Back in 2012, we looked at what the Federal Reserve was up to in the 1920s.

December 23, 2012: The Federal Reserve in the 1920s 4: The Historical Record

December 16, 2012: The Federal Reserve in the 1920s 3: Balance Sheet and Base Money

November 25, 2012: The Federal Reserve in the 1920s 2: Interest Rates

November 18, 2012: The Federal Reserve in the 1920s

I can’t believe over a year has passed since then. But, I was finishing my book. Finally, we can continue our story, taking it into the 1930s.

We will extend our charts up until 1941, which provides a nice perspective for the entire interwar period. The source of the data is here:

http://fraser.stlouisfed.org/publication/?pid=38

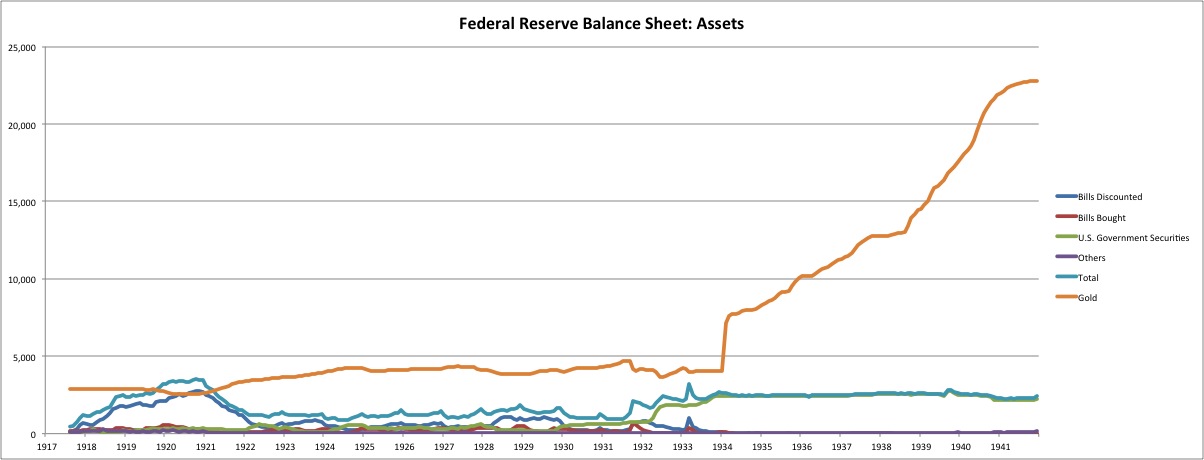

Virtually all the increase in Fed assets during the 1930s was in the form of gold bullion. I expect this was driven primarily by Europeans protecting their capital from war and the distress of the Great Depression. The United States also had difficulties during the Great Depression of course, but it wasn’t as bad as in Europe, where there were many sovereign defaults, bank failures, currency devaluations, and of course the rise of fascist governments throughout the continent. Scary!

The big jump in gold holdings in 1934 was related to the devaluation of the dollar at that time. The physical amount didn’t change, it just got revalued at $35/oz. instead of $20.67. Although the U.S. devalued, it then repegged to gold in 1934. Most countries, including Britain, devalued but did not repeg to gold. Instead, they had a floating fiat currency up until formally rejoining the world gold standard system in 1944 with the Bretton Woods Agreement. Thus, the U.S. was a relative safe haven. Plus, of course, there was no real risk of a land war in the U.S. itself, and the political system probably seemed a lot more stable than in other countries at that time.

We also see that the Fed was fairly active with its “open market operations” in the 1920s (which we documented in 2012), in this way mimicking the normal operating procedures of the Bank of England, which was the example everyone imitated in those days (I call this an Example #5 System in my book). However, after 1934, open-market operations basically cease, and the Fed essentially operates as a simple bullion/base money currency board, or what I call an Example #2 System in my book Gold: the Monetary Polaris. This imitates the way the Bank of England Issue Department operated.

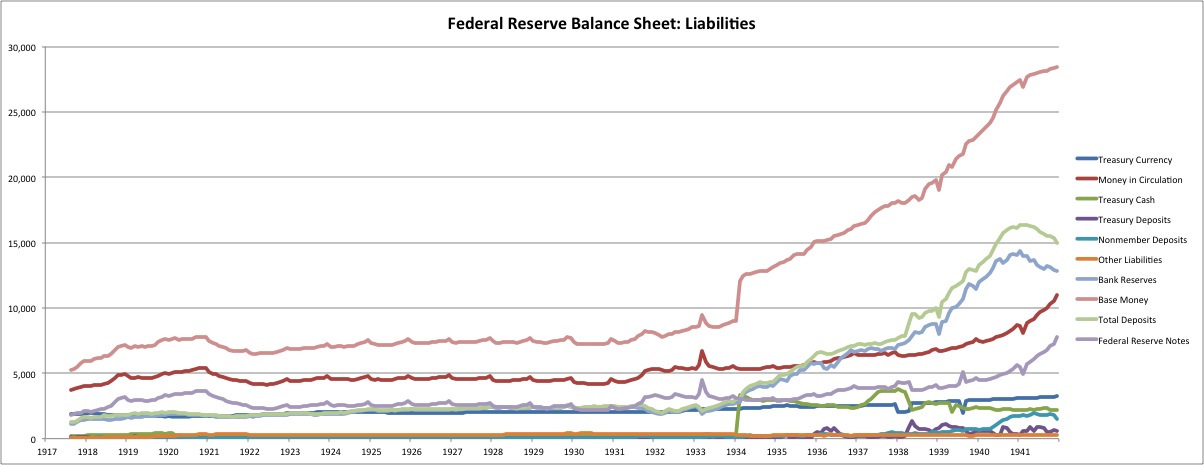

The Liabilities side of the Fed balance sheet of course includes base money, including banknotes and deposits at the Fed. Base Money also makes a big jump in 1934, but this is apparently due to the corresponding jump in Treasury Cash at the Fed, which is apparently related to the 1934 devaluation. The increase in assets due to the gold revaluation was offset by an increase in liabilities in the form of Treasury Cash, which the Treasury was then apparently able to spend as it saw fit. For this reason, I included Treasury Cash in base money, thus creating the rather large jump in 1934, although that was mostly an accounting artifact related to the devaluation. Money in Circulation (banknotes and coins) doesn’t make any particular rise at this time. We also see a big rise in Bank Reserves, beginning gradually in 1934. This is to be expected; banks would want to hold more reserves due to the risky environment of that time. If anything, I am a little surprised that this did not start to rise earlier.

The rise in banknotes beginning around 1939 might be related to increasing international usage of dollar banknotes, in light of failing currencies worldwide and political turmoil, including large-scale military invasions.

From this we can see that the Fed was not particularly expansionary in the 1920s, nor particularly contractionary in the 1930s. This is a bit of a myth, without any real historical evidence.

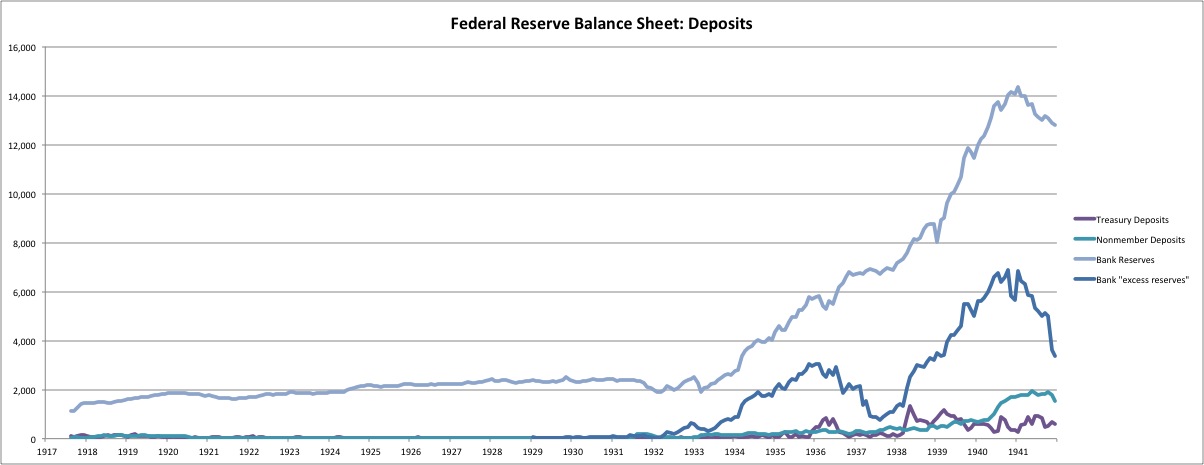

Here’s a little breakdown of deposits at the Fed, which consisted mostly of bank deposits (“bank reserves”). Plus, there is a little bit of Treasury deposits, and “nonmember deposits” which are probably foreign central banks.

There’s a little story behind the “excess reserves.” Apparently there was a change in the 1936-1937 period whereby the reserve requirements were raised. However, since reserves were already so high above the reserve requirement, this had little real effect except perhaps driving banks to hold more reserves, so that they would continue to have a large surplus above the requirement. This is not particularly “contractionary” in the context of a gold standard system, because the system itself will create more base money in response to the demand for it. Thus, if a higher reserve requirement created a higher demand for base money in the form of bank reserves, the gold standard system would accommodate this increased demand, which is of course exactly what happened, and is why base money and bank reserves rise so much in the latter 1930s. Because of this, there is never a “shortage of money.”

In general, people are far too eager to look for monetary explanations for the difficulties of the 1930s, when actually it was largely a fiscal (tariff/tax increase) event, combined with credit defaults including sovereign default and bank insolvency. Of course there were monetary problems too, including many currency devaluations, most of which were followed by a period of floating fiat currencies for most countries. The fact that the currency was floating was bad enough; there was always the possibility that the currency could be devalued again, or simply depreciate in a chaotic fashion, which indeed was the case in many examples.

I don’t see anything in particular here that suggests the Fed was particularly “contractionary” in the early 1930s, or in the 1936-37 period, as a result of an increase in reserve requirements at banks.

We will look at more info from the 1930s soon.