(This item originally appeared at Forbes.com on May 5, 2023.)

Recently, I kicked sand in the face of those who propose “commodity baskets” as a measure of currency value, as an alternative to gold. Gold works very well. The United States based the dollar on gold for nearly two centuries, until 1971, and became wealthy without “inflation.” Everybody knows gold works. So why experiment with solutions that are certain to be inferior?

But we can appreciate where this has served a productive role in the past. I think we may be reaching a point in history when the present floating fiat system becomes completely intolerable, and people are ready for new solutions. Governments have always reached this point in the past, eventually, due to chronic currency abuse. Historically, this is when the political time is right to create new institutions — much as the whole world formally went back to gold in 1944, with the Bretton Woods Agreement. This might be within a decade, or maybe sooner than that, if this “trillion dollar coin” thing actually gets any traction.

Nevertheless, we are not there yet. Things at the Federal Reserve can’t be expected to change very much, right away. They will keep making it up as they go along, within the context of the present floating fiat system. Congress won’t do anything meaningful, for now. President Donald Trump nominated Judy Shelton and Herman Cain to serve on the Federal Reserve Board of Governors. Both have been outspoken supporters of the gold-based dollar that worked so well before President Nixon blew it up in 1971. Unfortunately, in the kerfuffle following the 2020 election, Congress didn’t quite get to confirming Shelton’s nomination, although support was there.

But, what if they had? Obviously, as just one member of the seven-member Board, Shelton would not have been able to undertake any dramatic changes. She might not have been able to influence policy much at all. Even her vote would only be a vote within the context of the present floating-fiat system — presumably, a vote to perhaps raise or lower the official interest rate on reserve balances held at the Federal Reserve.

In the 1980s and 1990s, the Board of Governors had several people who kept an eye on commodities and gold, as a way to stabilize the value of the dollar. This was not a formalized system, but Chairmen Paul Volcker and Alan Greenspan definitely took caution when it seemed that the value of the dollar was either falling dramatically vs gold and commodities, or rising. This played out into their policy decisions.

This was no surprise. Greenspan had been a public advocate of the gold-based dollar in the 1960s — countering the arguments of Milton Friedman and the other Monetarists, who were certain that floating fiat currencies would shower benefits down upon everyone. (Why anyone still takes this seriously, I don’t know.) Paul Volcker, as Treasury Secretary for International Affairs, spent his early career defending the dollar’s link to gold at $35/oz, within the Bretton Woods gold standard system.

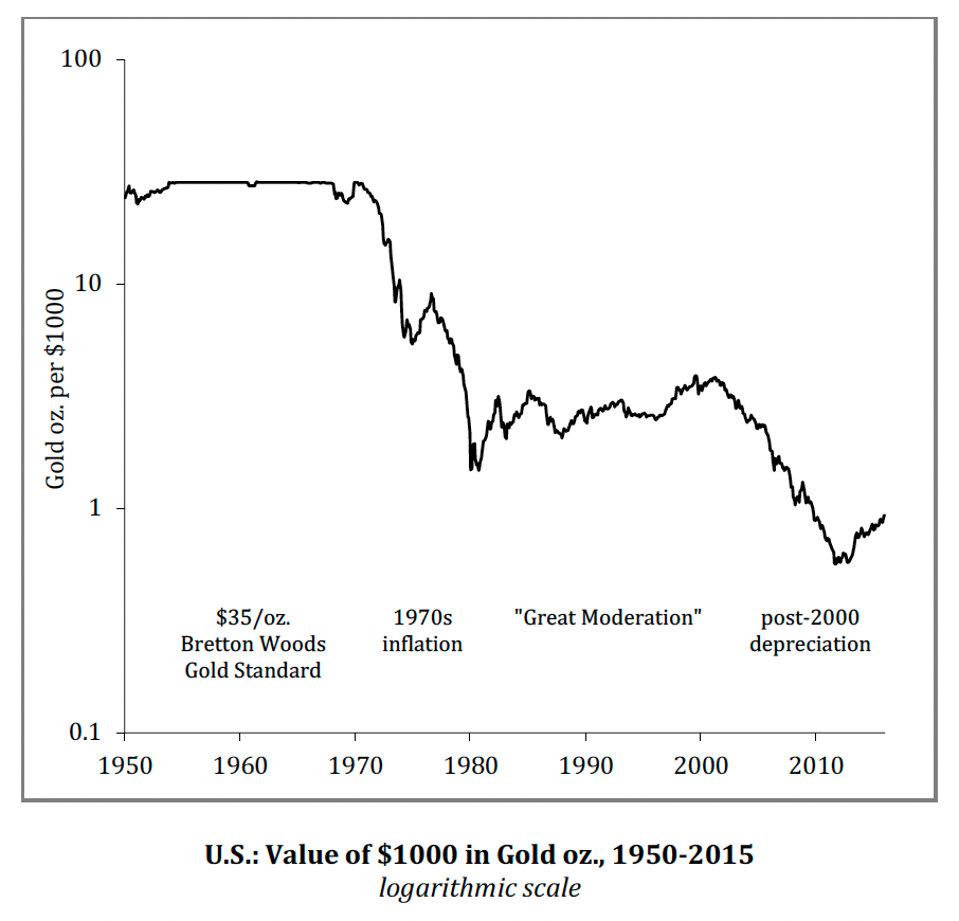

In practice, it worked — sort of. The value of the dollar vs. either gold or commodities (in other words, the “price of gold,” or a dollar index value of a commodity basket) went up and down in wide swings. But, over a period of decades, the dollar really did keep its value vs. gold. It was about $350/oz. during the early 1980s, under Volcker, and ended around that level when Greenspan left office in 2006.

This crude and haphazard stability for the dollar brought an end to the 1970s stagflation. The economy recovered. Economists called it the “Great Moderation,” although they still don’t know how it happened. (Volcker and Greenspan did it, with the help of Wayne Angell, another Fed governor, who explicitly used a commodity basket to guide his policy voting.)

So, it was a success. But, it was no lasting solution. The dollar today is worth only about a sixth of its value under Greenspan. ($350 x 6 = $2100/oz. of gold.) Also, even during the “Great Moderation” period, there were wild swings and a lot of difficulties — a very different outcome than the smooth placidity of the gold-based dollar in the booming 1880s. (After 28 years of a floating dollar beginning with the outbreak of the Civil War, the dollar was repegged to gold in 1879.)

If today’s floating fiat dollar is going to continue, it would be good if things were managed more like they were under Greenspan. The dollar’s value would be kept stable vs. gold and commodities. There was even some hope, in the 1990s, that this informal but successful kludge could be formalized, with a more explicit gold link. I think the Federal Reserve today looks at gold and commodity prices, having learned something from Volcker and Greenspan, although they don’t talk about it.

But, such mamby-pambying usually doesn’t amount to much. Eventually, “something happens,” and whether a recession, Covid-like event, bank crisis, debt ceiling debate or Treasury funding crisis, attention at the Federal Reserve again moves away from Stable Value to “Do Something!” The long-term trend has been one of decline.