The Bank of England, 1914-1941

July 20, 2014

Today we are looking at the balance sheet of the Bank of England, 1914-1941. The source of the data is the Federal Reserve’s Banking and Monetary Statistics, 1914-1941, available here:

http://fraser.stlouisfed.org/publication/?pid=38

This follows our investigation of the Federal Reserve during the same time period.

January 19, 2014: The Federal Reserve in the 1930s

January 26, 2014: The Federal Reserve in the 1930s #2: Interest Rates

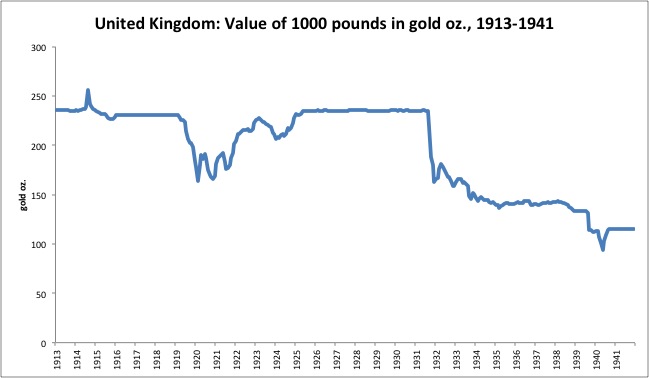

The history of the British pound during this period looks like this:

The pound was floated at the onset of World War I. It sank in value somewhat during that time — probably more than is indicated by this chart, as it is based on exchange rates with the US dollar and there were a lot of gold and capital controls during the wartime period. After the war, the value of the pound was raised back to its prewar gold parity. Britain returned to a gold standard system in 1925. In September 1931, the pound was devalued. Afterwards, it remained a floating currency, although there was some attempts to keep it from floating very far.

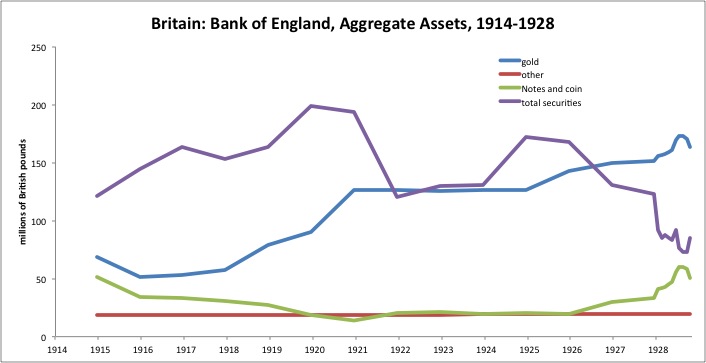

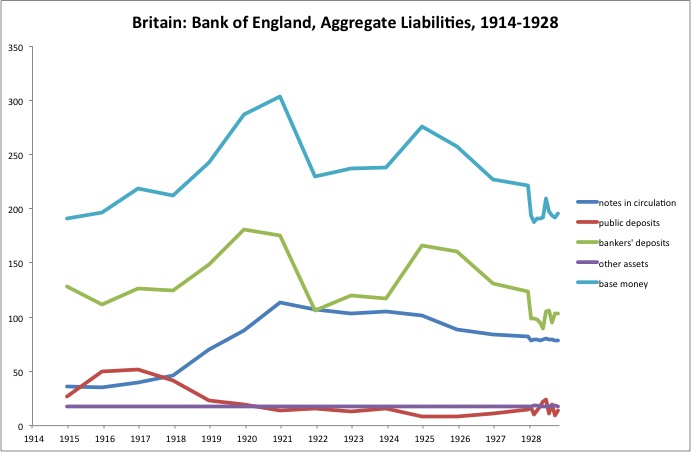

Total base money rises quite a bit during the war. In 1921, there is a major contraction, mirroring what was happening at the Federal Reserve at the same time. Although there were some “public deposits,” which could include government deposits, most of the deposits were deposits of banks (“bank reserves”), showing that the deposits of the BoE were acting as a final payment method, much the same as is the case in central banks today.

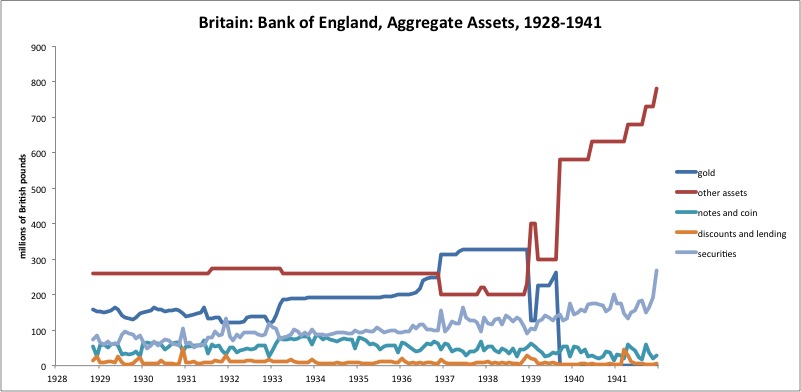

After November 1928, the data series changes. “Other Assets” of the Issue Department increase by a large amount, and are mostly unchanged over long periods. The notes to the data say that this represents “securities and silver coin held as cover for fiduciary issue [banknotes], the amount of which is also shown by these figures. The Currency and Bank Notes Act, 1928, fixed this issue at £260,000,000, and it has subsequently been altered by direction of the British Treasury under the terms of this Act and in accordance with the Currency and Bank Notes Act, 1939.” I don’t know what this means, and it probably isn’t that important for our purposes here.

More notes from the data indicate: “On January 6, 1939, £200,000,000 of gold (at legal parity) transferred from the Bank of Exchange Equalization Account of March 1, 1939, about £5,500,000 (at current price) transferred from Exchange Account to Bank; on July 12, 1939, £20,000,000 of gold transferred from Exchange Account to Bank; on September 6, 1939, £279,000,000 transferred from Bank to Exchange Account.” By the end of the 1930s, especially as WWII was beginning, capital and exchange controls were heavy.

“Effective March 1, 1939, gold valued at current prices instead of legal parity.”

“Fiduciary issue increased by £50,000,000 on June 12, 1940, and April 30, August 30, and December 3, 1941.”

Banknotes in circulation makes a big jump upward with the new data series, from £78.3m in October 1928 to £367m in November 1928. Eh? The notes say that:

“Notes issued less amounts held in banking department and–from 1919 through October 1928–amounts held in currency note account.”

That is a rather large discrepancy, but it actually doesn’t matter too much, since the BoE was on a gold standard system at the time. We are really interested in the transition to the Great Depression in the 1929-1935 period.

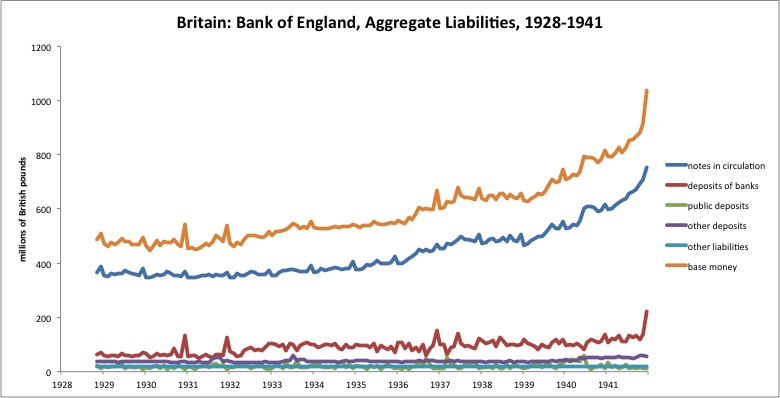

The most interesting portion is total base money, 1928-1941 — the orange line. This is composed of notes in circulation (blue), and the various forms of deposits (banks, public and other). I suspect that “public” is mostly the British government, and “other” might be the holdings of foreign governments and central banks.

Total base money is quite stable during this time. It did not grow very much before or during the devaluation of 1931; nor was there any contraction of meaningful size. The little spikes are related to year-end seasonality. By the onset of WWII in 1939, things are transferring very much to wartime mode, with heavy capital and exchange controls — although capital and exchange controls had already become common worldwide due to economic difficulties during the 1930s.