The Gold Standard in Britain 1778-1844

January 23, 2010

We’re continuing our series of investigations on what a gold standard looked like, in real life, during the 1700-1971 period.

January 16, 2011: The Composition of U.S. Currency

January 9, 2011: The “Money Supply” With a Gold Standard 2: 1880-1970

January 2, 2011: The “Money Supply” With a Gold Standard

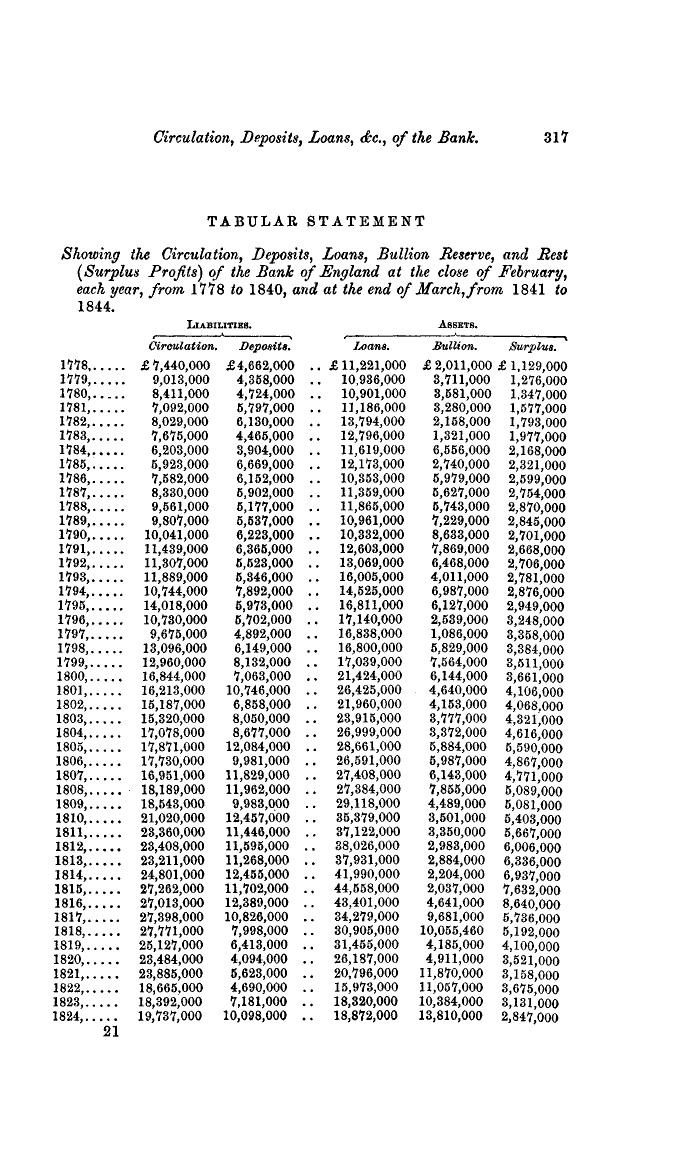

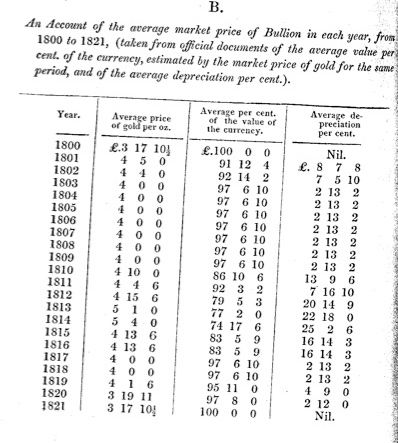

I went off to the library to find info on the Bank of England, which maintained a gold standard from 1698 to 1914 at a single parity (with a big lapse in 1797-1821). Unfortunately, thus far I was only able to find info for the years 1778-1844. Here it is:

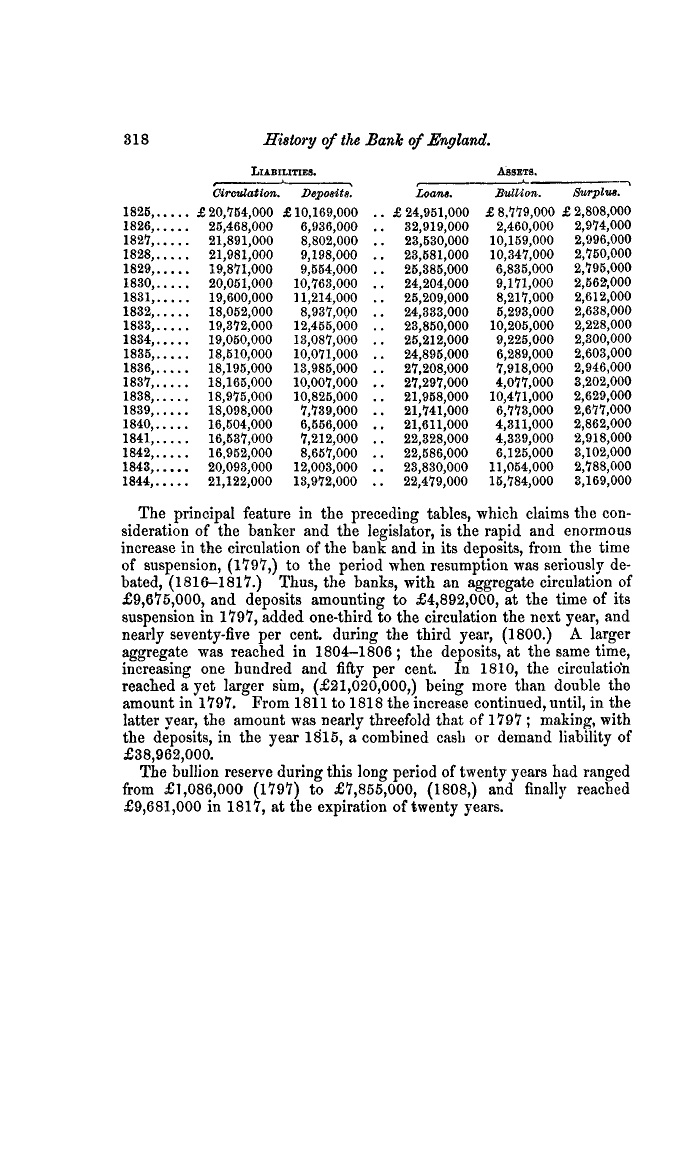

Here’s what it looks like. Unlike the U.S. example, where there were literally thousands of banks issuing banknotes, in Britain the Bank of England had a monopoly on banknote issuance. So, this represents the entire paper currency circulation. Once again, you can see a few things here:

1) There was never any “100% reserve.” The “reserve ratio” (bullion to banknotes ratio) varies wildly during this time.

2) Banknotes outstanding did not follow any “2% per year” curve related to gold mining, etc.

3) I don’t have info on imports and exports of gold here, or “current accounts” data, but if I did you would see that there is no relation there either.

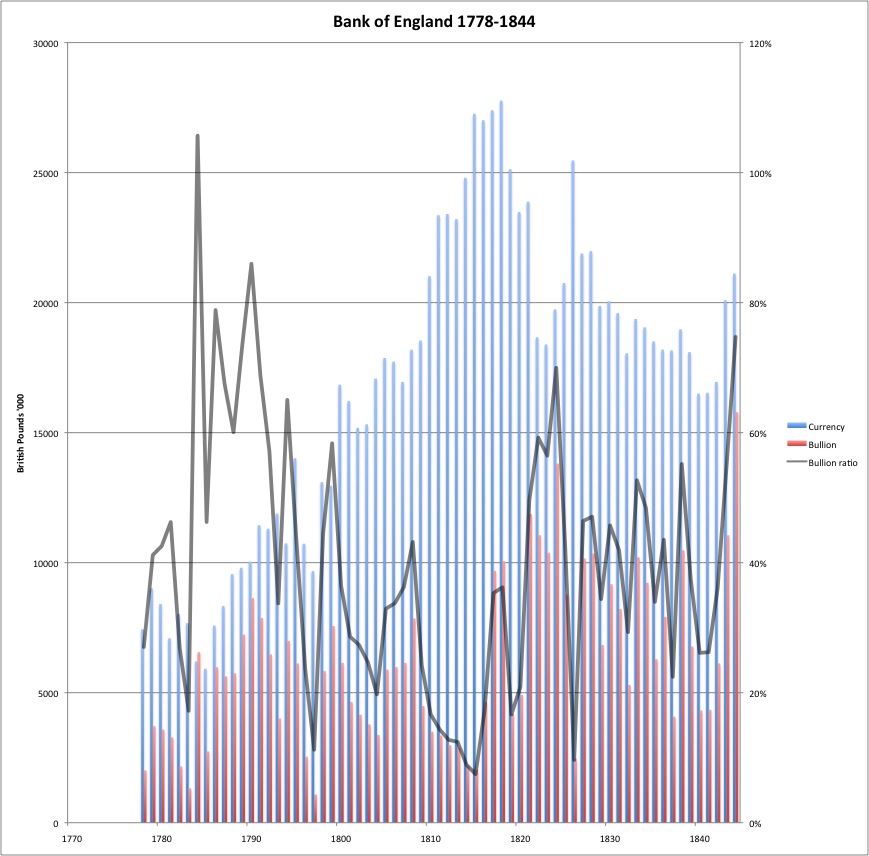

Here’s a description of the floating of the pound in the years 1797-1821, showing the price of gold in pounds, and the implied devaluation of the currency in percent. (Yes, this is exactly how people thought of it in those days. Which is exactly the same way as I think of it today.)

April 15, 2007: The Value of Today’s Dollars in 1854 Dollars

As you can imagine, there was a lot of discussion about how to put the pound back on the gold standard. David Ricardo, a retired financial speculator, began to write about this topic. He was later regarded as one of the greatest economists of the 19th century. Here is his first 1807 pamphlet, The High Price of Bullion, Proof of the Depreciation of Banknotes.

The High Price of Bullion, Proof of the Depreciation of Banknotes

Particularly after Napoleon’s defeat at Waterloo in 1815, which ended the Napoleonic Wars, an effort was made to return the pound back to its prewar parity at £3 17s 10.5d. (That’s three pounds, seventeen shillings, 10.5 pence. There were twenty shillings to a pound, and twelve pence to a shilling.)

You can see a few results of this decision. After a rather brisk expansion in banknotes outstanding, beginning in 1815, the amount becomes stable around £27 million. Then, it starts a decline to £18 million in 1822. This of course was the mechanism by which the pound’s value was raised back to its prewar parity. During this period, the gold bullion holdings are all over the map, from £2 million in 1815 to £10 million in 1818, back down to £4 million in 1819, up to almost £12 million in 1821, and down to £2.5 million in 1826. Do you see what I mean when I say that the amount of gold held is actually irrelevant? It’s the banknotes outstanding, in relation to the demand for banknotes, that determines the value of the banknote.

Here’s David Ricardo on the topic:

It is on this principle that paper money circulates: the whole charge for paper money may be considered as seignorage. Though it has no intrinsic value, yet, by limiting its quantity, its value in exchange is as great as an equal denomination of [gold] coin, or of bullion in that coin …

It will be seen that it is not necessary that paper money should be payable in specie to secure its value; it is only necessary that its quantity should be regulated according to the value of the metal which is declared to be the standard.

Principles of Political Economy and Taxation, 1821

November 23, 2008: Redeemability and Reserves

The same trick works today:

November 24, 2008: Russia’s Currency Crisis

November 16, 2008: How To Stabilize the Ruble

January 3, 2010: The GLD Standard

August 26, 2007: How To Operate a Gold Standard

August 19, 2007: Gold Standard Fallacies

July 25, 2010: The Argument for a Gold Standard (2010 edition)

November 6, 2009: A Brief History of the Dollar