Gold Holdings of Central Banks and Governments 2: The Larger View, 1850-2000

August 17, 2014

We’ve been looking at some history of the gold holdings of central banks and governments.

August 10, 2014: Gold Holdings of Central Banks and Governments, 1913-1941

August 3, 2014: The Reichsbank, 1924-1941

July 27, 2014: The Bank of France, 1914-1941

July 20, 2014: The Bank of England, 1914-1941

July 18, 2014: Foreign Exchange Rates 1913-1941 #8: A Brief Summary

June 22, 2014: Foreign Exchange Rates 1913-1941 #7: Switzerland’s Independence; Turkey Avoids DevaluationJune 1, 2014: Foreign Exchange Rates 1913-1941 #6: Hyperinflation in Poland; Russia’s WWI Decline

May 25, 2014: Foreign Exchange Rates 1913-1941 #5: Devaluations By Japan and France

April 27, 2014: Foreign Exchange Rates 1913-1941 #4: Britain Leads the World Into Currency Chaos

April 20, 2014: Foreign Exchange Rates 1913-1941 #3: The Brief Rebuilding of the World Gold Standard System

April 6, 2014: Foreign Exchange Rates 1913-1941 #2: The Currency Upheavals of the Interwar Period

March 30, 2014: Foreign Exchange Rates 1913-1941: Just Looking At the Data

January 26, 2014: The Federal Reserve in the 1930s #2: Interest Rates

January 19, 2014: The Federal Reserve in the 1930s

December 23, 2012: The Federal Reserve in the 1920s 4: The Historical Record

December 16, 2012: The Federal Reserve in the 1920s 3: Balance Sheet and Base Money

November 25, 2012: The Federal Reserve in the 1920s 2: Interest Rates

November 18, 2012: The Federal Reserve in the 1920s

Today, we are going to put this data in a little more context. I’ve reviewed this before, but this is a nice way to round out this series.

The source for most of our data today comes from “Central Bank Gold Reserves: An historical perspective since 1845,” World Gold Council Research Study No. 23, by Timothy Green, 1999.

You can get the paper by clicking here.

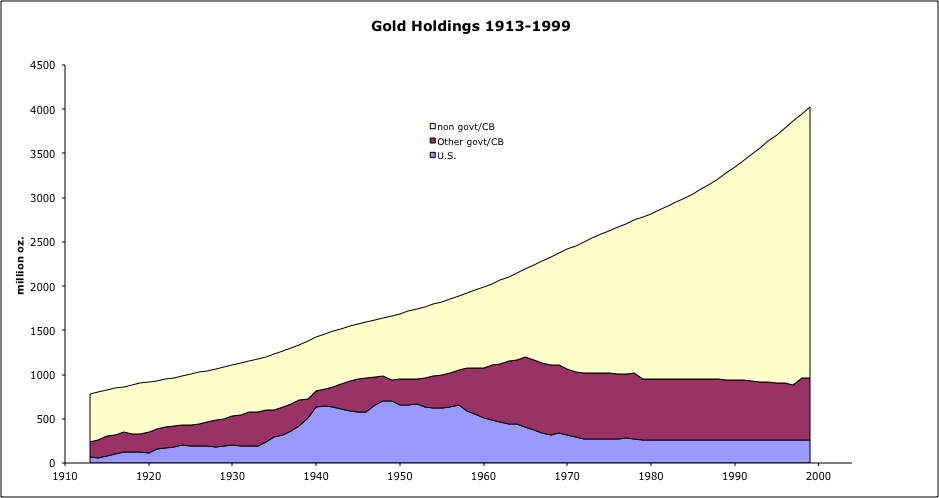

Here’s a look at the holdings of central banks and governments, compared to the estimated total aboveground world gold supply. In general, there was a trend toward central bank/government accumulation of bullion up to about 1950. It went up a little more afterwards, but not really keeping pace with gold production from mines. After 1965 or so, government gold holdings generally declined. Today, they make up a much smaller percentage of total aboveground gold than they did in the past.

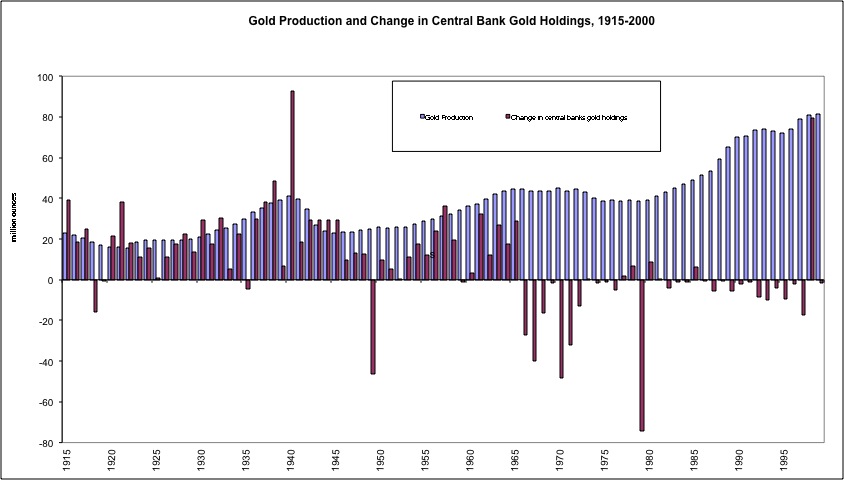

Here’s a look at total holdings of central banks and governments, compared to mining production, from 1915 to 1999. As we can see, even in the accumulation years before 1950, the pace of aggregate accumulation was less than mining production, and didn’t really have any big spikes until 1941, during WWII.

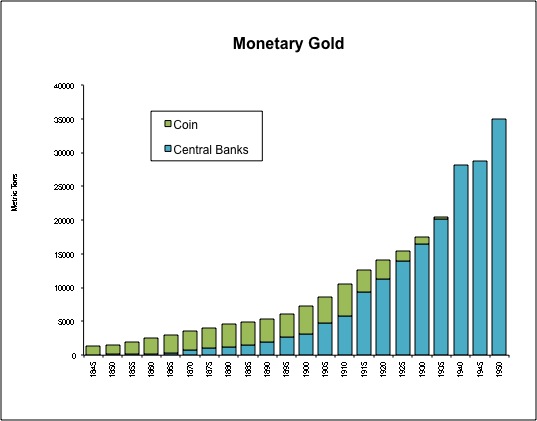

Here’s some similar data, here in five-year intervals. Central banks gradually accumulated gold in the pre-1914 era — that was when central banks were generally established, following the pattern of the Bank of England, around the world. Gold coins gradually fell out of favor, exchanged for more convenient banknotes with central banks. Note that gold coins didn’t really make a revival even in the turmoil of WWI, the Great Depression, and WWII. You might think that people would want to hoard gold coins in a coffee can, in those conditions, but actually they didn’t.

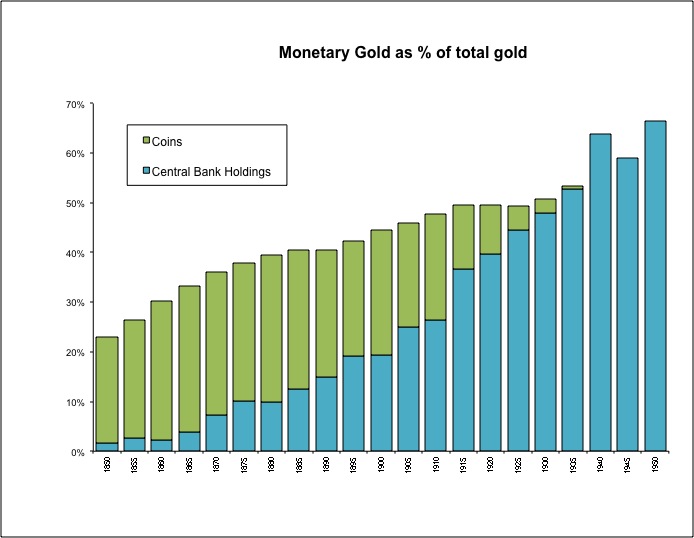

This is the same data, here represented as a percentage of estimated world aboveground gold bullion supply, from 1850-1950. Although central banks and governments accumulated a lot of gold bullion during the latter 19th century, this was offset by a decrease in the use of gold coins, so that the total “monetary gold,” coins and bank reserves, didn’t actually change that much as a percentage of aboveground gold. Note again the decrease in the use of gold coins during the difficult 1914-1950 period. Overall monetary gold was pretty flat between 1910 and 1935, as a percentage of total aboveground gold.

There are a lot of hypotheses out there that WWI, the supposed “gold exchange standard” of the 1920s, the Great Depression, and WWII led to major accumulation or disaccumulation of gold bullion for various reasons, which might have some consequences if it in fact occurred. These are reasonable hypotheses, but alas, ones that are not supported by historical fact. So, they should be abandoned.