Gold Is Stable in Value 2: Interest Rates

April 17, 2011

We’ve been looking at some evidence to support the assertion that gold is stable in value. Unfortunately, this is harder than it sounds because there is no measure of perfectly stable value against which we can compare gold. So, instead we look for evidence that gold’s value changed, by some meaningful amount. Our first look was at long-term commodity prices. I concluded that commodity prices showed basically what you would expect them to show if gold were stable in value. Actually, I would say that commodity prices showed even more stability than one would normally expect.

April 10, 2011: Gold is Stable in Value

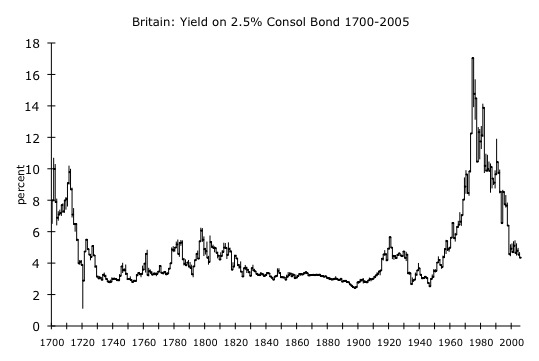

Now we will look at interest rates. If gold is stable in value, then interest rates on debt denominated in gold would be very low, and stable. That is exactly what we see:

This is the chart of the yield on British Consol Bonds from 1700-2005. A Consol was British government debt with an infinite maturity.

There is quite a bit of turmoil at the beginning, because there was a bit of currency kerfuffle and things were still settling down from the floating-currency period before 1698. However, by the 1730s things settle down. There’s a bit of a lift in the 1780s, which I ascribe to the American Revolution, and then another lift in the 1798-1821 period, when the pound was actually a floating currency during the Napoleonic Wars. After the pound was repegged to gold again in 1821, things settle down again and we have a full century of basically flatline interest rates, until World War I. I suppose someone will complain about the gentle drop in interest rates around 1880-1900, but remember the foreshortening effect of such a long timeframe. This is a move of about 50bps over twenty years! 2.5 bps a year! Today, we have moves of 2.5bps per day, every day.

Some people will look at a chart like this, and they will see all they need to know regarding gold as a basis for monetary systems. Other people just see a wiggly line.

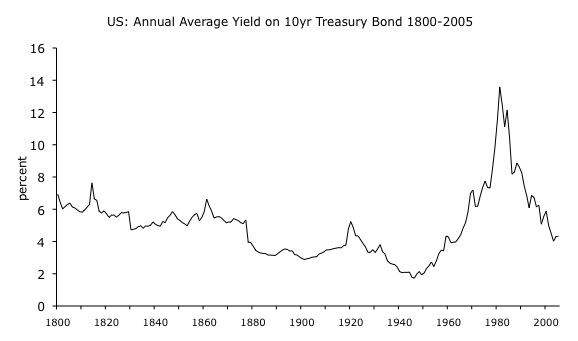

Once again straight from my book, here’s a similar chart for U.S. yields. These are quite a bit higher, because the U.S. was an “emerging market” during the 19th century. The U.S. government had a hyperinflation and near-default in the 1780s-1790s, so investors were a little nervous. From 1860 to 1879, the dollar was a floating currency due to the Civil War. However, once the dollar was repegged to gold in 1879, yields fell to British-like levels around 3.5%. During the 1950s and 1960s, yields rose even though the U.S. was nominally on a gold standard, due to the increasing influence of Keynesian ideology, which led to a major devaluation during the 1970s. So, I would say that the 1800-1860 period represents the U.S. during its “emerging market” phase, with a gold standard, and the 1880-1914 period represents the U.S. during its “developed market” phase, with a gold standard.

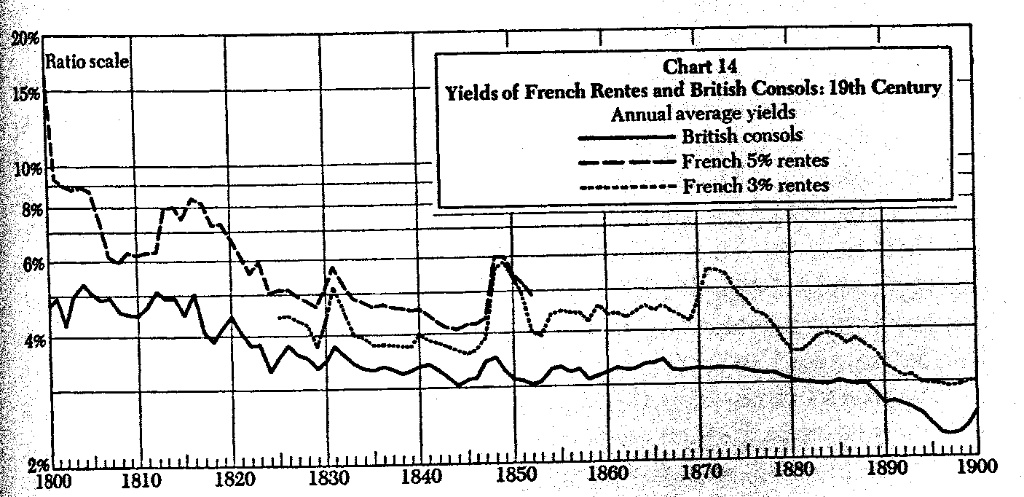

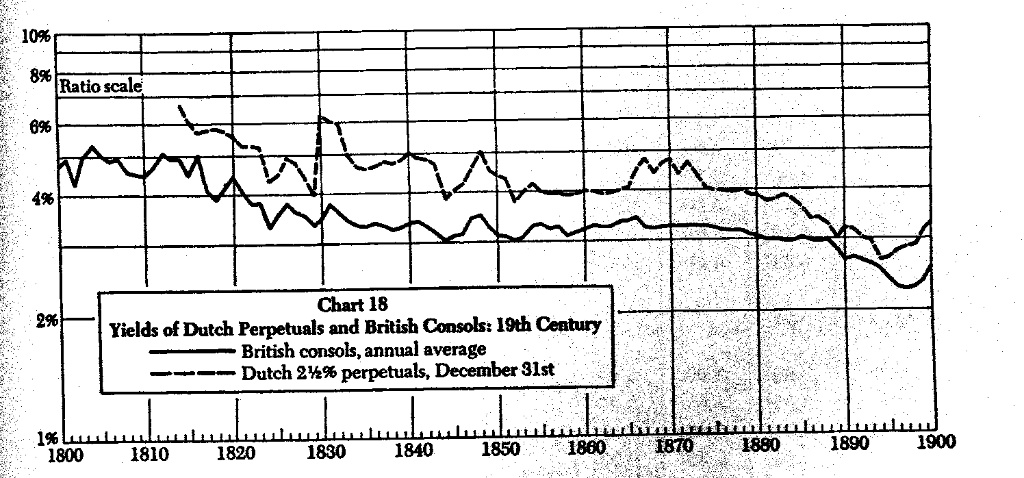

Unfortunately, that is about it in terms of detailed information on interest rates. You can find quite a bit more information in Sidney Homer’s book A History of Interest Rates. Also, there may be some time series data at globalfinancialdata.com, for a fee. To summarize, during the 19th century, European government bonds typically traded at a “spread” to British Consols, just as government bonds trade at a spread to German debt today. Before then, the data is rather spotty and anecdotal. The idea that a government is a “risk free” credit is a rather modern notion. However, even back to Roman times, the best borrowers were typically paying about 3.5%-5% on gold-denominated loans.

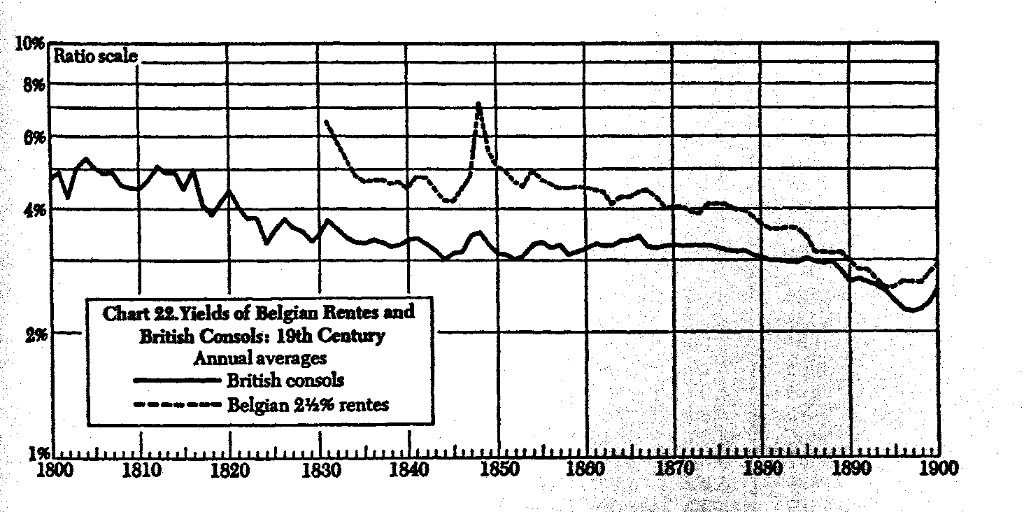

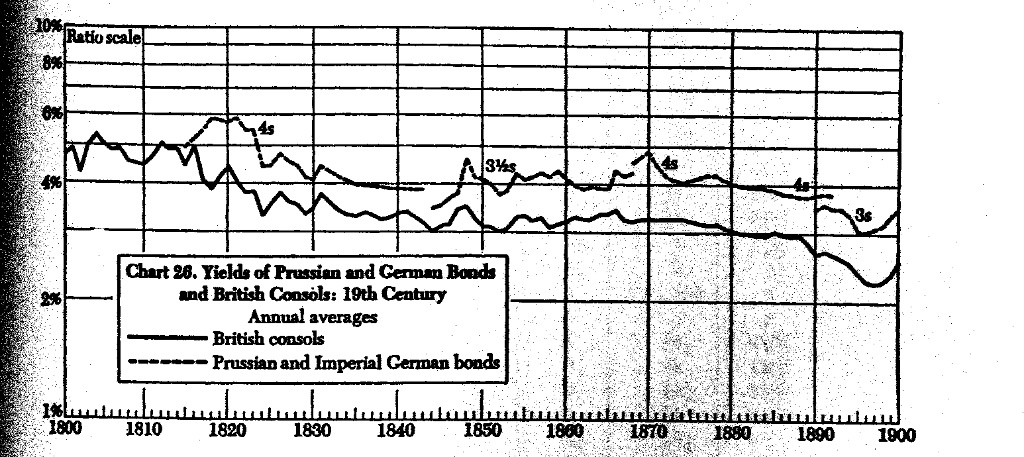

Sidney Homer provides some graphs of European government bond yields during the 19th century. I’m not sure they are particularly illustrative of anything, except that lower-quality credits trade at a spread to the best-quality Consols, but here they are:

In conclusion, I would say that the record of interest rates is about what one would expect to see if gold were stable in value.