(This item originally appeared at Forbes.com on April 15, 2019.)

Oh, the shrieking! The media commentariat has come out with its usual temper tantrum regarding the admiring remarks made by Herman Cain and Stephen Moore toward the gold standard, the principle by which the U.S. dollar was managed for 182 years, between 1789 and 1971. This recent item from the Los Angeles Times typifies the genre.

I know these things are complicated (I wrote three books about the gold standard, the “gold trilogy,” because just one was not enough), so I will try to make it simple for nonspecialists:

1) The United States embraced the principle of a gold-based dollar for nearly two centuries, until 1971.

2) The United States, during that time, became the most successful economy in the world; perhaps, in the history of the world.

3) The United States also enjoyed, for nearly two centuries, a steady rise in the income of the median worker; since 1971, this has stagnated for the first time in U.S. history.

When you do the same thing, over and over, for nine generations, and end up at the pinnacle of global wealth and influence, is it because:

1) You did something wrong.

2) You did something right.

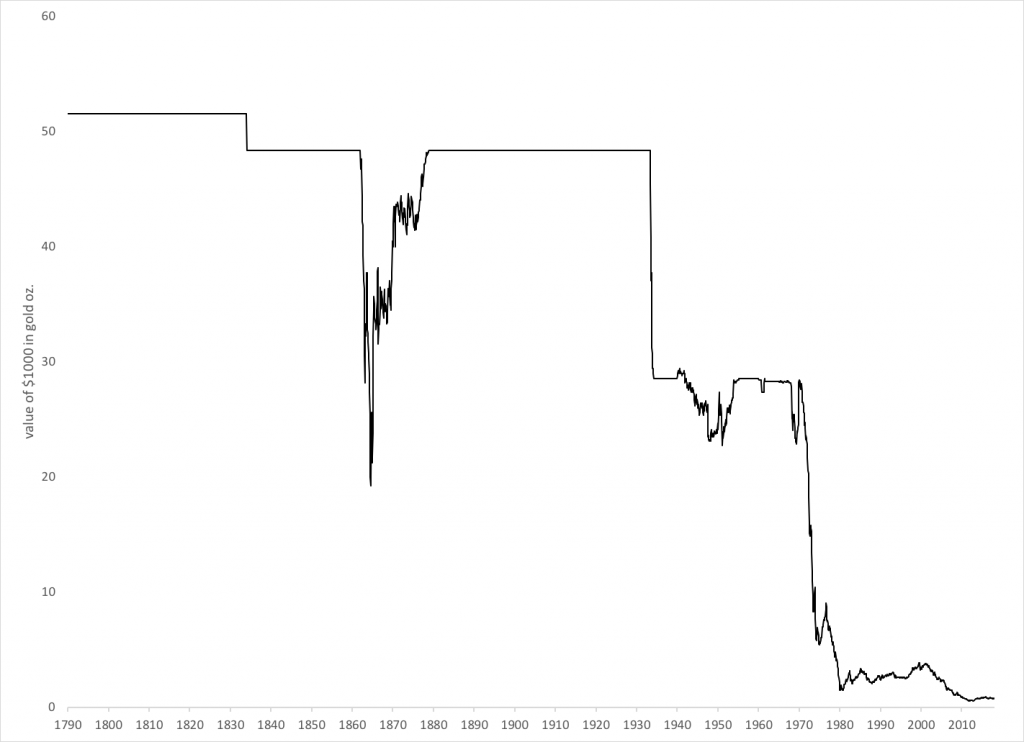

And, when you then blow up the world monetary system, setting off a disastrous decade of “stagflation;” when incomes stagnate for decades despite lower tax rates and other advantages; when interest rates go on a rampage that has taken forty years to tame; when the value of the dollar is less than a thirtieth of its value in 1970, compared to gold; and when, in short, your once-great country needs to be made great again, is this because:

1) You did something right.

2) You did something wrong.

I know, these are hard questions. They must be hard, because nobody can find one single academic economist that gets it. Steve Moore and Herman Cain get it, along with (I think) Donald Trump and Mike Pence.

The fact of the matter is, very few academic economists understand even the rudiments of the monetary principles that formed the foundation of the Western World for centuries before 1971. (As I detail in my books, it was exactly this lack of understanding that led to the breakdown of the world monetary system that year.) Some academics are actually pretty good. Among them are Lawrence White of George Mason University, Michael Bordo of Rutgers University, Giulio Gallarotti (a professor of government who had to step in due to economists’ inadequacies, and surpassed the entire profession) at Wesleyan University, and Kevin Dowd of Durham University (U.K.). I am mentioning these people by name by way of contrast: so that when I characterize the typical academic as ill-informed and mistaken, I mean precisely the gulf that separates people like White, Bordo, Gallarotti and Dowd from the common academic riffraff.

The L. A. Times article is interesting, because it quickly makes a detour into the Great Depression — somewhat odd, don’t you think, for a short item for a general audience supposedly about current affairs. This is because the Great Depression, and people’s reaction to it, still forms much of the framework for monetary policy today. Every serious discussion soon becomes a discussion about the Great Depression.

If you look back on the history of the United States, and the world, during the gold standard years (let’s say 1500 to 1971), it is mostly rather good. When there was peace, a business-friendly environment including low taxes, and money based on gold, the results were excellent time and time again, in the U.S. and in any other country that tried it. This is what I call the “magic formula,” and it is the subject of my most recent book, The Magic Formula.

However, there is one major flaw, or point of debate, in this multi-century track record of success: the Great Depression. On this, and this alone, rests all resistance to Stable Money in general, and the gold standard in particular (the traditional means of achieving Stable Money). Thus, I think we should talk about it — in the kind of plain language that fits in an op-ed.

During the Great Depression, we find that the environment was not business-friendly at all, and taxes and tariffs rose dramatically throughout the world. In the U.S., the Smoot-Hawley Tariff of 1930 was followed by a series of domestic tax increases that brought the top income tax rate from 25% to 81%. Many governments around the world pursued a similar path. As economies crumbled, further socialistic intrusions were introduced, such as president Franklin Roosevelt’s National Industrial Recovery Act of 1933, a disaster of socialistic central planning and price controls that was found unconstitutional by the Supreme Court in 1935. (Amity Shlaes’ book The Forgotten Man has an excellent account of the NIRA and similar policies in the U.S.) In time, civil unrest and wars broke out — the Spanish Civil War of 1936, the Sino-Japanese War of 1937, the German annexation of Austria in 1938 — which, as you can imagine, is not really so good for business either.

With all this going on, it is no surprise that economies crashed, even though governments continued to maintain the gold standard, at least at first.

The economists of the time didn’t really understand what was going on. They really didn’t have any training or understanding of fiscal policy (taxes, tariffs, regulations) at all. To them, economies seemed to collapse for no good reason. It seemed that capitalism was “inherently unstable.” They called it a “decline in aggregate demand,” which doesn’t really mean much more than: “there’s a recession.”

Since they didn’t really understand what was going on, they also could not propose any meaningful solutions. It seemed that they were left with two options: “do nothing,” or engage in some kind of currency devaluation, which governments had reached for throughout history when they got into trouble. Governments did leave the gold standard and devalue their currencies, many of them by 1931. This did provide some “relief” — there is a reason why devaluation has been popular for centuries. But it also came with a basket of nasty consequences, and soon became unpopular. The U.S., which devalued in 1933, had an unemployment rate in the mid-teens for the remainder of the decade. The unemployment rate in France, which did not devalue until 1936, never rose above 5%. The estimated unemployment rate in Germany, which did not devalue, was 44% in 1932, and 3.8% in 1938 — the strongest recovery of any major economy.

Thus, when economists today say that the “gold standard caused the Great Depression,” what they really mean is: the gold standard prevented economists from using the one tool that they thought they understood, which was currency devaluation, in the face of a catastrophic collapse that mystified them. In fact, governments did devalue, many of them at the relatively early date of 1931, and it didn’t work very well; but “if all you have is a hammer, everything looks like a nail.” You can understand why these people would screech and wail about having their one tool taken away from them. They would be left with: “do nothing.”

A similar discussion erupted in 2012. Certain European governments got into a heap of trouble, including Greece and Spain. The reason for this was actually similar to the Great Depression. In the wake of the financial crisis of 2008, many of these governments had big tax increases as part of an “austerity” strategy, with predictable economic consequences. A group of economists explicitly compared the shared euro currency to the gold standard of the 1930s. It prevented Greece or Spain from dealing with their problems with a big currency devaluation. They demanded that Greece and Spain leave the eurozone, introduce their own independent currencies, and devalue them.

But nobody blamed the euro itself for Greece and Spain’s problems. They were entirely nonmonetary. In a similar way, even the Keynesian devaluationists (Barry Eichengreen among them) do not blame the gold standard for the problems of the 1930s. But, like the euro in 2012, the gold standard in the 1930s prevented governments from using currency devaluation to deal with their many non-monetary problems. (Let me point out that this is actually their interpretation, not mine, although I also agree with it.) It is not too hard to imagine that, if Spain and Greece really did leave the eurozone and devalue by perhaps 60% as some suggested, this might bring some short-term “relief” and also some very nasty consequences (giant losses for foreign investors and consequent bank failures among them), provide no lasting solution to the high taxes and other unresolved nonmonetary problems in Spain and Greece, and eventually prove to be unpopular.

With that, we can see that the gold standard’s track record, over the two centuries before 1971, has no major blemishes. It is really a debate about what one should do when non-monetary problems of Great-Depression-like severity appear.

The difference between Steve Moore and Herman Cain, and some other economists today, is that Moore and Cain understand very well that big tax increases, a worldwide tariff war, socialistic intrusions in the market economy like Roosevelt’s NIRA, civil unrest and war, are bad for business. The solutions to these problems are: lower taxes, a free market, free trade, international peace and domestic tranquility — not a currency devaluation. In other words, they have many tools in their toolbox.

This is the kind of perspective that Moore and Cain can bring to the Federal Reserve. We could use more like them.