I think it is worthwhile to think about the Capital-Labor Ratio in terms of Foreign Trade.

Previously, we took some time to think about the effects of Immigration on the Capital-Labor Ratio.

January 12, 2024: Economic Nationalism: The Capital-Labor Ratio

Basically, immigration means More Labor, which tends to depress the Capital-Labor Ratio, to the detriment of most people in society. Capital loves it, of course. Basically, you get the guy in the upper left corner, “Toryism,” accompanied by a vague sense of “unjust exploitation of the worker.” This tends to produce the response in the upper right, Socialism. Oscillating between these poles will destroy your society.

Usually, it is hard to find this “unjust exploitation of the worker.” Wages are low, but that’s because business is marginal. Low-wage/labor-intensive businesses, in the US or around the world, the “sweatshop,” are not known for their high profit margins. Basically, it is a Bad Business Environment for both Labor and Capital. Successful, growing businesses with high profit margins (Nvidia today; Ford Motors in the past) usually offer pretty good wages. “Unjust exploitation of the worker” today mostly takes the form of cartelist behavior, for example in healthcare or education, the financial system (“usury”), or the artificial housing shortage we have today. Nevertheless, there is a persistent sense that people work all day, under difficult conditions, and are not properly compensated.

Now let’s forget about immigration, and just look at trade.

Trade can be seen as a kind of indirect supply of labor. When you buy cheaply produced goods from China or Vietnam, you are, in effect, importing cheap labor. That cheap Chinese or Vietnamese labor is basically competing with your local higher-cost labor. The result of this is a factory is opened in China; and closed in the US. China has more capital, and more productivity (a new factory) and the US has less (an old factory closes).

This can be remedied over time. You could invest in new productive enterprises in the US, which would absorb that newly-freed and underemployed labor that resulted from importing cheaper goods from China. Basically, with the addition of more Capital, Labor would again be in demand. But, this takes time. And, since capital creation and capital investment in the US is low, it takes a lot of time. And, since this accumulation of new Capital has taken place during a time of increasing Labor from immigration, we basically never get there.

Another consequence of this is increasing Specialization. No longer do we produce what we consume. We have to sell something to foreigners, so that we can buy cheap stuff from foreigners. The United States is still a major exporter of manufactured goods. But, just as with Germany and Japan, these are usually complex, high-value Capital Goods, which we do not see in the retail stores. Things like Nvidia boxes, MRI scanners, specialized enterprise software, or the complicated equipment used in the oil and gas industry.

This is not a bad solution — maybe, inevitable — for small countries. South Korea can’t realistically attain a high level of economic independence. For one thing, it has no significant fossil fuels. But, all those trade connections are maintained by what amounts to military protection and alliance, provided by the United States. The United States is large enough to produce a lot of its needs domestically, and maybe it should, for security reasons.

We are not particularly concerned with trade with developed countries including Canada, Europe and Japan. Their wages are about the same as ours, so trade with them does not create a new imbalance in the Capital-Labor Ratio in the US. There are issues regarding foreign exchange rate instability, but for the most part, even though GM and Ford don’t like competing with Toyota and BMW, we sense that Americans in general benefit from the competition and variety provided by Toyota and BMW. We can also buy luxury goods from France, and sell them LNG and Nvidia boxes, in this case engaging in beneficial specialization and trade.

It is worth stepping away from these issues from a theoretical perspective, and take up a historical perspective. The amount of Cheap Labor that has been freed up and made available via Trade (not immigration) since 1970 has been quite amazing. This includes, of course, a couple billion people in China and India, but also Latin America and elsewhere in Asia such as Indonesia or Vietnam.

Let’s think about what things looked like in 1970. Much of the world was Communist, and we didn’t trade much with them. This included all of China and Eastern Europe including Russia. Besides the regular European developed countries, about the only trade competition of significance came from Japan, which had somewhat lower labor costs, but not that much. Japan in 1970 was already basically a developed country. Much of the competitive advantage of Japan actually came from Capital, not cheap Labor. Due to increases in Productivity, it took much less labor for Toyota to make an automobile than GM, in 1980. Cheap cars, not cheap labor. Today, it takes about 29 hours of labor to make a vehicle, which is really amazing when you think about it.

For those lower-income areas that were not outright communist, such as India, many had political instability and policy issues (socialism and corruption) that prevented effective commerce from arising. The genius of European Empire, such as British rule of India, was that all these issues of governance (and also finance) were very well taken care of, allowing development of domestic Labor and resources. But, after WW2, all that was abandoned, and whatever good came of it, India today is not well managed at all. The first thing that happened after the British left was a giant civil war, resulting in the independence of Pakistan and, eventually, Bangladesh. Which is not good for business. But mostly, I think, it was just a lot more difficult to organize international production. Frigidaire didn’t make refrigerators in Indonesia in 1960, because how would you do that? Send a letter? No internet, no email. Even international phone calls cost serious money in those days. As late as the 1990s, people working in US investment banks in Tokyo counted the minutes carefully. You tended to get products made for domestic consumption, that could also be exported — and, most of these products were pretty horrible, so you bought US products.

There was also a basic lack of knowledge. I remember hearing a story about an auto parts factory in Brazil. They had constant quality issues. It was discovered that one reason for this is that none of the workers knew what an automobile was. They had no idea what they were making.

At the Bretton Woods conference of 1944, world leaders realized they had messed up bigtime. The terrible Tariff Wars of the 1930s, ignited by the US Smoot-Hawley Tariff of 1930, were a big reason for the difficulties of the 1930s. At the Bretton Woods conference, they attempted to establish an International Trade Organization, which failed but became the General Agreement on Tariffs and Trade. This led to the creation of the World Trade Organization in 1995, part of the long process of trade liberalization that took place after WW2.

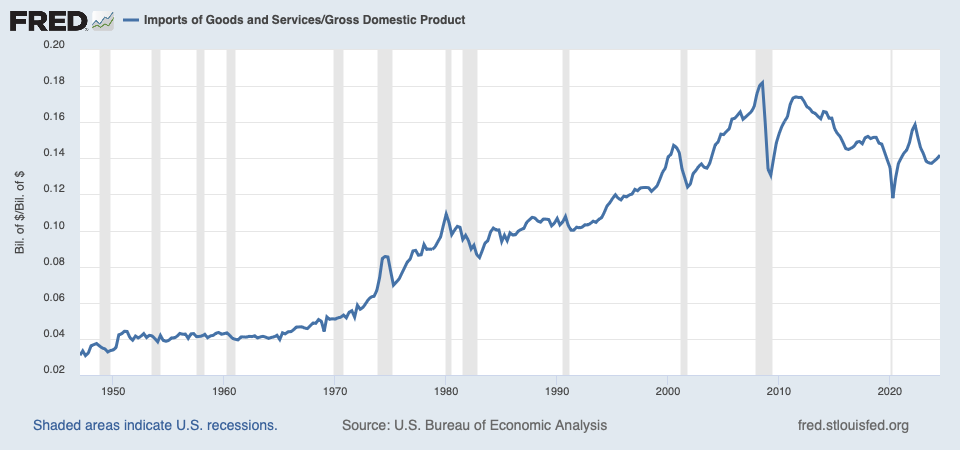

You can see the effects of this trend of Free Trade after WW2 by the ratio of US Gross Imports of Goods and Services, as a percentage of GDP:

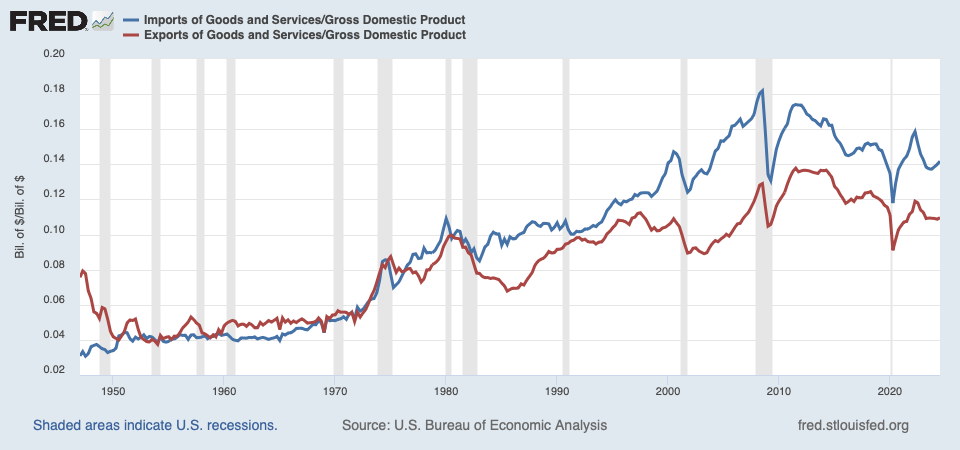

Now, we should recognize also that US Exports of Goods and Services also rose:

The expansion of Cheap Imports was matched with Exports, of such things as software from Microsoft or Oracle.

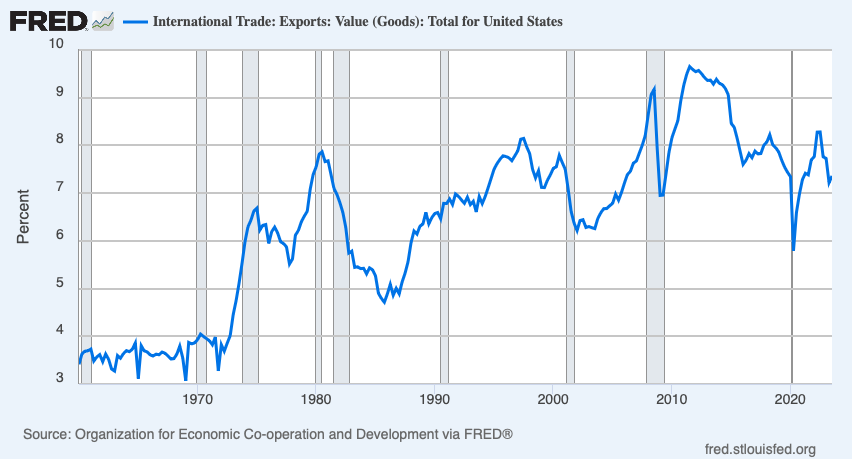

This appears to be a graph of US exports of Goods alone, excluding services, as a percentage of GDP.

Cheap Labor via trade has expanded beyond Goods now, with information technology, and includes Services and direct Labor. These are your Indian call centers or computer programmers, or Polish website developers.

The point is, there has been an enormous expansion of available Cheap Labor due in part to advances in information and transportation technology. This has tended to depress the Capital-Labor ratio in the developed countries. There has also been a political element, notably the inclusion of China into the World Trade Organization in 2001, or NAFTA in 1994.

Now we are introducing two interesting real-world factors: differences between countries, let’s say France or China (primarily the difference in labor costs), and also, the historical evolution of various factors over time, including political factors (communism to capitalism), governance factors (WTO, NAFTA), and also technology-type factors (Internet communications). A policy that makes sense, for Adam Smith as he described trade between Britain and France in the 1770s, or that might make sense today between the US and France, may not make sense between the US and China (or some other low-wage trading partner). Or, a uniform (not country-specific) policy that made sense when the realistic trading partners were limited to the developed countries in the 1960s, might not make sense when the realistic trading partners are much broader today.

I know of nothing in formal economics that would be helpful in making some calculated response to these factors, and of forming beneficial policy. We have only a vague “free trade is good” response, which is little more than an affirmation of the Post-WW2 Consensus that arose out of the Trade Wars of the 1930s. The Economic Nationalists are sensitive to all these issues, but also have not codified their arguments into a cohesive whole.

When you consider all these factors, I think it is reasonable to stop undercutting the US worker, the Bottom 30%, with all the cheap labor in the world, by using perhaps a 20% across-the-board tariff. Actually, nearly all developed countries already have this, as an inherent part of their VAT systems, also with a rate around 20%. I would prefer replacing the US Income Tax also with a VAT, so that would serve as both an income tax replacement and a universal tariff combined. But, you would have to repeal the Sixteenth Amendment. We don’t want to end up with both an Income Tax and a VAT. I think it is a better solution than a Flat Tax (which is actually quite similar), but also, a bigger political hurdle.