In the past, “Economic Nationalism” sometimes had a monetary component. Basically, this was a currency devaluation. “Easy money” and devaluation has been part of the Keynesian macro-manipulator handbook since the Ancient era, and more recently, since the Great Depression significantly undermined the Stable Money consensus of the 19th century.

In the 1930s, devaluations were undertaken basically to “relieve debtors,” and also, reduce effective wages through the devaluation of the currency in which wages are paid. This would presumably allow greater employment. Also, exporters would get a direct advantage. Domestic industries would get an effective advantage since, from their perspectives, products from foreign competitors would become “more expensive” in terms of the devalued currency.

October 2, 2016: The Interwar Period, 1914-1944 (contains extensive forex information)

“You can’t devalue yourself to prosperity” has been a timeless adage in economics. It makes sense that you don’t make people wealthier by devaluing their wages. But, during a time of recession or crisis, it has been a stopgap that governments have grasped for over and over again, over the centuries.

These effects seem to provide an “advantage” to the “nation” (illusory of course), while also creating an artificial “disadvantage” to the rest of the world, who has to deal with artificial competitive issues, plus huge losses on investments in the devalued currency. “Relieving debt loads” just means a partial default to creditors, and this is particularly apparent to foreign creditors, who take immediate losses on their devalued assets.

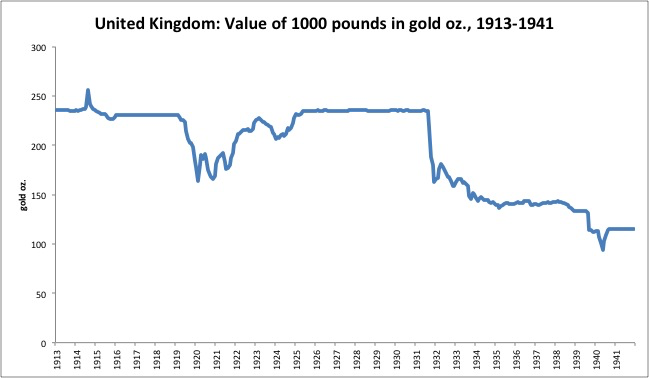

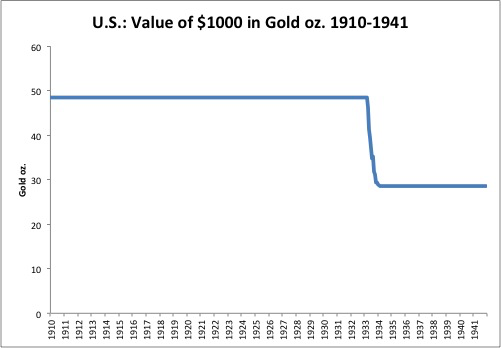

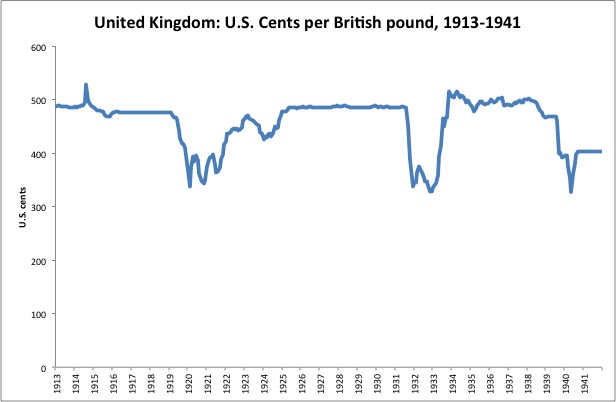

People today don’t sense what a catastrophe the devaluations of Britain (and many others) in 1931, and the US in 1933, were to the rest of the world. The Rest of the World (which included the US in 1931), took mammoth losses on what was then considered the “risk free asset,” British and US government bonds. This naturally pushed the investors in those bonds — banks, pension funds, insurance companies — towards bankruptcy themselves, as their assets now did not cover their liabilities. This is the financial side of things, not the trade competition side. They used to call it “beggar thy neighbor devaluation.”

You could make a comparison to the proposed Greek devaluation of around 2012-2013. It didn’t happen, but many at the time argued that Greece should somehow leave the euro and introduce a new “Greek drachma” whose sole purpose of existence was to be devalued. The basic arguments were just as I listed above, a straight mirror of the Great Depression. Banks and others, throughout the EU, that held Greek debt (there was a lot of it, which was the cause of the crisis), faced mammoth losses, if the existing debt had been redenominated in this new “drachma.” On the other hand, if the existing debts were not devalued, but remained euro-denominated, then lenders would again face mammoth losses, not because the debt was devalued, but because the burdens on debtors would immediately soar, as they had liabilities in euros but assets and revenue in devalued drachma. There would be a wave of bankruptcies, again blowing up creditors and debtors alike.

Thankfully, Greece (and others on the danger list including Portugal and Spain) stuck with the euro, and the crisis was averted. But, it demonstrated that “monetary Economic Nationalism” is not just a historical artifact of the 1930s, but an issue today as well, for basically the same reasons.

The reaction to the Economic Nationalism particularly of Britain’s devaluation of 1931, was to relieve the forex effects by normalizing exchange rates. By this I mean that other countries would also devalue, by around the same amount, which would bring exchange rates back to about their pre-devaluation levels. This not only relieved trade issues, but also made whole the foreign investors, who would see the value of their British government bonds return to their original level as measured in (devalued) local currency. The US devaluation of 1933 was justified by various arguments regarding commodity prices, but the result was to return the USD/GBP forex rate to nearly its pre-1931 level.

Unfortunately, one effect of this is that everyone tends to go down the drain together. If you are overly concerned about foreign exchange rates, you will tend to devalue your own currency in line with other major devaluers. We are seeing this today, with Trump occasionally concerned that the dollar is too high, compared to the euro or yen which have been sliding in value (especially the yen). It is a reasonable concern, but what if the US had devalued in 1994, to match the devaluation of the Mexican peso, its new NAFTA partner? The US leadership knew that imitating Latin American dysfunction was not a good strategy, but in the near future we may also have to make a decision whether we want to imitate European or Japanese dysfunction, or instead, let them go their own destructive way without our company.

The better strategy, in 1933, was not to devalue the dollar, but rather to undo Hoover’s terrible 1932 tax hike, which, among many other increases, raised the top income tax rate from 25% to 63%.

June 27,. 2010: Tax Hikes of the 1930s

It was the economic downturn caused by this that made a dollar devaluation seem necessary. The same thing had happened in Britain in 1931. The day of the devaluation was the same day that a major tax increase was passed. Today we sense that eliminating the Hoover tax increase would have been politically difficult. Instead, Roosevelt allowed Hoover’s High Taxes to remain, and combined them with Unstable Money — the exact opposite of the Magic Formula.

And the results were terrible. So, don’t do that.