Today, we are making use of a new weekly dataset just released by the Bank of England. It is here:

http://www.bankofengland.co.uk/research/Pages/onebank/balancesheet.aspx

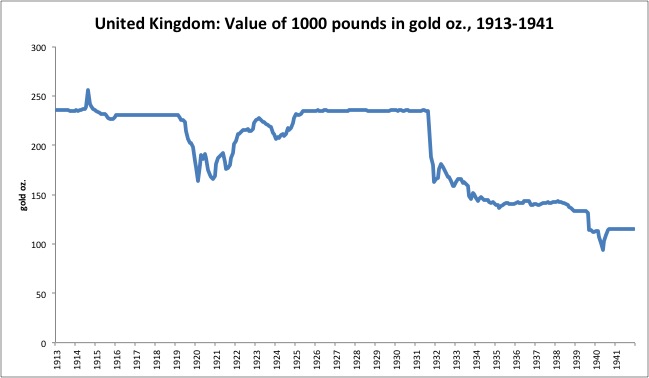

I thought I’d use it to get an idea of what was going on when the British pound was devalued on September 21, 1931.

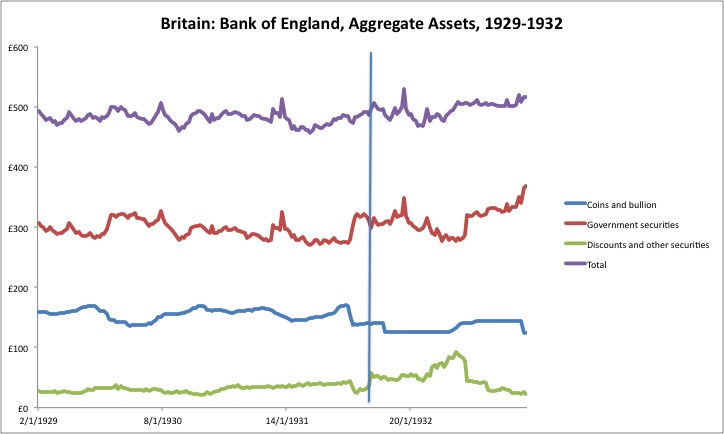

The vertical line of course represents the devaluation. We see a drop in gold a little before, which is related to a big rise in government securities. I would have to look at some history to get an idea of what’s going on here. It looks like either a) the BOE was fooling around with an “activist” monetary expansion, buying bonds first and then experiencing a gold outflow as a consequence, as the value of the pound sank vs. its gold parity; or b) there was a big gold redemption, which was intentionally “sterilized” by bond purchases, so that the monetary base would not change. Both are pretty scary, and definitely NOT what the BOE should have been doing — although, other central banks were doing similar things around that time, including the Federal Reserve in 1932. Definitely not confidence-inspiring.

Nevertheless, the BOE certainly had plenty of gold. It was not suffering chronic “outflows” except for that one decline. The flatlining of gold before the devaluation appears to be the point at which the BoE borrowed at least 50 million pounds of gold from the Bank of France and the Federal Reserve. Gold outflows were still continuing, but it was borrowed gold. It looks to me like the total amount of gold outflows (including borrowed gold) was at least 80 million pounds, perhaps even 100 million pounds. Since the total base money was about 480 million pounds, that would mean a monetary base reduction due to outflows of about 15%-20%. That is what was supposed to happen. Actually, what was supposed to happen is that an outflow of that magnitude would be matched by further monetary base reduction via sales of debt instruments (reduction in bonds/discounts). This obviously did not happen.

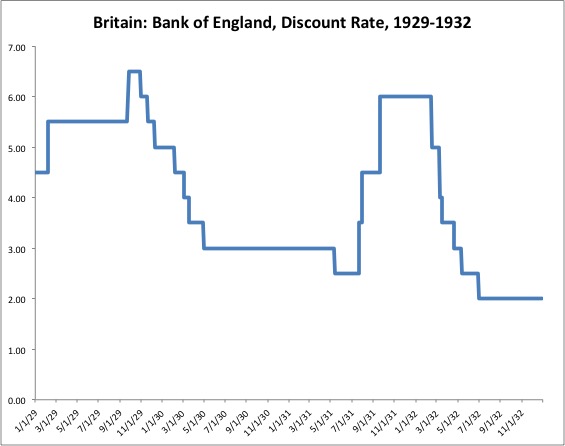

The traditional (pre-1914) way a reduction in debt assets would take place was via a rise in the discount rate, which was indeed raised. The result is that the BoE becomes less competitive vs. other lenders, and thus the balance of discounting/lending falls. We can see a major decline in discounting/lending corresponding to the outflow of gold and also the rise in the discount rate, in July 1931 (bottom green line). However, by this time, discounts were a very small part of total assets. Their big percentage drop did not mean much for total assets as a whole. Also, any decline here was offset by purchases of government bonds.

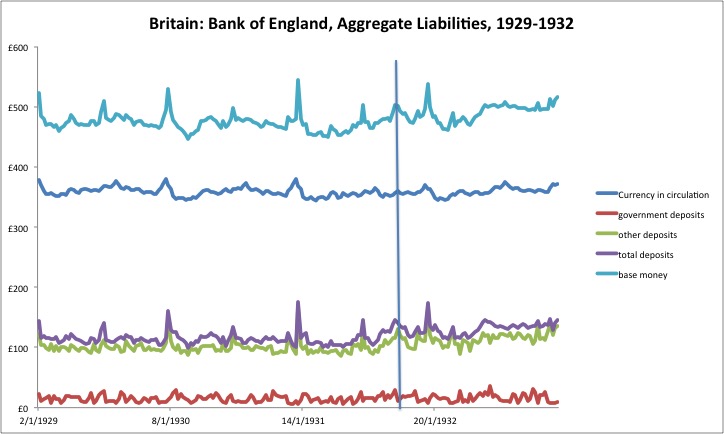

Here we have a look at the monetary base and its composition. We see a rise in the monetary base from around the beginning of 1931. Nothing wrong with this in itself. However, if the pound’s value was weak and “defense of the pound” was a priority, then there should have been some meaningful reduction in the monetary base. There certainly seems to be no attempt whatsoever to support the value of the pound via monetary base reduction before the day of the devaluation. On the contrary, base money was steadily rising. This corresponds to the historical narrative, which was that any base money contraction was avoided on the grounds that it would send the already-high short-term rates/discount rate still higher. The Keynesian “low interest rates” notion was getting the upper hand, in people’s minds, over the “stable value” basis of the gold standard.

Here is the Bank’s discount rate. The discount rate was rather notoriously not raised from its level of 4.5% before the devaluation. However, it was raised to 6% literally the day after. Discounts were a big part of the BOE’s operation before 1913, but by this time, they were obviously overshadowed by “open market operations” in government bonds, which were then a much larger portion of total assets. It wouldn’t really have mattered much if the discount rate was raised further.

This is just a preliminary look. However, it looks pretty clear to me that the BoE didn’t take any appropriate action to support the pound, via a reduction in the monetary base, probably because they were afraid that it would lead to higher short-term rates and a higher discount rate, perceived as being bad for the economy. Or, from the quantitative side, a reduction in the monetary base was perceived as being “contractionary,” although this is not actually true. There is no “contractionary” or “deflationary” effect of a reduction in te monetary base, if it is done to support the currency’s value — in other words, if it represents an adjustment to contracting demand. If the value of the currency doesn’t rise, there is no “monetary deflation.” Rather, if a central bank does not respond to contracting demand (sagging currency value vs. gold parity) with a moentary base contraction, but rather keeps the monetary base unchanged, the result is currency decline and “monetary inflation” — exactly the case for Britain in 1931. The value of the pound sank dramatically, although the monetary base was basically unchanged.