We’ve been looking at the idea that there was some kind of giant rise — in excess of 100%, which is to say, a doubling or more of gold’s real value — around the 1929-1933 period.

September 11, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s

I’ve been saying that there is no evidence of any such rise in the previous 500 years of history. After all, if gold did do things like that, causing Great Depressions along the way, it would not make a very good basis of monetary systems. The fact that gold continued to be used as a monetary basis, beating all contenders including silver, suggests that such things simply did not happen.

Let’s look at some data.

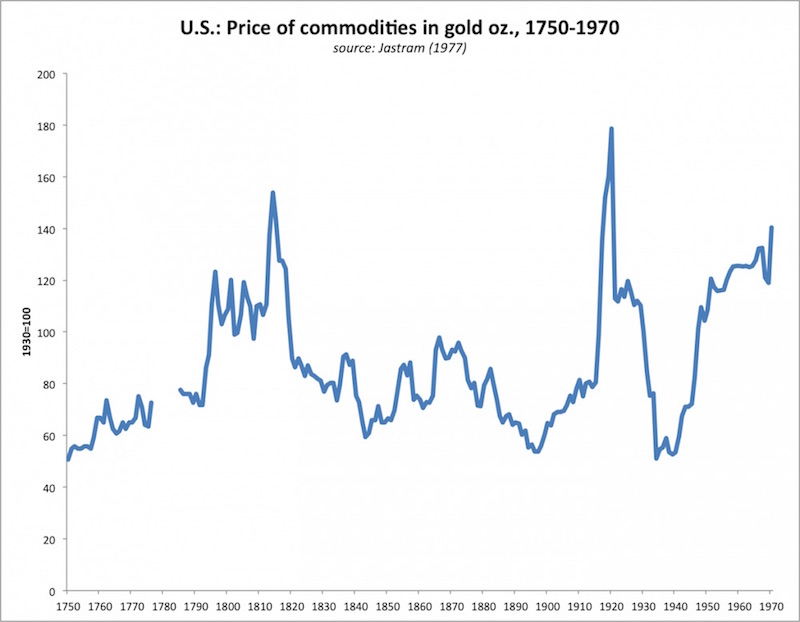

This is a chart of commodity prices compared to gold, from 1750 to 1970. As we can see, the dramatic drop of commodity prices in 1929-1933, unrelated to war, was unprecedented during this time period. The drop around 1816-1819 was related to the War of 1812, in which there was also some devaluation of the U.S. dollar. This was remedied in 1819. There was also, during this time, the Napoleonic Wars, which created a great demand for commodities from the U.S. (much like World War I), and which ended of course with Waterloo in 1815. So, that was another wartime episode, rather a lot like the spike related to World War I. Then there is the slow decline of prices, over a twenty year period, into the mid-1890s. I’ve talked about this several times, concluding that it was mostly, and perhaps entirely, a matter of a commodity supply glut rather than a case of gold rising in value.

Another thing we see here is that commodity prices after WWII are again at the higher end of their historical range. This implies, if anything, a lowish value of gold. Thus, if there was a 100%+ rise in gold’s value in 1929-1933, then there must have also been a corresponding fall in value sometime afterwards, to return gold’s value to something more like its 1920s level. In other words, we would have a decline in the value of gold by a similar giant, sudden, unprecedented amount, some (unidentified) time between 1933 and 1950.

November 21, 2015: Let’s Resolve the Gold Standard “Deflation” Fallacy

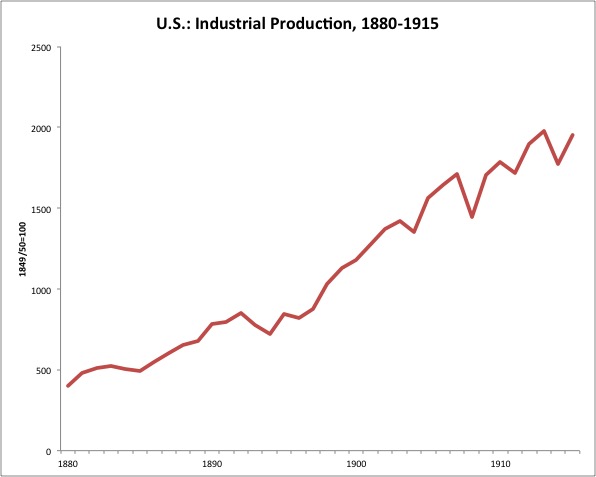

Despite the decline in commodity prices in 1880-1896, or perhaps enabled by it, U.S. industrial production rose dramatically during the time period — one of the most prosperous times, by this metric, up to the present day. Economists who compare this time to the Great Depression should probably be laughed at. If there was any rise in gold’s value during this time, it was modest enough that it didn’t impair the splendid prosperity of the time period — the “Gilded Age” as Mark Twain called it.

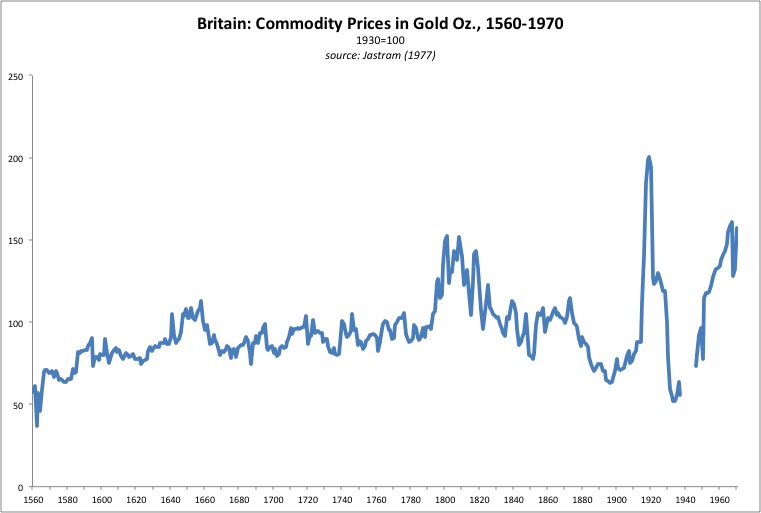

Now, let’s go farther back by looking at commodity prices in Britain compared to gold.

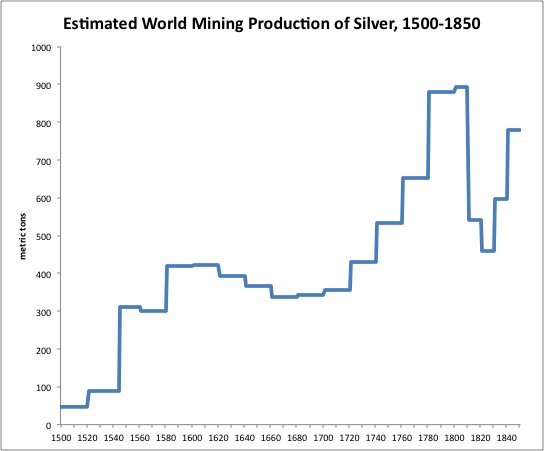

Again, we have a wartime rise in prices related to the Napoleonic Wars, and of course the spike related to WWI. Outside of those two events, however, the record is very stable. There was something of a rise from 1560-1600 or so. This is the time of the Spanish conquest of the New World. However, after the initial looting, almost all of the new mine production was silver, not gold. From 1550-1650, estimated world production of silver rose tenfold, while production of gold rose only 50%. The looting began around 1523 and was pretty much over by 1550, so any effect of that gold flow on commodity prices should have been over not too long afterwards. Instead, during the time of the looting, we find that commodity prices vs. gold in Britain hardly changed at all. The story that “a huge inflow of gold from the New World caused a giant rise in commodity prices” is basically fiction. What was happening, however, is that Henry VIII was devaluing the British pound, naturally causing rising prices in terms of the devalued pound. The pound was reduced to about a third its previous silver content, implying a threefold rise in nominal prices. Henry’s reign was 1509-1547, coinciding with the time of looting of the Inca and Aztec gold by the Spanish.

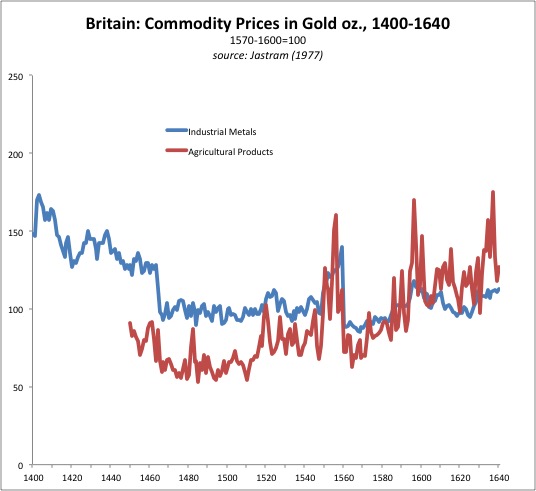

Here’s another dataset, going back to 1400 in Britain:

This commodity dataset is divided into metals and agricultural products. There’s a rise in agricultural product prices, roughly doubling over 100 years, 1500-1600. However, most of this rise comes after 1570, which was about 30 years after the Spanish gold looting period. We also see that metals prices were very flat, which suggests that price rises in agricultural products here were perhaps not related to changes in the value of gold, but rather had something to do with supply/demand for farm products.

All in all, it is a very impressive record of stability of value for gold, at least as far as can be expressed by the record of commodity prices, for a five-hundred year period before 1940. I think you can agree that there is no evidence here of any sudden 100%+ increase in gold’s value happening over perhaps four years — the claim made by the “giant rise in gold’s value” people for the 1929-1933 period. So, if that did happen, it was totally unprecedented.

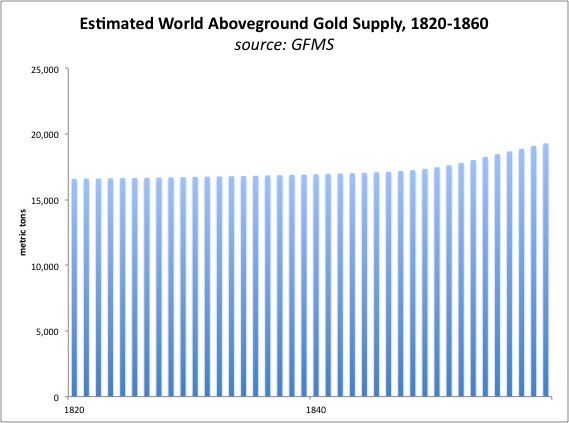

Now, if there was some kind of explosive increase in gold’s value beginning in 1929, you would expect it to be caused by some kind of first-time-in-five-hundred-years imbalance between supply and demand. Gold’s supply doesn’t change very much, because it is not consumed. Thus, the “aboveground supply” is essentially the aggregate of centuries of gold production. Annual mining production is only a small percentage of this, around 2%. So, if you start with 100 units of gold and have production of 2 units, you end with 102 units. If production falls by 50%, to 1 unit, then you start with 100 and end with 101. And if gold production doubles to 4 units, you start at 100 and end at 104. As you can see, it is very difficult to meaningfully alter the “supply” of gold with any kind of change in mining supply. This is often cited as a reason for gold’s natural stability of value — the quality that makes it an excellent basis for monetary systems.

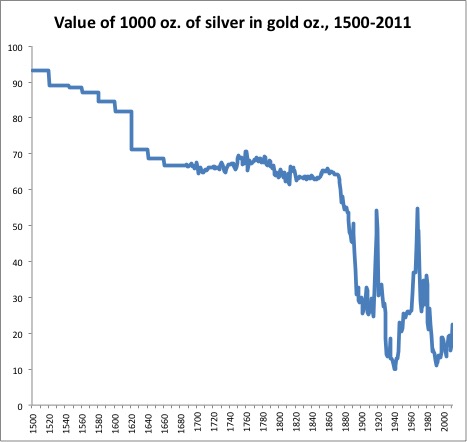

Much the same was true of silver. Before 1870, silver was also mostly accumulated in the form of coinage, bullion and housewares. The giant silver mining boom of the 16th century did indeed depress the value of silver vs. gold, but not by very much.

As we can see here, the giant tenfold increase in silver production 1550-1650 led to a decline in the value of silver vs. gold, from about 11:1 to about 16:1, over a period of two hundred years, 1500-1700. In practical terms, you would have hardly noticed this slow evolution in any given year, or even in a decade, or maybe even in a lifetime. Your grandfather would be telling stories of “when I was a child, it took twelve ounces of silver to buy an ounce of gold, not fourteen!” and nobody would care of course.

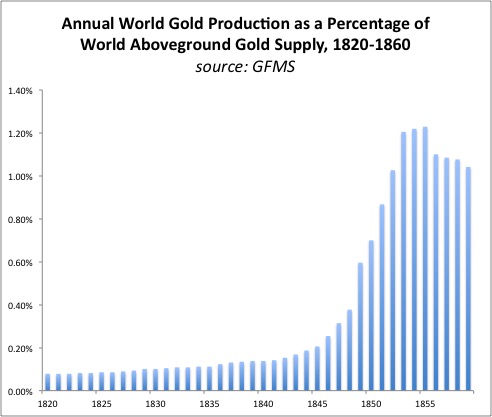

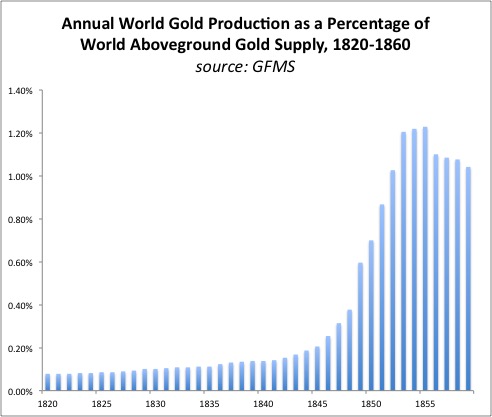

A similar tenfold increase in world gold mining production occurred in 1840-1860. We looked at that here:

January 24, 2016: The Gold Mining Boom of the 1850s

And yet, even that elevated rate of production was still just a small percentage of the aboveground gold accumulated over the previous 5000 years of gold mining history. (The GFMS estimates of aboveground gold used here are higher than some other estimates.)

Here is GFMS’s estimate of aboveground gold during the time period.

From that, it would perhaps not be too surprising that there was no particular evidence of a decline in gold’s value, resulting from the increase in mine supply.

The conclusion here is: if there was some kind of gigantic supply/demand imbalance in 1929-1933, then it is pretty hard to get there from the supply side. Even these colossal changes in mining production — a tenfold increase! — in either silver or gold didn’t really move the needle much. If a tenfold increase in production didn’t move the needle much, it is logical to presume that perhaps a tenfold (i.e., 90%) decrease wouldn’t do much either. There never has been a 90% decrease, so we don’t know. But, there have been a few 10% or 20% decreases, which we might reasonably expect to have no real effect at all.

I think that is enough for today. We will continue with this theme for a while longer.