and devalue the currency even further, resulting in a break of the dollar’s gold link and inflation;

b) The government, worried about its dwindling popularity, showered money on all its political supporters, calling this “stimulus.” Big deficits result;

c) High income tax rates from the war weren’t lowered, and in the recession, a new VAT was introduced.

What would the 1920s have looked like then?

Maybe some enterprising PhD student will study the 1920 recession in more detail.

* * *

A VAT tax in the US?

Certain Republican types have argued for years that the best tax system would be a national sales tax. No income, corporate, capital gains, payroll, inheritance etc. etc. taxes, just one simple tax on sales. It’s an idea with merit, although I personally prefer a bit of “progressivity” in tax systems, more like the Kemp-style flat tax.

This is completely different.

This is a brand new VAT (like a sales tax) on top of our existing tax system, which is none too generous as it is. Yowza! That could be truly disastrous — not only because of the economic implications of the tax itself, but also because tax hikes tend to depress demand for currency, which typically translates into downward pressure on currencies. So, we’d have a) downward pressure on the dollar, and b) pressure on Ben Bernanke to do something about the economy that’s crapped-out by the new VAT tax, and you know what that means for Mr. One Trick, right? More downward pressure on the currency!

The Washington Post reports:

http://www.washingtonpost.com/wp-dyn/content/article/2009/05/26/AR2009052602909_pf.html

With budget deficits soaring and President Obama pushing a trillion-dollar-plus expansion of health coverage, some Washington policymakers are taking a fresh look at a money-making idea long considered politically taboo: a national sales tax.

Common around the world, including in Europe, such a tax — called a value-added tax, or VAT — has not been seriously considered in the United States. But advocates say few other options can generate the kind of money the nation will need to avert fiscal calamity.

At a White House conference earlier this year on the government’s budget problems, a roomful of tax experts pleaded with Treasury Secretary Timothy F. Geithner to consider a VAT. A recent flurry of books and papers on the subject is attracting genuine, if furtive, interest in Congress. And last month, after wrestling with the White House over the massive deficits projected under Obama’s policies, the chairman of the Senate Budget Committee declared that a VAT should be part of the debate.

“There is a growing awareness of the need for fundamental tax reform,” Sen. Kent Conrad (D-N.D.) said in an interview. “I think a VAT and a high-end income tax have got to be on the table.”

A VAT is a tax on the transfer of goods and services that ultimately is borne by the consumer. Highly visible, it would increase the cost of just about everything, from a carton of eggs to a visit with a lawyer. It is also hugely regressive, falling heavily on the poor. But VAT advocates say those negatives could be offset by using the proceeds to pay for health care for every American — a tangible benefit that would be highly valuable to low-income families.

Liberals dispute that notion. “You could pay for it regressively and have people at the bottom come out better off — maybe. Or you could pay for it progressively and they’d come out a lot better off,” said Bob McIntyre, director of the nonprofit Citizens for Tax Justice, which has a health financing plan that targets corporations and the rich.

Hoo boy, does that sound uber-horrible.

Federal tax receipts haven’t been doing too well:

Federal tax revenue plunged $138 billion, or 34%, in April vs. a year ago — the biggest April drop since 1981, a study released Tuesday by the American Institute for Economic Research says.

When the economy slumps, so does tax revenue, and this recession has been no different, says Kerry Lynch, senior fellow at the AIER and author of the study. “It illustrates how severe the recession has been.”

For example, 6 million people lost jobs in the 12 months ended in April — and that means far fewer dollars from income taxes. Income tax revenue dropped 44% from a year ago.

“These are staggering numbers,” Lynch says.

Big revenue losses mean that the U.S. budget deficit may be larger than predicted this year and in future years.

http://www.usatoday.com/money/perfi/taxes/2009-05-26-irs-tax-revenue-down_N.htm

Democrats are still kicking around ideas of how to “fund” a National Health Care System.

I say: it’s already funded!

The best system, especially given our present situation, would probably be a fully government-operated system, just like the existing Veteran’s Affairs hospital system. Instead of having to be a veteran to get in, you just need to be a US citizen.

This would require hospitals, of course. The U.S. already has plenty of hospitals, including many private ones that are about ready to shut down. The government could make bids for private hospitals below the cost of building a new facility. There would probably be many thankful sellers.

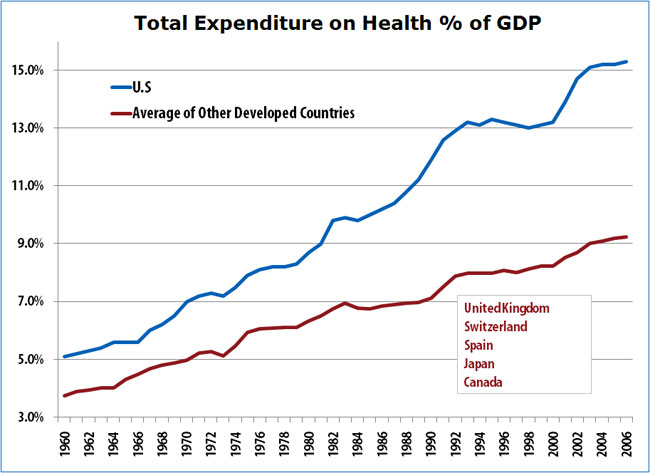

Then, you set a budget of perhaps 6% of GDP (possibly shared with states), to run them. This would be a budget-driven system, not a “needs” (wants/entitlements/profit) based one. The existing Medicare/Medicaid system would be phased out. There wouldn’t be any more Medicare entitlements fright stories, because we would already know what the budget 10 years from now would be. It would be 6% of GDP.

The US government (all levels) is already spending about 7.5% of GDP on health care. Or, to put it another way, the US government (all levels) is already spending about 22% of all health care spending in the world. That is plenty. So, this would actually be less than the present level of spending, which of course means no new taxes.

Like maintaining roads and delivering postage, this is something that governments are passably good at. Say what you want about the communist states like the Soviet Union or Cuba — they tended to have pretty good medical care.

Employers would be ecstatic. They would be free of health care obligations for most of their employees. Maybe the upper management would get some additional private-sector benefits.

Even doctors might like it. They would work 40 hour weeks and be free of malpractice risks.

I suppose some people wouldn’t be too happy with the level of care that they got at the Public Health hospitals. No problem. You can also go to a private hospital, if you are willing to pay up for it. Which is just the same as today’s system, without the public hospitals.

This would radically change the incentives from the profit-driven one of providing the least health care for the most cost to a budget-driven one of providing the most health care for the least cost.

* * *

Recent Federal Reserve internal paper showing “need” for -5% interest rate.

http://www.frbsf.org/publications/economics/letter/2009/el2009-17.html

* * *

I was reading about a fellow who broke his arm recently. He had an ambulance trip to the hospital and a half-day of care. It cost him over $100,000! For a broken arm? Even a fancy lawyer bills at only $500 an hour. What should four hours and some plaster cost? Don’t you think that’s a little ridiculous? I know many people think that’s ridiculous but they keep paying anyway. Can you imagine a sorrier bunch of serfs?

There’s a restaurant in town here that used to be a small hospital. On the wall they have a copy of a bill from 1944. It’s for a baby delivery, and includes a full week in bed, which is how they did things in those days. The total cost was $42. Even adjusting for inflation, that’s about $600 in today’s terms. Think about that.