We’ve been looking at how Russia can go to a gold standard right now, perhaps at 5000 rubles per gram of gold.

How Russia Can Go To A Gold Ruble Series

There is evidence that the Central Bank of Russia has indeed begun to do this, with the ruble definitively reaching its 5000/gram parity late last week.

We will not talk so much about current events today, but rather, the common ways in which central banks mess up bigtime — including the Central Bank of Russia in 2015, and also in 2008-9 before they got their heads on straight in February 2009. It is the same pattern we see in Thailand in 1998, and many other cases, including Britain in 1931 and also the United States in 1971.

In other words, we will talk not only about how to achieve a gold parity momentarily, but to keep it permanently, over decades and even centuries.

As I said last week, the basic method to manage a currency’s value is:

To REDUCE the base money supply when the currency is weak, via asset sales;

To INCREASE the base money supply when the currency is strong, via asset purchases.

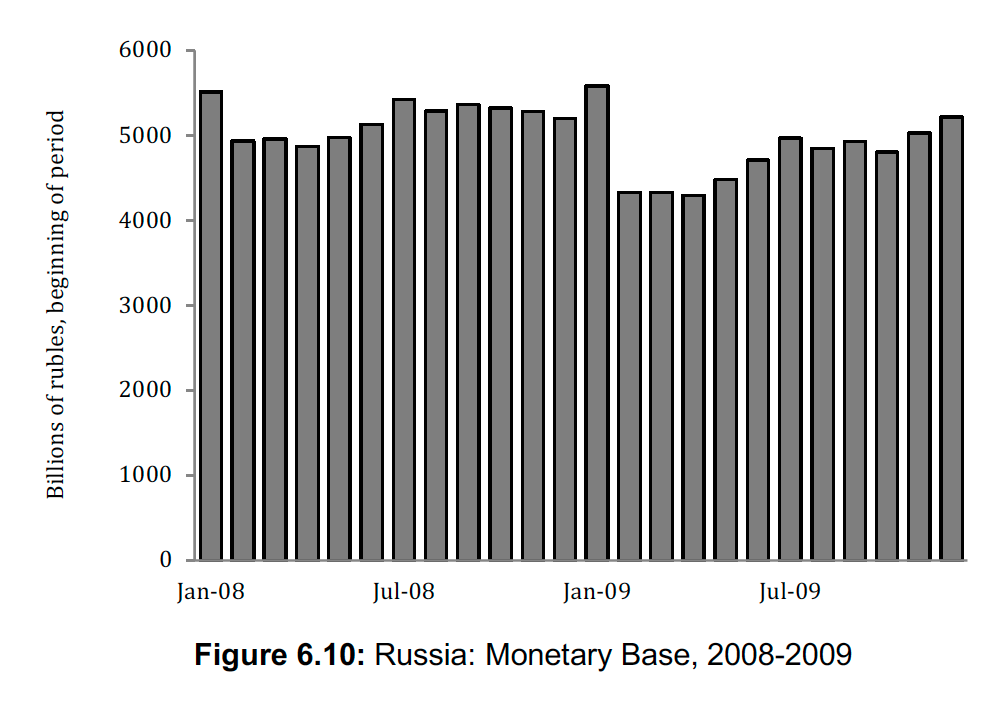

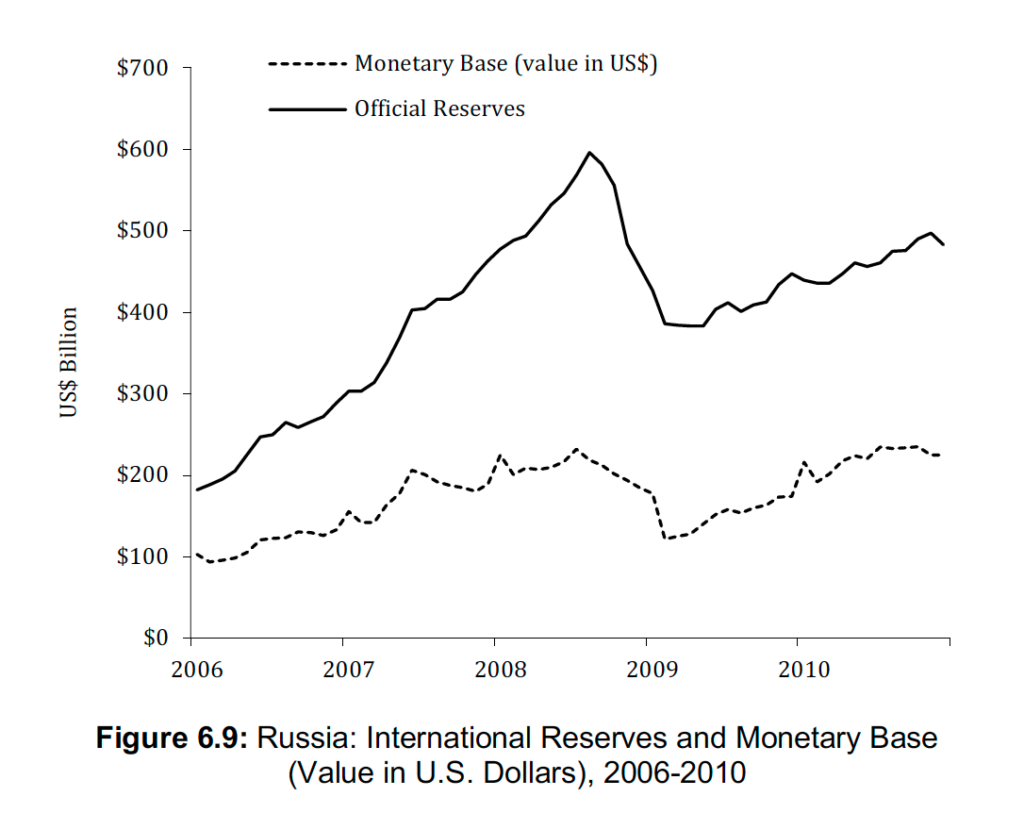

The basic problem emerges when there is the sale of some asset — typically foreign exchange reserves or gold bullion — to support the currency’s value, but the base money supply does not contract. This asset sale is “sterilized” by the purchase or acquisition of some other asset (or lending), which results in little change to the base money supply. For example, in 2008-9 we see:

November 24, 2008: Russia’s Currency Crisis

January 16, 2022: What’s Wrong With Turkey #2: Making It Way Too Complicated

Last week, we talked about the large reduction in Base Money in February 2009, the result of “brick wall” selling of foreign exchange reserves (USD) at 36 rubles/USD. However, we also see that, before February 2009, there was hardly any change in the monetary base. Actually there was an increase in January, which seems to be a normal seasonal pattern, but in the context of the crisis that year was very unnerving. The CBR was going the wrong way — and the decline of the RUB/USD accelerated. Also, we see that there was not any particular expansion of the monetary base either. There was no particular “money printing.” Thus, we can see that a currency can fall quite a bit (or also rise) without any meaningful increase in supply. Just like Bitcoin — the supply is very stable, but the value is all over the place.

If you look at foreign reserves at that time, there was an enormous drop in foreign reserves for about six months before February 2009, but no change in the monetary base. Also, the ruble kept falling. Unlike February 2009, this earlier sale of foreign reserves (purchases of RUB) was “sterilized.” There was no contraction of the monetary base. For that reason, it was totally ineffective.

I talked about various forms of “sterilization” here:

August 26, 2016: What is “Sterilization”?

August 28, 2016: What is “Sterilization”? #2: The Complexity of Central Bank Activity

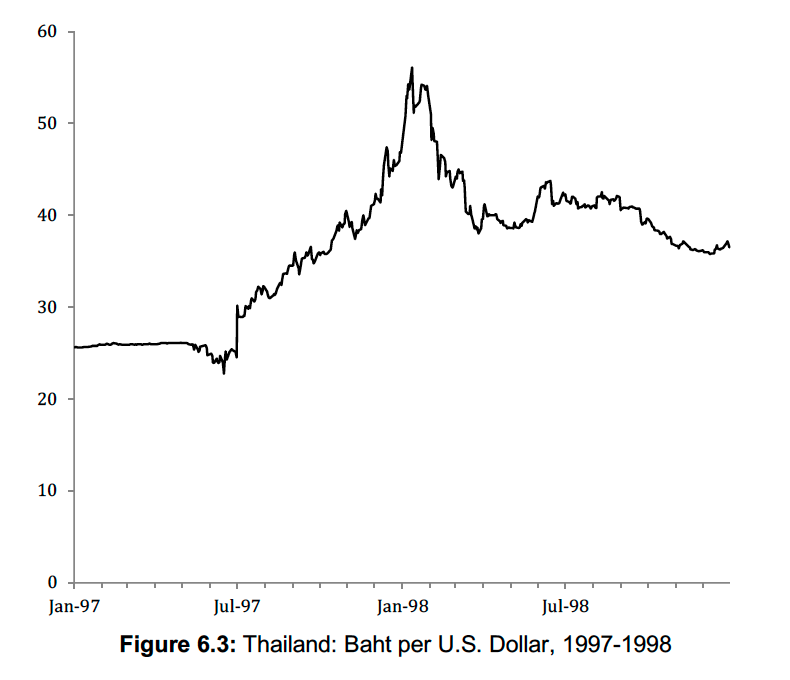

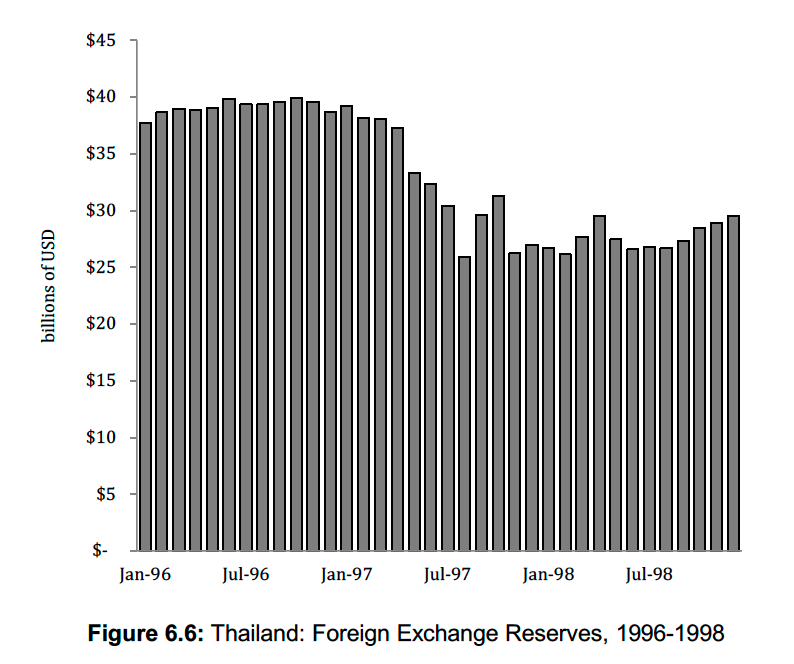

I have several more examples of the same phenomenon in Gold: The Monetary Polaris, including Thailand in 1998. The Thai baht was linked to the dollar, and then had a terrible breakdown:

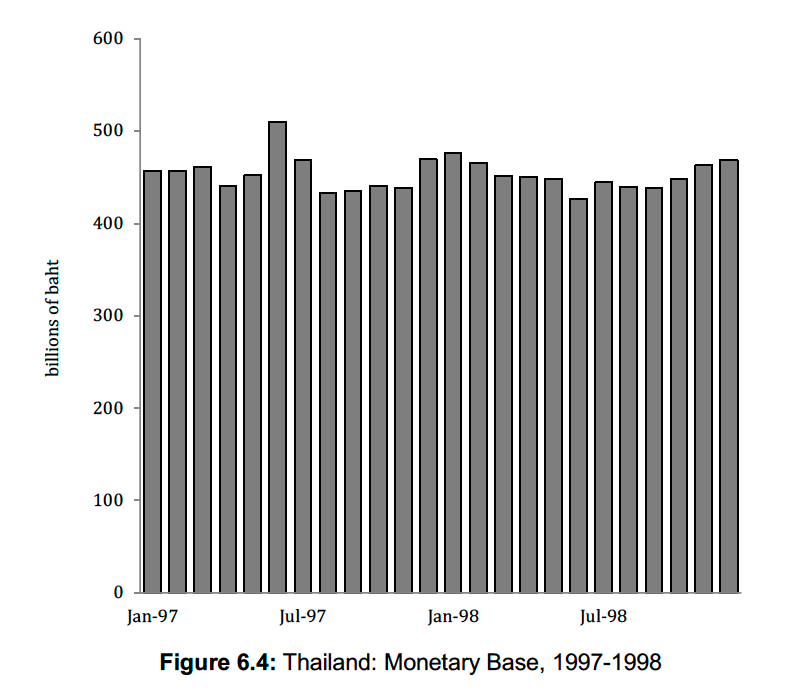

Just as in Russia in 2008-9, the baht monetary base was stable through the whole episode. There was no “printing money.” But also, despite very large sales of foreign exchange, there was no reduction in the monetary base. The sales of foreign exchange were “sterilized.” It was a complete failure.

Here we see the large sales of foreign exchange reserves “to support the baht” by Thailand’s central bank:

This sale of about $14 billion of foreign reserves should have resulted in the shrinkage of the baht monetary base by the equivalent of $14 billion. This would have been about 79% of all the baht in existence! This obviously did not happen.

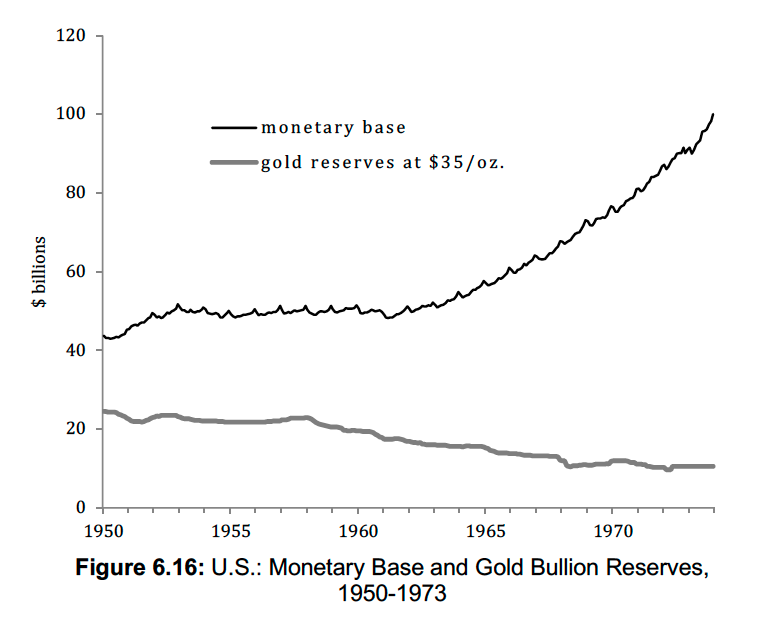

A similar process, over a longer period of time, resulted in the United States’ failure to maintain the $35/oz. gold parity in 1971. Over several years, there were gold outflows. (This was basically equivalent to foreign exchange outflows under a dollar-pegged regime like Thailand in 1998.) Normally, this would result in a short-term reduction in base money supply, to support the currency’s value. Then, the central bank would probably sell other assets (such as government bonds), reducing base money further, and supporting the currency’s value. This would drive the dollar above its gold parity, to $34/oz. let’s say, which would result in gold inflows. The Federal Reserve, offering to buy gold at $35/oz. instead of $34/oz., would be the highest bidder in the world gold market. After these short-term adjustments, the long-term effect would likely be a slow expansion of the monetary base, just as we see here, in line with economic expansion.

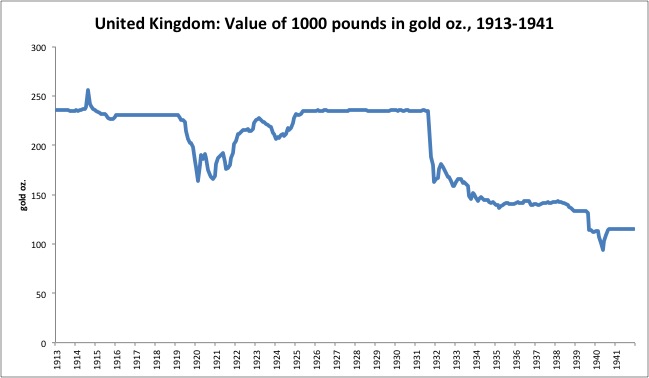

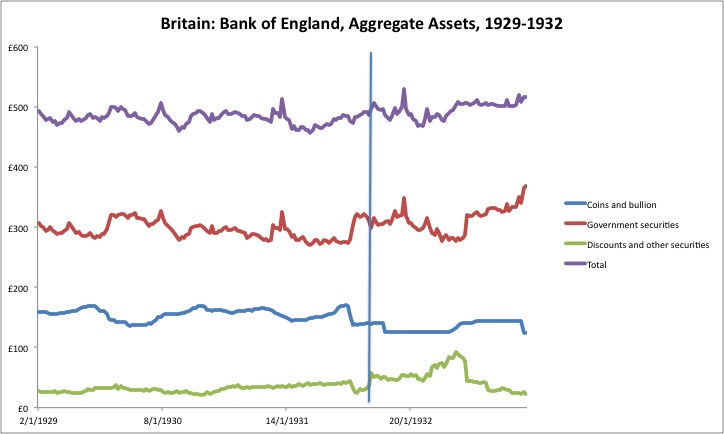

We saw also that the same process took place in Britain in 1931, a disastrous failure of the Bank of England’s gold standard policy. But, it wasn’t exactly a “failure,” but more of a mistake-on-purpose by those at the Bank who wanted a currency devaluation. (It was done while the head of the BOE, Montagu Norman, was away on vacation.)

May 22, 2016: The Devaluation of the British Pound, September 21, 1931

You can see the outflows of gold during the crisis. About 50m pounds’ worth of gold was sold. However, the BOE also borrowed at least 50m pounds of additional gold from the Bank of France and the Federal Reserve. By some accounts, as much as 200m pounds of gold were sold. This should have resulted in a reduction of the monetary base by 100m-200m pounds, in line with the gold sales. You can see how this gold sale was “sterilized” by the purchase of government bonds (red line).

Vertical line indicates the date of devaluation.

Since base money was about 500m pounds, a 100m-200m pound reduction in the monetary base would have meant a 20%-40% reduction — more than enough to support the pounds’ value, even in the most dire crisis. Also, the BOE could have sold some of its large holdings of government bonds, also to reduce the monetary base and support the pound’s value. This did not happen. As you can see, base money was unchanged, just like in Thailand in 1998 and Russia in 2008-9 (before Russia got its act together in February 2009, and fixed the problem in a matter of days).

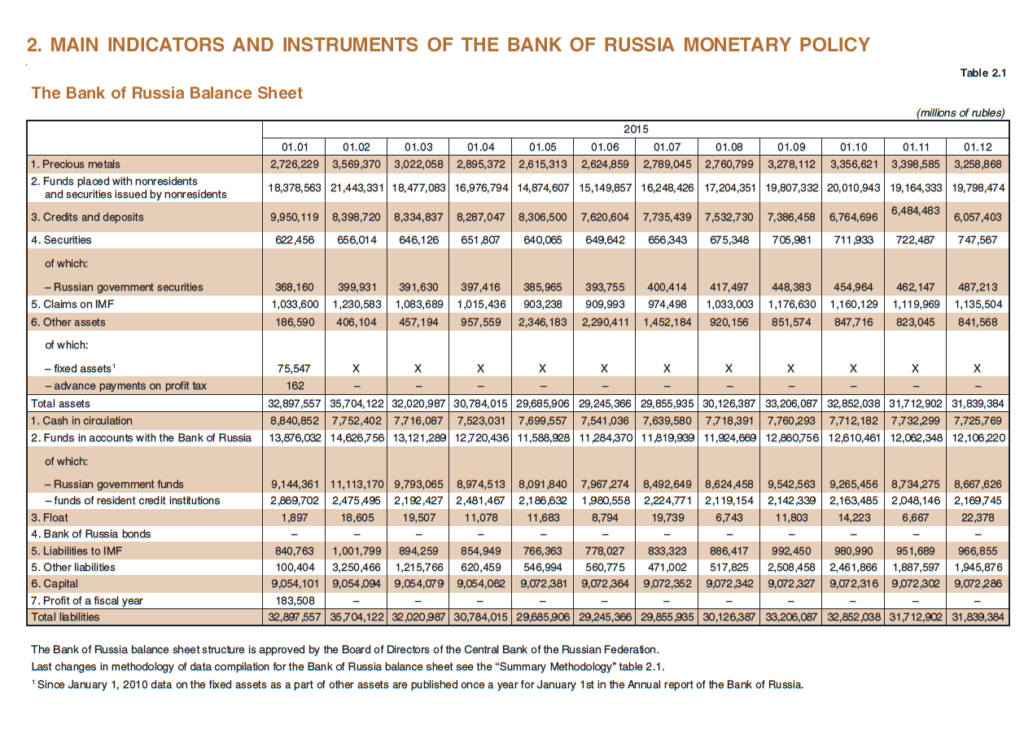

Now, let’s look at Russia in 2015.

October 16, 2014: Russia’s Currency Crisis: This Is So 2008!

December 19, 2014: It’s Official: Elvira Nabiullina Wears the Tall Pointy Hat for Mismanagement of the Ruble

October 25, 2015: Russia’s Central Bank Might Be Getting a Clue After All

This was a terrible disaster. Among other things, it totally killed the amazing growth trajectory of the Russian economy from 2000-2008, which had a bit of revival even after 2009. Since then, the Russian economy has been stagnant. Also, it coincided with the CIA coup in Ukraine during that time. Probably, the disorder in Russia was one factor that prevented Russia from acting more decisively to block that coup.

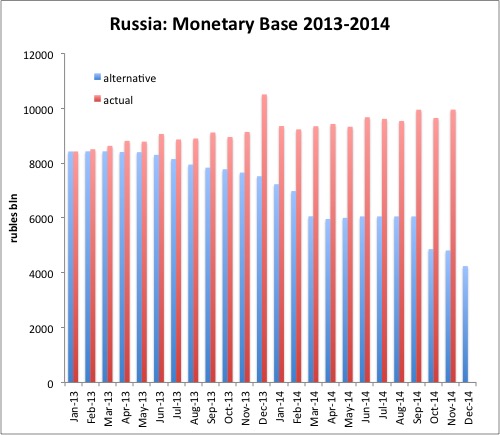

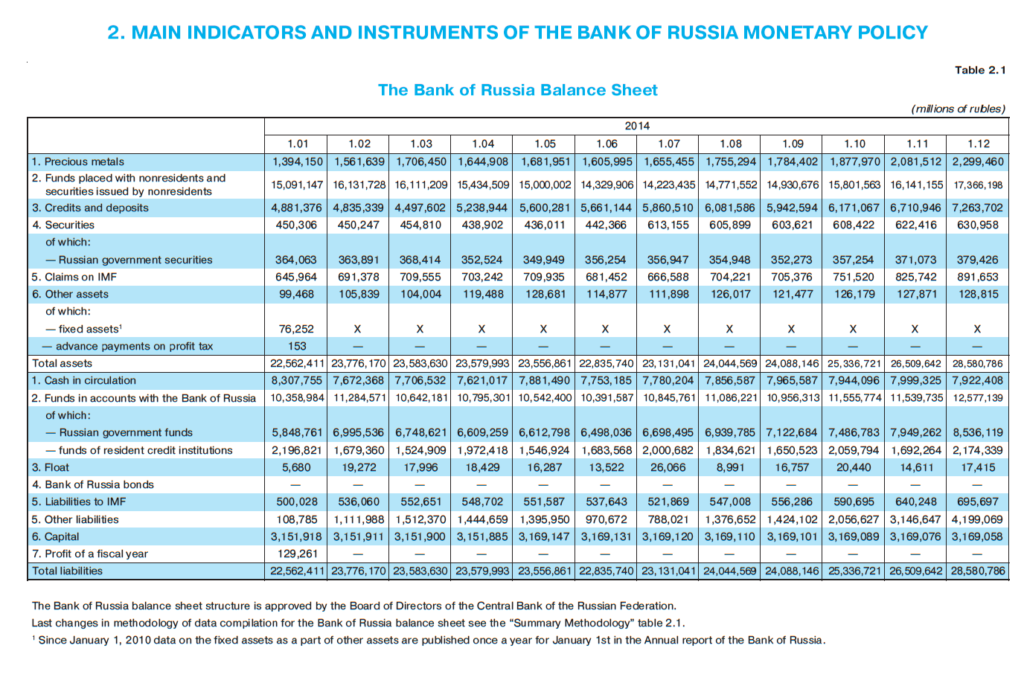

During 2014, Russia’s central bank consistently sold USD “to support the value of the ruble.” But, these sales were again “sterilized.”

The result, once again — just as we saw in Thailand, Russia in 2008-9, and even in Britain in 1931 — was that the monetary base was basically unchanged.

The “alternative” blue bars here show what would have happened if the monetary base contracted by the amount of the foreign exchange sales — if, in other words, Russia’s Central Bank did in 2014 what it did very successfully in February 2009. Obviously, these foreign exchange sales were far in excess of the 20% or so often necessary to support a currency’s value, even in a dire crisis.

This was, as you can imagine, very disappointing to me. It seemed like Russia’s central bank figured out the game in 2009, and would never consider making such a stupid mistake again. But, apparently, by 2014, they forgot it. It might have had something to do with a new central bank governor, Elvira Nabiullina, who became head of the central bank in June 2013 — and if you look at the history of the ruble, it began to break down only weeks after she arrived!

Wikipedia on Elvira Nabiullina

I really don’t know much about Nabiullina, but former Reagan administration official Paul Craig Roberts warned recently that she is an “Atlantic Integrationist” friendly with the goals of the EU, NATO, UN, and other globalist organizations presumably including the World Economic Forum — in other words, the groups that Russia is now effectively opposing in Ukraine. Here’s Paul Craig Roberts:

I think it is telling that, after this totally preventable dismal disaster, this colossal screwup, which crippled the Russian economy for years afterwards, Nabiullina was celebrated in all the usual UN/EU/globalist venues:

In an effort to stop the ruble’s slide, the Central Bank of Russia, under her leadership, hiked interest rates, free-floated the exchange rate, and kept a cap on inflation, thus stabilizing the financial system and boosting foreign-investor confidence. Euromoney magazine named her their 2015 Central Bank Governor of the Year.

In 2017, the British magazine The Banker chose Nabiullina as “Central Banker of the Year, Europe”.

Remember what I said about the British devaluation in 1931 — it was an accident-on-purpose, and using exactly the same method! John Maynard Keynes, the Fabian Socialist, was behind the devalution, and celebrated it soon afterwards.

This is the famous “Fabian window,” showing the Fabians’ goal (to reshape the world basically along Marxist/socialist/”New World Order” lines), and also their logo, the “wolf in sheep’s clothing,” which you can see over the anvil.

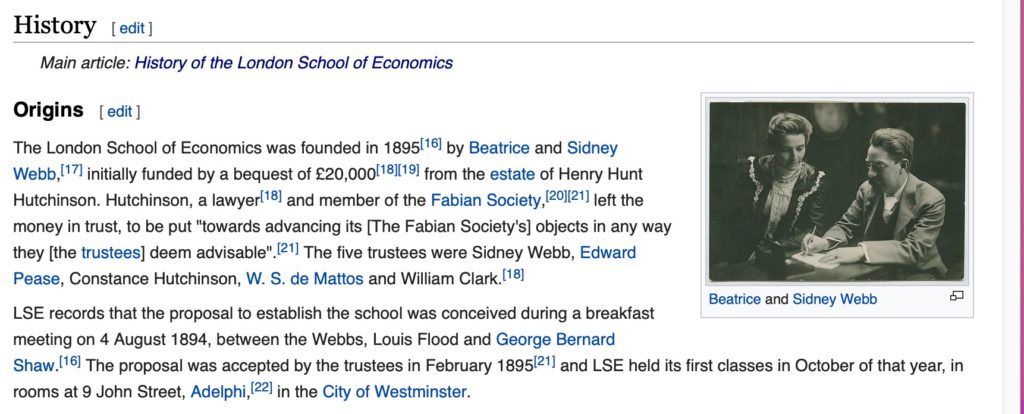

After going missing for many years, in 2006, it was installed at the London School of Economics, which was founded by the Fabians in 1895.

The ceremony was overseen by Globalist advocate and former prime minister of Britain, Tony Blair.

The point here is, the “accident-on-purpose” of the 1931 British devaluation had close ties to Keynes and the Fabians/NWO Globalists, who obviously wanted to promote their interests via economic channels, in fact founding a whole university of economics to do so.

July 10, 2011: The Occult Technology of Power

Now let’s see what was going on in 2014-2015:

I will just leave it here without comment, as raw material for peoples’ own investigations.

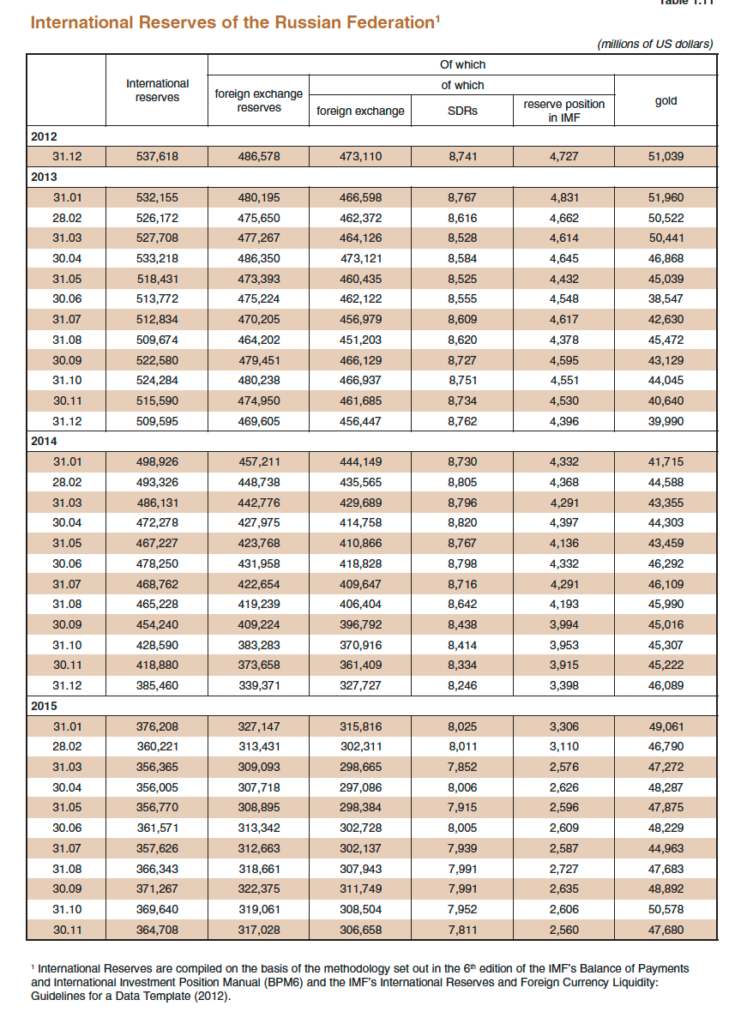

Here are foreign exchange reserves during that time:

The instructions that I laid out last week are clear. If there is weakness in the ruble compared to its parity (for example, 5000 rubles/gram of gold), then the Central Bank has four basic methods:

- Reduce the monetary base by selling gold at 5000 rubles/gram.

- Reduce the monetary base by selling CNY foreign reserves, in the market or at a price equivalent to 5000 rubles/gram.

- Reduce the monetary base by reducing domestic bank credit, allowing short-term lending to run off naturally.

- Reduce the monetary base by selling its holdings of domestic ruble-denominated bonds including Russian government bonds.

The Central Bank will allow monetary base expansion (normal with a growing economy) by:

- Offering to purchase gold at 5000 rubles/gram. These voluntary gold purchases would be achieved by new money creation, increasing the monetary base.

- Offering to purchase CNY foreign reserves, at a price equivalent to 5000 rubles/gram.

- If there is a persistent trend of gold or CNY purchases, then this can be combined with an expansion of domestic bank lending. But, for the most part, short-term interest rates are allowed to be set by the free market without central bank intervention.

- If there is a persistent trend of gold or CNY purchases, the central bank can engage in some purchases of domestic ruble-denominated bonds including Russian government bonds.

A longer discussion of these basic mechanisms is in Gold: The Monetary Polaris and also, Gold: The Final Standard.

I will talk a little about interactions between the central bank, and commercial banks, including lending and interest rates, soon.