(This item originally appeared at Forbes.com on June 16, 2000.)

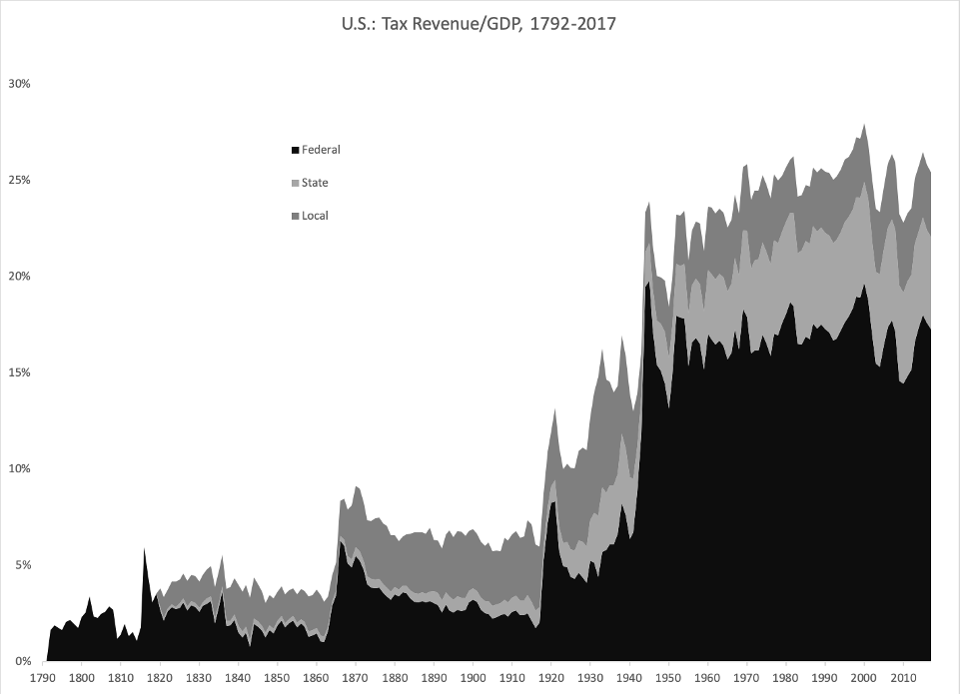

Taxes, we are told, have been around almost as long as Death. Even the most primitive tribe typically has some form of “taxation,” such as an expectation to participate in communal defense. We generally don’t think of taxation as being something that has developed over the years, like technology. But, much of our current taxation methods didn’t exist a century ago. Like the radio and transistor, they are twentieth-century technologies. Taxation has been a realm of rapid recent innovation. I say this to inspire the hope and expectation that the tax systems of the future will be different, and better, than those of the past.

Maybe you noticed that many of our institutions have been coughing up blood recently. This was predicted some years ago in The Fourth Turning (1997), by William Strauss and Neil Howe, which was recently sold out at Amazon.com. I loosely embraced this idea, which is one reason why I was inspired to write The Magic Formula (2019). I felt that we needed a book for a crisis era, and also, a blueprint for what comes afterwards. You need a blueprint now so that, when the era of destruction is over and it is time to build again, you know what you want to build.

When the Constitution was ratified in 1789, taxation was very primitive. Most taxes, in Britain and America, had been indirect taxes — mostly, excise taxes on individual products, and tariffs on individual products. This soon leads to thousands and thousands of taxes, and all kinds of associated problems. Also, the amounts that could be effectively raised, as a percentage of GDP, were not very high. There had been some experiments with general sales taxes — a tax on any sale. But, a single product, or the things that went into the product, would be taxed over and over again as it moved to market. It also applied to things like asset sales. Even at a seemingly low rate, it soon became terribly oppressive. These “turnover taxes” have been implicated in the decline of the Muslim Caliphates in the 10th century, and the Spanish Empire in the 16th. The Netherlands declared independence from Spain in 1581 in part to avoid this tax.

Direct taxes — taxes on people, instead of things — had been considered a mark of tyranny since Greek and Roman times. One common direct tax, throughout history, was a simple per-capita tax. Everyone pays a fixed sum. The problem is, any kind of tax of this sort soon comes up against large numbers of people who simply cannot pay it. Even today, how many Americans (without the help of consumer debt) couldn’t pay a $2000-per-person tax? What happens when they don’t pay? Do you throw them in jail? Often, a person’s house, land, tools and livestock — the things they needed to make a living — were confiscated and sold, rendering them destitute (and thus unable to pay the tax). Sometimes, people sold their children into slavery. Direct taxes like these were implicated in the French Revolution of 1789.

Although there were precursors, the first modern income tax emerged in Britain in 1799, during the long wars with France. It was very similar to today’s income tax, with several rates and a “tax return” much like ours. The top rate was 10%. It generated large amounts of revenue, and this revenue-generating success was a key element that allowed Britain to defeat France in the Napoleonic Wars. Nevertheless, this tax was considered such a violation of British principles of liberty that it was abolished in 1816, immediately after the end of the war.

In 1842, the income tax reappeared, but under a different guise. It was similar to today’s payroll tax. For most people, there was no “tax return.” In effect, it was an indirect tax on employment labor. Business owners paid a similar tax. There was only one rate — a “uniform” tax. This was highly successful. The revenue that it generated allowed Britain to eliminate hundreds of tariffs, including the repeal of the Corn Laws in 1846, which had been implicated in a famine in Ireland. Finally, there was a revenue solution that didn’t cause the disasters of Direct taxes until that time, and didn’t have the massive overcomplication and piteous inefficiency of the system of hundreds of excises and tariffs.

Unfortunately, the income tax, combined with the Marxist movements that became influential in the nineteenth century, combined to produce a monstrous new creature, the progressive income tax. This began in Britain in 1910, and the U.S. in 1913. With the start of World War I soon afterwards, top income tax rates rose above 40%, and haven’t gone much below that since. This was the idea of having different rates for different people, as part of a program of “redistribution” or other forms of social engineering. Income taxes soon became hellishly complicated, leaving us today with a tax code thousands of pages long. Also, we created endless political adversarialism, and chronic economic underperformance.

It was soon found that you could not really generate all that much revenue from these income taxes. Rich people can pay a lot, but there really aren’t that many of them. It doesn’t amount to much in terms of revenue/GDP. And, when rates went much above 20%, there were all kinds of negative economic effects.

The next advance was the common retail sales tax, introduced in the 1930s. This was a giant leap forward compared to the general sales tax (on all transactions), and also compared to the thousands of excises and tariffs. The retail sales tax was imposed only on finished goods, and excluded asset sales. In 1936, the U.S. introduced the payroll tax — as noted, similar to the nineteenth-century British income tax, but also, very unlike today’s graduated income tax. This was a single, flat rate (uniform) tax, there was no tax return, and in 70+ years there has never been any complexification. Today, this tax generates about 35% of all Federal tax revenue.

These taxes could generate big revenue, with low rates and not too much economic drag as a result. This allowed the widespread elimination of the primitive excise-and-tariff system. Tariffs today are considered mostly a way to manage trade relationships, rather than a foundation of tax revenue.

The next advance was the Value-Added Tax, which was first introduced in France in 1958. If you consider the history of taxation, it is amazing that it took us 6000 years to figure that out. While the VAT is usually considered a variant of the sales tax, it is also remarkably similar to common “flat income tax” proposals today. Since you have to sell something to get income, this makes sense. The VAT in effect takes a position within the process of commerce as a whole. Flat income taxes, payroll taxes, VATs and retail sales taxes tend to all be variants on the same thing — a single, flat-rate tax on commerce.

Today, France is known for having super-high taxes. But, France’s income tax does not generate any more revenue than the U.S.’s. Probably, it can’t. France’s government does not get its extra income from “taxing the rich.” It comes from payroll and VAT taxes — broad, flat, “uniform” taxes. If France eliminated its income tax entirely, it would still have very high taxes, and very high tax revenues — probably, more than 35% of GDP — which could fund a very high level of government services. But, the economy would do a lot better, and you would eliminate all the difficulties, contention and complexity of the income tax.

This is, actually, the principle that was expressed in Article 9 of the French Constitution of 1789:

Pecuniary privileges, personal or real, in the payment of taxes are abolished forever. Taxes shall be collected from all the citizens, and from all property, in the same manner and the same form. Plans shall be considered by which the taxes shall be paid proportionately by all,

In those days, “pecuniary privileges” (low or no taxes) were enjoyed by the aristocracy, which is what tends to happen when the aristocrats have political power as in the Ancien Regime. Today, those with political power are the democratic majority. No surprise then that about 47% of Americans pay no income tax. Every exemption and deduction that litters the income tax code is a “pecuniary privilege” to some interest group. Either way, the solution, then and now, was “taxes shall be paid proportionately by all” — the principle of Uniformity. This was ensconced in the Constitution (also 1789) as the “uniformity clause” in Article I Section 8.

In practice, this would mean that a payroll-type tax on employees should be matched with a “flat income tax” on business, at the same rate. This was roughly the successful British system of the nineteenth century.

It all becomes a lot easier if the spending side of government is smaller. Then you could have taxes that are uniform (one rate across the board for all people in all situations), and also, low. This might take the form of a provident fund system for retirement pensions and also healthcare, as is used in Singapore today. There is a backup welfare system if this proves insufficient, but even with that this system has allowed Singapore to keep its revenue/GDP ratio to 14.2%. You could probably fund this with a 20% VAT, and no other taxes — no income, payroll, or property taxes. Or, you could split it up, like Herman Cain’s “9-9-9 Plan.” The economist Lawrence Lindsey, who wrote President George Bush’s 2001 tax cut plan, has said that his ideal Federal tax system would be a simple VAT. I agree with this: if we are starting from a clean slate, a simple VAT makes the most sense to me. This would involve the repeal of the Sixteenth Amendment, and probably the addition of a new amendment that updates the Constitution’s original Uniformity Clause to modern conditions.

The main reason that we have an income tax today is that we needed a way to produce revenue in wartime, in the days before the invention of the modern retail sales, payroll and VAT taxes. This was combined with Marxist notions that have since been discredited. But, now we have those other alternatives, so we don’t need the income tax anymore. Soon, I think we will have a chance to get rid of it.

The Magic Formula is: Low Taxes, Stable Money. The Stable Money part is a gold standard. I think people are beginning to understand now why Stable Money has never been achieved any other way. Any human-run system eventually succumbs to human influences, known as “politics.” (I say “eventually,” but in practice, it was that way from Day 1: August 15, 1971.) In the Reagan era, Low Taxes just meant the existing system with lower rates. But, our understanding of tax technology has advanced a lot even since the 1980s. We can do much better now.