We’ve been talking about Understanding Money Mechanics (2021), by Robert Murphy. Or, maybe I should say we haven’t been talking about it, but the book did inspire me to discuss some issues that I’ve been thinking about discussing for a long time, but hadn’t got around to.

March 23, 2025: Understanding Money Mechanics (2021), by Robert Murphy

We described a common bank, which looks like this (denominated in kilograms of silver):

ASSETS

Loans 700kg

Securities (marketable bonds) 200kg

Reserves (silver coins or deposits at the bank clearinghouse) 100kg

LIABILITIES

Deposits 900kg

Shareholders’ equity 100kg

This has been the typical makeup of banks literally for centuries. Banks today are actually not much different.

You could extend the basic principles to credit more broadly, including direct lending, bonds, securitized loans (MBS for example), and so forth.

First of all, let’s observe that the balance sheet balances. Assets and Liabilities (and equity) are equal. Thus, borrowing (deposits) and lending (loans and securities) are about equal.

What determines the amount of deposits, or lending?

Basically, it is supply and demand. It arises from the aggregate decisions of all the people who hold deposits, or borrow, or lend. Let’s look at these people and see what motivates them.

Why do people hold deposits in banks? Basically, this is a preference for cash, in this case a convenient money substitute. Or, usually — actually a significant amount of Deposits are time deposits, which are one of the most illiquid of all credit instruments, since you can’t even sell it in the market like a bond. Nevertheless, we will begin our discussion with Demand Deposits. Why do people hold Demand Deposits? There are a number of reasons, which you can figure out pretty readily. Mostly it is because their income and expenditures don’t coincide perfectly, so there has to be some “store of money” in the interim. On top of that, bank deposits are convenient for distance payments (using a check or debit card or ACH), and are perceived as safer than holding literal money; in this example, silver coins in an iron box.

But, we can see that people don’t have to hold Demand Deposits. There is nobody forcing them to. They can choose not to, at any moment. At any moment, they could trade their Demand Deposits for a Money Market Fund, or a long-term Bond Fund paying a higher interest rate, or they could buy something, or invest in something, or do many other things.

What if people’s “demand” for Demand Deposits shrank? Then the total quantity of Demand Deposits would also contract. Basically, this would be accompanied by a contraction on the Asset side of the balance sheet, since the Balance Sheet must balance. Let’s say that 20% of Depositors, at a bank or perhaps throughout the whole banking system, decided to withdraw their Deposits in the form of silver coins, and put them in an iron box under their bed. The bank would have to pay out these coins. The bank would do this by reducing Assets. It could pay out of its cash reserves, the literal silver coins the bank already has in a vault, or which is in the vault of the Clearinghouse. It could sell its securities (bonds) for money; ultimately, coins. Or, it could receive payments from loans, either regular monthly payments or payments of principal upon maturity. Since the bank would be paying out this cash to Depositors, it would not be able to make new loans with the money, and thus the total loan book would shrink. Maybe the Depositors do not withdraw their Deposits in the form of silver coins, but instead invests in a Money Market Fund that holds government bills, or a bond mutual fund, or loan it directly to their brother-in-law. Deposits would shrink. Thus, we see that the Supply of Demand Deposits can expand or contract to fit the Demand for Demand Deposits, from Depositors.

Against this, we have the Bank. The Bank requires some deposits to fund its lending, but maybe not as much deposits as are available. The Bank can discourage deposits, by offering a lower interest rate. The interest rate on checking Demand Deposits is often zero, or nearly zero. Savings Deposits are nearly the same. Since a bank has to pay this interest, obviously it doesn’t want to borrow more money (have more deposits) than it has a need for. But, at an interest rate of zero, there is no particular disincentive for a bank to hold more deposits. It doesn’t cost them anything. They can always use the money to buy Securities, such as government bonds. However, depositors themselves can just buy a Treasury Money Market Fund, or a Government Bond Fund themselves, and enjoy the extra interest income. So we see a natural “supply and demand” between Banks and potential Depositors, between them determining the amount of Deposits.

On the other side of the Bank’s balance sheet, we have mostly Loans. How is this amount determined? First, you need to have someone who is interested in borrowing money. Second, they have to have the apparent capability to pay off the loan. A bank can borrow from depositors at a low rate of interest (maybe zero), and then lend at a higher rate of interest (maybe 7% or 8%), and make money off the interest spread. This is profitable. As a general principle, a bank will make as many profitable loans as it can. This is how a bank gets bigger, and increases its profits, both definitions of business success for bankers. But, loaning money to people who can’t or don’t pay it back, is not profitable.

Thus, a bank has what is known as “underwriting criteria.” This is basically a checklist of characteristics that determine whether a potential borrower is capable of paying off the loan. Thus, a Bank needs 1) a willing borrower; and 2) a borrower capable of paying off the loan. We can also add factors like collateral, or outside guarantees such as government guarantees of credit, and so forth. These factors together determine the amount of lending that a bank does; and consequently, the amount of deposits that are required to fund this lending.

Recently, since the crisis of 2008, banks have come under a lot of regulatory pressure to basically raise their underwriting standards, limiting loans to borrowers that are perceived as being unusually good credits. This is a reaction to the debt crisis of 2008, when a lot of lending was done with very bad underwriting, leading to a lot of bad debts.

In addition to these regulatory factors, banks can adjust the conditions of lending, with the result of increasing or decreasing both a) the number of willing borrowers; and b) the number of willing borrowers that meet underwriting standards. Interest rates are one factor. But, there are also credit requirements such as downpayments, loan-to-value ratios, credit scores, other collateral, debt covenants, and other factors which make it more or less attractive (or possible) to borrow.

All these factors together lead to the quantity of actual loans made, and their credit characteristics. As we can see, it is the outcome of many different factors and decisions by individuals, both borrowers and lenders. Let’s say you want to buy a car. Depending on various factors such as interest rates, downpayments, duration of the loan, etc., you may decide to borrow more or less money, in the form of an auto loan, to buy the car. If interest rates and downpayments are low, you might choose to borrow a lot of money and get a fancy car. If interest rates and downpayments are high, you might choose to borrow a little money and get a cheaper car, or use your existing car longer, or maybe just pay cash and skip borrowing altogether. All of these factors, in aggregate among thousands and thousands of borrowers, determine the quantity of auto lending, and the credit conditions under which the lending is made.

There are a couple more items on the Bank Balance Sheet. One is Shareholders’ Equity, or Capital. This is typically expressed as a percentage of Assets. Here, it is 10%, a common figure. It could be higher or lower, depending on a lot of factors, including regulations and the decisions of management.

On the Asset side, we have Marketable Securities, typically investment-grade bonds. Loans are typically for a long term, and illiquid, although they could be sold. A Bank has a need for something that produces interest income, but could be sold for cash readily. Thus, about 20% of a typical bank balance sheet consists of Securities.

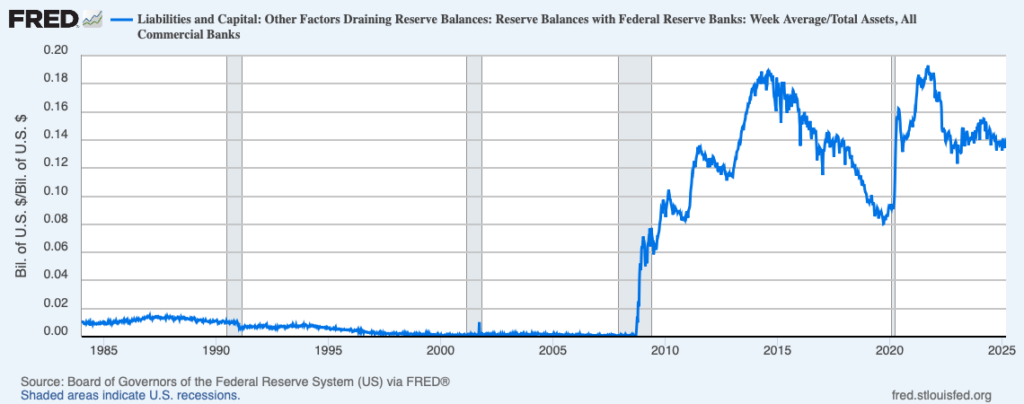

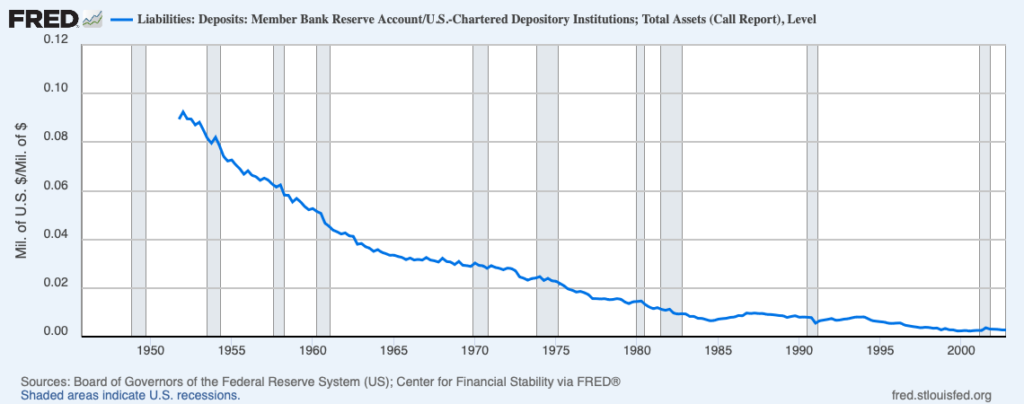

About 10% of Assets, in our example, is “Reserves,” which basically means cash. In our example, it means either silver coins held in a bank vault, or a deposit in the Bank Clearinghouse, where there are also silver coins held in a vault. Conventionally, these Reserves did not pay interest. But, since 2008, Central Banks have begun to pay interest on these Reserve Deposits, which increases their relative attractiveness. The amount of Reserves held by a bank is also subject to a number of factors, including regulation and the decisions of management. Traditionally, and in fact today, it is around 10%. (This graph shows 14%, but for Domestic banks only it is about 10%.) But, it has gone up and down over time, actually falling to extremely low levels in the 1990s and 2000s, until, in 2008, it was below 0.1%!

Here is data going back to 1952. You can see that the Reserves/Asset ratio was more like 8% in the 1950s. Why was this higher in the past, reached very low levels, and then rose again in recent years? Basically it was the decisions of bank management, in the context of the regulations of the time.

Now we can see the factors which determine both the Assets and the Liabilities of Banks. I’ve emphasized that all of these quantities are determined by a variety of factors, leading to a variety of decisions by individuals, to borrow or lend, or hold a greater or lesser amount of deposits, or bank reserves, or bank capital.

Finally, we have one more factor in this system, which is the silver coins themselves. This is a “full weight” coinage system, not a “token” coinage system. We will assume free export and import of silver, and free minting of silver. The value of the silver coins is basically the value of silver on the world market. In practice, there are often some complications. Coin wear and minting were a perennial problem in the past. Export and import restrictions have been common. But, it is so easy to smuggle silver (and especially gold) that such attempts at restrictions typically do not work very well, and the outcome is quite close to if there was free exchange and free minting of silver. The Spanish silver dollar was actually banned in the British colonies in America, since Britain was perennially at war with Spain. But, enough Spanish silver dollars entered the Colonies that it became the basis of the US Dollar, not the British pound.

What determines the number of silver coins in existence? We know that there is a limit defined by the amount of silver actually physically available in the world. But, most of the silver has always been in the form of jewelry, bullion bars or various housewares such as silver plate. If you wanted to, you could always take some of this and make it into coins, without having to wait for miners to dig up more silver. We will take one individual country, in this case Britain and the British coinage, as an example. Britain has no significant domestic silver mining, so must import nearly all of its silver.

We know that all the silver coins in existence, are held by someone — a person, a bank, a corporation, a government, etc. Silver coins are not just “circulating” on their own. Each person holds a coin, because they have some desire, or “demand” to hold a coin — just as they have some demand to hold Demand Deposits at banks. At any time, they can reduce their holdings of silver coins, perhaps by depositing them in a bank, or buying some other investment like a government bond, or investing in some other thing, or buying some good or service. At any time, they can increase their holdings of silver coins by withdrawing them from a bank, by selling some asset, by “savings” out of regular income, or many other means.

Thus, we can see that the amount of silver coins in existence is determined by the desire of each individual to hold silver coins, instead of spending them to buy some other thing.

If the number of silver coins in existence is in excess of this total demand, then ultimately, silver coins will either leave the country, used in payments to foreigners for some good, service or asset, or perhaps be converted domestically into some nonmonetary form of silver, like forks and spoons.

If people wish to hold more silver than they have, then one way or another, they will take silver to the Mint and have it made into coins. This might be from domestic nonmonetary sources, or from imports of silver.

Since silver coins are the only actual money in our example, we see that the “money supply” is not determined by mining, or banks, but by the aggregate desire of all individuals (and individual organizations like banks or corporations), to, for some reason, hold a silver coin.

We can also see that the value of these silver coins is basically the same as the world value of silver. If silver coins were somewhat more valuable (whatever that might mean), then it would make sense to import silver and make it into coins, thus arbitraging away the difference. The same would apply if domestic coinage were somehow less valuable than the world market value.

The ratio of Reserves to Assets of banks, or the ratio of Reserves to Deposits (almost the same thing), or the “reserve ratio,” is sometimes called the “money multiplier.” It is true that Assets are some multiple of Reserves. A 10% Reserve Ratio is the same as a “10x money multiplier.” But, let’s look at all the description thus far. What determines the amount of lending? It is a combination of willing borrowers, and banks willing to lend within certain underwriting standards. It is also somewhat related to banks’ ability to fund this borrowing, since you can’t lend money you don’t have. The balance sheet must balance. But, banks have a lot of options regarding funding, not only depositors, but higher-cost borrowing of various forms. So, in practice, if banks can make a loan under attractive conditions (the borrower meets underwriting standards, and the spread between the lending rate and the funding rate is adequate), then the bank will make the loan.

At no time do banks make loans because they are forced to by some “multiplier.” We already know all the factors that go into a lending decision, and at no point did some “multiplier” ever come into discussion. Bankers themselves don’t care about this, and they are the ones making the loans. Go read the Annual Report of any large bank, typically with hundreds of pages of descriptions of the bank’s activities, and see if some “multiplier” is ever mentioned, that somehow forces bankers to do something that they would rather not do. This does not exist in the real world.

In the 2000s, the Bank Reserve Ratio actually fell under 0.1%. This means a “money multiplier” of >1000. At this point, the whole notion should have been revealed as stupid nonsense. Banks “multiplying money” by 10x might seem plausible, but 1000x? Really? And nobody noticed? And this just went on for decades? Economists STILL don’t talk about this, even though the data is readily available as I have shown, because they don’t have any good answers. When their theory fails, their response is just to stick their heads in the sand and hope that nobody notices how silly they are. This is because most of them have the ability to learn, from a textbook, some “money multiplier” nonsense, and repeat it for a test. But, they don’t have the ability to face a reality that doesn’t match their mistaken theory, and then fix the theory. At that point, they are just adrift, and they don’t like being adrift.

We already saw that the number of silver coins, in our example, was determined by the desire of various individuals (and entities) to hold silver coins. One major holder of silver coins is banks, either in a vault, or as part of the Clearinghouse System. Thus, the amount of silver coins held as bank reserves is determined by bank managements’ desire to hold silver coins as bank reserves. Thus, the “multiplier” actually goes the other way. Banks typically manage their Reserves as a percentage of Assets (or Liabilities, same thing since they balance). Thus, the amount of lending drives the amount of reserves, not the other way around! In other words, a big bank, with lots of lending, will tend to hold more reserves. The more deposits a bank has, the more reserves it will also tend to have, because that’s what management decides is prudent policy. Or, maybe managements will be very imprudent, and hold ridiculously low reserves, as in the 2000s. Either way, managements decide. They are not being forced to do anything by some “multiplier.”

This applies even in the case of regulatory reserve requirements. We saw that the Reserve Ratio (Reserves/Assets) declined by huge amounts over time, from 8% to sub-0.1%, and also, that this was never at any time a stable figure. There is no straight horizontal line in the historical chart. This came about by two basic mechanisms: 1) Banks’ pressure on the political or regulatory process, to basically get what they want regarding reserve requirements; 2) Banks’ ability to game the system, for example using “sweep accounts” to move high-reserve-requirement “checking” deposits into low-reserve-requirement “savings” or “time” deposits. One way or another, banks got what they wanted. In other words, managements decided.

People make the example of a bank that increases both its Assets and its Deposits simultaneously, by making a loan, and then recording the amount of the loan in the deposit account of the borrower. And indeed, this would “self-fund” the loan, IF the borrower/depositor decided to keep the deposit in the bank. Normally, the borrower/depositor does not do this, because there is normally some reason why they borrowed the money besides just having it sit in a bank; and also, the Interest Margin, or difference between the interest rate on the Loan and the interest rate on the Deposit, that makes a bank profitable, is negative for the borrower. So, they would be losing money every month. Sometimes this actually happens. A corporation might borrow 1000kg on a ten-year loan, and then keep the 1000kg as a deposit or cash-on-hand, because it sees potential uncertainty in the future that might require a lot of cash. For example, if its regular operations become unprofitable, as in a recession, then they would still have to make payroll somehow. At some later point, the concern passing without incident and the Deposits still sitting there unused, the corporation will then pay off the loan, and both Lending and Deposits would decrease.

But, a more common scenario is that money is borrowed for some immediate purpose. Maybe you buy a house. You borrow 500kg of silver, which you receive as a deposit. Then, you pay for the house. The bank has to make this payment (to the bank of the home seller let’s say), using its Reserves held at the Clearinghouse, or in other words, silver coins. It doesn’t just “make money up out of nothing.” In our system, all payments require silver coins. Thus we see that this “banks make money up out of nothing” stuff is not really true. It is not hard to understand banks. Basically, it is just as banks themselves describe, to their shareholders, in something like an annual report.

At the aggregate level, of all banks, the amount of Deposits is determined by the willingness of Depositors to hold Deposits. At any time, they can change their mind. It is not somehow forced upon them by some outside factor.

Before 1913, in the more-or-less “Free Banking” period in the United States, commercial banks really did print banknotes (convertible to gold coin at the bank), and really did hand these out in the process of making a loan. A bank would loan you $1000, and give you $1000 of banknotes that the bank literally made themselves. These banknotes of course traded hands, the same as today, and were thus a form of money. Anyone could take these notes back to the bank, and get gold coins in exchange. Also, anyone could deposit these notes in any member of the National Bank System, which began in 1863. So, bank lending and “money creation” really were mixed together. In this case, the number of banknotes was regulated by their convertibility into coin. Banknote issuance being a profitable enterprise for a bank (basically zero-cost funding), banks naturally wanted to press into circulation as many notes as they could get away with. But, banknotes coming back to the bank in exchange for gold coin put a limit on this. In this way, the amount of money (banknotes) was naturally regulated. Ironically, this system is actually what a lot of “End the Fed” people, who complain today that “banks create money,” want to go back to — a time when banks actually created money. I say that any such multi-issuer “free banking” systems should have, in the spirit of Glass-Steagall, a full separation between the note-issuing (or today crypto-digital issuing) function, and the regular bank lending function. In other words, it would be in a separate company, bankruptcy-remote from the lending bank, probably with only investment-grade securities and gold bullion as Assets. This is basically the form today of dollar stablecoins such as USDT Tether or USDC, which are growing in popularity. A lot of this “banks create money!” stuff reflects something that was real in the 1880s, but has basically been extinct since the Federal Reserve was created. The current situation, in which banks do not create Base Money, only the Central Bank does, is actually directly analogous to my silver coin example. Nevertheless, even in the pre-1913 “banks create money!” days, there was no particular problem.