Now it is time to say a few words about the book that got me going on these topics: Understanding Money Mechanics (2021), by Robert Murphy.

April 13, 2025: Understanding Money Mechanics #4: Fiat Money

April 6, 2025: Understanding Money Mechanics #3: Chain of Causation

March 30, 2025: Understanding Money Mechanics #2: Supply and Demand

March 23, 2025: Understanding Money Mechanics (2021), by Robert Murphy

This is a fine book. It is succinct and plain-spoken, not given to jargon or dogma, or sophistry to score political points. Mostly I agree with its arguments and conclusions. Also, it has some nice charts.

Unfortunately, the Austrian Tradition is characterized by oceans of text arguing about generalities and principles. This has been a feature of the “Austrian school” since the 1880s, as it sought to provide an alternative view to the “Historical School” popular at the time. If you read Human Action, by Ludwig von Mises for example, I don’t think there is a single historical example cited, although you can tell that his discussion of general principles was motivated by historical events. Since there are no historical examples, there is also no need to ever provide any kind of real-world data. While there are some advantages to the focus on principles, a methodology which excludes any kind of real-world example, on principle or simply in imitation of people like Mises, is certainly in danger of losing the plot entirely, and drifting off into an imaginary land that doesn’t have much relation to reality. And this, I would say, has characterized the “Austrian school” for about the last century.

November 27, 2016: The Tyranny of Prices, Interest and Money 2: The Old Historicism

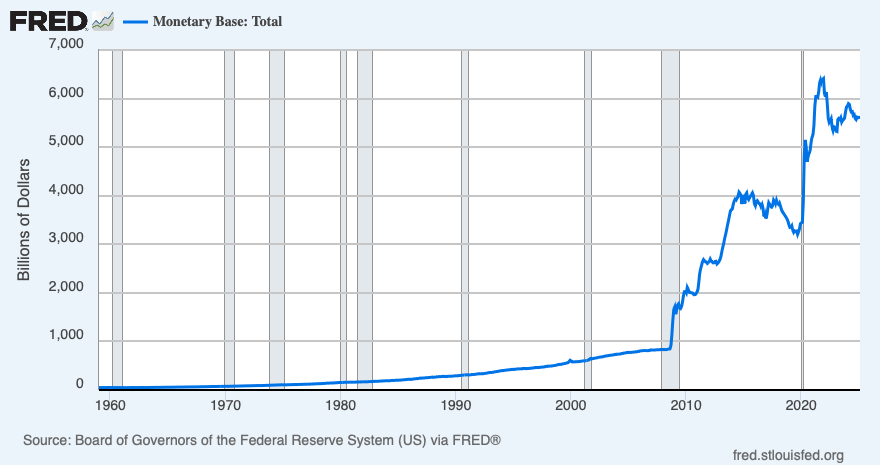

Murphy refers to real-world events, including some historical chapters going back to the beginnings of US history, and later, recent events including the financial crisis of 2008, and the various central bank innovations that have taken place in response to that crisis. This has included some real-world data in the form of charts, mostly just cut-and-pasted from the Federal Reserve’s FRED database, which I also like to use. It really is that simple, and more economists, of the Classical or “Austrian” flavor, should try it out.

Chapter 6 also has a nice list of the actions that the Federal Reserve actually took after 2008, which I thought was an excellent resource for understanding this time.

Unfortunately, when talking about a mostly good book, it is very tempting (and also fun) to focus on what I feel are the flaws. The flaws here are not just minor irritants, but fairly substantial, putting this book in the category of “flawed books” which are best enjoyed along with some commentary on those flaws like I am providing here. The student, or reader, should read this book with an eye to the sections that perhaps you feel are flaws, and not take it all on face value as received wisdom.

The prior four items in this series, the detailed discussion of bank borrowing and lending, can serve as a basis for identifying some flaws. Although, as I mentioned, Murphy himself recognizes some of the flaws of the conventional description in Chapter 12, so you could also take it as an addition to that discussion. Now I will talk about a few others.

Chapter 8 has a discussion of “Ludwig von Mises’s ‘Circulation Credit’ Theory of the Trade Cycle,” the title of the chapter. Here Murphy makes the interesting observation that Mises developed this theory, in his 1913 book The Theory of Money and Credit, to stand largely independent of central bank money manipulation, either in terms of quantity (money supply) or interest rates. This makes sense, for a book written in 1913. Basically it is a description of a kind of boom and bust, largely independent of any kind of government molestation (there are no tax increases or interventionist government policy, or central bank tomfoolery), but simply the free enterprise system having one of its hiccups. This is typically accompanied by a credit cycle of some sort, basically banks at first lending on a basis (underwriting) that looks like a mistake in retrospect; and then, cutting back on that lending when it has been revealed to be a mistake. This is indeed a common feature of market economies, so the description has some validity. The problem comes when extending this model to all events and at all times.

For example, you would think that the Austrians would be very sensitive to when there actually is government intervention or molestation of some sort, to a dramatic degree, and this certainly happened in the 1930s. Most of Murray Rothbard’s book America’s Great Depression amounts to a history of this interventionism; but Rothbard then defaults to this kind of “Austrian boom bust” theory, ignoring all his chapters on government intervention. It is rather dumb. Today, we have many fine books, such as FDR’s Folly: How Roosevelt and His New Deal Prolonged the Great Depression, by Jim Powell; or The Forgotten Man: A New History of the Great Depression, by Amity Shlaes. While these authors like to blame Roosevelt (rightfully), you can also assign blame to Hoover. After all, it was Hoover who kicked off the Smoot-Hawley Tariff in June 1930, and then followed it with gigantic tax increases which took the top income tax rate from 25% to 63%. But, after all these decades, Murphy too is still stuck in the “Austrian boom bust” camp, ignoring all these interesting things, and in Chapter 14 basically sticking with the extremely limited, and in this case completely inadequate, “Austrian theory of the trade cycle.”

June 27, 2010: U.S. Tax Hikes of the 1930s

When we wrote a book about inflation, we put on the cover: “Inflation: What It Is, Why It’s Bad, and How To Fix It”

You wouldn’t think that, after all these decades of floating fiat currencies, where today the dollar is worth about 1/90th of its value vs. gold as in 1970, we would still have to talk about such basic things.

But, we do. Let’s look at Chapter 9, “Monetary Inflation and Price Inflation.” I’m going to put here the whole first page or so of this important chapter.

And at the end of the chapter:

By now, you should already know what I am going to say. There is no mention here, anywhere, of the value of the currency. In our book, we emphasize that it is a decline in the value of the currency, for example its value vs. its historical benchmark, gold, that results in the adjustment higher of other prices to compensate.

Murphy does distinguish between monetary causes, and effects on prices, which he calls “monetary inflation,” the same term we use. He does not mention “non-monetary inflation,” or non-monetary effects on individual prices and the “general price level,” which can be important. But, that is a minor omission.

However, this “monetary inflation” comes about by … “increases in the quantity of money.”

This is easily falsifiable. We saw already that, between 1775 and 1900, the amount of Base Money in the United States rose by about 160x. This works out to about 4% per year, which is about in line with the expansion of the economy during that time. The value of the dollar, during this time period, was basically unchanged vs. gold; and despite this hundred-plus-fold “increase in the supply of money,” also vastly in excess of the increase in aboveground gold during that time from mining supply, there was no significant “price inflation.” Commodity prices were about the same in 1900 as they were in 1775.

“Aha!” you could say. “In that case, ‘inflation’ is the creation of too much money!”

Now we are already dancing around and making excuses, since we already refuted the first claim in about one sentence. If that’s what you meant, why didn’t you say so? But, then we have to determine what “too much money” is. The obvious answer is: An amount of money which causes the value of the currency to fall. Supply in excess of demand, at a certain gold parity. And this is how it was actually determined, during that 125-year period. (See my book Gold: The Monetary Polaris.)

But, if we are not going to reference the value of money, then we are again forced to make claims about the quantity of money. We observe that base money grew by about 4% annually during that time period. Does this mean that 4% is the correct number? (Milton Friedman made a similar claim in the 1960s.) No, it does not.

A currency whose quantity grows at 4% per year is roughly equivalent to Bitcoin. There is no mechanism maintaining its stable value. Thus, it is a floating currency. It might fall for some reason. But, the central bank doesn’t respond to this fall in value in any way. The central bank is stuck on its automatic 4%-per-year target. People see this, and sell the currency more, and then you have a disaster.

March 6, 2014: Bitcoin Proves Friedman’s Big Plan Was A Joke

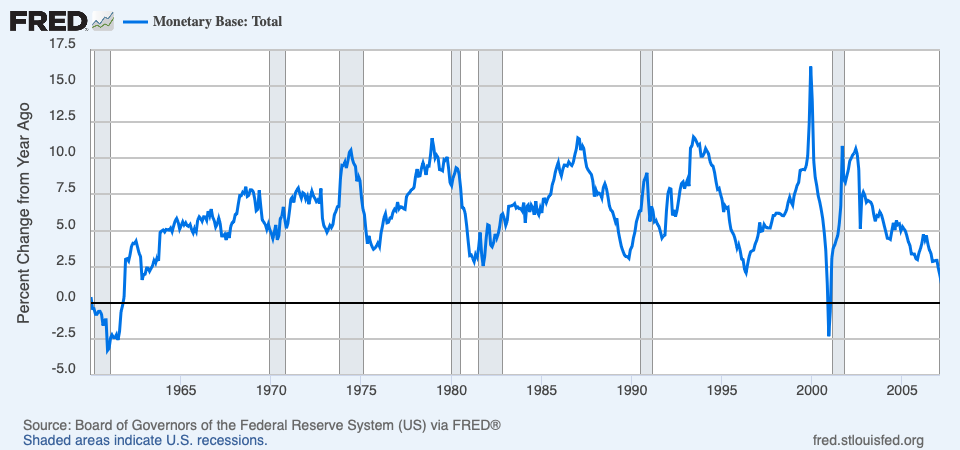

This is basically what happened in the early 1970s. In part influenced by Friedman’s arguments in the 1960s, the Federal Reserve tended to have a fairly smooth path of base money creation, between about 5% and 7% per year. This is more than 4%, but not a lot more. It was the norm during the gold standard years of the 1960s, and also, during the “disinflationary Great Moderation” period of the 1980s and 1990s. You might conclude that, if there is about 2% more money being created than is necessary per year, maybe the value of the currency would decline about 2% per year, or maybe “inflation” (the CPI) would be about 2% (which lots of economists thought was a good thing in those days, and still do today), or something like that. Or, you could argue (as people actually did in those days), that since you were coming out of a recession (the 1970 recession), you needed a little higher-than-average money supply growth — more like 7.5%. And then, you could dial it back once the economy got going — which they did, bringing this measure to 5% in 1973. But, what happened was, the currency collapsed. By 1974, it took almost $200 to buy an ounce of gold, about 5x more than the $35/oz. Bretton Woods gold parity, implying an 80% decline in the value of the dollar — not 2% per year.

And so we see that Murphy’s discussion about “inflation” is basically useless. It cannot diagnose real-world events, or produce some kind of positive outcome — a currency of Stable Value, normally achieved by fixing its value to gold.

In Chapter 13, “Crying Wolf on (Hyper)Inflation?” Murphy struggles with the very large amounts of base money creation by the Federal Reserve after 2008, and why, despite his definition of inflation being literally “money creation,” this did not cause substantial inflation. You would think this might inspire him to rethink his Chapter 8, especially since it has been about a decade now of this stuff. This chapter is nice because Murphy does a survey of common ideas from that time, which I think are all wrong. He gets the gist of it here:

Bingo! Now, suddenly, the value of money (“price of money”) pops up, correctly; and this is interpreted as a product of supply and demand for base money. This is actually right out of von Mises, where I originally got it from:

In theoretical investigation there is only one meaning that can rationally be attached to the expression inflation: an increase in the quantity of money … that is not offset by a corresponding increase in the need for money … so that a fall in the objective exchange value of money must occur. Again, deflation (or restriction, or contraction) signifies a diminution of the quantity of money … which is not offset by a corresponding diminution in the demand for money … so that an increase in the objective exchange value of money occurs.

Ludwig von Mises, The Theory of Money and Credit, 1912

But, if Murphy had read my 2007 book Gold: The Once and Future Money, which contains this quote, he would already know this.

I personally think there was a very obvious “increase in the need for money,” namely, the Basel III accord passed in November 2010, which required banks to hold quite large amounts of bank reserves (base money), in practice returning them to a 1950s-style condition where reserves were about 10% of assets. This was phased in through 2019.

series on Basel III and Bank Reserves

Still waiting for economists to catch up.

It takes economists a long time, because they are befuddled by stuff like this:

MV=PQ

(“Money”*”Velocity”=”Prices”*”Transactions”, with PQ usually taken as equivalent to nominal GDP)

Look at this equation.

Tell me where Basel III fits in.

I’ll wait.

The “inflation is caused by money-printing” people are going to have a heart attack soon, because the dollar seems to be falling in value once again, by quite a lot vs. gold, but not only is there no “money printing” going on, base money growth has actually been negative!

This will make people’s heads spin, and I am already bracing against the flood of stupidity that will arise (“You have to look at M2, not Base Money”). But, it fits von Mises’ description exactly.

Murphy ends with some good chapters about NGDP Targeting (blech!), Bitcoin, and Modern Monetary Theory (blech!). Enjoy the book for its good sections, see if you agree with my claimed “flaws,” and see if you can find flaws outside of the ones that I’ve identified here.