We’re continuing our look into the various notions that Robert Mundell brought up in his 1999 Nobel speech, regarding the Interwar Period, 1914-1944.

November 6, 2016: Robert Mundell’s Interpretation of the Interwar Period

October 30, 2016: Nonmonetary Perspectives on the Great Depression 3: Nonmonetary Causes

October 23, 2016: Nonmonetary Perspectives on the Great Depression 2: Steindl, Schwartz, and Eichengreen

October 16, 2016: Nonmonetary Perspectives on the Great Depression

October 2, 2016: The Interwar Period, 1914-1944

Mundell’s ideas turned up earlier in H. Clark Johnson’s book Gold, France and the Great Depression, 1919-1932 (1997), which gives some greater detail and has led to what is apparently now called the “Mundell-Johnson hypothesis.” I’ll let Johnson himself describe what this is supposed to mean, in this January 2016 review of Scott Sumner’s book The Midas Paradox (which I haven’t read yet, but apparently repeats some of these claims).

https://marketmonetarist.files.wordpress.com/2016/01/midas-review-clark-johnson.pdf

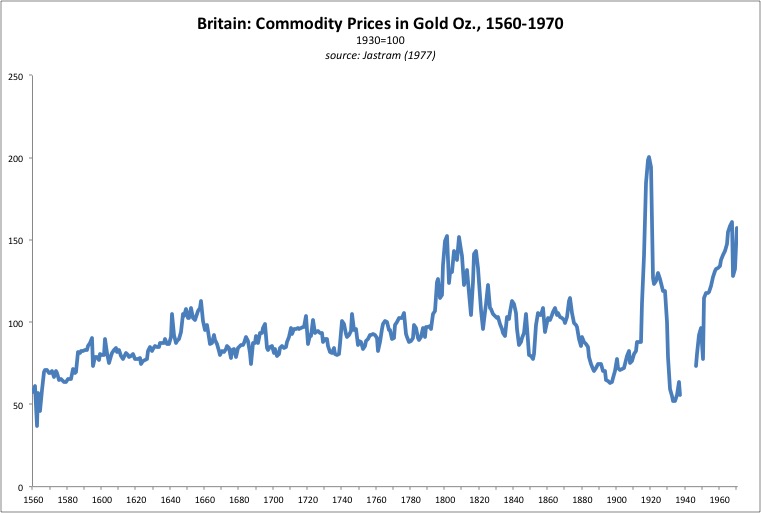

Monetary Origins of Depression

Sumner credits what he calls the Mundell-Johnson hypothesis, according to which the roots of the depression were in the post-WWI undervaluation of gold, as a precursor to his study. (footnote) As the junior placeholder on that hypothesis, I recap my understanding of it here. The purchasing power of an ounce of gold changed little from the middle of the seventeenth century to the middle of the twentieth. Gold constraints were typically relaxed during wars to facilitate official spending and borrowing – and allowing price inflation. But English deflation restored prewar price levels in the years after the Puritan wars of the seventeenth century and the Napoleonic wars of the nineteenth. A similar deflation was likely to occur after the First World War as major economies of Germany, Britain, and France would return to gold convertibility at the prewar value of $20.67/ ounce during the 1920s. The low postwar gold value affected monetary reserves in two ways: 1) it depressed the value of outstanding stocks; and 2) it reduced the price incentive for new gold production. In France, the US, and Germany, which had traditionally had large gold coin circulations, gold was mostly taken out of circulation during and after the war, which lessened confidence in convertible paper money. Economist Gustav Cassel drew attention to the “gold standard paradox,” by which a gold-based monetary system would require ever-increasing gold production to accommodate economic growth while maintaining reserve ratios. Yet world gold production during the 1920s was below what it had been in the decade before the war; and given the postwar decline in gold’s purchasing power, the real value of new gold produced in the mid-1920s was just over 50 percent of what it had been in 1914.

The doubters turned out to be correct. The viability of the gold standard was tied to its mystique; it provided a cultural and emotional link to the prewar status quo. In proposing a hypothetical increase in the gold price, perhaps at the time of the Genoa Conference in 1922, Mundell and Johnson intended a counterfactual through which subsequent deflation might have been prevented.

footnote: Robert A. Mundell, Nobel Lecture, 2000; and H. Clark Johnson, Gold, France, and the Great Depression, 1919- 1932 (Yale, 1997).

I talked a little about the Blame-France-ers, including Johnson, here:

August 7, 2016: Blame France 3: Dump A Pile Of Argle-Bargle On Their Heads

July 31, 2016: Blame France 2: Balance Sheet Peeping

July 24, 2016: Blame France

Here’s a little excerpt from Johnson’s 1997 book:

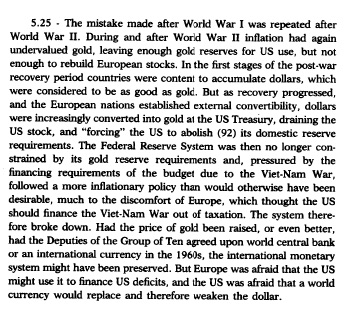

I was going to talk about Johnson’s version of things in a lot of detail, but I think that would not really be productive. Maybe we’ll get back to it sometime. Let’s go on. Johnson referred to an obscure 1989 paper by Mundell, “The Global Adjustment Mechanism,” originally published in Rivista di Economica Politica and later included in Mario Baldessari, John McCallum and Robert Mundell (1992) eds., Disequilibrium in the Global Economy. This was hard to get. Here are a few excerpts from the conclusion.

A lot here (and in Johnson) rides on “the Thornton Effect,” referring to some notions held by a British parliamentarian who died in 1815. His claim is apparently that when a country goes off gold (in his case, the introduction of the hyperinflationary assignats in France), gold tends to be exported, which results in a decline in the value of gold elsewhere. Thornton allegedly blamed this effect for the rise in prices in Britain following the introduction of the assignats in 1789, and their final descent into hyperinflationary oblivion in 1796.Let’s take a look:

There was indeed a rise in commodity prices compared to gold, in Britain in the 1790s. However, this could be as easily explained as a reduction in commodity supply (happens during war) and expansion of commodity demand during wartime. (The lift in 1640-1660 reflects the English Civil War.) In 1793 the Napoleonic Wars began, when the First Coalition of Austria, Sardinia, Naples, Prussia, Spain and, yes, Britain joined together to fight the new French Republic. At the time, much of the Italian peninsula was held by Austria. So, this First Coalition war against France involved pretty much all of Europe west of Russia and the Ottoman Empire. Also, the British pound had suspension of convertibility from 1797, resulting in a decline in the pound’s value and thus inflationary pressures on nominal prices in Britain. This first war ended when Napoleon forced the Austrians to accept surrender in 1797.

In general, I don’t think that the “Thornton effect” amounts to much, in the 1790s, and certainly not in the 1910s. The relatively small amount of gold that might have come out of France in the 1790s — if there was actually any at all, which makes sense but should not be assumed — would not likely make much difference for the world as a whole. The “Law of One Price” is the general rule for gold; the large worldwide aboveground stock tends to heavily dampen any effect of small localized supply. In other words, gold flows out of France might have increased the total amount of gold in the world outside of France by perhaps 2%. However, the difficulties of transport, and Mercantilist trade restrictions of the time, and restrictions due to warfare (surrounded by enemies, where was the French gold going?) might have allowed a bit of a localized depression in gold’s value in Britain, before becoming, as David Hume explained in the 1750s: like water, the same value everywhere.

There is a tendency by Mundell to ascribe all changes in commodity prices to changes in gold’s value, which I have said over and over is a crude fallacy. Following this logic, a change in commodity prices is itself “proof of a change in gold’s value.” The only thing left is to invent some vaguely-plausible justification for it. Nowhere do we consider the idea that the change might just be a change in real prices, as expressed in a medium of stable value (gold) — as if the supply-demand conditions of continent-wide war (and later World War), or the later effects of a worldwide economic collapse, would have no effect on that. Once you start to assume that commodity prices are a perfect measure of real value, and that gold’s value is jumping all over the place, then the natural conclusion is a commodity-basket standard (“price stability”), not a gold standard. Mundell too goes down this path, citing Jastram along the way, who makes the identical error.

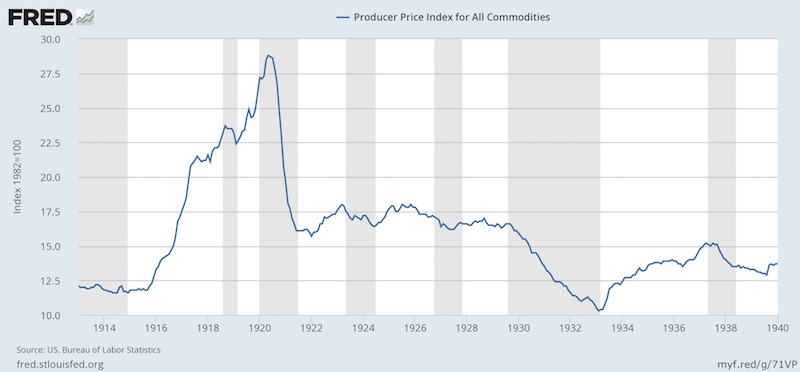

For World War I, we have a rather large spike in nominal commodity prices, as expressed in dollars. It is not too hard to imagine how wartime might affect commodity demand. But did it affect supply?

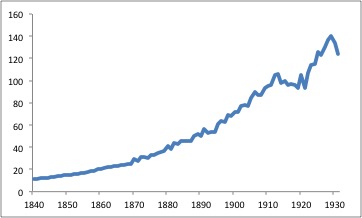

This is an index of worldwide “basic production” which includes commodities, and also things like electricity. It is from Warren and Pearson, Prices (1933).

Can you spot World War I?

Note that the stagnation of commodity production actually extends into the early 1920s, which, when combined with booming economies especially in the U.S. and France, certainly suggests why commodity prices were somewhat elevated during that decade.

Maybe you can see the silliness of ascribing all changes in commodity prices during a World War to some change in gold’s value caused by some “Thornton effect.” But, once you make the assumption that gold’s “purchasing power” (i.e. the inverse of prices) and its “value” are the same, things naturally trend in this direction.

Over time, it would make sense that the elevated commodity prices of the 1920s would settle back down toward their long-term averages — perhaps even go below the average, since the very definition of an “average” implies that prices must be below the average for about the same amount of time*magnitude as they are above. There’s nothing wrong with this — just additional capital being invested in commodity production, in response to the high profitability caused by the high prices. Production volumes picked up in the latter 1920s, and commodity prices had a slight moderation. Typically, the commodity-basketers have a bit of a fit around this point, because this suggests “deflation”, which they associate with economic decline. They tend to want to devalue the currency at the first sign of falling prices, but are willing to have a price rise. In this way, commodity basket arguments, though couched in terms of “price stability,” tend to be veiled arguments for currency devaluation in response to recession.

I think I will talk a little more about these nominal commodity prices.

Note that much of the rise actually takes place after 1918. (It also doesn’t start until the beginning of 1916.) There was some funny business with the dollar in those days, which we looked into previously.

March 25, 2012: The U.S. Dollar During WWI and the Recession of 1920

It wasn’t until the contraction of 1921 that the dollar’s value was restored back to its $20.67/oz. parity. There was some degree of dollar decline during the war years, but I don’t have any measure of how much the dollar was being devalued. The wartime capital controls and gold embargo produced a notional price of gold at “$20.67/oz.” even though this was a fiction. The best guess I have of the degree of dollar depreciation is from some other forex rates of the time.

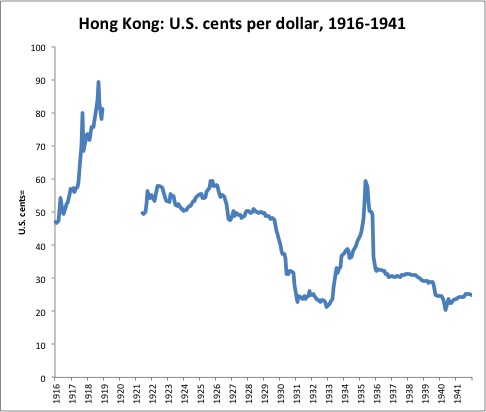

See the huge rise in HK dollars vs. U.S. dollars from 1916? This suggests that the real market value of the U.S. dollar was falling. I don’t think the HK dollar was really soaring higher.

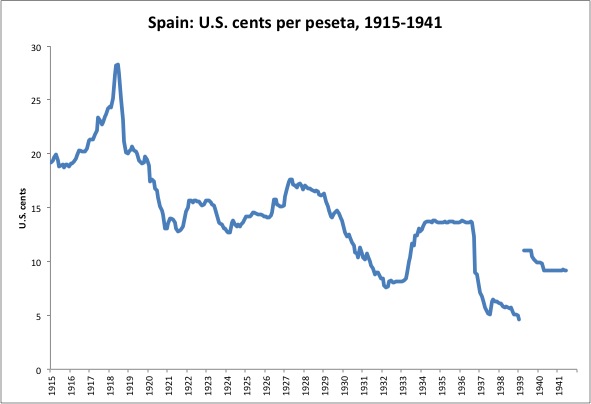

A similar story in Spain, again from the start of 1916.

The point is that the rise in nominal commodity prices in the U.S. (or Britain) reflected a substantial degree of currency depreciation. Unfortunately, I don’t really have any good measure of how much depreciation. Presumably, the market price of gold in U.S. dollars in someplace like Mexico City or Singapore would tell the tale.

So, we have a combination of both natural supply/demand characteristics for commodities in the midst of a World War, and also substantial monetary factors (variation of currencies from their prewar gold parity values) which we are unfortunately unable to gauge well. We also probably have the effects of wartime price controls, lifted afterwards, which might also account for some of the rise in prices after 1918. Even if there was some kind of “Thornton effect,” it would be so mixed up in these other factors as to be impossible to evaluate.

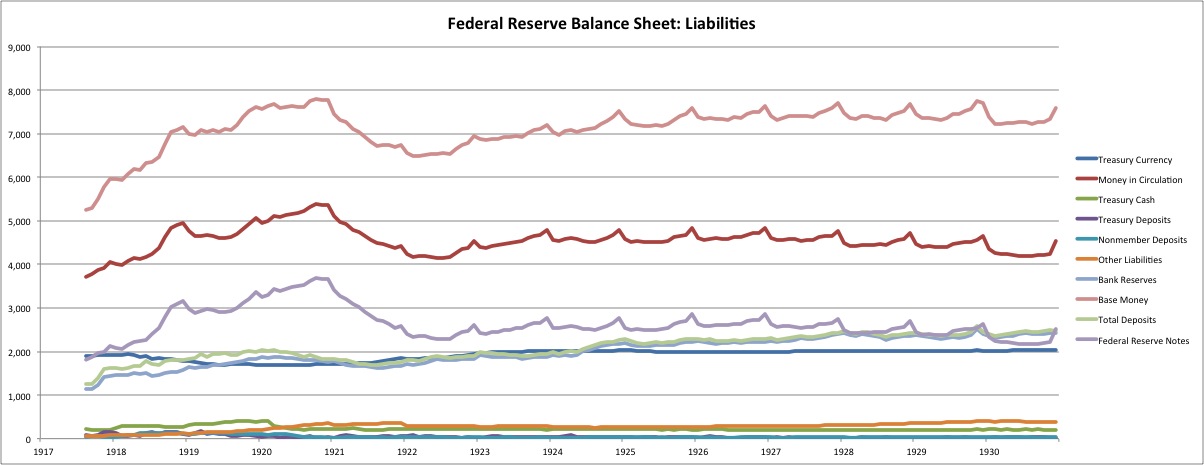

Mundell and Johnson then engage in a lot of talk about some sort of “shortage of gold” during the 1920s, which is pretty odd since, if anything, high commodity prices imply a lowish value of gold, which is hardly indicative of a “shortage.” (They argue that the highish prices were actually the cause of the shortage.) In any case, central banks continued their accumulation of bullion reserves for another two decades to far higher levels, with the result that in 1950, after a hundred years of accumulation, and with central bank gold reserves at their peak as a percentage of aboveground reserves, commodity prices were again high, and again indicative that none of this accumulation resulted in any rise in gold’s value.

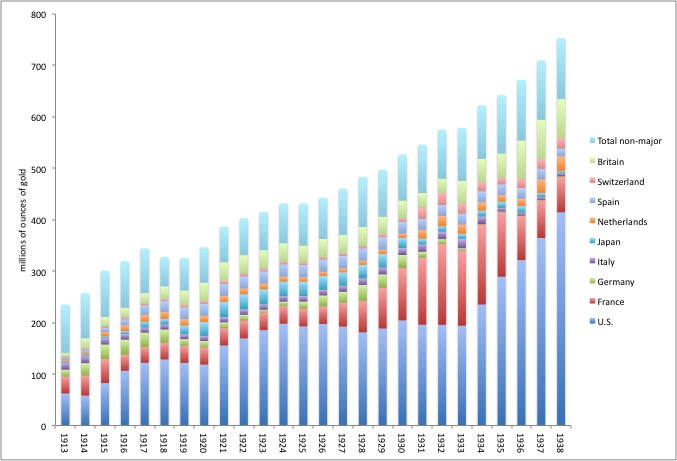

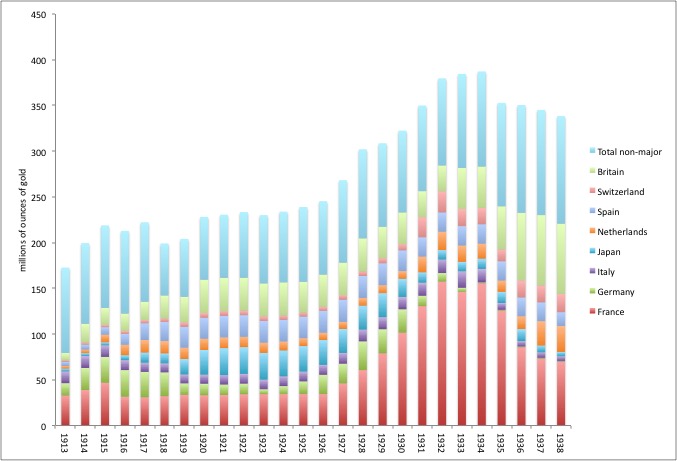

There seems to be the notion that Europe’s central banks disgorged some huge amount of gold during World War I, and then tried to get it all back again during the 1920s. This is not true. Europe’s central banks didn’t change their holdings of gold much at all between 1913 and 1927. Central banks as a whole steadily accumulated gold during the war, and steadily accumulated more afterwards, at a rather calm and sedate pace just as they had done for decades previous, and would do for decades afterwards.

The dip in 1918 in the “non-major” category is due entirely to Russia, which, in my time series, has gold reserves go to zero after the Communist Revolution in 1917. Since Russia actually was one of the world’s largest holders of gold reserves, this was a big deal. What actually happened to that gold is a different question.

If you like, this is how it looks ex-U.S.:

The total increase in central bank gold reserves between 1913 and the end of 1930, of 9,074 metric tons, was a little less than mining production (10,138 tons) during that time period. However, much of the increase came from a migration of gold coins in circulation into central banks vaults. Estimated gold coinage in circulation worldwide fell by 3,715 tons between 1910 and 1930. Between 1930 and 1950, central banks added another 18,523 tons to their reserve holdings, compared to mine production of 18,755 tons during that time period. The result was that, as noted before, in 1950 commodity prices were again unusually high vs. gold, indicating that this accumulation did not raise gold’s value in any significant way.

These charts show central bank reserves. But, there are also private holdings of gold, including coinage. Did these flow out of European belligerents? You might reasonably expect the opposite — that demand for bullion would increase when currencies are being devalued in the midst of wartime. Or, movements of gold would be banned altogether, which was the case during the wartime “gold embargo” in the U.S.

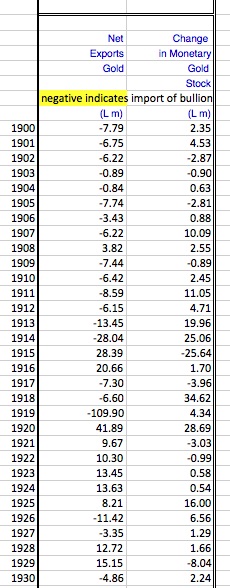

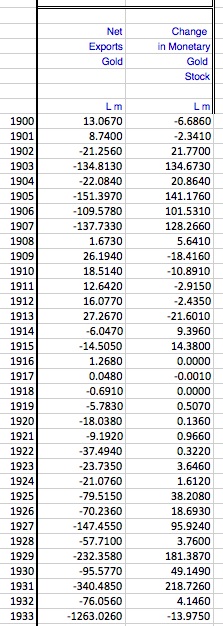

Here’s Britain. The first column is net exports of gold. A negative value indicates an import. The second column is the change in monetary gold, including coinage. The units are millions of British pounds.

The source is the “Jones-Obstfeld database”, “Savings, Investment and Gold in 13 Countries,” available at NBER.org.

http://www.nber.org/databases/jones-obstfeld/

As we see here, there was little net movement of gold during World War I. There is an inflow (“negative export” of 28 million) in 1914, matched by an equivalent outflow (28 million) in 1915, and then more inflows in 1917 and 1918. Apart from a large inflow in 1919, not much else happened through the 1920s, which were generally characterized by outflows.

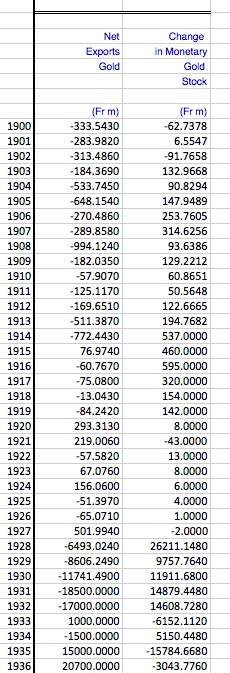

France. Units are millions of francs.

Here we have a large inflow in 1914, then further inflows throughout the war years. The 1920s are a mixed bag until large inflows in 1928, related to increasing reserves a the Bank of France as we’ve looked at earlier. Remember that the value of the franc after 1926 was only one-fifth of its value vs. gold pre-1914, about 400 francs per oz. of gold.

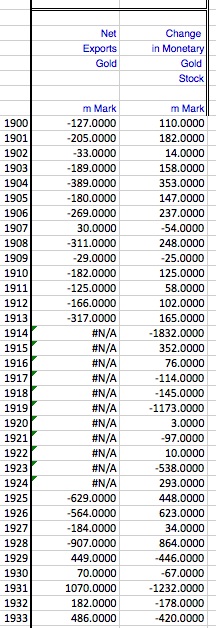

Germany. Millions of marks.

Unfortunately, no data on exports and imports here during the years of war and hyperinflation. Exports of gold in 1929-1933.

Italy. Units are millions of lira.

Not much going on during the war years, after a modest inflow in 1915. The value of the lira vs gold was much lower after 1925 than before the war, like France about one-fifth of its prewar value. The lira was repegged to gold in 1927, also around 400 lira per oz. of gold.

I think the trend is clear: not a whole lot of gold was coming out of Europe during World War I. Not a lot was going in during the 1920s, until perhaps the French purchases in 1929, which we’ve looked at in detail. On balance, I would say the picture here is similar to that for central bank reserves alone. Keep that in mind when reading about some “Thornton effect.”

I think I will attempt to draw a line under all this now, since much of it after 1925 rehashes what we said earlier about Cassel.

September 25, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s 3: Supply and Demand

September 18, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s 2: Never Happened Before

September 11, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s

Much of Mundell’s arguments amount to the fallacious assumption that the “purchasing power of gold” (commodity prices) is the same as its “value” — or, in other words, that a commodity price basket is a perfect indicator of value. This then proceeds to the assumption that the commodity price decline of 1929-1932 was also due entirely to some kind of change in the value of gold. We don’t see much supporting data for this hypothesis, mostly some unquantified hand-waving in the general direction of “demand from central banks.”

The “Global Adjustment System” in the title of Mundell’s paper refers to the mechanism by which the monetary base changes. In this case, we are basically talking about monopoly central banks. Mundell makes many of the same errors common during the Bretton Woods era — the notion that currency management, in a fixed-value system, is somehow related to trade. It is not. This is easy to see if you simply consider any two aggregates sharing the same currency, like New Jersey and Pennsylvania, or France and Germany while they use the euro, or Mr. Smith and Mr. Jones. You could compile “balance of payments” statistics for these jurisdictions, and they would have all the characteristics of similar statistics on the national level. But, obviously, none of that would have anything to do with the money.

The “adjustment system” for a fixed-value system is simple. It is this:

When the currency value is above its parity, base money supply is increased.

When the currency value is below its parity, the base money supply is reduced.

Currency boards do this today. I have a much more detailed description of this in Gold: the Monetary Polaris.

Or, as Giulio Gallarotti put it in The Anatomy of an International Monetary Regime: The Classical Gold Standard, 1880-1914 (1995):

The practice of gold monometallism is partly what has been known in monetary economics as a rule for regulating domestic money supplies. … Under a gold standard, authorities maintain a stable value of the currency … by defending the value of gold vis-à-vis the currency itself. When gold goes to a premium vis-à-vis notes (rises above the par value), it means the money supply is too large … and therefore must be held in check. When the value of gold drops below par, it means that the money supply needs to be increased. (p. 22)

The “adjustment system” for a floating fiat currency is also simple. It is this:

Whatever the currency managers want.

Sometimes, you can have a notionally “fixed value” system, with some discretion over the monetary base. This can only be maintained with capital controls, and even then has a tendency to blow up. For those intrepid few who actually read all of Mundell’s 1989 paper, or perhaps his book Monetary Theory (1971), it would be good to keep this in mind.

As we’ve seen so far, the claim that gold’s value changed in some catastrophic way in the 1929-1933 period, that it failed to serve as the “monetary polaris” as it had done for centuries previous, is not a common one. It is not part of the four other major “monetary interpretations” of the Great Depression, the Austrian, Monetarist, “gold-exchange standard” or Blame France (mostly) arguments. It is not part of the Keynesian argument, which did not claim a monetary “cause”. The arguments here, the “Mundell-Johnson hypothesis”, are for the most part contained in our previous discussion about Cassel, with a bit of creative “Thorton effect” arguments around WWI, which seem like fantasy to me.

October 2, 2016: The Interwar Period, 1914-1944

So, I conclude again that gold did not undergo some kind of significant change in value, with world-economy-destroying consequences, beginning around 1929. Gold served as the Monetary Polaris, a stable measure of value, at least stable enough not to cause any major problems, just as it had not caused any major problems in the previous five centuries either.

From this, we can again conclude that the onset of the Great Depression was due entirely to nonmonetary factors — specifically, the tariff war begun by the Smoot-Hawley Tariff in the U.S., followed by a tax-hiking “austerity” response worldwide, and the other many factors we’ve talked about. Actually, this is similar to the Keynesian interpretation common before 1960, and still common today (see Eichengreen), adding an explanation why there was a “falloff in aggregate demand” (i.e., a recession) beginning at that time.

Again, we find that it is the “small government free market” economist, the supposedly gold-standard-friendly economist, that feels impelled to invent a monetary explanation for the Great Depression. Again, we find that the contortions necessary to do this make a mess of their monetary understanding, in this case leading Mundell to recommend devaluations all over the place, and claiming “price stability” while also calling for a devaluation of the dollar from $35/oz. to $70/oz. during the 1960s. He mentions tariffs and domestic tax hikes as factors in the Great Depression (in his 1999 speech, but not in his 1989 paper), but does he then suggest that the U.S. government … maybe … should not have done that? Or, if the mistake was already made, that it should have undone that? Did the “creator of supply side economics” suggest … perhaps … a tax cut? Nope. Mundell recommends a currency devaluation. Not even a tax cut-and-a-currency devaluation. If only we had devalued the currency (earlier), we could have avoided World War II! But, Jacques Rueff and also, apparently, Ludwig von Mises also called for a devaluation from $35/oz. to $70/oz. in the 1960s, so it wasn’t just Mundell.

It was Mundell that provided the first impulse in the “supply side revolution” of the 1970s, which finally brought nonmonetary factors back into economic thought after being scrubbed in the 1870s. (Brian Domitrovic gives a good account of this in Econoclasts.) It was pretty good for the time, certainly compared to what the Samuelsons and Tobins were preaching in those days.

Things have moved beyond that now — far, far beyond. But, it was only a tiny number of people, the “supply side inner circle,” that understood this.