As part of our continuing investigations into the Interwar Period, we’ve been looking at a funny episode in 1937.

June 18, 2017: The “Gold Sterilization” of 1937

October 2, 2017: The Interwar Period, 1914-1944

I think it has been productive to spend all this time on the 1930s. I feel like we are airing out a lot of past confusion and trauma. Of course, many people may not agree with my interpretations and conclusions. But, along the way, they might get the data and materials to come to their own conclusion, and in that way reach some kind of resolution.

Again, we will look at things now from a more historical perspective, using our usual resources, Milton Friedman’s Monetary History of the United States, 1867-1960 (1963), and Allan Meltzer’s A History of the Federal Reserve, Volume I: 1913-1951 (2003).

Also, you might want to review our earlier discussion about “sterilization,” a term that is used to refer to several, very different situations, which is confusing.

August 28, 2016: What Is “Sterilization”?

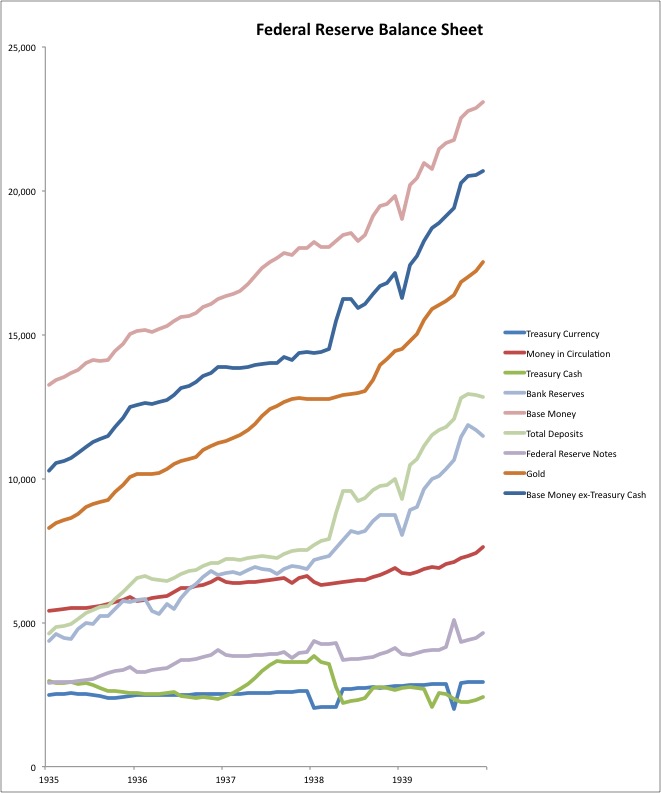

But first, let’s take a more detailed look at what was happening during that time:

“Base money” is the top line in pink. I also added another series, “base money ex-Treasury Cash,” below that in blue. “Treasury Cash” is a funny item. This is the definition given in the source of these statistics, the Banking and Monetary Statistics (p. 364):

Treasury cash and deposits with Federal Reserve Banks. These items represent the funds which the Treasury has at its disposal without drawing on its balances with depositary banks. When the Treasury builds up its cash or its deposit balances with the Reserve Banks by obtaining funds through taxes or borrowing from the public or the banks, bank reserves are reduced; when the Treasury spends these funds, reserve balances are increased. Fluctuations in Treasury cash and deposits with Reserve Banks have recently occurred primarily as a result of irregular Treasury receipts accompanying more regular and gradual variations in expenditures, this difference being partially reflected in sharply changing Treasury deposit balances at the Reserve Banks. Treasury cash includes gold bullion, silver and minor coin, and currency held in the Treasury, except (a) gold held against gold certificates, (b) silver held against silver certificates and Treasury notes of 1890, and (c) prior to January 31, 1934, gold held for Federal Reserve Banks, The various components are shown in Table E, page 367.

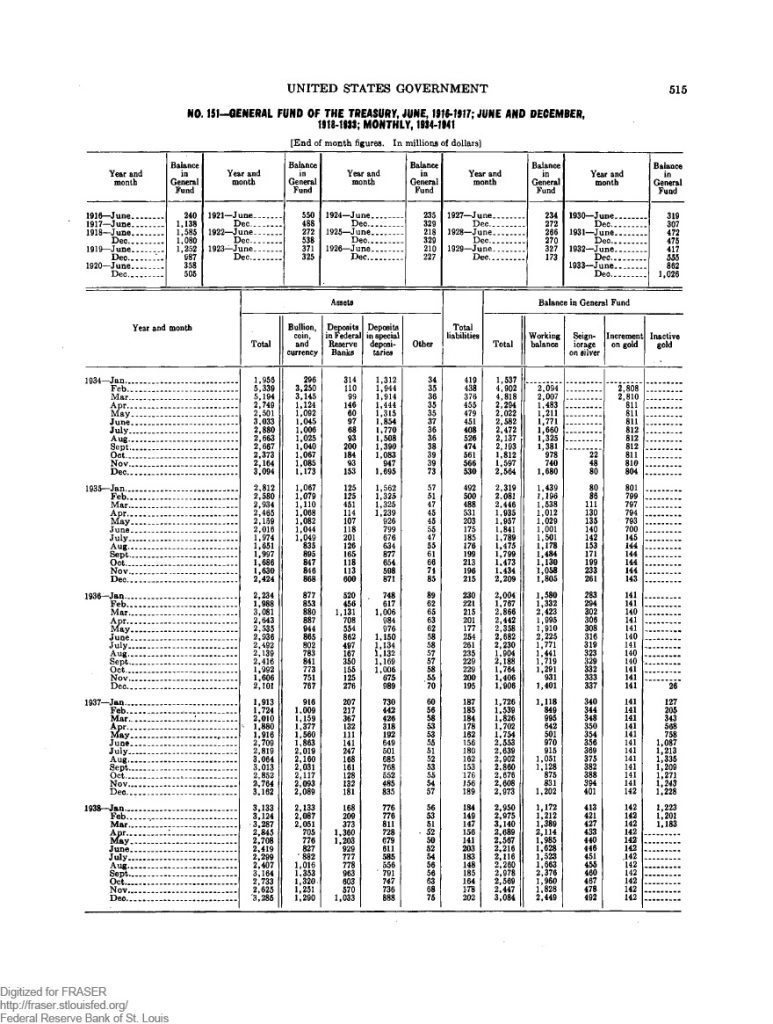

The item of Treasury cash was increased by 2.3 billion dollars after the close of business on January 31, 1934, as a result of reduction in the gold content of the dollar. (footnote 7) Since the value of the gold stock was correspondingly increased at the same time, this transaction in and of itself had no effect on the amount of member bank reserve balances. (footnote 8) From December 24, 1936, until early in 1938 the Treasury followed the policy of setting aside gold acquired in an inactive account and of not issuing gold certificates against such gold. This inactive gold was counted as a part of Treasury cash, which increased as gold stock increased, with the result that gold acquisitions had no effect on bank reserves. Monthly figures of the amount of gold in the inactive account appear in Table 151, page 515.

Treasury deposits with Federal Reserve Banks represent the general account of the United States Treasurer with the Reserve Banks. The account maintained by the Treasury at the Federal Reserve Banks for the Stabilization Fund is included in nonmember deposits. Treasury deposits may fluctuate widely in a short period of time but, in general, this item is maintained within rather restricted limits and does not exert a long-continued influence on bank reserves in any one direction. Treasury currency, Treasury cash and deposits, gold stock, and money in circulation are interrelated in such a manner that important changes often take place among these items without affecting member bank reserves in any way. For example, the Treasury may hold gold or silver in Treasury cash; or it may issue certificates against them and deposit the certificates with the Reserve Banks, thus decreasing Treasury cash and increasing Treasury deposits at the Reserve Batiks. Member bank reserves are not affected until the Treasury draws upon these deposits. On balance, issuance of gold and silver certificates results eventually in an increase in bank reserves, while their retirement results in a decrease in reserves, although at various stages in the process reserves may not be affected.

(footnote 7):By proclamation of the President, dated January 311, 1934, the weight of the gold dollar was reduced from 25 8/10 grains to 15 5/21 grains, nine-tenths tine. Between January 31, 1934, and February 1, 1934, the gold stock increased 2,985 million dollars, of which 2,806 million dollars was the increment resulting fro/n the reduction in the weight of the gold dollar and the remainder was gold which had been purchased by the Treasury previously but not added to the gold stock. The increment was covered into the Treasury as a miscellaneous receipt and appeared, together with the new gold, as a General Fund asset.

(footnote 8): The increment arising from United States gold coin turned in by the public after January 31, 1934, was also added to both Treasury cash and to gold stock at the time of receipt. The increment from this source amounted to about $11,000,000 from February I, 1934, to December 31, 1937; $500,000 in 1938; $350,000 in 1939; $450,000 in 1940; and $305,000 in 1941.

And here’s Table 151:

It appears that the Treasury was, for some reason, purchasing gold via the gold convertibility mechanism (an open offer to pay $35/oz.), and instead of paying for these purchases with base money, it was instead — Friedman said — purchasing them with funds obtained by bond issuance. This went on for a while, until the Treasury then seemed to return to normalcy in April of 1938. It appears that base money ex-Treasury cash makes an unnatural flatline during this period, suggesting that this process interfered with the automatic adjustment of the monetary base via gold conversion. The Treasury was certainly capable of buying some bullion on the market, financed by debt, just like any other investor, without affecting the process of automatic adjustment via gold convertibility. Thus, we should consider the possibility that the gold convertibility mechanism was not impaired, but that this flatline reflected a normal outcome. But, just judging by the way it looks, I would say that there was indeed some interference in this mechanism. The jump in April 1938 represents a conversion of the Treasury’s bullion into Federal reserve deposits.

The total significance was, in effect, the amount of the “sterilized” gold purchases, which was about $1,200 million. This was about 8% of the $15,000 million of total base money (ex-Treasury cash) at the time.

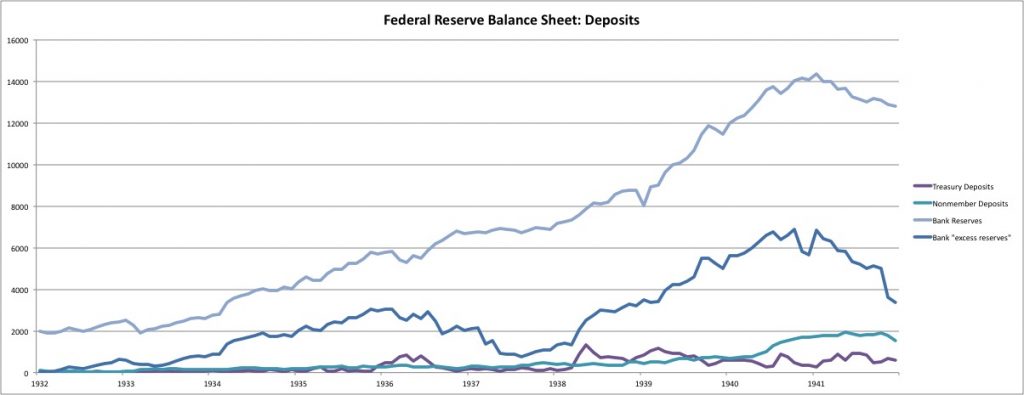

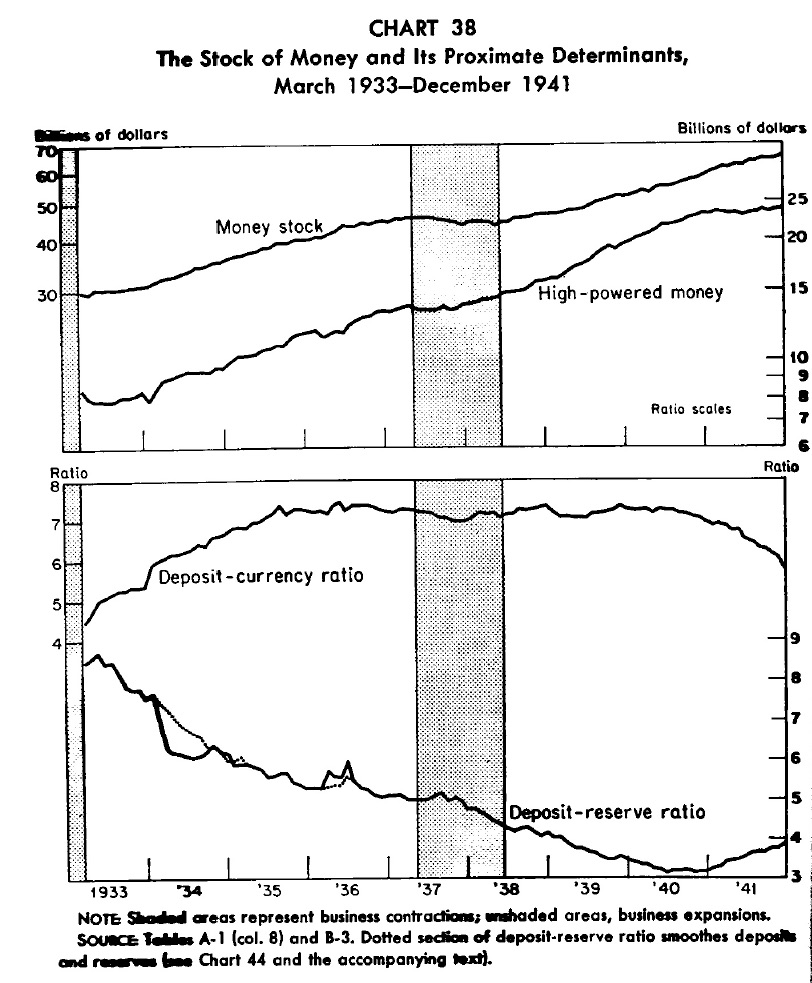

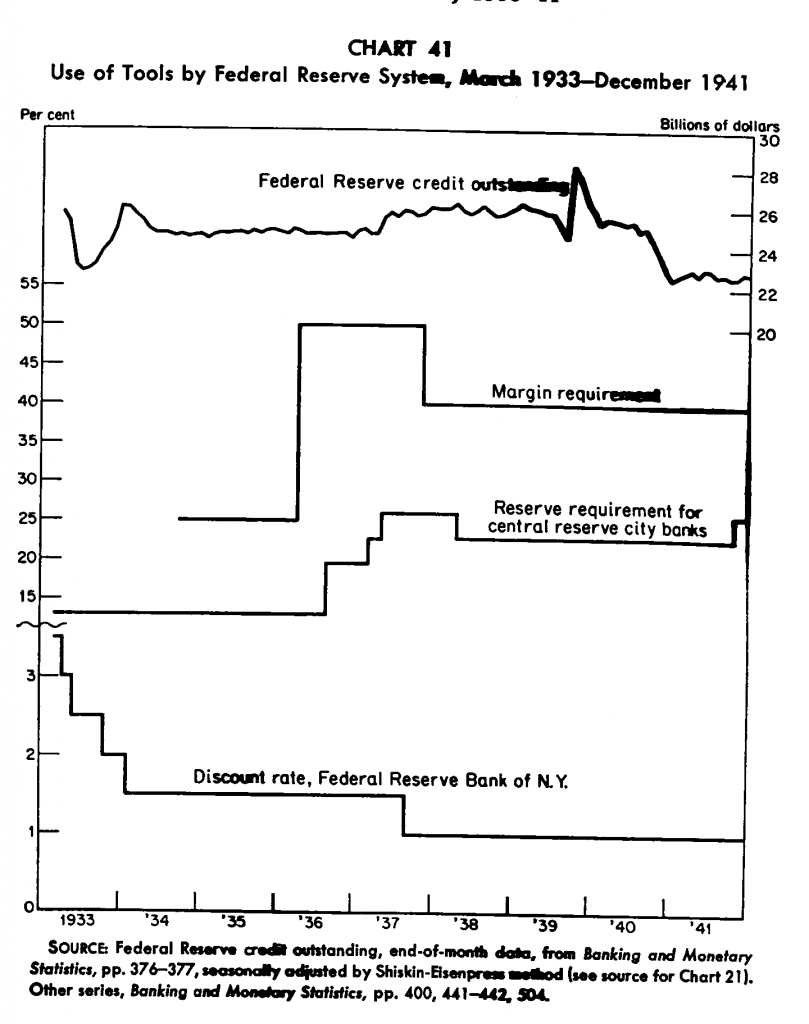

The “sterilization” of gold inflows coincided with an increase in reserve requirements. These were two reactions to a single concern: that the increase in “excess” reserves represented some kind of danger. The Federal Reserve board seemed to think that it represented a latent danger of some kind of unnatural and excessive credit expansion, or “inflation” — a typical Monetarist line of thought. (This is from Meltzer, which has much more discussion on the topic than Friedman. But, there is a potential author bias here: Meltzer, being a Monetarist, would naturally tend to interpret things in a framework he was comfortable with.) It is clear that the Fed’s understanding of the issue was rather poor. The “excess” reserves were, in my view, simply a natural reaction of banks to a risky and unpromising environment. Friedman has a nice chart showing a long-term trend toward holding more reserves vs. deposits. This trend does not seem to have been affected very much by the reserve ratio requirement changes of 1936-37.

Meltzer said: “There is no evidence of a study by the Board or the reserve banks to understand why banks held large excess reserves.” (p. 495).

In practice, if banks did not want to hold such large excess reserves — if, in other words, the demand for Fed deposits (base money) declined — then this would ultimately be met with a sagging dollar value and gold outflows, which would have been simply the reverse of what was happening at the time, which was increasing base money demand for bank reserves, rising dollar value and gold inflows. There was no problem to be solved. The fact that the Fed was getting anxious about this suggests to me that they didn’t know how a gold standard system is supposed to work, and also didn’t know very well how banks work.

Since many of these men actually had a career in banking, I am sure they knew how they worked. However, sometimes people don’t make the connection between the practical day-to-day business of banking and the bigger-picture “macro” sort of viewpoint from the Federal Reserve. Or, they had a tendency to defer to the “economic experts,” who rarely had any experience in banks.

Here is a chart from Friedman regarding reserve requirements:

I regard the gold inflows as the natural consequence of banks’ desire to hold higher reserve levels — the increase in reserves has to come from somewhere, via some mechanism, and since total credit was basically flatlined at this point, the only mechanism left was gold conversion. However, many, including President Roosevelt apparently (not exactly a monetary expert) considered the inflows to be “speculative” and “inflationary.” They did not really understand what they were witnessing.

Meltzer has some nice commentary about nonmonetary factors that contributed to the 1937 recession (p. 521-22). He cites a reduction in soldiers’ bonus payments; the passage of the undistributed profits tax; the introduction of Social Security including the new payroll tax; and an increase in labor costs following a series of strikes in major industries. Roosevelt was seen as becoming more hostile towards business. The undistributed profits tax was repealed in 1938; the economy improved. Meltzer also has some commentary on the French (and franc-bloc) devaluation of September 1936, another source of chaos at the time.

We will leave aside for now the question of whether the changes in reserve requirements had much effect on banks’ behavior, and the economy as a whole. In general, I would say: not much.

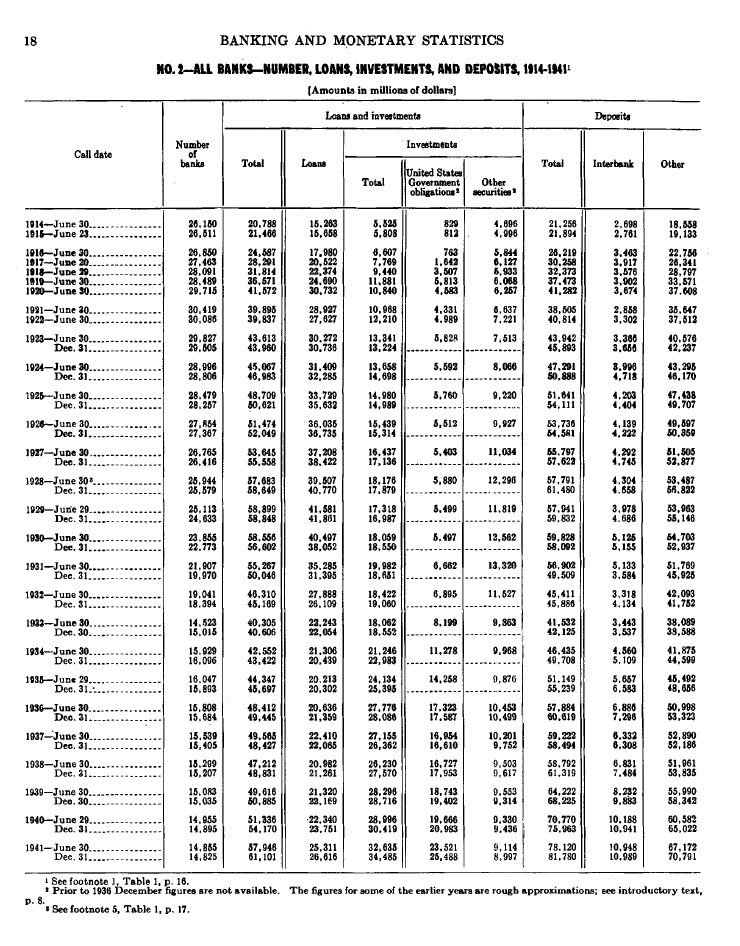

We can see that lending basically flatlined from 1933 to mid-1940, with most of the changes in banks’ balance sheets from acquisition of government bonds. Lending was $20.636B in June 1936 and $22.065B at the end of 1937.

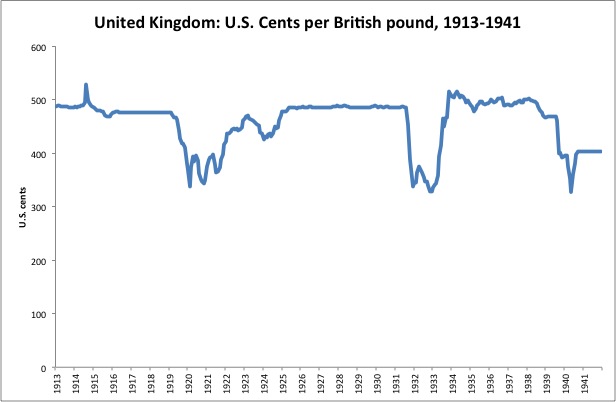

If we are going to get an idea of how much of an effect the Treasury “sterilization” program had, one possible place is in exchange rates between the dollar and the British pound. We might see a rise in the dollar vs. the pound. Unfortunately, we do not have a lot of good comparisons besides the pound. We will ignore the franc-bloc devaluers, since they have their own drama. Most other currencies seemed to have had a link to the pound or dollar during that time period, and thus do not provide any additional insight.

There was a rise in the dollar vs. the pound (decline in the pound vs. the dollar), but this was in 1938, actually after the “sterilization” was ended. There is not much evidence of a rise in the dollar here from late 1936-early 1938.

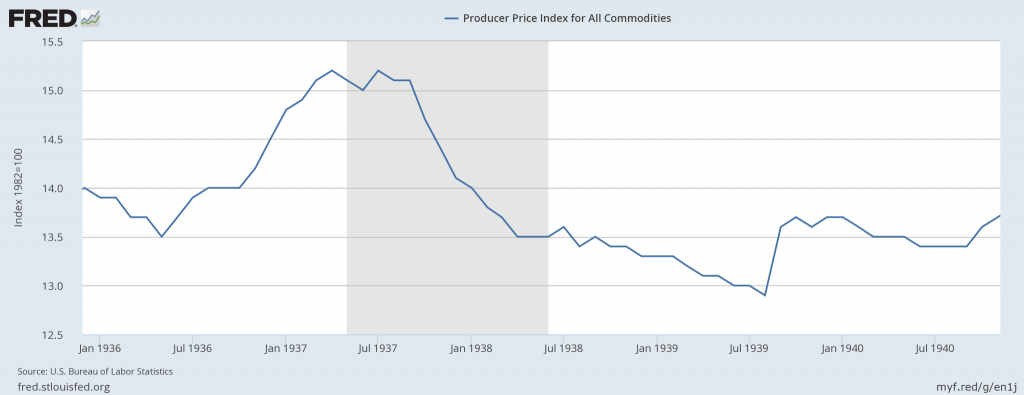

Let’s look at commodity prices during the time:

We see a decline in commodity prices during the recession, which is no surprise. By itself, this does not indicate any change in the value of the dollar. Commodity prices declined by about 10%, from 15.0 to 13.5. However, we also see that commodity prices did not recover afterwards, even after the “gold sterilization” policy was rescinded, and the monetary base was allowed to expand according to the usual operation of the gold standard system, which at this time amounted to the gold convertibility mechanism alone. This tends to suggest that monetary factors (an effective undersupply of dollars/rise in the dollar’s value, and its later correction) were not very important.

On balance, I don’t think the monetary inconsistencies of 1937 amounted to very much. What if they caused an effective rise in the dollar’s value by 5%? That is certainly a major deviation from a $35/oz. fixed parity. But, it is not such a big deal in the bigger picture. I suppose someone would want to try to make a big deal of this, but we have been living our entire lives in an environment of floating fiat currencies, where 5% moves happen all the time. We should be familiar with this, and its consequences. It is like a change in the dollar’s value vs. the euro from $1.26 to $1.20. A 10% move (or something like a domestic equivalent, if you want to think of it in those terms) would be a bigger deal, but still not very troublesome. This is roughly the scale of the 8%-of-base-money potential undersupply resulting from the “Treasury gold sterilization,” compared to what it would have been without molestation.

But even that interpretation requires some assumptions that may not be quite true, and the reality might have been that it was a lesser effect even than that. There is some inconclusive but perhaps pertinent discussion in both Friedman and Meltzer that the Treasury’s “cash” holdings and “deposits” at the Fed were somewhat interchangeable, and thus the use of the “cash” function instead of “deposits” did not represent a significant deviation from normalcy. Obviously, I have not quite decided where I stand on this myself. But, we can at least state the significance: if there is some merit to this line of thinking, it would mean that the real effect was even less.