The “Money Supply” with a Gold Standard

January 2, 2010

Usually you hear a couple things about the “money supply” with a gold standard. The first thing you hear is that it is determined by gold mining. The second thing you hear is that it is limited to the amount of gold held “in reserve,” whatever that means. Sometimes you hear that it is determined by the “current account balance.” All of this is bunk.

Let’s look at the United States. The U.S., during the 19th century, had the most libertarian money and banking system you could imagine. Unlike Britain, where the Bank of England had an effective monopoly on currency issuance, it was pretty much a free-for-all in the United States. Anyone could issue money. Of course, nobody would accept this money unless it had a credible link to gold. The gold link was mandated by the Constitution of 1789, and they stuck to it (with some lapses, notably during the Civil War) until 1933.

The point here is that the idea of a gold standard was that the currency’s value would be linked to gold. The amount of currency would expand or contract, matching demand, such that the value remained stable. The actual amount of money was a residual, the aftereffect of the mechanism which kept the value stable.

The “dollar” was originally a European silver coin called the “thaler” which originated in 1518. Our “dollars” were basically the same value as those 16th century European coins until 1933, when there was a one-time devaluation, and the dollar was repegged at $35/oz. Today’s floating currency system dates from 1971.

The money supply of the United States in 1775 has been estimated at $12 million. This was mostly in the form of silver coins, mostly of foreign origin. The most common coin was the Spanish silver dollar, one of the “thaler” coins that Europe had been using since 1518.

February 28, 2010: A Gold Standard is a Value Peg

April 30, 2006: Value and Quantity

November 6, 2009: A Brief History of the Dollar

January 3, 2010: The GLD Standard

April 15, 2006: Where the Rothbardians Went Wrong

I think we should start here with the notion of “what is money?” So we know what we are talking about.

Money is what is today known as “base money.” It is mostly paper bills and coins, with some electronic bank reserves. Bank reserves are the “money” that banks use to pay each other. In the past, these bank reserves were also paper notes and coins. Because these were large transactions (between banks), you needed really big bills.

1918 $10,000 bill, used for large transactions

Remeber, a dollar was worth about 1/20th of an ounce of gold in those days. So, this bill was worth 500 ounces of gold, or about $700,000 today.

Surprising at it may seem, all monetary transactions today are done with base money (i.e. real money). You can’t pay a bill “with a credit card.” What actually happens is that the bank pays the bill with bank reserves (i.e. a bank to bank transaction), and then records that you owe the bank for the funds transfered. When you pay a bill “with a checking account,” what actually happens is that the bank pays the bill with bank reserves (base money), and then reduces the amount of money that it owes you (your checking account). All other “forms of money” are really forms of credit. You can tell because there is a counterparty. Who is the counterparty for a dollar bill? Theoretically, it is the Fed, but in fact the Fed is not obligated to do anything, at any time, just because you have a $20 bill. As opposed to a credit contract, which is a legal agreement between counterparties, money itself is something like a manufactured object. This is easy to see with a gold or silver coin. You have to manufacture the thing. Paper money is the same, but the costs of manufacturing are drastically lowered because it is made of paper instead of gold. Just like your blender, which is now made of plastic instead of stainless steel. However, if the money serves the same purpose as a gold coin — by having the same value as a gold coin — then it works just fine, even though it is made of paper instead of gold.

June 2, 2008: World Without Paper Money

April 21, 2007: Weights and Measures

April 15, 2007: The Value of Today’s Dollars in 1854 Dollars

To get back to our story, the money supply in the United States in 1775 was about $12 million, mostly of silver coin although there were already some banknotes floating about, issued by private commercial banks.

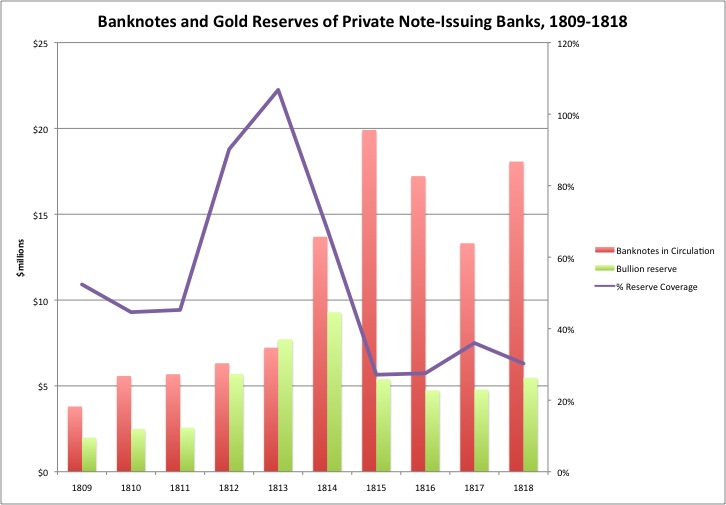

There was a hyperinflation in the 1776-1789 period, but for our story we will skip over that part. In 1809, a survey of the banking system recorded 92 reporting banks with total bank notes in circulation of $3.80 million. Plus whatever bullion coins were out and about. These banks held $1.99 million of gold (i.e. about 96,000 ounces at $20/oz.) as a “reserve” for their banknote issuance. By 1818, this had expanded to $18.07 million banknotes, with $5.47m of gold in reserve. The U.S. government itself had a bit of a funny episode of money printing, issuing $15.46 million of Treasury Notes during this time, but they were retired so that in 1818 the entire monetary system of the U.S. consisted of coins and these $18.07m of banknotes issued by private commerical banks.

Imagine the United States in 1809. It stretched from Georgia to Maine. There were no telephones or telegraphs in those days. This survey of 92 banks was the best they could do at the time. However, there may have been other banks issuing banknotes, not to mention coins being carried in from overseas and so forth. So what was the real money supply of 1809? The fact is that we don’t know. They didn’t know either. Did any of those 92 banks have any idea how many banknotes were being issued by the other 91? Of course not. It didn’t matter! The only thing that was important was that the value of the banknotes remained at its specified gold parity. This was done by the adjustment of supply. If the value of the banknotes was sagging compared to its bullion parity (i.e. people were bringing them in to be traded for bullion), then the issuance of banknotes was reduced. If the value was above the parity, more banknotes were issued.

Admittedly, this was a time of some turmoil, since it contained the War of 1812, some excess note issuance by banks in the South, issuance and redemption of Treasury Notes, and other turmoil. We’re just looking at the operations of commercial banks here.

For one thing, we see that the amount of gold in reserve has almost no relation to the amount of banknotes in circulation. The reserve coverage varies wildly. Second, we see that the amount of banknotes in circulation has no relation to the amount of gold at banks, the amount of gold in the world, the production of gold miners, or some such thing. The important thing for a gold standard is only that the supply matches the demand, producing a currency whose value is linked to gold. (The purple line and right axis shows the ratio of banknotes outstanding to bullion held.)

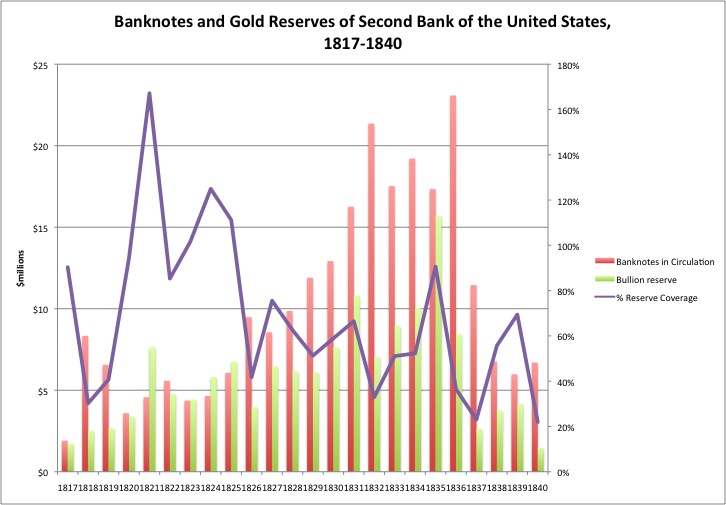

Now let’s move along to the 1817-1840 period. Here we have a similar graph, but for just one bank, the Second Bank of the United States. This was just one of many commercial, note-issuing banks, but it was the largest and most influential.

Here we see that the Second Bank of the United States had wildly varying banknote issuance, and wildly varying gold reserve coverage. There was no “steady expansion of the money supply due to mining.” There was no “100% reserve,” or even some stable reserve/issuance ratio. The total aggregate money supply of the United States was a lot more stable, of course. But they didn’t know that. They had no idea what all the other banks were doing, at least not in real time. The only thing that was important for them is that the value of their banknotes be maintained at their proper gold parity via the adjustment of supply.

Here we have some statistics for all commercial banks from 1833-1859. We end in 1859 because in 1860, the U.S. government began issuing “greenback” currency not-linked to gold, and the U.S. went off the gold standard until 1879. These statistics are from the Historical Statistics of the United States 1789-1945.

So once again, we see that banknotes in circulation is all over the map, and bullion reserves at commercial banks have fallen to under 20% in most situations. (The wild variations are due to a banking crisis that began in 1837. If your bank goes bust, then the banknotes issued by that bank were worthless.)

Beginning in 1860, the free-for-all libertarian banking system was reformed. The U.S. government organized the “National Bank Notes” system, whereby banknotes would only be issued by certain chartered banks. This was to assure people that their banknotes came from a reasonably respectable institution. There were lots of National Banks, however, not just a handful. After the removal of the “greenbacks,” the entire U.S. monetary system consisted of these National Bank Notes issued by private commercial banks. There was no government or Federal Reserve-issued money. Of course, all these National Bank Notes were linked to gold, via the mechanism of supply adjustment, with supply adjustment still performed on a bank-by-bank basis. However, the gold reserve for the National Banks was aggregated at the Treasury. The banks themselves held Treasury obligations (debt).

Typical National Bank Note, from the Annville National Bank of Annville, Pennsylvania (1918).

Let’s continue our story from 1880, when the dollar was returned to the gold standard at $20.67/oz. after the Civil War devaluation. By this time, silver has been demonetized, so we are effectively on a gold-only standard (monometallic) although this was not made official until 1900. The Treasury ended up holding a lot of silver in those days. Bullion reserves are given in gold-only terms and also in gold+silver terms, with the silver accounted for at market prices. This is the first time we have reliable system-wide statistics.

September 12, 2010: the Gold:Silver Ratio

Once again, we see that banknote issuance by no means stays in some stable 2% per year trend defined by gold mining, nor does it maintain any stable ratio with bullion reserves. Bullion reserves vary from 30% to 60% during this period. Counting gold alone (as you should, because this was really a monometallic standard), we see that they drop as low as 12% or so. What stayed stable during this time was of course the value of banknotes, as defined by their $20.67/oz. gold peg.

We have come to the end of our first century. We began in 1775, with the dollar pegged to gold near $20/oz., and we ended in 1900, 125 years later, with the dollar still pegged to gold near $20/oz. (in actuality there was a little bit of variation, but let’s just call it even point-to-point).

Remember that we began our show with $12 million of money, mostly in the form of foreign silver coins. In 1900, including gold and silver coins, we have $1,954 million of notes and coins, an increase of 163 times over 125 years.

So we see that a gold standard does not at all limit the money supply to some fixed quantity. The money supply increased by 163 times! However, the value of money was stable, at $20.67 per ounce of gold.

As it turms out, we have some statistics on world gold production going back to 1493. Let’s start our story in 1780:

From this we can see that the total amount of aboveground gold increased by about 3.4x. Not 163x. Three point four times. So explain to me again how it is that “money supply” is determined by “gold production”? Of course it’s baloney.

Why did the total currency in circulation expand by 163 times? Because the United States was an expanding economy. The population of the U.S. was 5.24 million in 1800 and 76.21 million in 1900. Plus, each of those people got a lot more wealthy during that time as well, due to the Industrial Revolution. Also, financial systems became a lot more complicated, so there were a lot more monetary transactions. With a different country, which didn’t enjoy such an amazing expansion during that time — China perhaps — you would have a totally different result, even with a gold standard. A gold standard is a system where supply is expanded (or contracted) to meet the demand for money, such that the value of money remains stable, i.e., pegged to gold. There was a lot of demand for money in the U.S., maybe not so much in China.

As I argued earlier, it’s a lot like today’s gold-linked ETFs:

January 3, 2010: The GLD Standard

An ETF is a lot like a paper currency in some ways. Both are “paper,” although an ETF is not even that. ETFs are supposed to have 100% bullion coverage, but in fact that is probably a bit of a fib. The point is, why does GLD have the “money supply” (shares outstanding) that it does today? GLD issues shares in response to market demand. If the market threatens to push the value of GLD above its gold bullion peg, more shares are issued. If people demand less GLD — they’re selling — then shares are purchased and removed from circulation to support the value, once again keeping it pegged to gold bullion. This is the exact mechanism that paper currency issuers used in the 19th century. It has nothing to do with mine supply, or gold reserve holdings. GLD does not go out and buy gold bullion, on a whim or something like that, and then issue shares in proportion to the bullion purchased. No no no. It’s all driven by market supply and demand. For example, what if we decided that GLD was bogus, and the Julius Baer gold ETF was our preferred gold ETF of choice? Then we would sell GLD and buy the Baer fund. The “money supply” (shares outstanding) of GLD would contract and the “money supply” of the Baer ETF would increase. Both would remain pegged to gold (ideally).

That is pretty much how a gold standard system works. It is a system that links a paper currency to gold via a mechanism of supply adjustment. This situation of “multiple ETFs linked to gold” is very much like “multiple world currencies linked to gold.” Would the base money supply of France or Britain grow or contract at the same rate as the U.S., even if all the currencies were linked to gold? Of course not. They would vary depending on the demand for francs, pounds, and dollars, just as the shares outstanding of various ETFs vary depending on how much people want to own one ETF instead of another.

By now, you may have figured out that most everyone, the mainstream academics and Nobel-Prize-winning newspaper columnists, the Rothbard amen corner and other “goldbug” types, mostly have no idea what a gold standard is.

December 15, 2010: The Biggest Obstacle

But there needs to be more than me and a couple obscure academics (and a handful of “supply siders”) who understand this stuff. Now, there is me and you. Really, that’s all there is. You can look for some other group that has been able to figure this stuff out, but you will never find it. It doesn’t exist. Just me and you. We have to start somewhere.

September 5, 2010: Stable Money

July 25, 2010: The Argument for a Gold Standard (2010 edition)

June 24, 2007: The Gold Standard in a Nutshell

August 19, 2007: Gold Standard Fallacies

April 26, 2009: Two Monetary Paradigms

July 28, 2008: “Why Not the Gold Standard?”

November 6, 2009: A Brief History of the Dollar

April 21, 2007: Weights and Measures

April 15, 2007: The Value of Today’s Dollars in 1854 Dollars

February 28, 2010: A Gold Standard is a Value Peg

August 26, 2007: How To Operate a Gold Standard

November 23, 2008: Redeemability and Reserves

January 3, 2010: The GLD Standard

March 21, 2010: A New Gold Parity

October 27, 2008: Making Currencies that Last

May 9, 2008: The Gulf’s Currency Solution

May 6, 2008: The Key to Managing Currencies