In the Long Run, We Are All Dead

December 6, 2009

We can imagine the kind of discussions that must have taken place before President Roosevelt devalued the dollar in 1933. From 1789 — actually from 1518, but that’s a story for another day — the dollar was worth about $20.67 per ounce of gold. The 1933 devaluation was the first permanent devaluation in the history of the United States.

On one side of the table was the classical economist, who might be called an “Austrian” today. He probably said things like: “You can’t devalue yourself to prosperity. In the long run, we will be worse off after a devaluation.”

On the other side of the table was the mercantilist economist, someone like John Maynard Keynes. “Easy money will help in the short term,” he may have said, “and in the long run, we are all dead.”

In the midst of economic disaster, the Keynesian argument was persuasive. The dollar was devalued in 1933 — but, in deference to the classical economist, it remained pegged to gold at $35/oz. until 1971. Since 1971, we’ve been living in Keynes’ world exclusively, where central banks “lower interest rates” and engage in “quantitative easing” on pretty much a daily basis, in response even to very minor economic fluctuations.

Now Keynes is dead and we are living in the long run.

In the mid-1890s, there was a similar conversation about whether to engage in a currency devaluation, or remain on a sound gold standard. Andrew Carnegie, one of the wealthiest men in the world at the time, argued in favor of the gold standard in a paper called “The A B C of Money”:

Nothing places the farmer, the wage-earner, and all those not closely connected with financial affairs at so great a disadvantage in disposing of their labor or products as changeable “money.” … You all know that fish will not rise to the fly in calm weather. It is when the wind blows and the surface is ruffled that the poor victim mistakes the lure for a genuine fly. So it is with the business affairs of the world. In stormy times, when prices are going up and down, when the value of the article used as money is dancing about–up to-day and down to-morrow–and the waters are troubled, the clever speculator catches the fish and fills his basket with the victims. Hence the farmer and the mechanic, and all people having crops to sell or receiving salaries or wages, are those most deeply interested in securing and maintaining fixity of value in the article they have to take as “money.”

August 20, 2006: The A B C of Money

Does that sound like our world today?

During the gold standard period, until 1971, industry was the focus of the U.S. economy. Making real goods and services to enhance people’s lives. The financial sector was simply a means of providing capital to industry.

During times of changeable money — today’s floating fiat currencies — the speculator has an advantage over the businessman. Generations of the finest minds and most dynamic personalities have flooded into finance, because, quite simply, that’s where the rewards are. Even corporate managements have been enriching themselves primarily through financial tricks, such as backdating options, rather than by providing competitive products and services. The most high-minded industrialists find that success and failure depends more on speculating on exchange rates or the price of fuel than on producing goods that fill genuine needs.

The deterioration caused by floating currencies shows up in statistics, when you measure them in gold. For example, here’s a graph of U.S. per capita income, measured in gold ounces:

We can see the tremendous burst of wealth-creation in the 1950s and 1960s, a time when the dollar was pegged to gold and industry — rather than finance — was the focus of the economy. Beginning in 1971, with the introduction of floating currencies, this completely falls apart. Today, we are back to a mid-1950s level, having gone nowhere in fifty years.

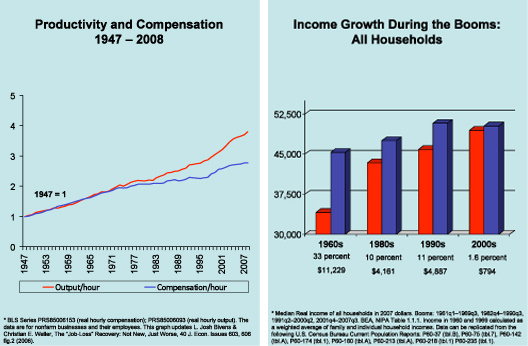

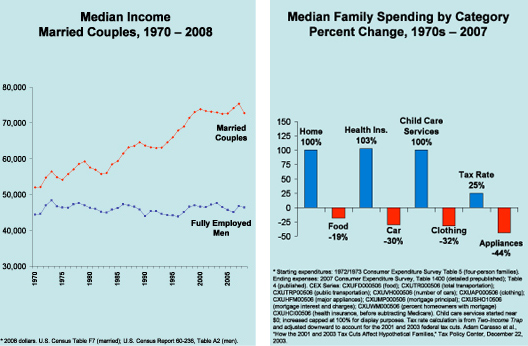

Since 1970, we’ve had smaller family sizes, more two-earner families, more compensation in the form of healthcare and pensions rather than wages, and a greater portion of total income flowing to the higher earners. Wages for those in the lower 80% or so have done worse than “stagnated.” This is the average income of “production workers” — in other words, not management, and excluding income from capital.

Pretty much a kick in the guts plain and simple.

Median family income has gone nowhere in the last decade.

Over the last 40 years, all the increase in median income has come from women entering the workforce. The median income of fully employed males has been flat (actually down in gold terms).

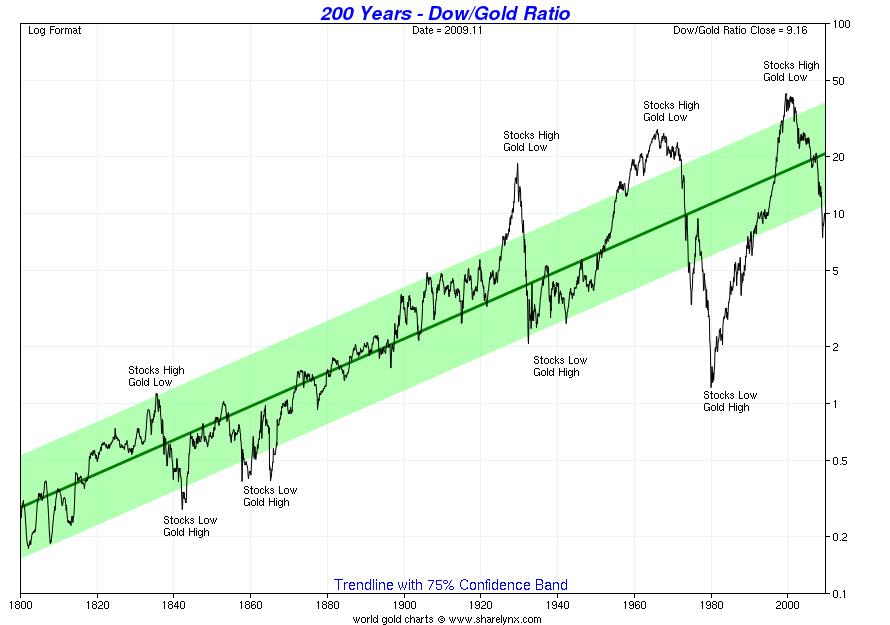

The stock market tells the same tale:

Here we can see the great rise of U.S. industry over 200 years — until 1970. The DJIA is also back to a mid-1950s level. The period before 1880 or so is very hypothetical — there wasn’t much of a “stock market” in those days.

It looks like we have a reliable rising trend, suggested by the sloping green bar. But, I would argue that there was a significant change in 1971, which means that this rising green band is probably no longer appropriate.

S&P500 profits are also at fifty-year-old levels, when measured in gold-linked “1925 dollars.” Even most of these profits have been financial profits, which arguably don’t represent the creation of any useful goods and services.

The problem with currency manipulation, and outright money-printing, is not that it doesn’t work. Unfortunately, it works! You can blow another asset bubble, or get people to shop for a couple quarters, or inflate away debts, pay for the government’s bailouts and “stimulus” plans, kick the can for another year or two, and get re-elected.

But you won’t achieve prosperity this way. That takes a stable currency, and the most stable currency is one pegged to gold.

How could any country become prosperous simply by jiggering the unit of account? No fiat currency regime has lasted very long, and the present one seems to be collapsing from its own internal corruption.

There was a recovery during the 1980s and 1990s. Things only got back to roughly where they were in the 1960s, and nowhere near there if you were an average production worker, but nevertheless, it was an improvement from the dismal conditions of the 1978-1982 period.

A recovery in the future is not guaranteed. We won’t rise to unprecedented heights just because someone drew a green band on a graph. After the complex Roman capitalist economy disintegrated, Europe didn’t return to those levels for about 1400 years. More recent examples abound: Spain was once the greatest power in Europe. It never recovered. Argentina has been grinding around for generations.