Greg Ip Gets It Wrong: What A Gold Standard Really Was, And Could Be

November 13, 2015

(This item originally appeared at Forbes.com on November 13, 2015.)

http://www.forbes.com/sites/nathanlewis/2015/11/13/greg-ip-gets-it-wrong-what-a-gold-standard-really-was-and-could-be/

Wall Street Journal economics reporter Greg Ip took on the topic of what a gold standard system really is, and failed miserably.

But, I give him some credit. Hardly any academic specialists understand it either, and you can’t really ask a reporter to do much better than the so-called “experts” that he is required, by profession, to consult.

The core mistake, as I see it, is the notion Ip describes here:

A gold standard system is not, and has never been, a system that “fixes the supply of money to the supply of gold.” Absolutely not. A gold standard system is what I call a fixed-value system. The value of the currency – not the quantity – is linked to gold, for example at 23.2 troy grains of gold per dollar ($20.67/ounce). This was U.S. policy from 1834 to 1933.

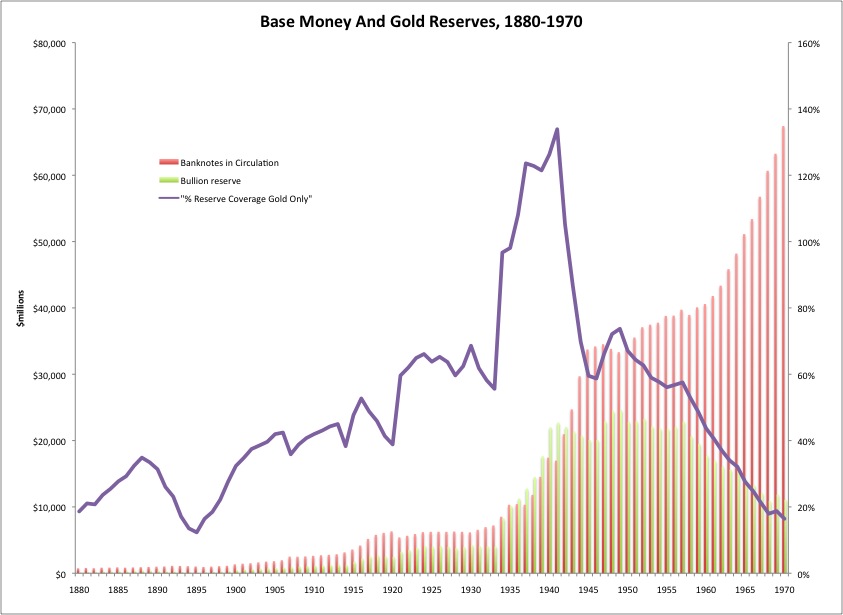

From 1775 to 1900, the U.S. money supply (technically known as “base money”) increased by 163 times, from $12 million to $1,954 million. During this time, the total aboveground gold supply increased by about 3.4x due to mining production.

163 is not the same as 3.4.

However, during this time, the value of the dollar was stable vs. gold, beginning at 24.75 troy grains of gold and ending at 23.2 troy grains, after a small adjustment in 1834 which had to do with the bimetallic system then in use.

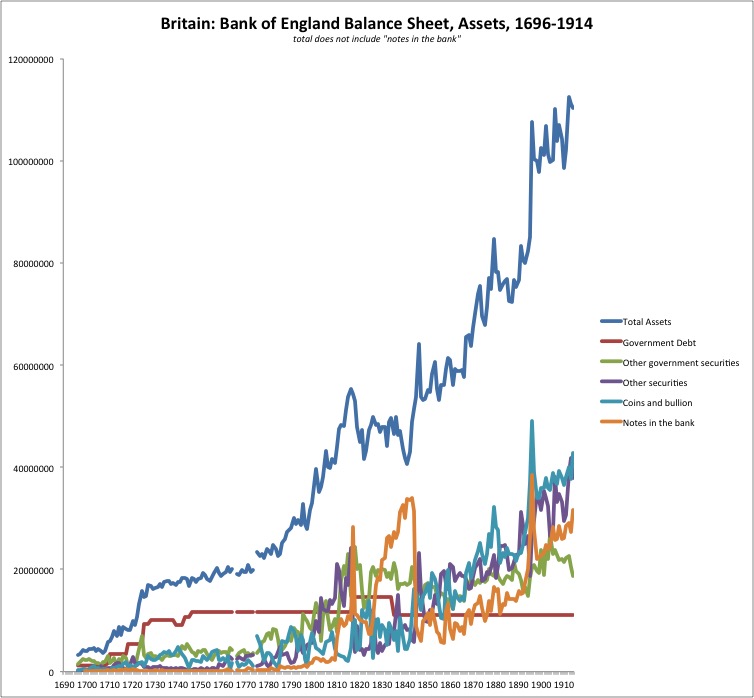

The Bank of England typified gold standard currency management prior to 1914.

Why did the U.S. dollar monetary base increase so much during this period? It was a time of incredible expansion for the U.S. economy, and the monetary system naturally expanded to accommodate this need. A gold standard system can provide as much (or as little) base money as is required, within the context of the fixed-value peg.

During that 125 year period, despite a Revolutionary War, a Civil War, and also the War of 1812, the U.S. economy was the most successful in the world. If the U.S.’s $20.67/ounce gold standard policy was such a mistake, how did that happen?

What about a system where the “supply of money is fixed to the supply of gold”? That would be a sort of gold-reserve monetarism. Since the aboveground supply of gold increases by about 2% per year due to mining production, I suppose this means that the base money supply would also increase by about 2% per year. What would happen then?

In that case, the value of the currency would be free to bounce all over the place. This is almost exactly the system used by Bitcoin, where the total supply of bitcoins increases by a small amount each year, while the value swings wildly. It is also the system that was long promoted by Milton Friedman (a longtime floating currency advocate and gold-standard hater), who actually called for a Constitutional Amendment to fix the growth rate of the dollar base money supply to about 3% per year – just like Bitcoin.

At the Cato Institute’s monetary conference last year, professor Lawrence White joked that this is the “Andy Warhol limited edition print monetary system” used by Bitcoin, where there is a fixed supply and a freely floating price.

At the same conference, given the assignment to speak on “the role of gold in monetary systems,” I decided to emphasize this exact point. Gold is the standard of value in a fixed-value system. It is just like fixed-value systems in use today by dozens of countries (I counted fifty-five), where the value of the currency is linked to the euro, for example via a currency board. It’s the same principle, just using gold as the “standard of value” instead of the euro.

I talk about these topics in great detail in my 2013 book, Gold: the Monetary Polaris.

Now you can see perhaps why I think it is so important that we have a new network of intellectual support surrounding these topics. The mainstream academic understanding is so poor that even these most basic principles are misunderstood. Greg Ip got the unfortunate job of surveying the conventional wisdom.

Now do you understand why our previous gold standard arrangement, the Bretton Woods system, blew up in 1971? People didn’t understand the most rudimentary principles of its operation. Mostly, they still don’t. That’s why creating a new world monetary system along similar lines seems “impossible” today, even though people like former Fed Chairman Paul Volcker think it would be a good idea.

If you’ve read this far, give yourself a pat on the back because you now know more about this than most academic specialists.

You think I’m joking, but unfortunately, I am not.