(This item originally appeared at Forbes.com on November 18, 2016.)

http://www.forbes.com/sites/nathanlewis/2016/11/18/jfk-vs-nixon-gold-vs-ngdp-targeting/#671a1f4e3538

“Gold vs. nominal GDP targeting” would seem like a pretty wonky discussion to most people. So, I will try to put it in different terms: John F. Kennedy vs. Richard Nixon.

When John F. Kennedy promised to “get the economy moving again” in the 1960 presidential election, the U.S. was in a recession officially dated from April 1960 to February 1961. Kennedy didn’t know, at first, how he would achieve his promises of 5% real GDP growth. Eventually, as described in Larry Kudlow and Brian Domitrovic’s recent book JFK and the Reagan Revolution: A Secret History of American Prosperity (2016), he landed on what I call the Magic Formula: Low Taxes and Stable Money. The low taxes took the form of a major tax reform posthumously passed in 1964. Stable Money was provided by the Bretton Woods gold standard of the time, which kept the value of the dollar at $35/oz., and which Kennedy actively defended against the “soft money” notions of his academic advisors.

It worked: nominal GDP was up 9.6% in 1966, the best year of the following boom, and “real” GDP was up 6.6%.

In 1970, Richard Nixon faced a recession officially dated from December 1969 to November 1970. He took a very different approach than Kennedy: after promising in the 1968 campaign that he would eliminate a 10% income tax surcharge imposed by Lyndon Johnson, he not only kept the surcharge, but added new taxes including a doubling of capital gains tax rates to near 50%.

On the money side, he replaced William McChesney Martin, who had been the head of the Federal Reserve since 1951, with Arthur Burns, Nixon’s longtime advisor, who had suggested in 1960 that Nixon’s bid for the presidency would be helped by a strong dose of “easy money.” The Federal Reserve – namely, Bill Martin – did not cooperate, and Nixon lost to Kennedy by a small margin.

Burns took office at the Fed in February 1970. Nixon also aimed for 5% growth in time for his re-election in 1972. This was going to be accomplished by the printing press. To produce 5% “real” growth, it was decided that 9% nominal GDP growth was to be the target. Burns set to work.

It was high taxes and “easy money” – the opposite of the Magic Formula that Kennedy had used. Specifically, it was a nominal GDP target, to be achieved wholly via the actions of the Federal Reserve. The target seemed reasonable – indeed, it was just what had been achieved by the Kennedy “policy mix” a few years earlier.

Nixon’s strategy also worked: nominal GDP growth was 9.8% in 1972, and “real” growth was 5.2%. Nixon was re-elected in 1972 by a large margin.

Then came the consequences. In the process of reaching Nixon’s “nominal GDP target,” the value of the dollar fell to an average of $63.91/oz. of gold in December 1972, a decline of 45% from its previous $35/oz. gold parity. Along the way, in August 1971, any remaining commitment to maintaining that gold parity was abandoned, with enormous consequences that we are still wrestling with today. The world monetary system broke apart, was put back together by Nixon in December 1971, and then broke apart again in early 1973. It is still broken.

Afraid to cause another recession with “tight money,” the Federal Reserve allowed the dollar to fall to $184/oz. in December 1974. The dollar was worth less than one-fifth of its pre-Nixon value, vs. gold. A decade of stagflationary malaise began. Nixon, and the rest of the U.S. elites, eventually blamed Arab oil. The rest of the world called it “the Nixon Shocks.”

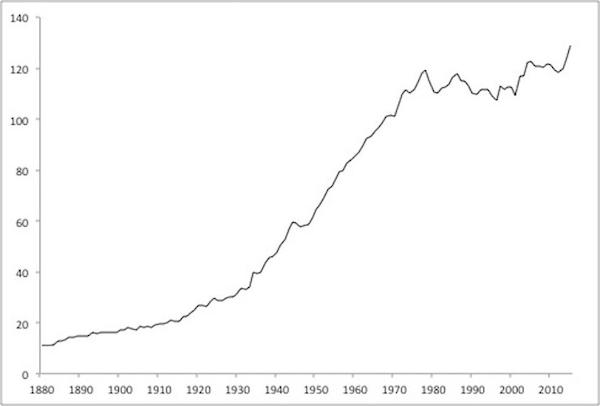

U.S. Wages Adjusted by CPI, 1880-2015. Source: measuringworth.com

Today, there are many calls for “nominal GDP targeting,” whether in a “rules-based” automated form, or as a guideline for discretionary policy as it was for Burns and Nixon (or most every central banker today). But you can’t create prosperity with the printing press, then or now or ever. You might be able to create an artificial boost, as Nixon did, but in the longer term, funny money manipulation only leads to mediocrity and decline.

Don’t do it the Nixon way.

Do it the Kennedy way. Keep the money stable in value, and then do everything else you can think of – tax reform, regulatory reform, education reform, or a dozen other things – to make people prosperous and happy. Especially tax reform.