Foreign Exchange Rates 1913-1941 #7: Switzerland’s Independence; Turkey Avoids Devaluation

June 22, 2014

We continue our investigation of currency histories of the 1914-1941 period.

June 1, 2014: Foreign Exchange Rates 1913-1941 #6: Hyperinflation in Poland; Russia’s WWI Decline

May 25, 2014: Foreign Exchange Rates 1913-1941 #5: Devaluations By Japan and France

April 27, 2014: Foreign Exchange Rates 1913-1941 #4: Britain Leads the World Into Currency Chaos

April 20, 2014: Foreign Exchange Rates 1913-1941 #3: The Brief Rebuilding of the World Gold Standard System

April 6, 2014: Foreign Exchange Rates 1913-1941 #2: The Currency Upheavals of the Interwar Period

March 30, 2014: Foreign Exchange Rates 1913-1941: Just Looking At the Data

As before, there’s a notation in the data that “rates are nominal for at least five days during the month,” which I am calling “capital controls.” There were no doubt various forms of capital controls before and after this as well. Also, gold values reflect the assumption that the value of the U.S. dollar was $20.67/oz. during the WWI period, which was not actually the case.

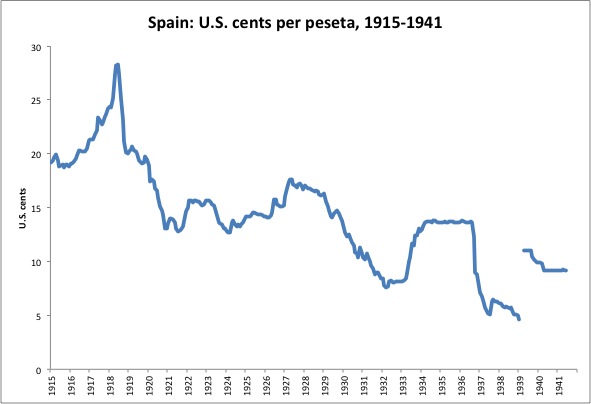

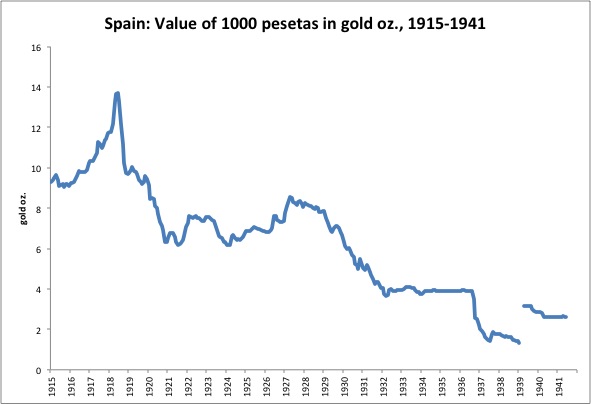

Spain:

Spain never really returned to a gold standard system in the 1920s, as most countries did, although it appears that there was some attempt at stabilization around the 1927-1929 period. The currency began losing value in mid-1929, lost further value along with the British devaluation in 1931, and was, oddly enough, stabilized against gold in early 1932. Spain did not react to the dollar devaluation of 1933, but devalued again in 1936, probably prompted by France, and also the outbreak of civil war in Spain. The “revaluation” in 1939 represents a change to a “National peseta” at the end of civil war.

Capital controls were imposed in September 1936.

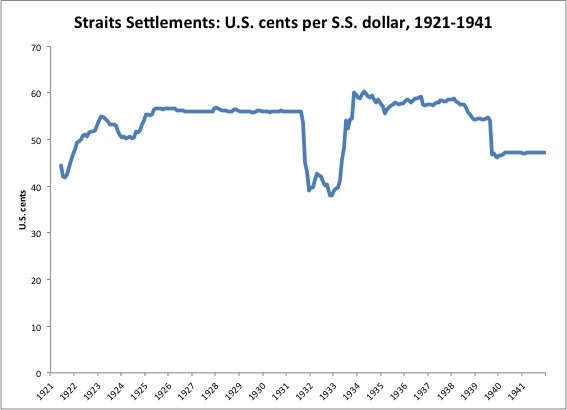

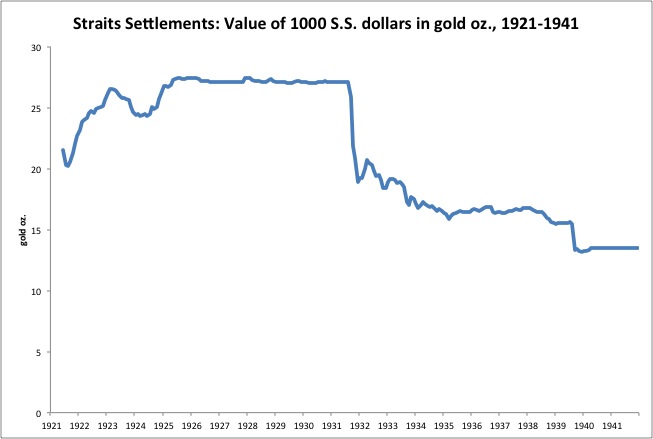

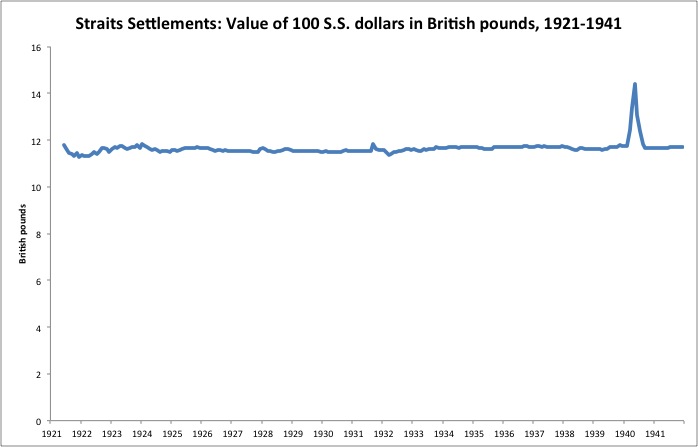

Straits Settlements (Singapore):

The Straits Settlements (now Singapore) were of course a British territory, so it is no surprise that the history of the Straits Settlements dollar mirrored the British pound.

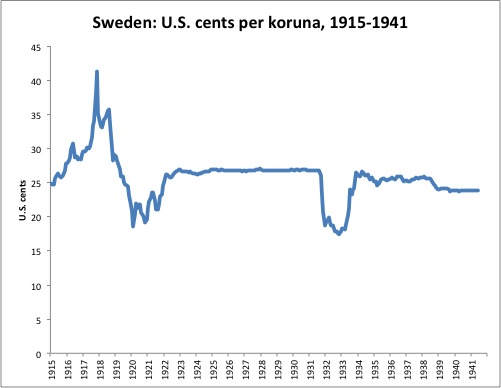

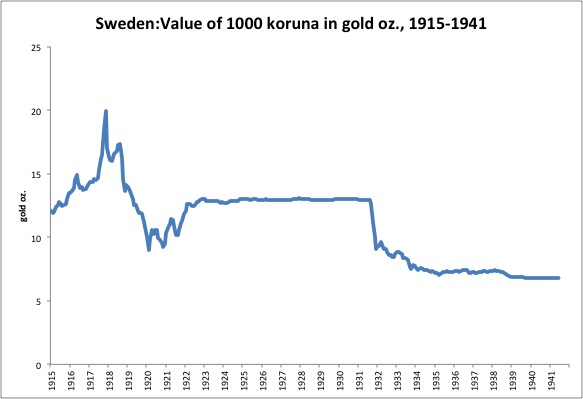

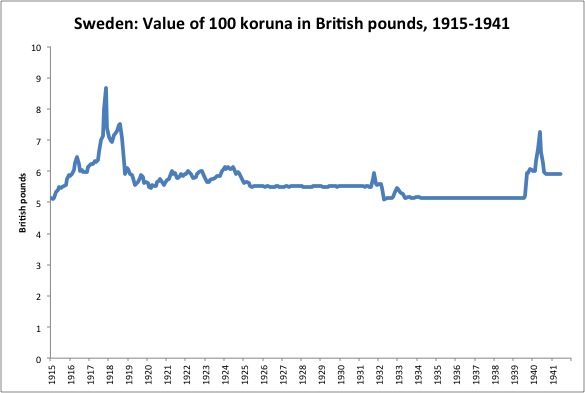

Sweden:

Sweden, along with several other countries, shows a sharp rise of the currency vs. the dollar after 1914. This probably represents the devaluation of the U.S. dollar, or at least hte British pound, with the outbreak of WWI. There was some funny business going on regarding the maintenance of stable forex rates between the British pound and the dollar at the time, although the U.S. did not enter the war until 1917. In 1918, the koruna and several other currencies show a sharp drop against the dollar, which is probably not a rise in dollar value as the dollar was being overprinted at the time. It wasn’t until 1920-1921 that the Fed began to contract dollar base money, raising its value back to its gold parity. So, I think there was just a wave of devaluations of other currencies, so that their forex rates with the dollar/pound wouldn’t get too out of line.

Sweden effectively returned to a gold standard system in 1922, and devalued alongside the British pound in 1931, to a degree just slightly greater than Britain’s devaluation.

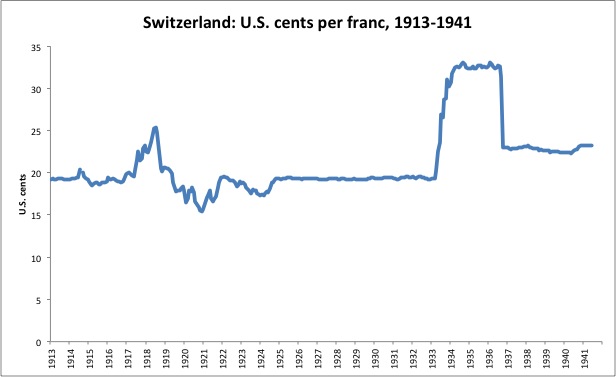

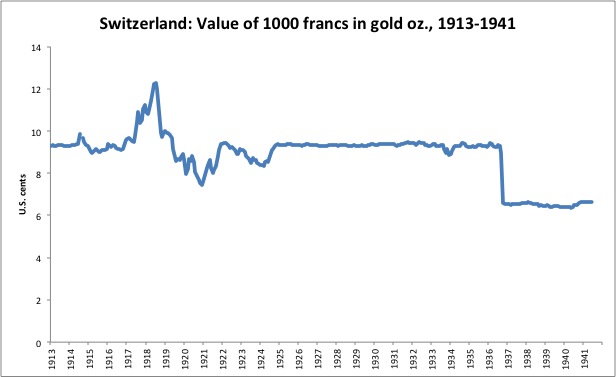

Switzerland:

The Swiss franc also shows this pattern of rising value vs. the dollar and pound until 1918, and a sharp drop. Switzerland returned to a gold standard system in 1925, and devalued in 1936.

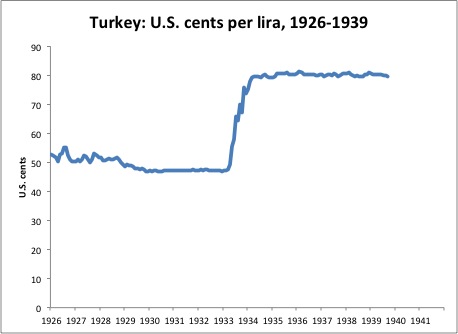

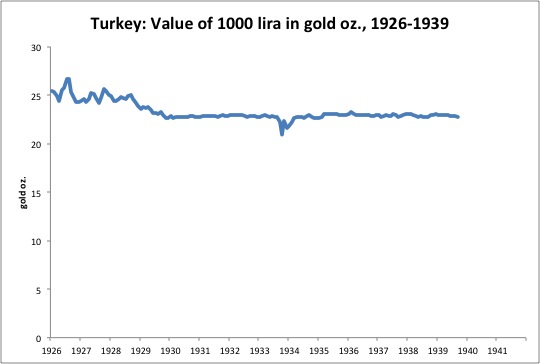

Turkey:

I suspect there was some high drama for the Turkish lira during and after WWI. In any case, it was stabilized vs. gold by 1926, and formally pegged to gold in 1929. Turkey did not devalue during the 1930s.

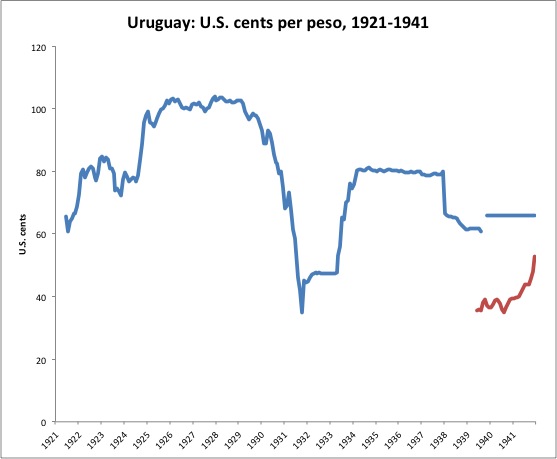

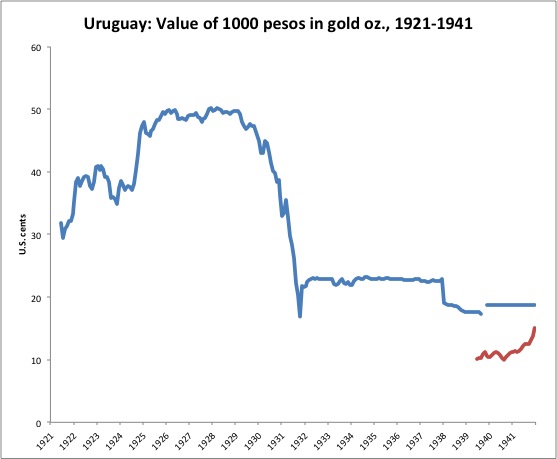

Uruguay:

Uruguay effectively returned to a gold standard system in 1926, although as you can see it was rather messy. Devaluation of the peso began in 1929 and continued until 1932, when the currency was stabilized against gold. Another devaluation followed in 1937. Capital controls were imposed in April 1933, and continued thereafter. From 1939, there’s a two-part currency, with a “controlled” rate and a “non-controlled” (presumably black market) rate, here shown in red.

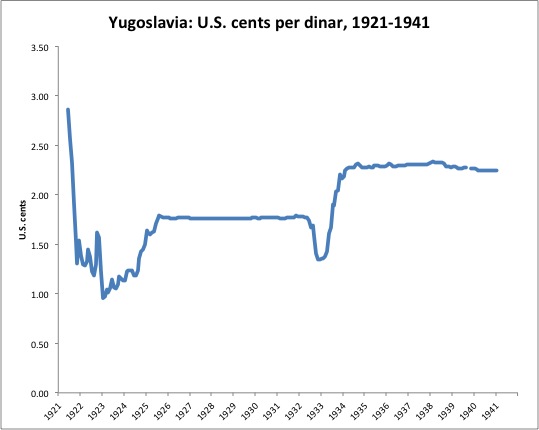

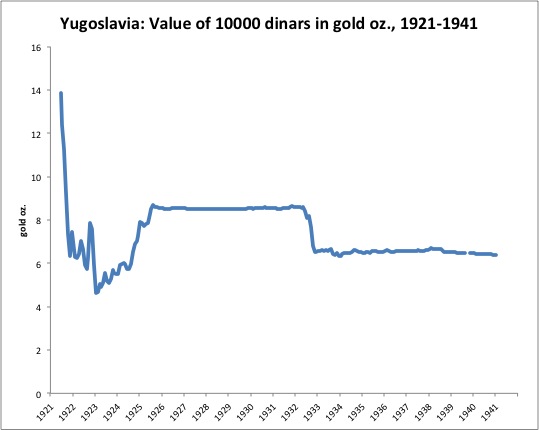

Yugoslavia:

Yugoslavia had a rather sharp drop of the currency during and soon after WWI, probably amounting to modest hyperinflation if we were to look at prewar exchange rates. The dinar was repegged to gold in 1925. A devaluation took place in 1932.

Whew! That’s it. I think it helps to look at these real histories of real currencies, rather than taking someone’s canned narrative. Probably, even that person didn’t look at this stuff.

It’s too bad we don’t have more info on the history of these currencies just before, during, and just after WWI. I bet there was a lot of drama during that time. I suspect that, if we look at the trauma of the WWI period, the 1930s will actually look like something of a repeat or mirror image. There was of course more trauma during WWII, as many currencies (and states) disappeared entirely.