(This item originally appeared at Forbes.com on April 23, 2025.)

Economic Nationalism, done right, could work very well for the United States in coming decades. The most glorious period for US business, before 1913, was a time of high tariffs and controlled immigration. But, it was also a time when there was no Income Tax; and, in this pre-Federal Reserve era, the money was fixed to gold. The result was very good. The United States, at first a promising “emerging market,” ended up a global superpower.

The present era of Globalism dates from Bretton Woods Agreement of 1944, passes landmarks such as the North American Free Trade Agreement of 1994, but reached its full expression with the inclusion of China into the World Trade Organization in 2001. This was paralleled by a range of technological developments, empowered by the new Internet, which made long-distance supply chains possible. Although this Globalist trend arguably did benefit the world as a whole, it is not clear at all that it benefited American citizens. Many industries were “hollowed out,” with unemployment, underemployment and depressed wages the first consequence. A weak domestic economy did little to pick up the slack. Supply-chain dependency proved incompatible with a trend toward a more “multipolar” world, where China or Russia’s growing regional authority combined with American exhaustion with its post-WWII role as global policeman.

Within this framework, certain Economic Nationalists (such as Pat Buchanan) have argued in favor of an across-the-board flat rate tariff, avoiding the aggravating complexity of different rates for different products from different countries. It is basically the tariff equivalent of a flat-rate retail sales tax, and might be in the range of 10% to 20%. To this might be added some country-specific (but still flat-rate) tariffs, depending on the situation, perhaps 5%-20%. For some reason, we feel that Free Trade with Canada or Germany is far less problematic than Free Trade with China or Mexico. Why is that? There are many answers to this question, most of them good answers, which goes to show that general economic principles supposedly for all times and all places are not useful here. These things take place in a historical and geographic context.

Tariffs are taxes; and all taxes tend to have negative economic consequences. Part of the United States’ brilliant nineteenth-century strategy was also its superlative domestic economic policy, combining Low Taxes with a very business-friendly regulatory framework. The Trump Administration has been talking about eliminating the Capital Gains Tax, which the Supply Side economists of the 1980s long argued was the most economically harmful tax, compared to its modest revenue. Eliminating the tax would be a certain moneymaker – the economic health that followed would result in higher revenues from all other taxes. Unfortunately, this reasonable attempt to balance higher tariffs with lower domestic taxes has been running into trouble, both with the difficulty of continuing the lower tax rates introduced in the 2017 Tax Cuts and Jobs Act, and also some hints towards higher income taxes. Higher tariffs and higher domestic taxes combined is not going to result in a healthier economy. It also won’t result in more tax revenue.

Unfortunately, the Trump Administration, in its tariff policy, has embraced a framework that is basically fallacious and certain to lead to destructive policy that benefits nobody, including Americans. It was expressed in a recent paper by Stephen Miran called “A User’s Guide to Restructuring the Global Trading System.” Miran was later appointed as the Chairman of the Council of Economic Advisors. This paper focuses on “trade imbalances” (basically current account deficits), which are supposedly to be remedied with tariffs and also changes in foreign exchange rates. But, lest we put too much blame on Miran, this line of thinking goes back at least into the 1950s, and historically far earlier, into the Mercantilist era of the eighteenth century. Variants are found in common economic textbooks today.

I would reject this entirely. It is tempting, to some people, to find such a body of widely-embraced pre-existing economic dogma that seems to support a Nationalist agenda that was arrived at largely from real-world experience. But most of its claims are false. The whole idea that “trade imbalances” need to be resolved with changes in exchange rates is bizarre. The fact of the matter is, the different States of the United States, or the different countries of the Eurozone, also have “trade imbalances” with each other, even while sharing the same currency! This arises from the basic fact that “trade imbalances” don’t exist. All trade is always balanced.

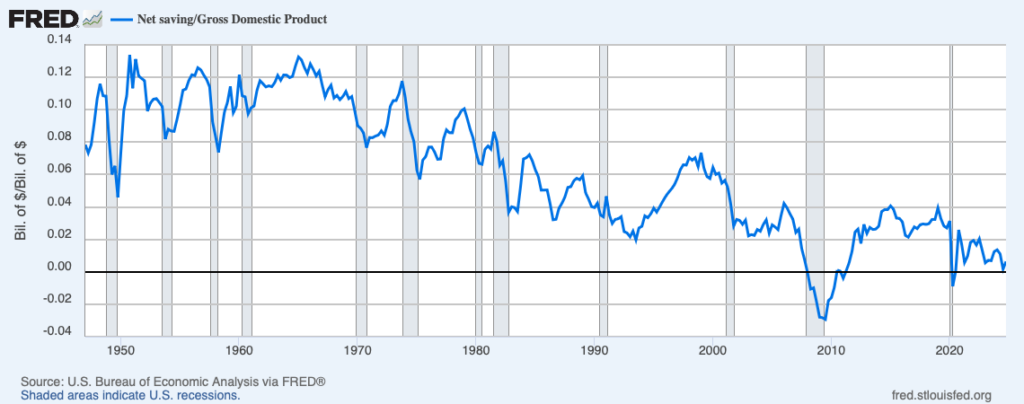

The primary reason for “trade imbalances” (US current account deficits) is the low rate of domestic capital creation. The US domestic savings rate is low. Nearly all of this savings, in recent years, has been exhausted in financing Federal deficits, leaving almost nothing for net domestic investment. This has resulted in a reliance on foreign capital even for today’s low levels of domestic investment, which shows up statistically as a positive financial account and negative current account, or “trade imbalance.” The solution is a higher rate of domestic capital creation (getting rid of the capital gains tax would help), combined with smaller Federal deficits. Let’s take note here that this solution, perfectly sensible as it is, is also completely contrary to postwar Keynesian doctrine, which says that recessions or underperforming economies are caused by too much saving; and that more spending and larger Federal deficits are the answer. Postwar Keynesian dogma should follow postwar Mercantilist dogma onto the scrap heap of history.

During the high-tariff Nineteenth Century, the dollar’s value was securely fixed to gold. Although the US also ran a Current Account Deficit throughout the nineteenth century (basically due to European capital flowing to where it was treated best), this was never a problem, and nobody tried to solve this nonexistent problem with currency devaluations. The result was that the US became an economic superpower.

Nevertheless, if the US dollar is “strong,” but other currencies are weak and decline in value, the resulting swings in foreign exchange rates will introduce serious issues in foreign trade. That’s why the economist Robert Mundell argued that free trade and floating exchange rates are inherently incompatible – one justification for the creation of the Eurozone. Probably this would be a good situation to put to use that country-specific flat-rate tariff mentioned earlier, which would provide some cushioning against the effects of foreign exchange swings. But, I would abandon all claims that various countries are “currency manipulators” – a claim that bizarrely includes even those countries that fix their currencies to the dollar!

Already the more practical members of the Trump Administration have come to the conclusion that the recent tariff strategy does more harm than good, even to Americans. The whole framework of “fixing trade imbalances” via tariffs and foreign exchange movements (detailed in Stephen Miran’s paper) should be abandoned immediately. There is still a place for a policy of Economic Nationalism, that could include substantial tariffs. These are best as flat-rate tariffs. For good results, such as strategy should be combined with good domestic policy, including Low Taxes and Stable Money – or what I’ve called “the Magic Formula.” It worked for the United States in the nineteenth century, and it could work again today.