How To Stabilize the Ruble

November 16, 2008

Emerging market currencies usually have trouble when the dollar rises. I am surprised to see this popping up so quickly after the rather short dollar rise since July, but it has been quite dramatic. The Eastern European currencies have been particularly hard hit.

I’m not going to go on and on about it. The fix is simple, especially for those countries with substantial foreign reserves. Here’s what you do:

Assuming that you want to support the value of your currency:

1) Sell dollars (from reserves) and buy your currency.

2) This must be unsterilized intervention. When you buy, for example, a billion rubles or hryvna, they must disappear from existence. This means a contraction of base money equivalent to the size of the intervention.

3) There should be no interest rate target or other monetary open-market mechanism. Often, these systems will cancel out the effects of the intervention. Thus, when base money is reduced by step 1), you must not allow base money to rise via some other open-market operation. The market for short-term debt is free and unmanipulated.

Optional: You can also reduce the supply of base money via sales of domestic debt, or really any other asset. Once again, this must be unsterilized intervention. Base money must contract and stay contracted, at least until the crisis passes.

That’s it. It’s pretty easy when you get the hang of it.

The Russian Central Bank said that as of November 10, the monetary base was 4,416 billion rubles. At 27 rubles/dollar, that’s about $163 billion (quite a large number by the way). So, with $163 billion, you could buy every ruble in the world. If the central bank does not have $163 billion of foreign reserves, it can use domestic reserves. The unsterilized sale of 1,000 billion of Russian government ruble bonds, for example, would reduce the monetary base to 3,416 billion rubles, worth about $126 billion. In practice, of course, you wouldn’t have to reduce the monetary base by that much. Maybe 20% would be more than enough. So, we’re talking about $32.6 billion in foreign reserves or the equivalent (883 billion rubles) in domestic bonds. This is really no big deal.

The Russian central bank says that as of September 1, 2008 (before the recent crisis, we’ll say), the monetary base was 4,508.7 billion rubles. So, how much has the monetary base contracted? Not a whole heck of a lot.

On August 29, 2008, foreign reserves were $582 billion. On November 7, 2008, foreign reserves were $484.6 billion, a decline of $98 billion.

Now, if you followed the process above, the ruble monetary base would have contracted by about $98/$163 billon or 60%. That probably would have solved the crisis at least three times over. Instead, you’re $98 billion poorer and still pulling your hair out.

Here’s a hint, Russians: If you act like a dumbass, you get dumbass results. I’m a big Russia fan. Don’t blow it.

Somebody call the Russian embassy and tell them to Solve the Damn Problem:

January 27, 2008: Crisis Management

Here’s the website:

http://www.russianembassy.org/

* * *

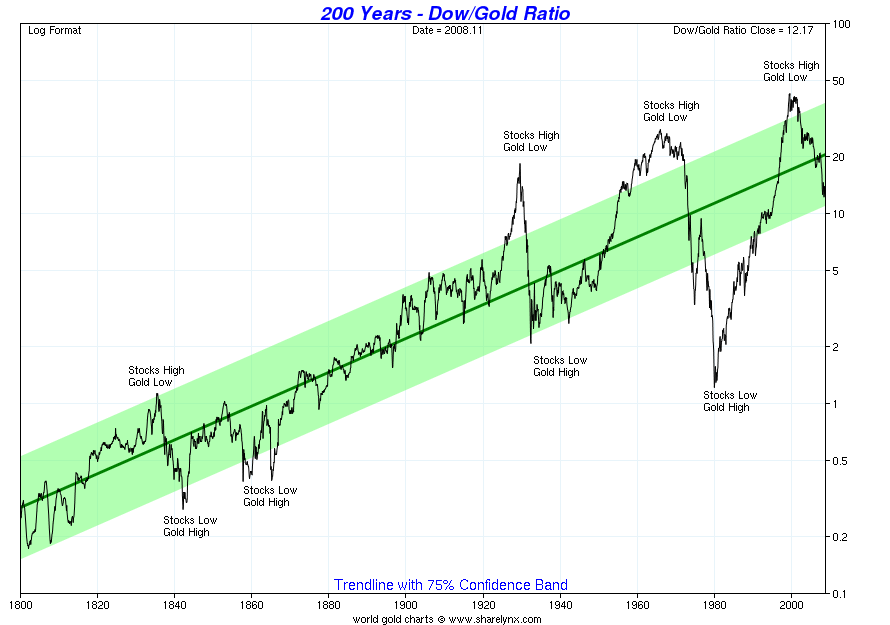

These charts speak for themselves:

I think we’ll probably go to about 1:3 Dow/gold ratio, which would take us all the way back to levels of 1900. However, stocks would be quite cheap then, while in 1900 they were relatively expensive.

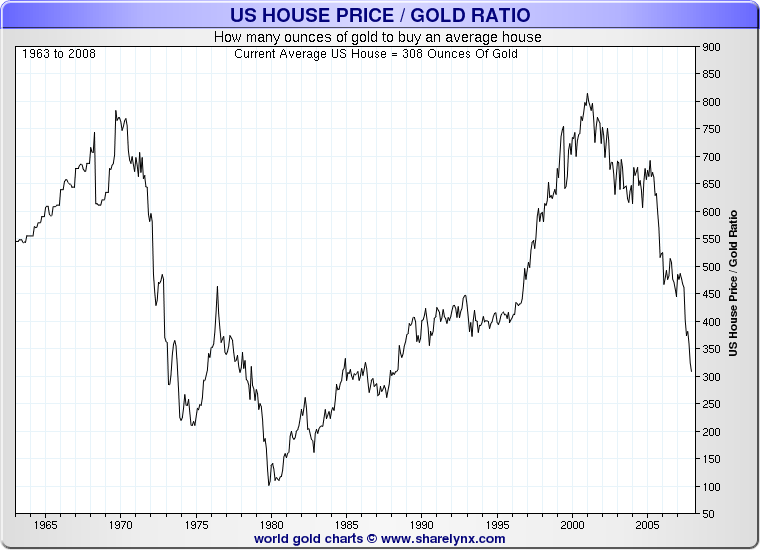

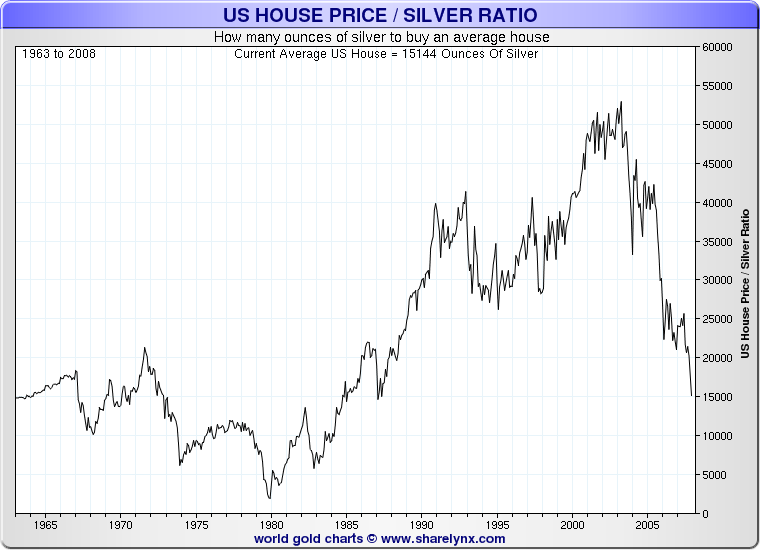

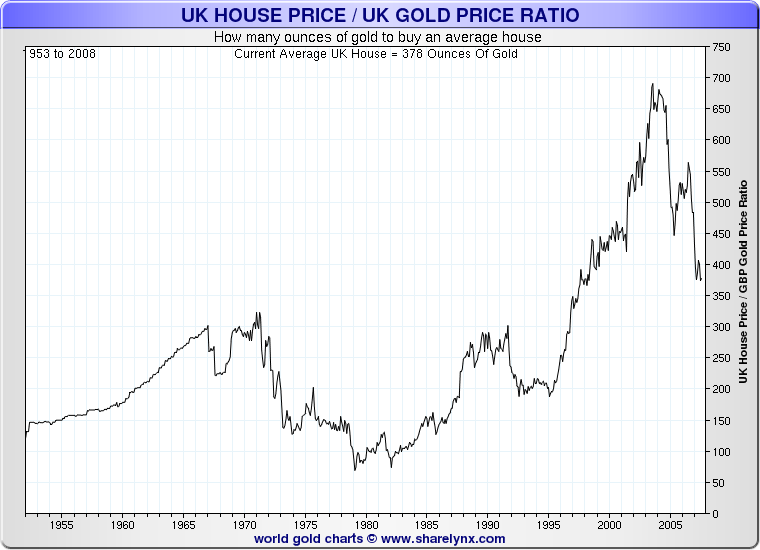

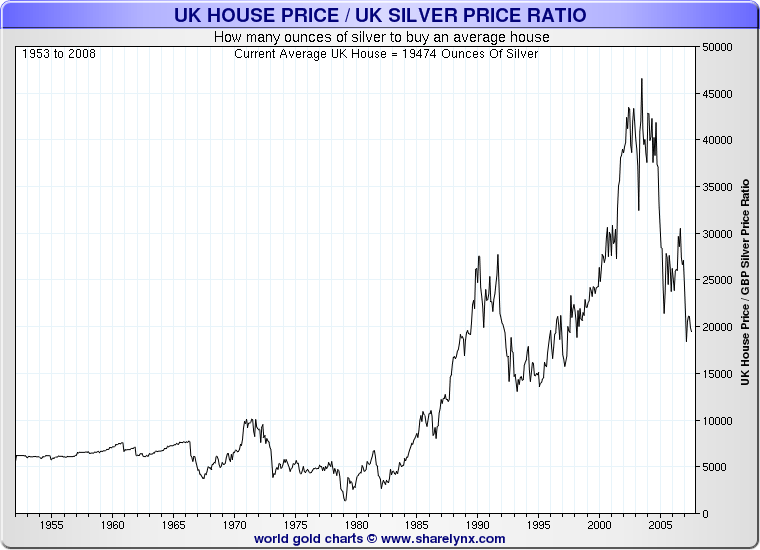

Here are some nice charts on U.S. and U.K. houses:

In 2004-2005 I bought 2000 oz. of silver, with the idea that I could trade it for a house in the future. At the time, the average U.S. house cost about 40,000 oz. of silver, so that would be a 20:1 improvement. We can see that houses got to about 2000oz. of silver in both the U.S. and U.K. around 1980.

* * *

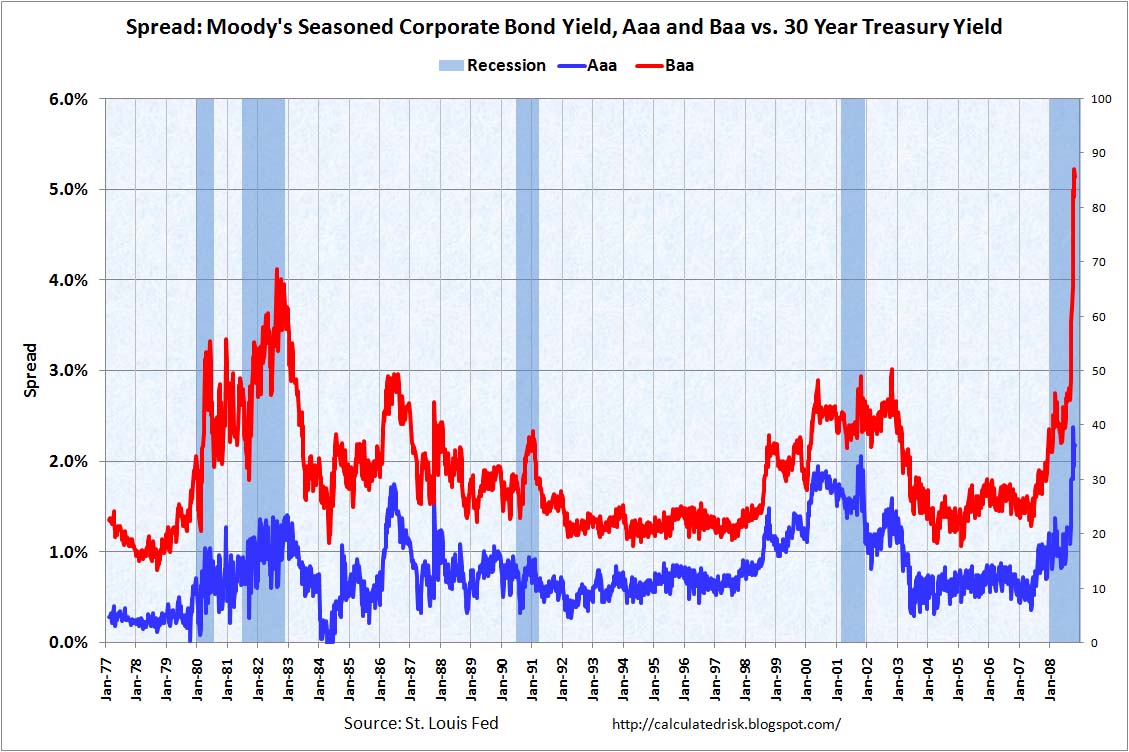

This is a good one: spreads on BAA corporate debt. Kinda wide. As we saw a couple weeks ago, BAA corporates hit a maximum yield of 11.5% during 1932, while the government bond yield was about 3.5%. So, an 800 bps spread (on a monthly basis). We’re around 550 bps now. This suggests to me that either: a) the bond market is nuts, or b) the stock market is nuts.

* * *

A nice quote from 1939, in a letter to the WSJ:

Andrew Wilson is right: The New Deal did not end the Great Depression (“Five Myths About the Great Depression,” op-ed, Nov. 4). No less an authority than FDR’s Treasury secretary and close friend, Henry Morgenthau, conceded this fact to Congressional Democrats in May 1939: “We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and if I am wrong . . . somebody else can have my job. I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises . . . I say after eight years of this Administration we have just as much unemployment as when we started . . . And an enormous debt to boot!” Indeed, FDR’s market-suffocating policies are almost surely what put the “Great” in Great Depression.

Laura S. Clancy

Arlington, Va.

See, just like I told ya. I am actually appreciative of the New Deal. For one thing, it introduced the 5×8 40 hour workweek, instead of the 6×10 60 hour week that was common at the time. I think everyone can give some thanks for that. Plus, it introduced a lot of other things that people had been agitating about for decades. In a broader scope, steps such as the New Deal are what made the downtrodden/exploited factory worker of the 1890s into the fat and happy worker of 1960. Plus, there were some important welfare aspects. However, it did almost nothing to resolve the economic problems of the time. A soup kitchen can be very welcome when there is high unemployment. But, it doesn’t solve unemployment.

A reader asks why I like Obama. For one thing, I didn’t particularly like the alternative, a senile, bad-tempered war nut and his Nazi cheerleader. (OK, I thought Palin was fun, just for the sheer whacko factor.) Plus, the Republican Party has been overrun by its fascist/corporatist/imperialist wing, which even now is looting the Treasury in its last days in office. I am more of the peaceful, libertarian, small government persuasion. Will Obama’s economic policies make the recession worse? Probably. But, I think Obama and the sorts of people he is likely to gather around him are also capable of learning. I think they will make small mistakes rather than large ones, and maybe learn from those mistakes. The Democrats will probably rescind a lot of the police-state apparatus installed by the Bushies, and eventually withdraw from the pointless foreign wars. Foreign policy in general is likely to be a lot more friendly. There will be some welfare disbursements, which is fine and a lot more useful than bombing a desert somewhere. Also, the Democrats will probably make the first steps toward renovating the health care system in the U.S., which is totally non-functional. I honestly think the Mexican system works better, and, at 5.6% of GDP, is about 1/3rd the cost even in relative terms. (Would you believe that in absolute dollar terms, health care spending in the U.S. is about 50% of all the health care spending in the world? What a scam!) Maybe we’ll even get some trains built. As far as the economy goes, it will probably be a disaster by the end of March, while Obama is still figuring out how to use the White House copy machine. I think he’ll be nice to have along for the subsequent period.

* * *

Bailing out GM: General Motors really needs to go through bankruptcy. Remember, bankruptcy doesn’t mean that everyone is fired and the auto factories are turned into U-Stor-It facilities. It means that the company’s obligations become renegotiable. Pretty much all the U.S. airlines went through bankruptcy in the early 1990s, but they kept flying. Some did it again around 2003. GM’s big obligations are to its employees. I’ve thought that the employees are willing to deal here, but not until the equity and the debt take a haircut. Which is as it should be. Why should a worker give up promised benefits just so shareholders can get a dividend? First things first, buddy! I would guess that the employees would be content with the same sort of deal that their couterparts at Toyota or Volkswagen are getting at their Kentucky factories. But, that discussion doesn’t start until GM is in bankruptcy.

However, for GM to enter this sort of bankruptcy-restructuring, it needs what is known as debtor-in-possession financing. DIP loans keep the company going while the other stuff is being worked out. This normally wouldn’t be a problem, but these days any sort of credit is a problem. If a company can’t get DIP financing, then liquidation becomes more likely by default. The U.S. government loan to GM should be in the form of DIP financing. Then, GM could properly restructure, which would probably mean cutting production roughly in half. Certainly the brands and product lines need to be slimmed down to perhaps sixteen vehicles, from sixty-something now. (Toyota has seventeen vehicles under the Toyota brand, and a couple more in Lexus and Scion. Even that is probably too many. Do we really need six Toyota SUVs?) You could also organize the merger with Chrysler. The whole thing would be good for GM, in the longer run. If the U.S. government loans the money to GM without BK, then the money will all get eaten up funding overproduction and excessive employee benefits, the two problems GM can’t really solve without going through the bankruptcy process. That would just leave GM with the same problems and still more debt.

* * *

A reader also asked about the moribund price of gold. This is a reflection of the dollar’s rise since July. Yes, I think the gold market is manipulated. It has been “manipulated,” to varying degrees, since the 1950s — more so now than before, it must be said. However, oddly enough, one effect of this manipulation is the rise in the dollar. When they sell gold and buy dollars, how do you know that they are pushing gold down, and not pushing the dollar up? Indeed, it appears that the effect is to push the dollar up, at least to some extent. The dollar is also getting a lift from the position-liquidation trade.Comex open interest in gold is collapsing.

It is getting harder to say what the price of gold is. It appears that gold is available at all sorts of prices, with various limitations on quantity and delivery period. I could sell 25 Krugerrands for $200 each, but that doesn’t make the price of gold $200. Is that any different than the various coin dealers etc. selling for $850 or whatever, with limited availability and a two-month wait time? I’ve heard of recent deals being done in the multi-million dollar range for real bullion at prices north of $1,050/oz. Kilobars in Europe seem to be getting mid-$900s consistently. The U.S. Mint is selling Gold Eagles at $1,119 — but they’re out of stock. Can you really get a 100 oz. bar on the Crimex for $72,000? Maybe you can get a few, who knows. (I got some in October, but I think the likelihood of getting delivery for December is declining.) But, obviously, you can’t get enough to close the arbitrage gap that seems to just get bigger by the day. I heard that at a gold coin show in Munich last week, there were lines sixty people deep trying to buy gold coins. How hard is it to get some 400oz. bars and bang them into coins? Not very hard. But, it’s not happening. It appears that some people are getting 400oz. investment bars in London, but I’m also hearing that Middle Easterners and Indians are trying to get size and can’t. Eventually, all of this will resolve itself, maybe by the end of next March. I think it will resolve itself at prices over $1,000/oz.

If you are interested in buying gold today, I would look at Bullionvault or Goldmoney. These are the only outlets I know of today where you can get real bullion (or pretty close to it) for London posted prices, in retail size. You might try to get delivery on the Comex, but be prepared for failure there.

For a while, you could get 1000oz. silver bars for good prices. A nice trade was to sell 1 oz. gold or silver coins (which get a nice premium) and buy 1000oz. silver bars. One guy traded 460 coins for 46 bars with a dealer, a 100:1 ratio. However, I’m hearing that availability of 1000oz. bars has dried up. I’d try the Comex.

If you are going the Comex route, I’d suggest taking delivery in the off-months, such as the November gold contract. You can still get delivery in November gold up until about the end of next week.

* * *

OK, since I mentioned it, here’s another hintaroonie for incoming Democrats: U.S. healthcare spending as a percent of GDP is about 16%, and is expected to rise to 20% by 2017. The government (all levels) now pays about 45% of all healthcare spending in the U.S., or about 7.2% of GDP. This 7.2% of GDP is more than the cost of the comprehensive national healthcare systems of Britain (6.9%) or Canada (6.9%)! It’s more than Australia (6.4%) and almost as much as Germany (8.9%). In other words, national health care is already being paid for in the U.S. Just nobody is getting any benefits. Let’s put it in corporate terms — OK, corporate masters (especially YOU Rick Wagoner), how would you like to have no healthcare costs at all? And no higher taxes either. Sound nice? Talk to your Congressman.

* * *

Austerity in Vallejo, CA: This WSJ article describes some of the problems municipalities got themselves into.

Remember, this is an average. Cops were getting paid retirement benefits based on the average of their last three years of work. Of course, officers toward the ends of their careers will tend to make above the average. Plus, they would pump up the number with overtime for their last three years. I was hearing nearly $200,000 on salary plus overtime alone. 90% of that is $180,000 per year. Still think paying taxes is a moral imperative? Californians — do you still want to pay that extra 1.5% sales tax surcharge? Your policeman thanks you — suckers.

* * *

Consumer credit crunch? There seems to be a real credit crunch on the commerical side. The trade finance issue doesn’t seem to be going away, for example. However, on the consumer level I’d say we still have some tightening to do just to get back to normal. The new news in the mortgage sphere is that you need a 20% downpayment for FICO less than 720. (You still might get less than 20% down via FHA or some government-sponsored channel, and for FICO above 720.) Well, in the olden days (1950s or 1960s), you needed 20% down plus the equivalent of FICO above 720 to get any mortgage at all. That was just the normal way of doing business. I still get credit card offers in the mail on a daily basis.

* * *

A nice op-ed by Judy Shelton for the WSJ regarding gold.

http://online.wsj.com/article/SB122663373660027575.html?mod=article-outset-box

And here’s one in the Washington Times:

http://washingtontimes.com/news/2008/nov/09/golden-opportunity/

For a while, I’ve stayed out of these sorts of mainstream publications. They like things to be very mamby-pamby, while I have a habit of plain speaking. I like outlets like the Asia Times or Pravda, where a certain measure of eccentricity is accepted. (These get read by important people too.) It’s good that folks like Judy Shelton are softening people up a bit.