We’re continuing with the idea of “targeting interest rates,” something that it seems central banks have been doing since the nineteenth century. I think it is time to consider abandoning this concept. Central banks no longer have interest rate targets or policies. This might sound rather radical, but actually, it is pretty close to the way things already are today.

Let’s think about the alternatives to targeting interest rates.

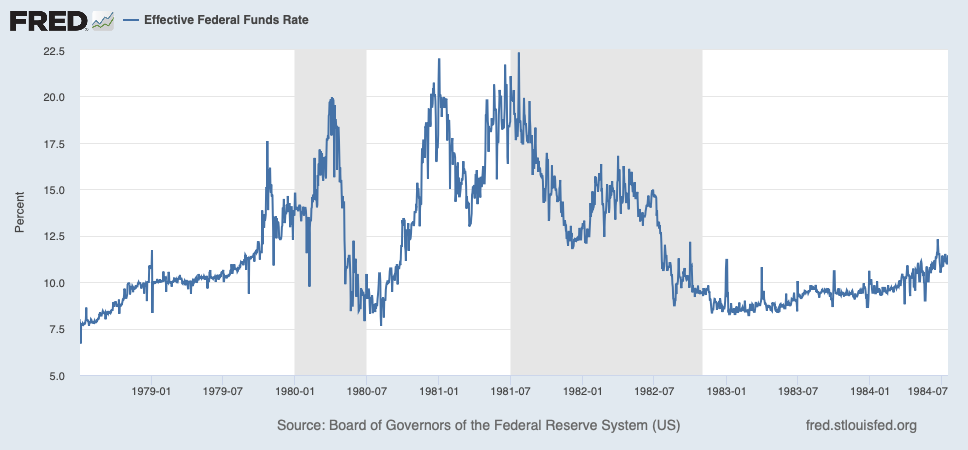

One such example is the Monetarist period 1979-1982. There was a Fed Funds rate during that time, but not a policy of targeting the Fed Funds rate by the Federal Reserve. The Federal Reserve was using targets of M2 and other Monetarist targets.

This accounts for the wild volatility of interest rates during that time. But, this was not only because the Federal Reserve was not active in damping such movements. It also arose due to the wild currency volatility of that period.

Another alternative format is targeting some measure of value, such as gold, or another currency. In these cases, changes in the quantity of money (base money) arise from the value of the currency relative to its target. The simplest case is that of an automatic currency board, or what I called an “Example #1” or “Making Change System” in Gold: The Monetary Polaris. In the case of a currency board, let’s say the currency parity is 1:1 with USD. The central bank/currency board agrees to either buy or sell USD and the domestic currency, in unlimited size, at 1:1. (This is also the operating mechanism of Tether, a USD-linked cryptocurrency stablecoin.)

June 30, 2019: A Rosetta Stone of “Stablethings”

Let’s say this domestic currency is the Argentine Peso, or ARS, which really did have a 1:1 currency board with the USD during the 1990s. We can see that, if the market price of ARS is USD$0.99, or in other words the ARS is weak, then anyone who wants to sell ARS and buy USD (for example, an importer) would go to the central bank and get USD$1.00 for ARS$1, instead of USD$0.99 on the open market. Alternately, if the ARS is strong, at USD$1.01, then anyone who wants to sell USD and buy ARS would rather buy ARS at USD$1.00 at the central bank, rather than pay USD$1.01 on the open market.

Thus, we see that transactions with the central bank, and thus the increase and decrease of the central bank’s USD assets and the increase and decrease of ARS in circulation, arises from these transactions. There is no interest rate policy, and no mechanism to manage interest rates. In practice, ARS interest rates would tend to follow USD interest rates, and if the Federal Reserve has an interest rate targeting policy for the USD, then that would also be translated to ARS as well. But, there is no such mechanism with the ARS currency board itself.

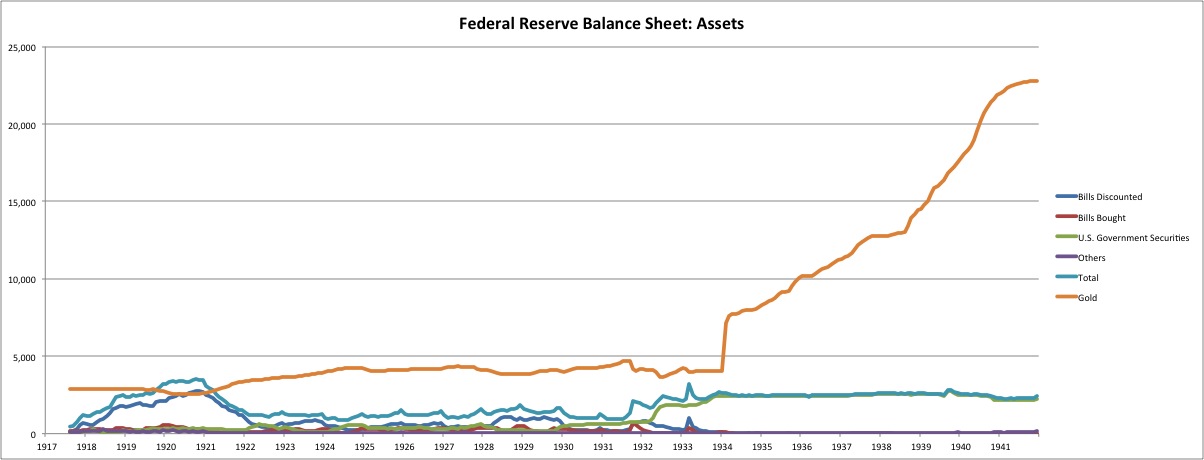

If you just substitute gold for USD, then you get a particularly simple sort of gold standard system, which operates under the same principles. The only transactions by the central bank (Federal Reserve) are USD for gold, and vice versa, at the target parity of, let’s say, $35/oz. This was what the Federal Reserve did in the 1933-1941 period.

Here we see that all of the Federal Reserve’s activity in debt instruments goes dormant after 1933. The only changes are in gold. Thus, the large expansion in the monetary base during that time basically took place due to the tendency of the USD to rise. It took (let’s say) $34.95 to buy an ounce of gold on the open market. Since the Federal Reserve was buying gold at $35, everyone with gold to sell (miners) would sell to the Federal Reserve, and get $35 rather than $34.95. The Fed’s gold holdings increased, and the dollar monetary base expanded.

From this, you can see that there was no interest rate targeting policy at the Federal Reserve during the 1933-1941 period. There was no mechanism by which such a policy could arise. There were no transactions in debt instruments, and gold transactions were entirely passive, initiated by market participants, like a currency board or Tether.

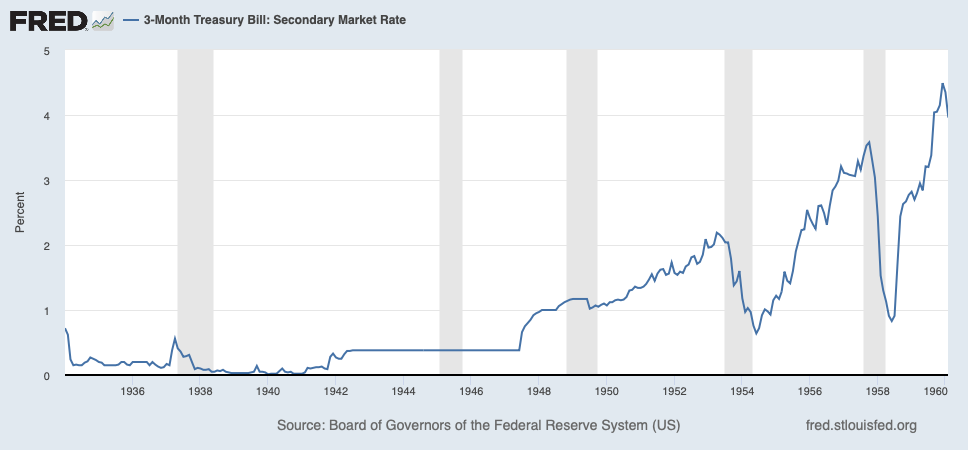

During this period, short-term interest rates were very low. Like today, banks had very high reserve ratios, and had no need to lend to one another, so there was effectively no “Fed funds rate.” Let’s look at the market rate on 3 month Treasury bills to get an idea.

It was very low, but still somewhat variable until the wartime period.

Thus, we have two examples where the Federal Reserve did not have an interest rate target: The early 1980s Monetarist period, and the late 1930s period. One had very high rates in an environment of macroeconomic and currency turmoil; one had very low rates in the midst of the Great Depression, but with the USD linked to gold.

What are our options here today?

We could have a currency-board-like arrangement, a Fixed Value system, where all of the changes in Federal Reserve assets and liabilities come about basically from transactions at the parity price. This could be a currency board with another currency (ARS and USD), or it could be a gold standard system (USD and gold). In either case, interest rates just are what they are. It is determined by the market, just as is the case for 3m TBills.

Or, you could have a floating currency, and no fixed value target, but where assets and base money of the Federal Reserve change according to some other decisionmaking framework. In the early 1980s, this “other format” was the Monetarist framework (quickly abandoned). Today, it might be QE or whatever. In this case too, interest rates just are what they are. We are already quite close to this today.

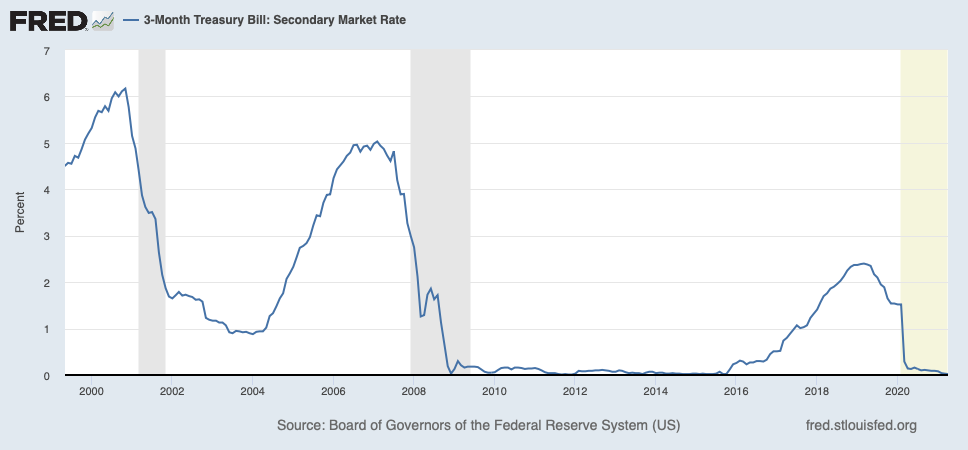

Here are recent 3m TBill rates:

The Fed Funds target was basically abandoned in 2008. The Interest on Reserves policy produced a rise in short-term rates in 2016-2020, but that has also been almost abandoned (presently 0.10%). If so, then it seems that today’s basically 0% short-term rates have arisen from market forces, rather than Federal Reserve policy. This is, I would say, somewhat similar to the Great Depression period, 1933-1941. It is worth noting that there was actually a substantial dollar devaluation during that time, in 1933, but this had little effect on interest rates. Similarly, we have had substantial dollar devaluation since 2009, with the USD going from about $900/oz. to $1900/oz. today, with near-zero rates throughout.

In a healthier situation, we might expect short-term interest rates to be around perhaps 2% for 3m TBills, and 3% for longer-dated government bonds, in the context of a gold standard system where there was no interest rate target or manipulation policy.

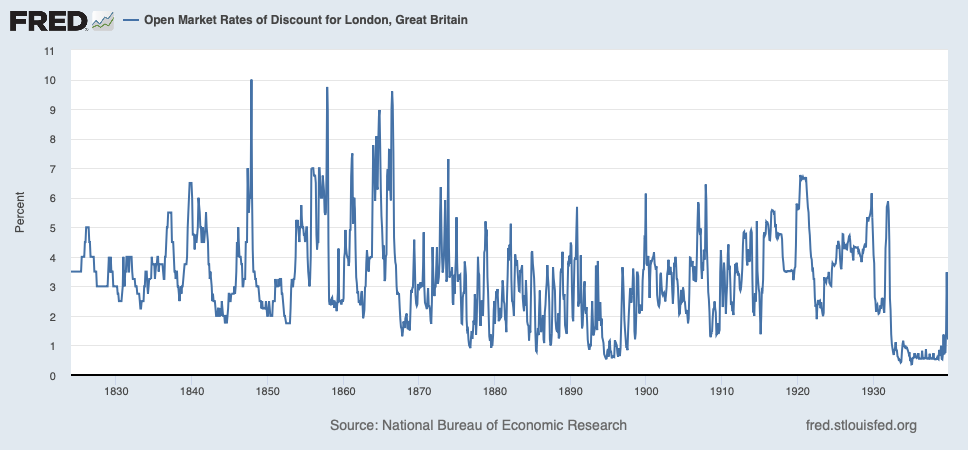

Here are open market rates of discount in London during the 19th century. But, these are basically short-term corporate loans, not TBills, so the rates are higher.

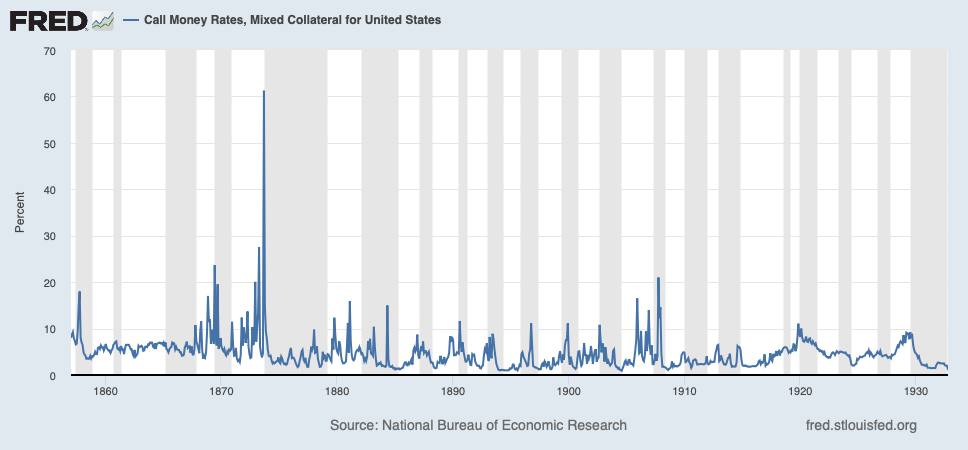

Call money rates in the US were similar, although spikier. This begins a long discussion regarding the distributed National Bank System during that time (there was no Federal Reserve), which had regulatory limitations on base money creation that tended to create short-term shortages.

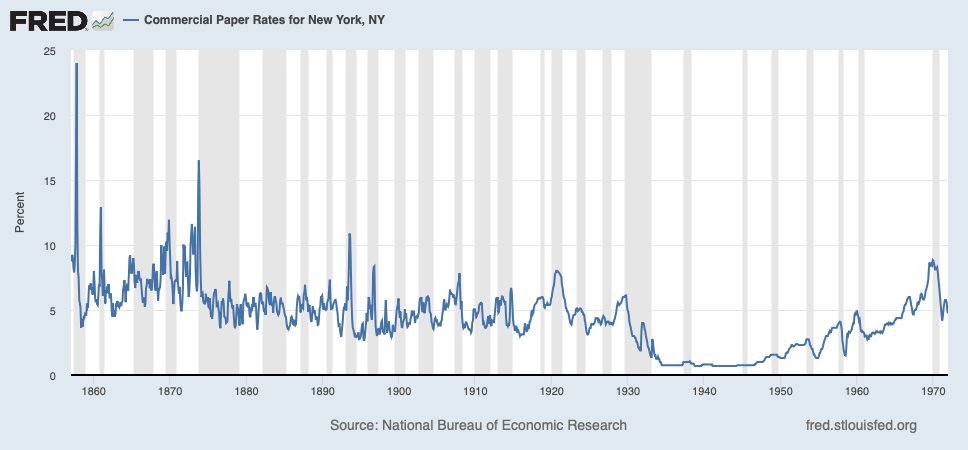

Here are commercial paper rates. So, I think it is clear that the examples of the 1930s and today are anomalous. In a gold standard system with a healthy economy, short-term CP rates are more like 5%.

Remember, the USD was a floating currency until relinked to gold in 1879. There was a big decline in yields afterwards.

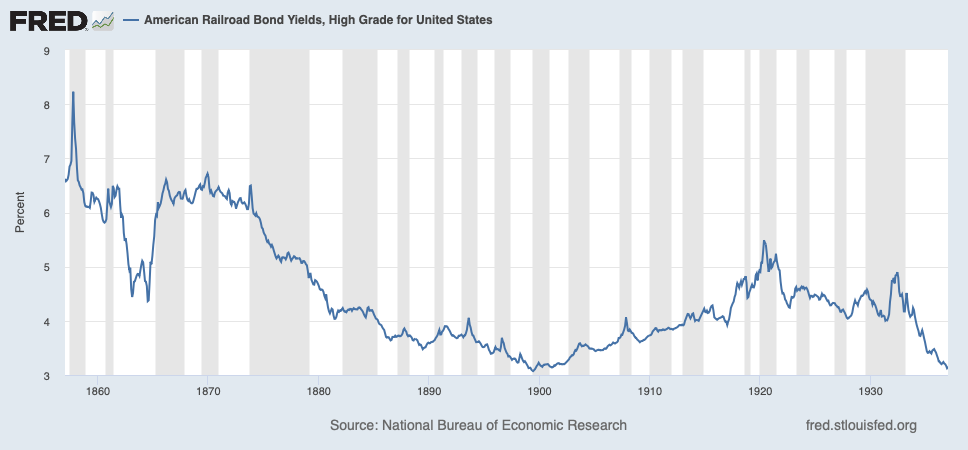

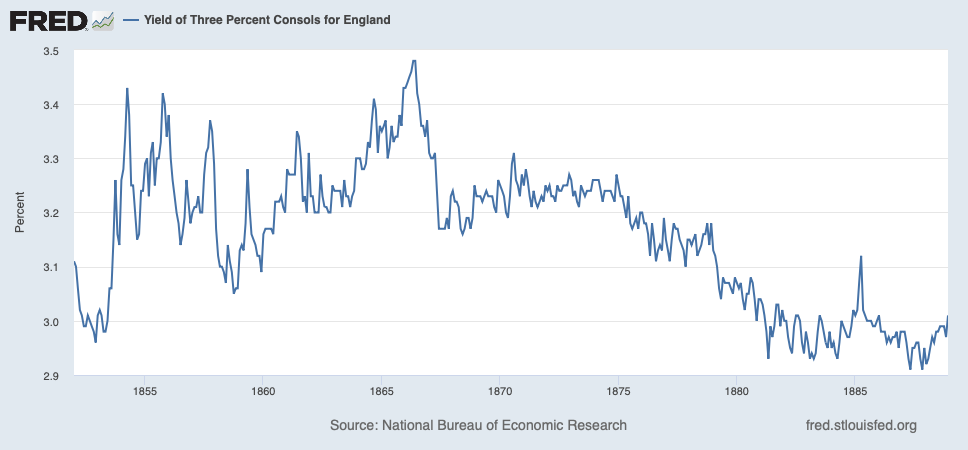

Yields on 3% Consol bonds, British government bonds of infinite maturity. This is an incredibly tight range: 50 years (1850-1900) where the yield was between 2.9% and 3.4%.

Today, the Federal Reserve is — if not exactly “targeting” — certainly influencing interest rates basically by buying and selling the debt itself, Treasury debt and MBS. This is in the context of a floating fiat currency. Overall, it is similar to what the Fed was doing during WWI and WWII, when it was pressured by the Treasury to limit interest rates to allow cheaper funding of the wars. We will see where this goes. Historically, this sort of thing has rarely ended well.

In the past, the gold standard era, interest rates were left to free-market forces. Instead, there was a fixed-value policy — keeping the value of the dollar at $20.67/oz., or later, $35/oz. Yes, you can do that, and many countries do this today, especially those with operating currency boards.