Today we will look at Robert Mundell’s interpretation of the Interwar Period, 1914-1944.

October 30, 2016: Nonmonetary Perspectives on the Great Depression 3: Nonmonetary Causes

October 23, 2016: Nonmonetary Perspectives on the Great Depression 2: Steindl, Schwartz, and Eichengreen

October 16, 2016: Nonmonetary Perspectives on the Great Depression

October 2, 2016: The Interwar Period, 1914-1944

When I entered the “supply side inner circle” around 2001, I was surprised to find that a lot of the “supply side” legends said a lot of things that didn’t sound right to me, or to the others I knew. When Robert Mundell gave his version of twentieth-century economic history as part of his 1999 Nobel Prize acceptance speech, there was a fair amount of grumbling in the “inner circle” that Mundell seemed a little floppy. I shared this view. I would even say that it became a little bit of a litmus test: “What did you think of Mundell’s 1999 speech?” You had to know what was being referred to, and have a well-founded opinion about it.

While I shared others’ misgivings, I withheld any concrete judgement until I could get a better idea of what Mundell’s arguments were. (This took fifteen years.) The version in the speech is really an abbreviated version. Was there some kind of detailed argument behind it, perhaps supported by evidence and data? Mundell is a smart guy, and he probably had some sort of reasoning behind his conclusions. Maybe I would learn something new. I looked at Mundell’s entire bibliography, at his personal website, and did not find any titles that suggested such an in-depth treatment. I did eventually find a more detailed treatment of these ideas, which we will look into later.

http://robertmundell.net/bibliography/

I put this is a separate category, as this version of things hasn’t really spread much beyond Mundell himself I would say, and is not a widely-held “interpretation.”

For today, let’s just look at the version in the 1999 speech.

http://robertmundell.net/nobel-prize/

By comparison with past centuries, the twentieth has produced extremes. Its earliest part was a benign continuation of the pax of the 19th century. But this calm before the storm was followed by World War I, communism, hyperinflation, fascism, depression, genocide, World War II, the atom bomb, and the Soviet occupation of Eastern Europe. There followed a period of comparative stability, punctuated by the balance of terror of the Cold War, the Nato Alliance, and decolonialism. Toward the end of the century the Cold War ended, the Soviet Empire was dismantled, democracy emerged in Eastern Europe, the Pax Americana flourished and the euro came into being. The clue to the 20th century lies in the links between its first and last decades, the “bookends” of the century.

In 1906, Whitelaw Reid, the US Ambassador to Britain, gave a lecture at Cambridge University with the title, The Greatest Fact in Modern History, in which the author, a diplomat, journalist and politician, was given as his subject, the rise and development of the United States!1 It cannot have been obvious then that the rise of the United States was the “greatest fact in modern history” but it was true that in a matter of only two centuries a small colony had become the biggest economy in the world. The first decade of the century hinted at what the last decade confirmed, viz., American preponderance. Forget the seventy-five years between 1914 and 1989!

An underlying theme of my lecture today is the role of the United States in what has been aptly called the “American century.” I want to bring out the role of the monetary factor as a determinant of political events. Specifically, I will argue that many of the political changes in the century have been caused by little-understood perturbations in the international monetary system, while these in turn have been a consequence of the rise of the United States and mistakes of its financial arm, the Federal Reserve System.

The twentieth century began with a highly efficient international monetary system that was destroyed in World War I, and its bungled recreation in the inter-war period brought on the great depression, Hitler and World War II. The new arrangements that succeeded it depended more on the dollar policies of the Federal Reserve System than on the discipline of gold itself. When the link to gold was finally severed, the Federal Reserve System was implicated in the greatest inflation the United States has yet known, at least since the days of the Revolutionary War. Even so, as the century ends, a relearning process has created an entirely new framework for capturing some of the advantages of the system with which the century began.

The century can be divided into three distinct, almost equal parts. The first part, 1900-33, is the story of the international gold standard, its breakdown during the war, mismanaged restoration in the 1920’s and its demise in the early 1930’s. The second part, 1934-71, starts with the devaluation of the dollar and the establishment of the $35 gold price and ends when the United States took the dollar off gold. The third part of the century, 1972-1999, starts with the collapse into flexible exchange rates and continues with the subsequent outbreak of massive inflation and stagnation in the 1970’s, the blossoming of supply-side economics in the 1980’s, and the return to monetary stability and the birth of the euro in the 1990’s. The century ends, however, with our monetary system in deficit compared to the first decade of the century and that suggests unfinished business for the decades ahead.

I. Mismanagement of the Gold Standard

The international gold standard at the beginning of the 20th century operated smoothly to facilitate trade, payments and capital movements. Balance of payments were kept in equilibrium at fixed exchange rates by an adjustment mechanism that had a high degree of automaticity. The world price level may have been subject to long-terms trends but annual inflation or deflation rates were low, tended to cancel out, and preserve the value of money in the long run. The system gave the world a high degree of monetary integration and stability.

International monetary systems, however, are not static. They have to be consistent and evolve with the power configuration of the world economy. Gold, silver and bimetallic monetary standards had prospered best in a decentralized world where adjustment policies were automatic. But in the decades leading up to World War I, the central banks of the great powers had emerged as oligopolists in the system. The efficiency and stability of the gold standard came to be increasingly dependent on the discretionary policies of a few significant central banks. This tendency was magnified by an order of magnitude with the creation of the Federal Reserve System in the United States in 1913. The Federal Reserve Board, which ran the system, centralized the money power of an economy that had become three times larger than either of its nearest rivals, Britain and Germany. The story of the gold standard therefore became increasingly the story of the Federal Reserve System.

World War I made gold unstable. The instability began when deficit spending pushed the European belligerents off the gold standard, and gold came to the United States, where the newly-created Federal Reserve System monetized it, doubling the dollar price level and halving the real value of gold. The instability continued when, after the war, the Federal Reserve engineered a dramatic deflation in the recession of 1920-21, bringing the dollar (and gold) price level 60 percent of the way back toward the prewar equilibrium, a level at which the Federal Reserve kept it until 1929.

It was in this milieu that the rest of the world, led by Germany, Britain and France, returned to the gold standard. The problem was that, with world (dollar) prices still 40 percent above their prewar equilibrium, the real value of gold reserves and supplies was proportionately smaller. At the same time monetary gold was badly distributed, with half of it in the United States. In addition, uncertainty over exchange rates and reparations (which were fixed in gold) increased the demand for reserves. In the face of this situation would not the increased demand for gold brought about by a return to the gold standard bring on a deflation? A few economists, like Charles Rist of France, Ludwig von Mises of Austria and Gustav Cassel of Sweden, thought it would.

Cassel(1925) had been very explicit even before Britain returned to gold:

“The gold standard, of course, cannot secure a greater stability in the general level of prices of a country than the value of gold itself possesses. Inasmuch as the stability of the general level of prices in desirable, our work for a restoration of the gold standard must be supplemented by endeavours to keep the value of gold as constant as possible…With the actual state of gold production it can be taken for certain that after a comparatively short time, perhaps within a decade, the present superabundance of gold will be followed, as a consequence of increasing demand, by a marked scarcity of this precious metal tending to cause a fall of prices…”

After gold had been restored, Cassel pursued his line of reasoning further, warning of the need to economize on the monetary use of gold in order to ward off a depression. In 1928 he wrote:

“The great problem before us is how to meet the growing scarcity of gold which threatens the world both from increased demand and from diminished supply. We must solve this problem by a systematic restriction of the monetary demand for gold. Only if we succeed in doing this can we hope to prevent a permanent fall of the general price level and a prolonged and world-wide depression which would inevitably be connected with such a fall in prices.”

Rist, Mises and Cassel proved to be right. Deflation was already in the air in the late 1920’s with the fall in prices of agricultural products and raw materials. The Wall Street crash in 1929 was another symptom, and generalized deflation began in 1930. That the deflation was generalized if uneven can be seen from the percentage loss of wholesale prices in various countries from the high in 1929 to September 1931 (the month that Britain left the gold standard): Japan, 40.5; Netherlands, 38.1; Belgium, 31.3; Italy 31.0; United States, 29.5; United Kingdom, 29.2; Canada, 28.9; France, 28.3; Germany, 22.0.

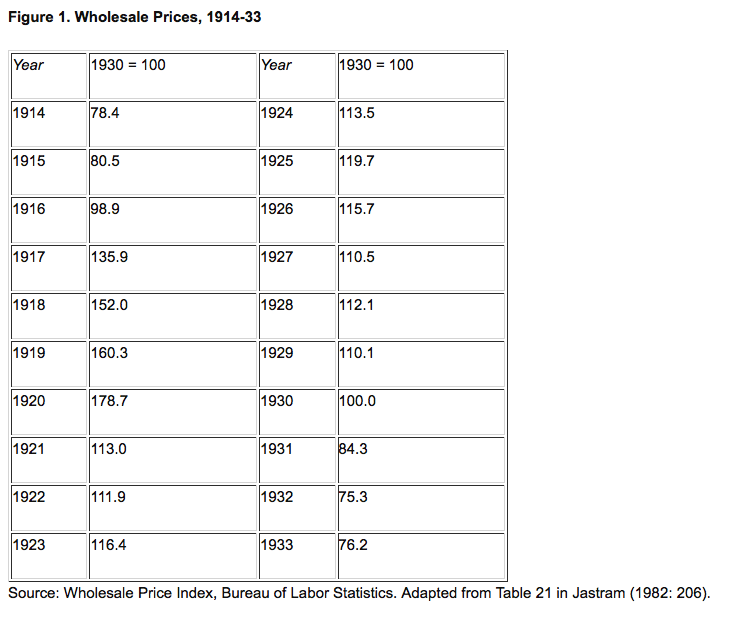

The dollar price level hit bottom in 1932 and 1933. The highlights of the price level from 1914 to 1934 are given in Table 1:

For decades economists have wrestled with the problem of what caused the deflation and depression of the 1930’s. The massive literature on the subject has brought on more heat than light. One source of controversy has been whether the depression was caused by a shift of aggregate demand or a fall in the money supply. Surely the answer is both! But none of the theories—monetarist or Keynesian—would have been able to predict the fall in the money supply or aggregate demand in advance. They were rooted in short-run closed-economy models which could not pick up the gold standard effects during and after World War I. By contrast, the theory that the deflation was caused by the return to the gold standard was not only predictable, but was actually, as we have noted above, predicted.The gold exchange standard was already on the ropes with the onset of deflation. It moved into its crisis phase with the failure, in the spring of 1931, of the Viennese Creditanstalt, the biggest bank in Central Europe, bringing into play a chain reaction that spread to Germany, where it was met by deflationary monetary policies and a reimposition of controls, and to Britain, where, on September 21, 1931, the pound was taken off gold. Several countries, however, had preceded Britain in going off gold: Australia, Brazil, Chile, New Zealand, Paraguay, Peru, Uruguay and Venezuela, while Austria, Canada, Germany and Hungary had imposed controls. A large number of other countries followed Britain off gold.

Meanwhile, the United States hung onto to the gold standard for dear life. After making much of its sensible shift to a monetary policy that sets as its goal price stability rather than maintenance of the gold standard, it reverted back to the latter at the very time it mattered most, in the early 1930’s.

Instead of pumping liquidity into the system, it chose to defend the gold standard. Hard on the heels of the British departure from gold, in October 1931, the Federal Reserve raised the rediscount rate in two steps from 1_ to 3_ percent dragging the economy deeper into the mire of deflation and depression and aggravating the banking crisis. As we have seen, wholesale prices fell 35 percent between 1929 and 1933.

Monetary deflation was transformed into depression by fiscal shocks. The Smoot-Hawley tariff, which led to retaliation abroad, was the first: between 1929 and 1933 imports fell by 30 percent and, significantly, exports fell even more, by almost 40 percent. On June 6, 1932, the Democratic Congress passed, and President Herbert Hoover signed, in a fit of balanced-budget mania, one of its most ill-advised acts, the Revenue Act of 1932, a bill which provided the largest percentage tax increase ever enacted in American peacetime history. Unemployment rose to a high of 24.9 percent of the labor force in 1933, and GDP fell by 57 percent at current prices and 22 percent in real terms.

The banking crisis was now in full swing. Failures had soared from an average of about 500 per year in the 1920’s, to 1,350 in 1930, 2,293 in 1931, and 1,453 in 1932. Franklin D. Roosevelt, in one of his first actions on assuming the presidency in March 1933, put an embargo on gold exports. After April 20, the dollar was allowed to float downward.

The deflation of the 1930’s was the mirror image of the wartime rise in the price level that had not been reversed in the 1920-21 recession. When countries go off the gold standard, gold falls in real value and the price level in gold countries rise. When countries go onto the gold standard, gold rises in real value and the price level falls. The appreciation of gold in the 1930’s was the mirror image of the depreciation of gold in World War I. The dollar price level in 1934 was the same as the dollar price level in 1914. The deflation of the 1930’s has to be seen, not as a unique “crisis of capitalism,”as the Marxists were prone to say, but as a continuation of a pattern that had appeared with considerable predictability before—whenever countries shift onto or return to a monetary standard. The deflation in the 1930’s has its precedents in the 1780’s, the 1820’s and the 1870’s.

What verdict can be passed on this third of the century? One is that the Federal Reserve System was fatally guilt of inconsistency at critical times. It held onto the gold standard between 1914 and 1921 when gold had become unstable. It shifted over to a policy of price stability in the 1920’s that was successful. But it shifted back to the gold standard at the worst time imaginable, when gold had again become unstable. The unfortunate fact was that the least experienced of the important central banks—the new boy on the block—had the awesome power to make or break the system by itself.

The European economies were by no means blameless in this episode. They were the countries that changed the status quo and moved onto the gold standard without weighing the consequences. They failed to heed the lessons of history—that a concerted movement off, or onto, any metallic standard brings in its wake, respectively, inflation or deflation. After a great war, in which inflation has occurred in the monetary leader and gold has become correspondingly undervalued, a return to the gold standard is only consistent with price stability if the price of gold is increased. Failing that possibility, countries would have fared better had they heeded Keynes’ advice to sacrifice the benefits of fixed exchange rates under the gold standard and instead stabilize commodity prices rather than the price of gold.

Had the price of gold been raised in the late 1920’s, or, alternatively, had the major central banks pursued policies of price stability instead of adhering to the gold standard, there would have been no Great Depression, no Nazi revolution and no World War II.

II. Policy Mix Under the Dollar Standard

In April 1934, after a year of flexible exchange rates, the United States went back to gold after a devaluation of the dollar. This decreased the gold value of the dollar by 40.94 percent, raising the official price of gold 69.33 percent to $35 an ounce. How history would have been changed had President Herbert Hoover devalued the dollar, three years earlier!

France held onto its gold parity until 1936, when it devalued the franc. Two other far-reaching events occurred in that year. One was the publication of Keynes’ General Theory; the other signing of the Tripartite Accord among the United States, Britain and France. One ushered in a new theory of policy management for a closed economy; the other, a precursor of the Bretton Woods agreement, established some rules for exchange rate management in the new international monetary system.

The contradiction between the two could hardly be more ironic. At a time when Keynesian policies of national economic management were becoming increasingly accepted by economists, the world economy had adopted a new fixed exchange rate system that was incompatible with those policies.

In the new arrangements, which were ratified at Bretton Woods in 1944, countries were required to establish parities fixed in gold and maintain fixed exchange rates to one another.

…

IV. Conclusions

It is time to wrap up the century in some conclusions. A first conclusion is that the international monetary system depends on the power configuration of the countries that make it up. Bismarck once said that the most important fact of the nineteenth century was that England and America spoke the same language. Along the same lines, the most important fact of the twentieth century has been the rise of the United States as a superpower. Despite the incredible rise in gold production, Gresham’s Law came into play and the dollar elbowed out gold as the principal international money.

The first third of twentieth century economics was dominated by the confrontation of the Federal Reserve System with the gold standard. The gold standard broke down in World War I and its restoration in the 1920’s created the deflation of the 1930’s. Economists blamed the gold standard instead of their mishandling of it and turned away from international automaticity to national management. The Great Depression itself let to totalitarianism and World War II.

The second third of the twentieth century was dominated by the contradiction between national macroeconomic management and the new international monetary system. In the new system, the United States fixed the price of gold and the other major countries fixed their currencies to the convertible dollar. But national macroeconomic management precluded the operation of the international adjustment mechanism and the system broke down in the early 1970’s when the United States stopped fixing the price of gold and the other countries stopped fixing the dollar.

The last third of the twentieth century started off with the destruction of the international monetary system and the vacuum sent officials and academics into a search for “structure.” In the 1970’s the clarion call was for a “new international monetary order” and in the 1990’s a “new international monetary architecture.” The old system was one way of handling the inflation problem multilaterally. Flexibility left each country on its own. Inflation was the initial result but a learning mechanism educated a generation of monetary officials on the advantages of stability and by the end of the century fiscal prudence and inflation control had again become the watchword in all the rich and many of the poor countries.

Today, the dollar, the euro and yen have established three islands of monetary stability,which is a great improvement over the 1970’s and 1980’s. There are, however, two pieces of unfinished business. The most important is the dysfunctional volatility of exchange rates that could sour international relations in time of crisis. The other is the absence of an international currency.

The century closes with an international monetary system inferior to that with which it began, but much improved from the situation that existed only two-and-a-half decades ago. It remains to be seen where leadership will come from and whether a restoration of the international monetary system will be compatible with the power configuration of the world economy. It would certainly make a contribution to world harmony.

Hmmmm.

First of all, this is, by all appearances, a predominantly monetary “interpretation” of the Interwar Period including the Great Depression. The main argument seems to be that gold itself changed value — a variant on the #5 theory that I ascribed to Gustav Cassel, who Mundell mentioned. Mundell makes a little mention of “fiscal shocks” in the form of tariffs and domestic tax hikes, but somewhat in passing (two sentences!) while his monetary ideas get most of the attention.

September 25, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s 3: Supply and Demand

September 18, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s 2: Never Happened Before

September 11, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s

This is also a bit of a hodgepodge — a little bit of this and a little bit of that, somewhat in the manner of the Blame France arguments. The overall impression is one of piling up a lot of justifications behind a preordained conclusion.

August 7, 2016: Blame France 3: Dump A Pile Of Argle-Bargle On Their Heads

In the end — like the Blame France-ers — Mundell is a devaluationist. His recommendation is no different than that of Keynes or Friedman or Eichengreen or Temin, or what was actually done by Franklin Roosevelt. “Had the price of gold been raised in the late 1920’s” — this means a devaluation, like the 1933 devaluation of the dollar from $20.67/oz. to $35/oz. — “or, alternatively, had the major central banks pursued policies of price stability instead of adhering to the gold standard” — this means a floating fiat currency whose value drops considerably, such that nominal commodity prices would not have fallen — “there would have been no Great Depression, no Nazi revolution and no World War II.” So, now we know what the justifications are supposed to justify. It is an interesting storyline to get there, but in the end, the conclusion is 100% by-the-consensus. The black sheep is still following the herd.

My overall impression is that Mundell was not willing to give up some form of “monetary interpretation,” which had become popular among all right-leaning “small government free market” economists across the board. He wasn’t willing to say, as I have said, that Milton Friedman’s version of things is malarkey, a thinly-veiled justification for devaluation and floating fiat currencies, no different than the Keynesians.

June 19, 2014: Explaining “Freaky Friday” — How the Gold Guys Became Their Own Worst Enemies

I should also say that making up new “interpretations” of the Great Depression, while coming to a 100%-by-the-consensus result, has long been a proven career booster for ambitious academics. Keynes himself set the example, making up a bunch of justifications in 1936 for what politicians just wanted to do anyway in 1931. In effect, Keynes showed the new generation of economists how to make a living in the new environment. Friedman was another good example, ending up in exactly the same spot as the Keynesians but by a wholly different route, sort of like sailing west to Asia. Today, we get ever more creative “interpretations” by the Blame-France-ers, plus things like Scott Sumner’s book The Midas Paradox. I think any attempt at actually finding any truth has largely fallen by the wayside. Today, this is mostly theater, and its purpose is to entertain the department heads who determine tenure, and who have very picky tastes.

Here’s an interesting view of the world of academic economists, from a professor of economics.

We are experiencing deep economic problems and it is the fault of the economics discipline. Their macro theories suck. But, there is no mechanism forcing it to alter its models when they don’t appear to work. This is so because economists basically write for each other in a language only they understand and their jobs depend on impressing a limited number of journal editors and referees, not correcting real-world problems. The academic inbreeding that has resulted has led to dysfunctional theories and, despite the fact that there were economists who accurately forecast the Financial Crisis, because their work is incompatible with what is published in “good” journals it has been all but ignored. Economics is broken and there is no internal incentive to fix it. …

Economics emerged as an academic discipline some time in the late 1800s. At that point, we stopped writing for policy makers and the general public and started writing for each other. That, in and of itself, is not problematic, except that a) we became increasingly insular as we spent more time with each other than those using or being affected by our policies and b) the language we used became much more specialized so that those outside our group couldn’t really look over our shoulders and say, “Hey, wait a minute, that doesn’t make any sense!” If you aren’t an economist, it’s very difficult to decipher what economists are saying.

A huge part of writing to impress each other is getting published in refereed academic journals. You spend months, maybe years, writing papers that you hope some journal editor and referee(s) believe is worthy. Typical rejection rates are at least 75%, often higher. That doesn’t prevent the individual from sending the article elsewhere, but since our etiquette dictates that the paper can only be under review at one journal at a time, it means that the lag can be considerable. Nor is this just for fun. If the portfolio you submit when you come up for tenure is inadequate, you’re fired (they give it a nice name: you are offered a terminal contract). Thus, any economist who wants to keep her job must be able to impress the senior faculty in charge of the publication outlets. There is absolutely no incentive to engage with anyone other than these individuals. Indeed, one can have a fantastically successful career having never once written something understandable by a policy maker, business person, or consumer. Furthermore, unlike, say, engineers, we don’t get clear and direct feedback from those who employed our policies. There is a very large disconnect. …

Almost every department (not ours, thankfully) maintains a list of journals that count toward tenure, promotion, and raises. They are either exclusive in the sense that “if you don’t publish here we don’t count it at all” or they are ranked from best to worst. You can submit articles to the latter if you like, but you’ll need ten of those to add up to one of the former. Given the intense time constraint under which those seeking tenure operate, the choice is obvious. Either you fall in line with what everyone else in the department thinks is “good” or you get your CV ready. Nor do these lists vary significantly from department to department so that one could choose where to work on that basis. Rather, they are all basing theirs on the same of academic articles that did the ranking for them. …

Our Catholicism is the school of thought called Neoclassicism and our St. Peter is comprised of the university department chairs, deans, and presidents who are forced to try to maximize their position in the various rankings published by US News and World Report and the like. The result is cookie cutter departments, with everyone desperately trying to look better than everyone else but by the exact same set of criteria! … All this means that while innovative research is possible, it actually has to be within some pretty narrow confines.

http://www.forbes.com/sites/johntharvey/2016/10/31/five-reasons-you-should-blame-economics/#41acdd3e14aa

When you consider the writing of any academic economist, over the past century at least, you have to consider these factors. Usually, it is the most important thing. I’ve often compared the academic economists to the Catholic Church, and it is interesting that this academic economist does so too. Being a “creative” Catholic might be a career-booster — the preferred path to a becoming a bishop. But, you have to remain a Catholic.

It is not just the high priests of academic dogma who like to be stroked. They too bend to the pressures exerted upon them — pressures that come, in large part, from central banks themselves. Since “interpretations” of the Great Depression serve as the ultimate justification for floating fiat currencies today, and it is floating fiat currencies (instead of an automatic, nondiscretionary system like a gold standard or currency board) which gives central bankers their outsized status and influence, we should not be surprised to find that various “blame gold interpretations” fit quite well within central banks’ present agenda.

The Federal Reserve, through its extensive network of consultants, visiting scholars, alumni and staff economists, so thoroughly dominates the field of economics that real criticism of the central bank has become a career liability for members of the profession, an investigation by the Huffington Post has found.This dominance helps explain how, even after the Fed failed to foresee the greatest economic collapse since the Great Depression, the central bank has largely escaped criticism from academic economists. In the Fed’s thrall, the economists missed it, too.

“The Fed has a lock on the economics world,” says Joshua Rosner, a Wall Street analyst who correctly called the meltdown. “There is no room for other views, which I guess is why economists got it so wrong.”

Priceless: How the Federal Reserve Bought the Economics Profession

Probably it is a little incorrect to go into all this sort of thing, which doesn’t really address the assertions on the table directly at all. But, having been involved in this sort of thing for a long time now, what I am often most concerned about is what are the motivations of the writer? From the motivations spring all the rest of the verbiage.

For example, if you think that the motivation is to spout “Catholic” (no offense to Catholics) dogma in a servile manner to please department heads for careerist reasons, and that no meaningful examination of reality is ever intended to take place — and you think this because you have seen it time and time again over the past decade or two, and this time is recognizably not very different at all from all the other times — then we don’t really have to take the arguments very seriously, as an examination of reality, because the author doesn’t either.

My motivation is to treat the gold standard as innocent until proven guilty. The reason for this is that, if the gold standard really “caused” the Great Depression, then it conceivably could do so again. As I think we have seen in detail by now, neither the Keynesians nor the Monetarists — the two most popular “interpretations” over the past eighty years — make any real claims that the gold standard was the “cause.” There hasn’t been much defense necessary, because there are no claims to begin with. We are actually in agreement.

I intended this to be something of a coda to our look into “monetary interpretations of the Great Depression”, but I can tell already that it is going to get pretty involved. We will continue with this discussion soon.