Foreign Exchange Rates 1913-1941 #2: The Currency Upheavals of the Interwar Period

April 6, 2014

Last week, we started to look at the history of currency values in the 1913-1941 period. I’m still not sure this will be worthwhile, but the initial results were fairly interesting.

March 30, 2014: Foreign Exchange Rates 1913-1941: Just Looking At the Data

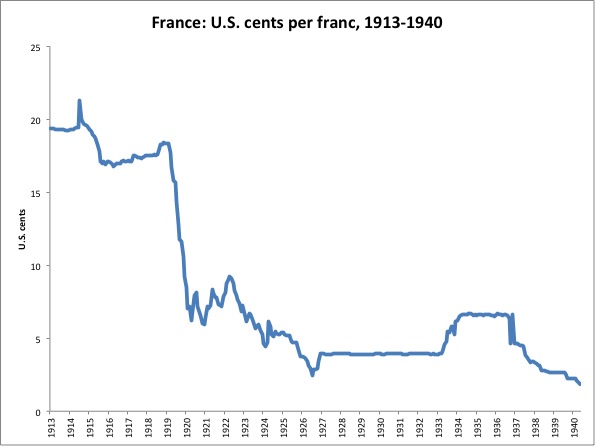

France:

The french franc was another significant currency of that time, with what one might call a “leadership role” in currency affairs. In other words, other countries would react to or imitate what France was doing. So, let’s take a look.

This shows the number of U.S. cents per french franc. The franc lost a lot of value during WWI and soon afterwards, far too much to allow the franc’s value to be raised back to its prewar parity, as was the case in the U.S. and Britain. It was repegged to gold in late 1926, at a devalued rate. The franc was devalued in 1936 — relatively late, following Britain in 1931 and the U.S. in 1933 — and as we see it never really stabilized again, but continued to lose value into WWII.

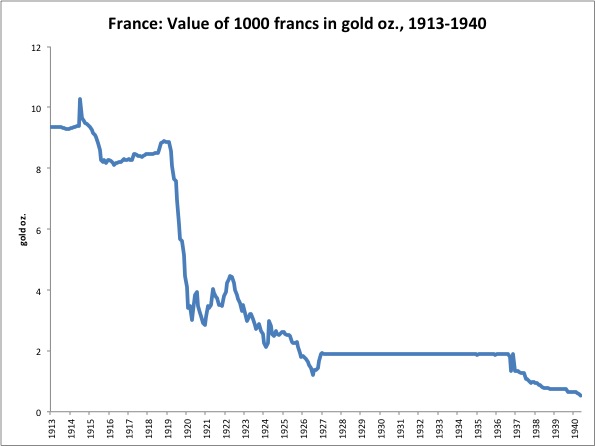

Here’s what it looks like in terms of gold.

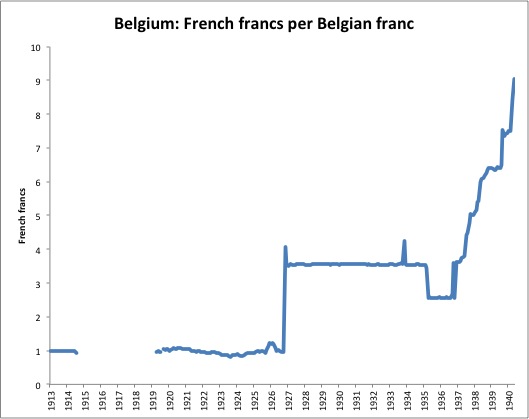

I mentioned previously that Belgium’s history mirrored France’s, so here’s the value of the Belgian franc/belga vs. the French franc. Remember, the belga currency was introduced when the Belgian franc was repegged to gold, also in 1926 along with France. However, the belga was worth five prior Belgian francs, so that rise in value is really just a redenomination. It appears that the belga’s gold value after 1926 (taking into account the 5:1 redenomination) was less than the French franc’s gold value, however, as it was worth a little less than four French francs — a sort of devaluation you could say.

Belgium devalued in April 1935, no doubt setting the political precedent for France to do the same a year later. However, the Belgian franc retained its value (vs. gold) after the 1935 devaluation, while the French franc sank into the depths.

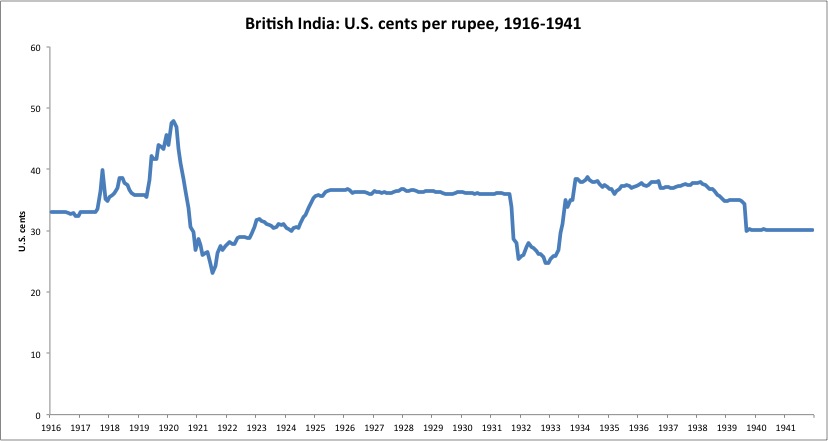

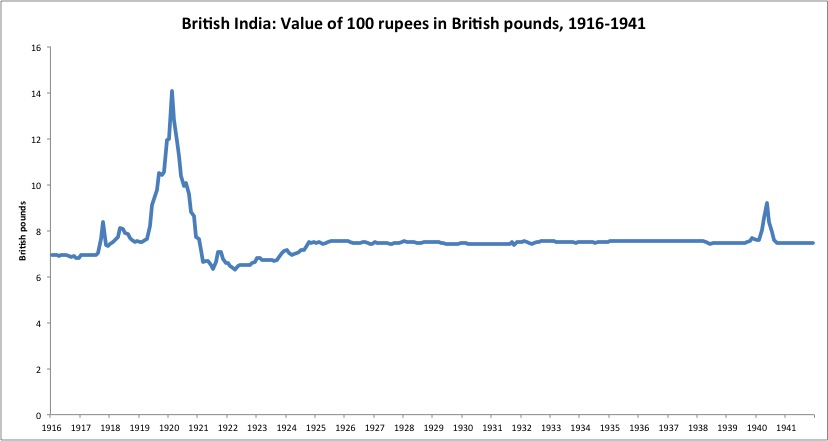

British India:

India was British in those days. I think that silver coins were in widespread use in rural India in those days, as was the case in China as well. However, the British overlords also maintained a rupee currency which, not surprisingly, was linked to the British pound. Thus, it was devalued in 1931 along with the British pound, and again in 1939. This was actually fairly significant, because India produced a lot of commodity goods for world export, notably cotton and cotton cloth.

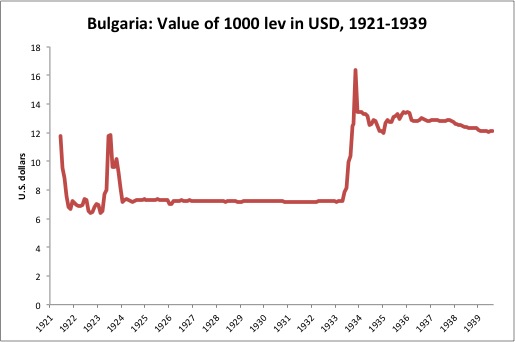

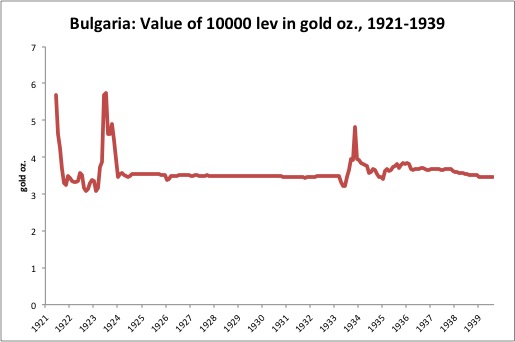

Bulgaria:

The Bulgarian lev retained its value vs. gold throughout the 1930s. Capital controls were imposed beginning in April 1932. I seem to remember that there was hyperinflation in Bulgaria soon after WWI, which is perhaps why our data here begins in 1921.

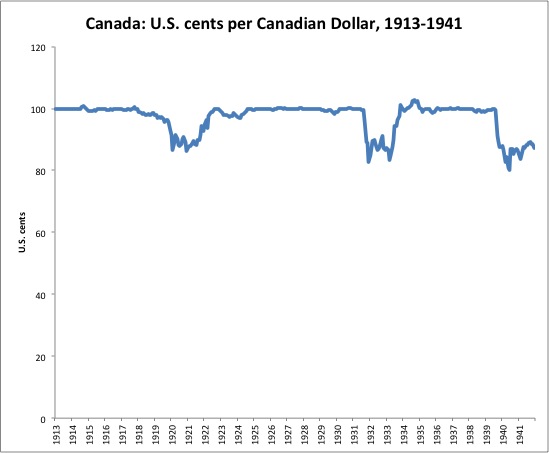

Canada:

Not surprisingly, Canada’s history amounts to a combination of British and U.S. influences. The Canadian dollar lost some value during WWI, and was returned to its prior gold standard parity in 1925, along with the British pound. The Canadian dollar was devalued in 1931, along with the British pound. However, the Canadian dollar was stabilized vs. the U.S. dollar (and thus gold) afterwards, more so than the pound, which was more of a floating currency. Another devaluation in 1939 mirrors that of Britain.

Beginning in March 1940, Canada lists an “official” rate and a “free” rate. The two are about the same, however. The free rate is shown.

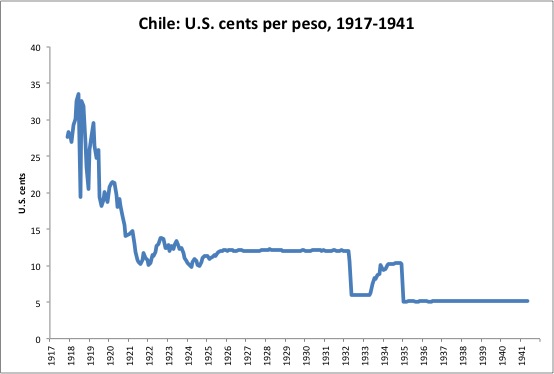

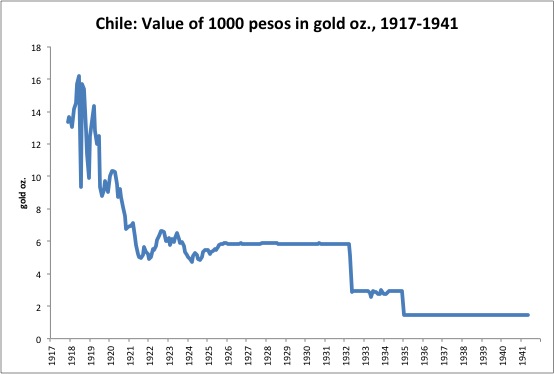

Chile:

The Chilean peso lost a lot of value during WWI, like the French franc, and was repegged to gold in late 1924. It was devalued in May 1932, after the British devaluation but not coinciding with it. However, after that, the peso was effectively repegged to gold, even maintaining this while the U.S. dollar was devalued in 1933. Another devaluation in January 1935 returned the peso/dollar rate to roughly its 1932 level. Apparently, Chile liked the “competitive advantage” from the 1932 devaluation vs. the USD, and wanted to return it after the U.S.’s 1933 devaluation. It’s a typical pattern of that time. Capital controls were imposed beginning in April 1933. From November 1937, there is an “official” rate (shown) and also an “export” rate, which is about 22% lower in value.

Adding it all up, the peso lost a lot of value from where it was at the beginning of WWI (not shown here).

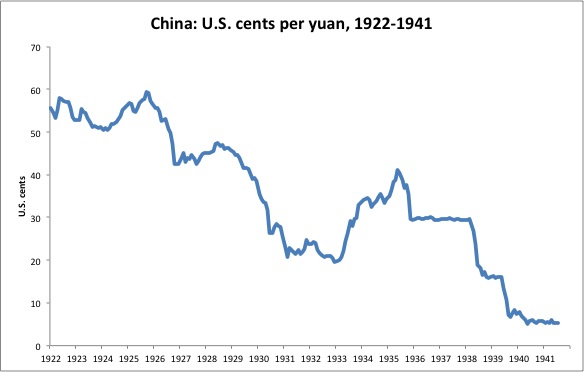

China:

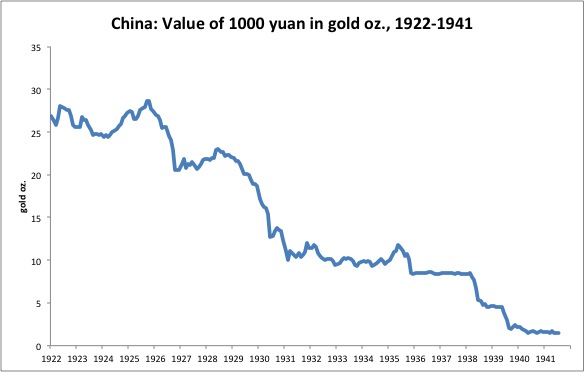

Chinese mostly used a metallic currency during most of this time, which had been the case since the collapse of paper money in the Ming dynasty. In other words, they used silver coins, and any other form of silver on metallic weight. The tael was a common measure in China, although the Mexican silver dollar was also popular. There was a paper yuan as well, which has a 1:1 parity with the Mexican silver dollar coin.

Thus, the variability of the yuan/dollar rate basically reflects the variability of silver vs. gold during this time. However, as we can see, the paper yuan was linked to gold in 1935, transitioning to a gold basis from a silver basis. This didn’t last long, as the paper yuan was devalued in 1938, as it was printed to meet the needs of military spending in the face of the Japanese invasion.

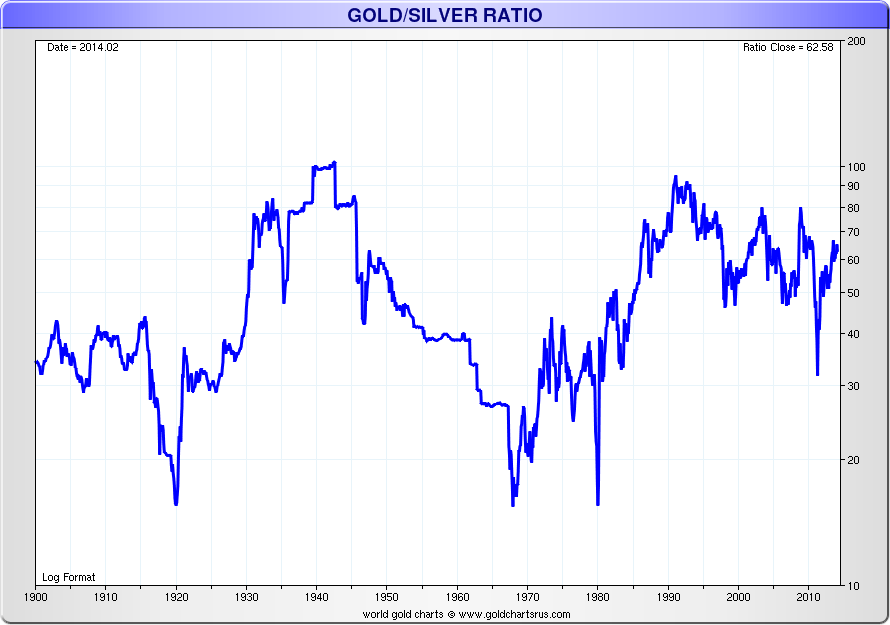

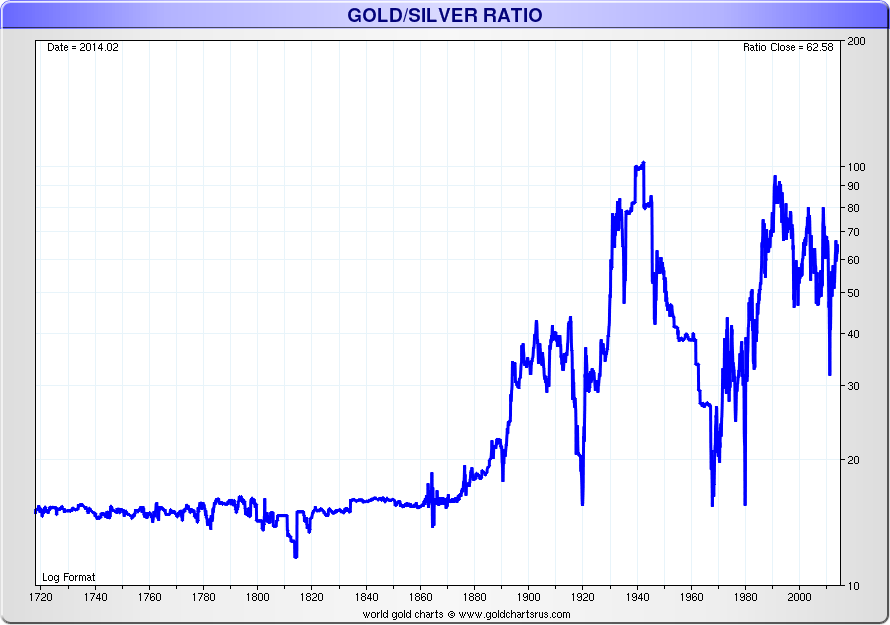

Now you can see why Chinese people preferred metal coins. Once you are using a metal coinage-based currency, you will naturally tend towards silver instead of gold, because gold is of too high a value for use in coinage exclusively, without some kind of lower-denomination adjunct. This was fine for a long time, and formed the basis of “bimetallic” systems around the world. Silver and gold were basically two versions of the same thing, because their market value remained in a reliable range. That is why I consider bimetallic systems to be “gold standard systems,” which may confuse some people who don’t know this history. People at the time considered them to be gold-based systems too. However, beginning in the 1870s, this ruptured for the first time in history, which drove most of the world to monometallic gold-based systems. Chinese and Indians stuck with silver coins.

For some reason, I find this strangely satisfying. It is nice to get an idea of what was going on during that time.