40 Out Of 40 Economists Agree: The Monetary System That Made America Great Is Nonsense

December 10, 2015

(This item originally appeared at Forbes.com on December 10, 2015.)

http://www.forbes.com/sites/nathanlewis/2015/12/10/40-out-of-40-economists-agree-the-monetary-system-that-made-america-great-is-nonsense/

For 182 years – 1789 to 1971 – the United States embraced the principle of a “stable dollar,” which, in practice, meant a dollar linked to gold. Before 1933, the parity value was 1/20.67th of a troy ounce. From 1933 to 1971, it was 1/35th of an ounce.

This was the “gold standard era.” The idea was simple: you wanted the dollar to be as stable, in monetary value, as possible. After centuries – actually, millennia – of experimentation, people had discovered that the best way to do this, in an imperfect world, was to link the value of the currency to gold.

It was really no different than the fifty-plus countries today that link their currencies to the euro, rather than indulging in some kind of homegrown “monetary policy” and an independent floating currency. The main difference was the “standard of value.” Before 1971, we used a “gold standard,” and today, many countries use a “euro standard.”

During the 18th and 19th centuries, the premier leader in gold-based monetary discipline was the Bank of England. From 1694 to 1914 (excepting wartime), the British pound was reliably fixed to gold at 3 pounds, 17 shillings and 10 pence per troy ounce.

Britain – which in the 17th century had been an economic backwater of no great significance – then became the financial capital of the world, the birthplace of the Industrial Revolution, and ruler of the greatest global empire of the era.

Not bad.

Britain’s monetary leadership faltered after World War I. The devaluation of 1931 was followed by a period of floating currency, and then several devaluations after WWII.

After 1914, the world’s greatest example of gold standard discipline was the United States. Although there was a devaluation in 1933, the dollar remained linked to gold afterwards, and there were no more devaluations until 1971.

The United States, which had been secondary to Britain in 1914, then rose to be the world’s financial center, the leading example of industrial excellence, and ruler of what amounted to the greatest global empire of the era.

What a coincidence.

The New York Times, surveying the landscape of contemporary thought, told us recently that out of 40 “leading economists,” all 40 said that a gold standard “would not improve the lives of average Americans.’

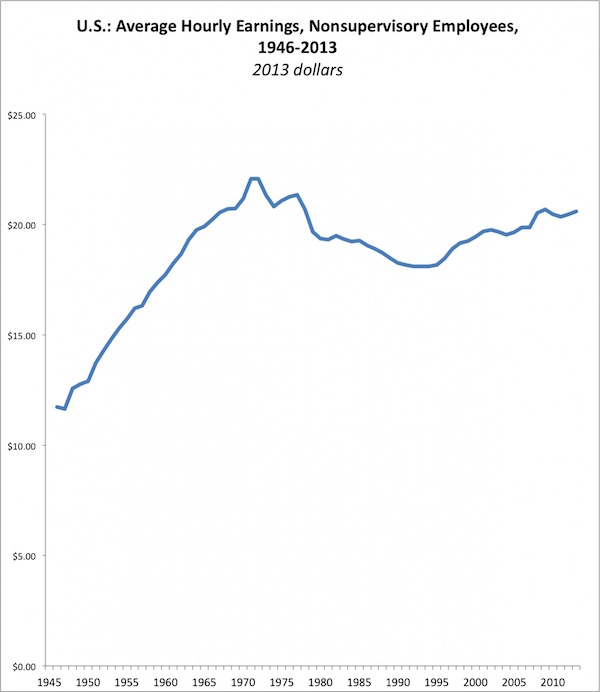

At the end of the gold standard era, in the 1960s, the U.S. had the wealthiest middle class the world has ever seen.

It was so lovely, that nobody — not even president Richard Nixon, and Federal Reserve Chairman Arthur Burns — wanted it to end.

If the gold standard policy didn’t “improve the lives of average Americans,” how was it possible that, after 182 years, the average American was wealthier than ever?

It appears that 40 out of 40 “leading economists” never really bothered to think about that one.

And if you can “do better than a gold standard,” as Michael Bordo told the Times, then why – in four decades – has nobody done so?

Can you spot the end of the gold standard – in 1971 – on this chart? Maybe it is a coincidence.

We’re supposed to be impressed by this degree of consensus among the “experts.” My impression is that, when everyone thinks the same thing, then nobody is doing much thinking at all.