For a long time, people have been wondering if Russia and China, along with some allies including perhaps some Middle Eastern states (Libya was one once) and Malaysia, could introduce a new currency bloc based on gold.

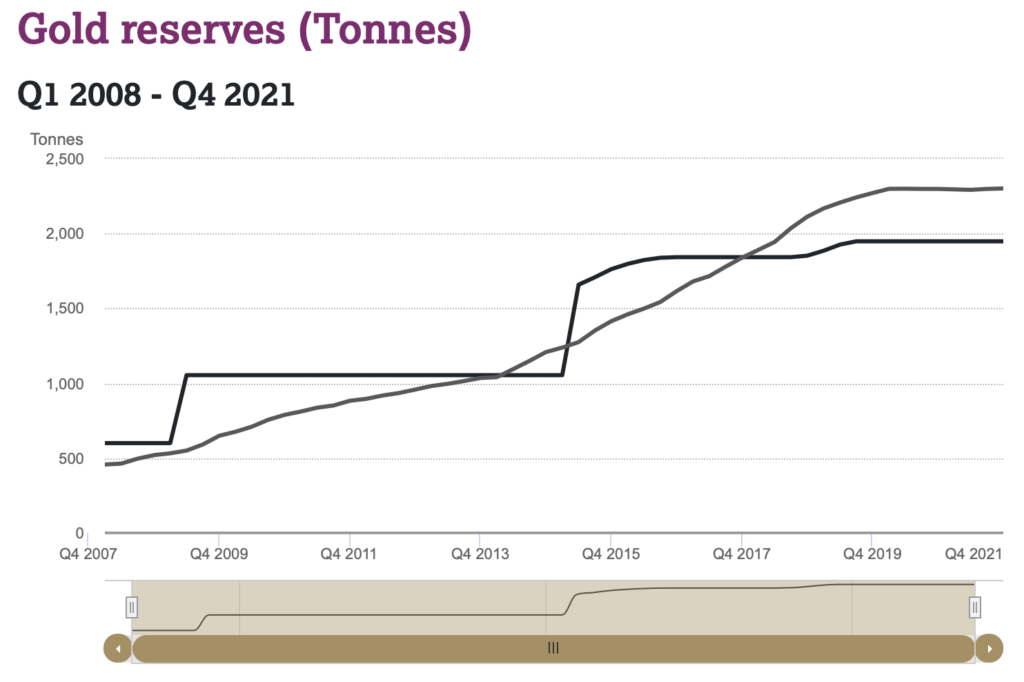

Both Russia and China have been building up their official central bank gold bullion holdings.

Some people think that China’s actual holdings are far higher than this, perhaps as high as 20,000 tons (10x the official level). Russia’s actual holdings are also suspected to be higher than the official levels.

I myself have a little interest in this. My first book Gold: The Once and Future Money (2007) was published in both Russian and Chinese. This led to my participation in TV documentaries on monetary topics that were produced by China Central Television, the largest station and the state broadcaster, and Channel One, Russia’s largest TV channel and also the state broadcaster. In other words, the government TV stations in both China and Russia were educating the public about gold-based money.

Here’s a 2019 story in Russia Today, the state-linked media channel:

Russia bringing back the gold standard may kill US dollar & solve main problem of cryptocurrencies

You don’t see this sort of thing in mainstream US media.

Unfortunately, despite this promising talk, the actual management of the Russian ruble has been rather bad, declining from about 27/USD before 2008, to around 75/USD before the recent crisis.

This does not exactly get me enthused that the Central Bank of Russia would be able to successfully manage a gold standard currency, even if they wanted to. Probably, they would be hesitant even to try.

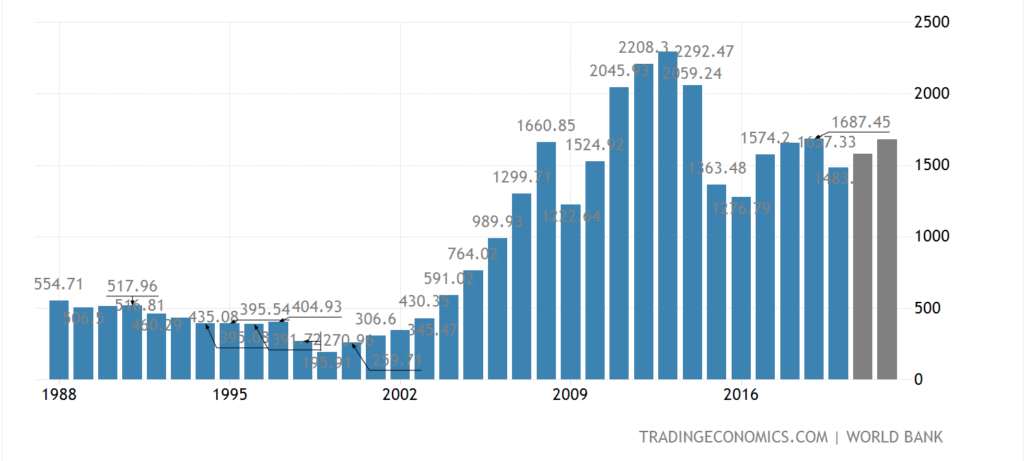

Russia, along with much of the rest of post-Soviet Eastern Europe, had an amazing explosion of economic growth in 2000-2008, which I interpreted as the outcome of the adoption of Steve Forbes-like Flat Tax policies throughout the region, along with the stabilization of currency values including the ruble around 27/USD. In other words, Low Taxes and Stable Money, or: The Magic Formula. Russia’s GDP, as measured in USD, actually rose by a factor of eight times, a growth rate of 30% per year. I didn’t really think it was possible until I saw it happen.

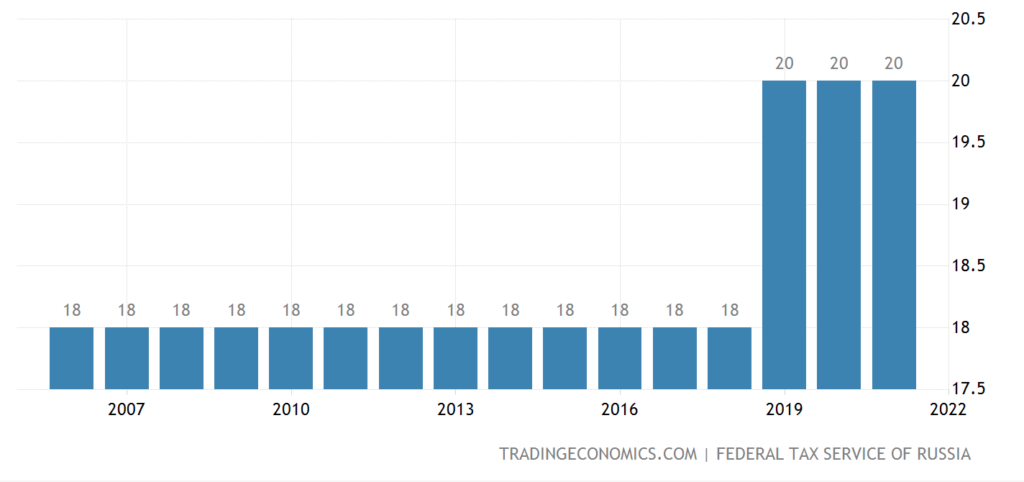

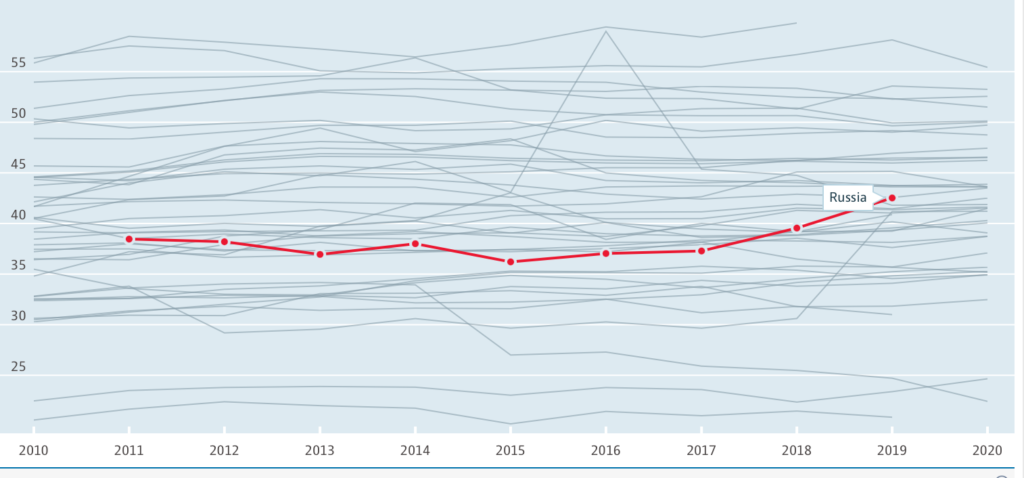

Unfortunately, this amazing curve of expansion was halted by the crisis of 2008 which, in Russia as in many other places, was accompanied by a currency crisis. The ruble was actually stabilized for a while after 2009, but in 2014 had another crisis. Also, although the wonderful 13% Flat income tax remains in place, other taxes rose during this time. Here’s the VAT rate:

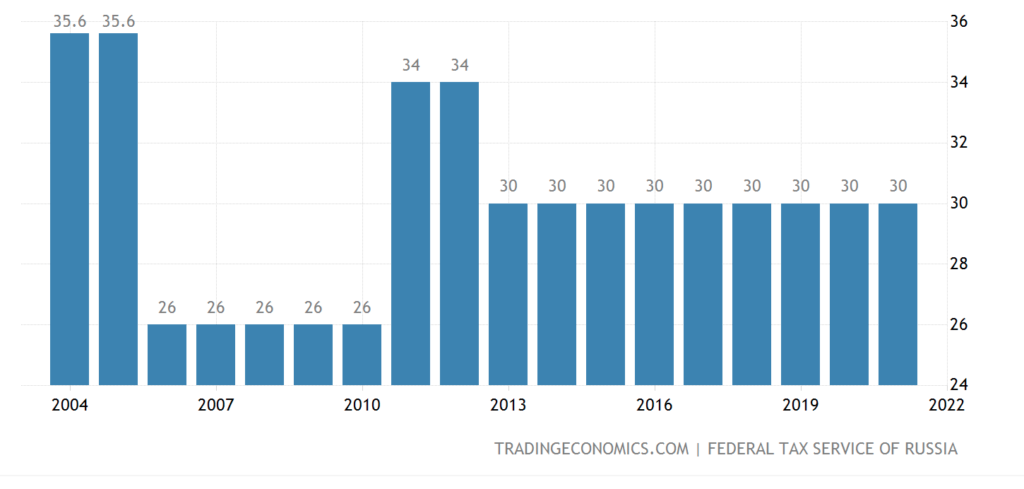

And here’s the payroll tax rate:

Russia’s tax revenue/GDP has been rising, and is very high.

High and rising taxes, and unstable money. The economic boom of 2000-2008 was over.

I like to think that I actually had a small influence in the currency crisis of 2008, which kept things from getting out of hand. The story is in Gold: The Monetary Polaris.

November 24, 2008: Russia’s Currency Crisis

January 16, 2022: What’s Wrong With Turkey #2: Making It Way Too Complicated

Russia is actually in a rather nice position today, if they want to transition to a gold ruble. First, the present management of the ruble is so bad, that there is not much urge to “stick with the devil you know,” (a floating fiat currency) as in the United States. People are ready for a change.

October 16, 2014: Russia’s Currency Crisis: This Is So 2008!

December 19, 2014: It’s Official: Elvira Nabiullina Wears the Tall Pointy Hat for Mismanagement of the Ruble

October 25, 2015: Russia’s Central Bank Might Be Getting a Clue After All

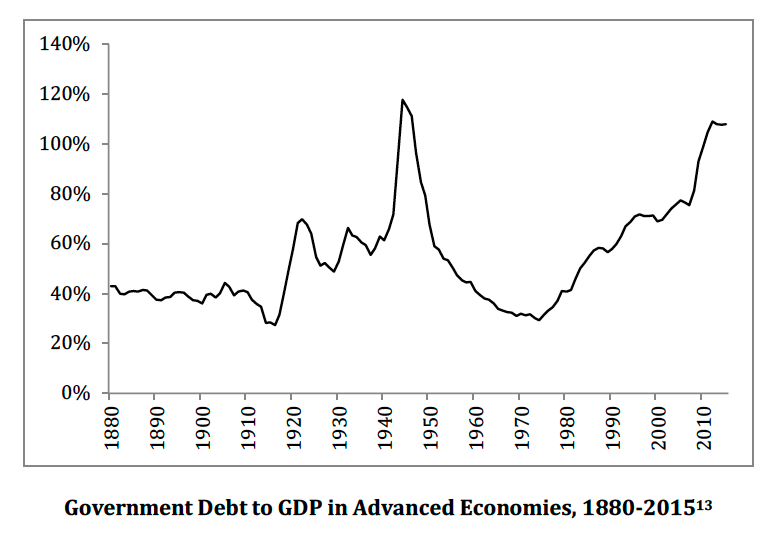

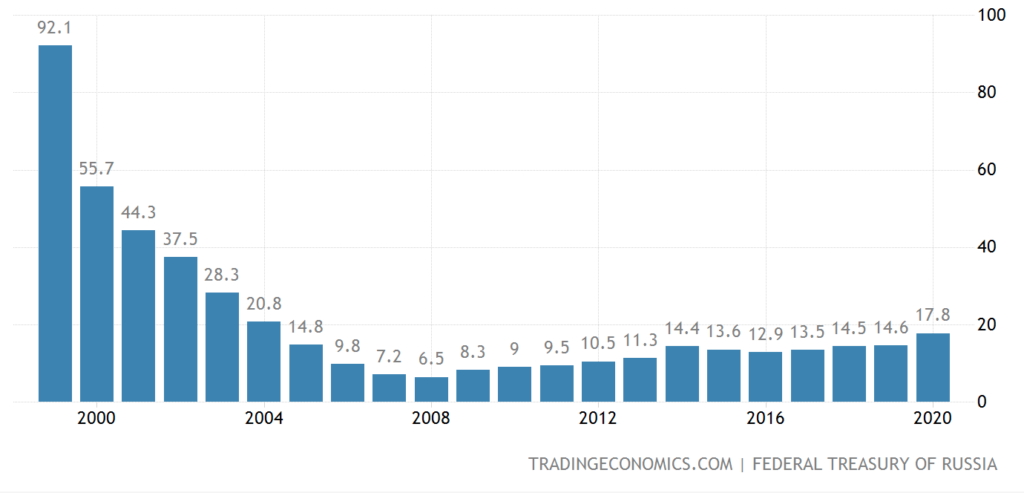

Second, there is not a lot of government debt. If the US or the ECB went to a gold standard today, that would mean that they would have to pay back all that debt in gold-based dollars. There is a strong, latent urge to “inflate it away,” slowly or suddenly. That assumption was, I assert, present in the decision to take on the debt in the first place. In other words, the tendency of major governments today to run persistent deficits is to some degree motivated by the awareness that the debt will ultimately be inflated away, which is in fact what has happened, partially, over the last fifty years. Ray Dalio, who knows as much about this as anyone, has basically made that suggestion, aka a “beautiful deleveraging.” Before the introduction of floating fiat currencies in 1971, major governments tended to have small deficits, and debt/GDP levels declined during peacetime.

Government debt/GDP in Russia is only about 18%, even post-Covid.

Plus, they would probably be paying a lot less interest on that debt, if it was based on gold.

Third, Russia does not have close economic ties with the West. After years of sanctions, even before recent events, there is not a lot of cross-border business. All countries have a strong interest in maintaining a stable exchange rate with trading partners — at least, not having their currency rise too much vs. trading partners (there is a lot less worry about having a falling currency). Volatile exchange rates make all cross-border trade and investment problematic. This is why all the major currencies tend to follow each other lower over time. The EUR, GBP or JPY are not really strong “alternatives” to the USD, because the central banks of each of these want to keep exchange rates from getting too out of hand. However, today, Russia not only has limited economic ties with the rest of the world, but also, I would argue, a new interest in limiting economic ties, or in other words, a policy of greater economic independence, or at least, limiting trade to a few key partners including China and India. Also, Russia’s main exports are commodities, which have worldwide pricing, and are thus less subject to the influence of exchange rates.

If Russia would adopt a gold standard currency today, this would mean, naturally, that the exchange rate between the RUB and the USD would be basically the price of gold in USD — pretty volatile. This is a daunting prospect. The same for the EUR or JPY. Also, not only would there be a lot of short-term volatility, there would be a long-term tendency for the RUB to rise vs. the USD; or, in other words, for the USD to fall in value vs. gold, its trend over the past fifty years since 1971. This could be a problem if you were competing closely with Germany in capital goods or with Japan in automobiles. But, this is not much of a problem for Russia right now. Also, if you look at the RUB/USD rate over the past decade, it is not exactly stable anyway.

Russia could also have a policy of linking the RUB to something like a basket of USD and EUR, basically the “currency basket” policy used by Singapore and other countries. But, this implies having foreign exchange reserves in USD and EUR — which Russia’s central bank did have, until recently. I think they are not likely to go that route in the future. Anyway, for a variety of reasons, the problem of exchange-rate volatility with other floating fiat currencies, which tends to be a deal-killer for most countries, is less of an issue for Russia.

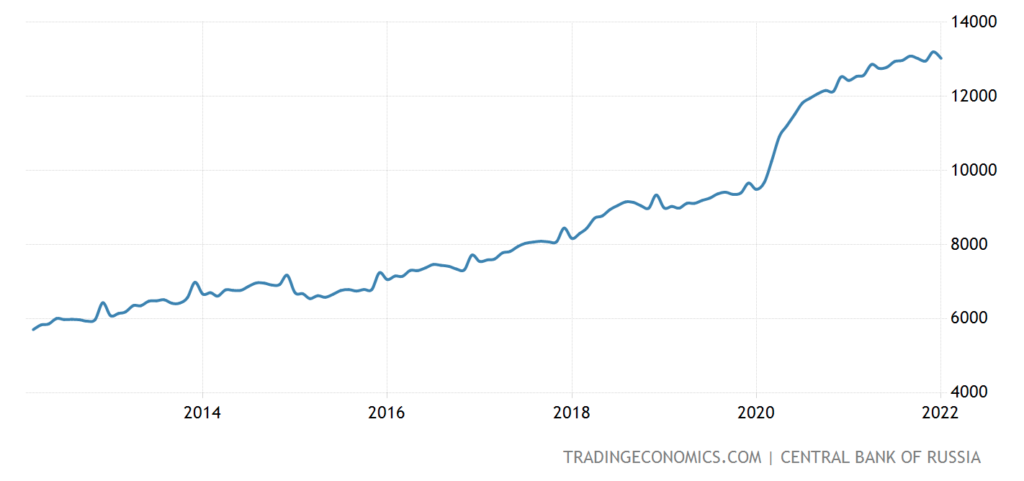

Fourth and lastly, Russia’s central bank already has enough gold reserves to provide more than 50% reserve coverage for the existing monetary base. This is unusual among countries. The monetary base was recently about 13 trillion rubles. At 75/USD, the ruble’s market value a few months ago, that was worth about $173 billion.

The 2300 metric tons of official gold reserves is equivalent to about 74 million troy oz. At $1900/oz., that was worth about $140 billion or 10.5 trillion rubles (at 75/USD). So, even at 75/USD and $1900, or 142,500 rubles per oz., Russia’s central bank had about ($140 billion/$173 billion) or (10.5 trillion/13 trillion) or 81% gold reserve coverage. This makes linking the ruble to gold potentially very easy. I think I would round up to a ruble/gold parity of 150,000 oz., if troy ounces is what you like to use as a benchmark. Maybe grams or kilograms would be better. It works out to about 4500 or 5000 rubles per gram of gold. We will look into how this can be done — and what Russia’s central bank has been doing recently; namely, all the wrong things — in later items.

In the Big Picture, I hope that Russia will embrace both sides of the Magic Formula, not only coming up with some form of Stable Money (such as a gold standard policy), but also, Low Taxes. The combination worked unbelievably well in 2000-2008. If it worked only half as well again, Russia’s rise as a world power would be assured. After a while, we would not be measuring Russia’s GDP in terms of USD, but the US’s GDP in terms of gold, and by extension, gold-linked rubles, or whatever the name of the new currency might be.