(This item originally appeared at Forbes.com on December 31, 2023.)

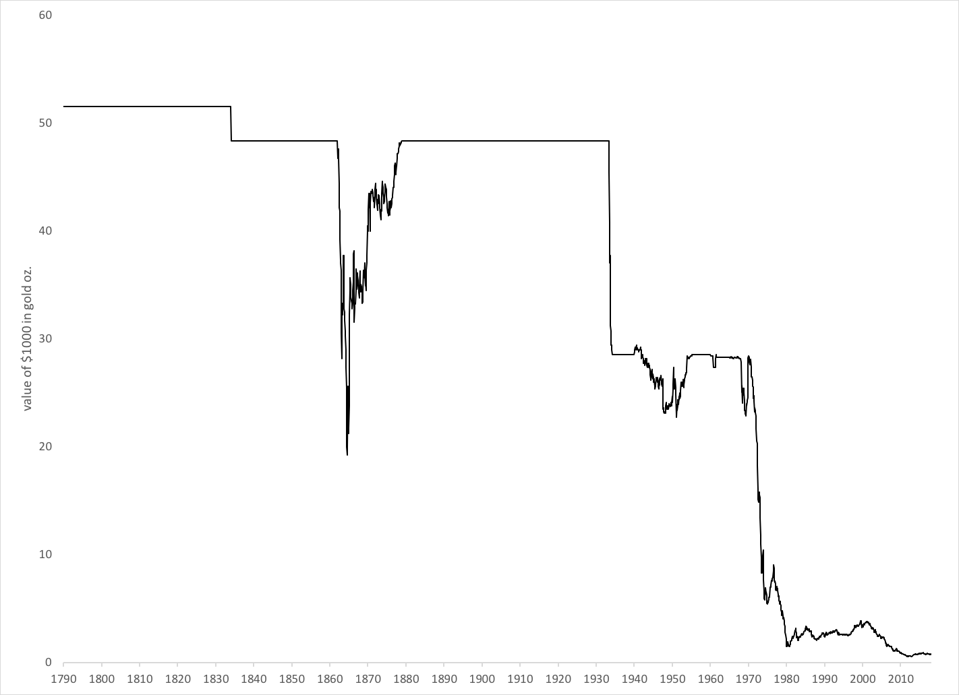

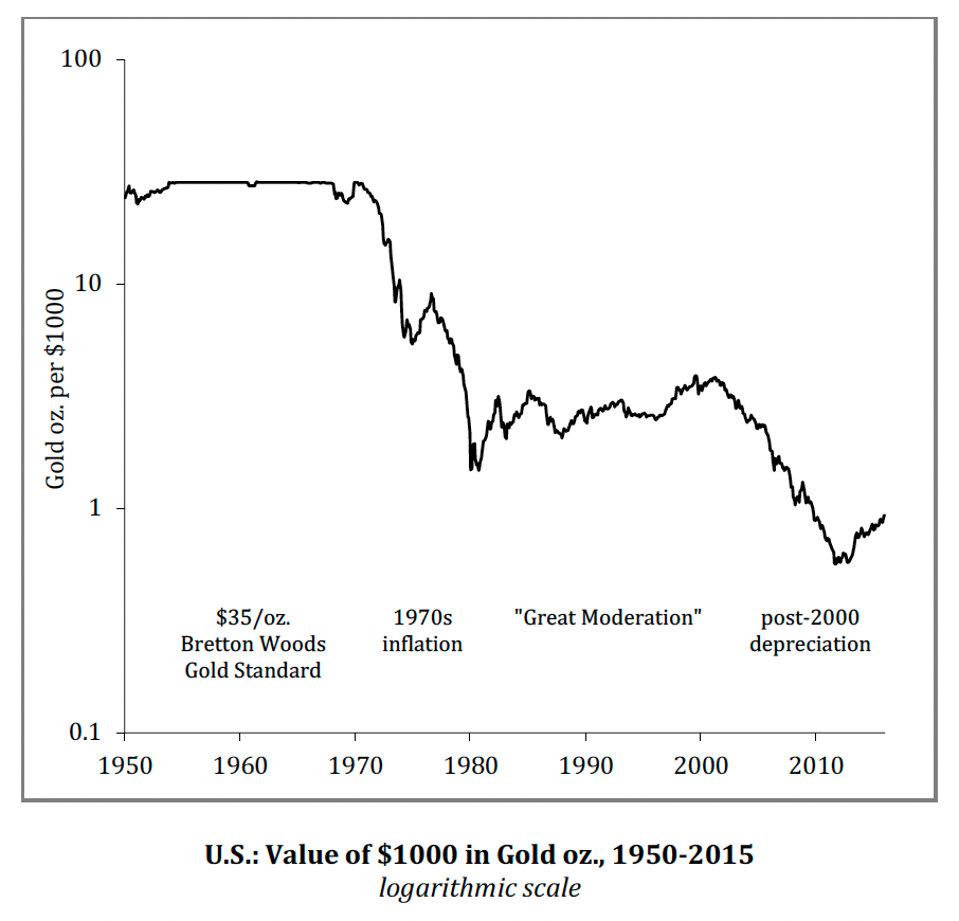

In recent weeks, it has taken about $2067 to buy an ounce of gold — an important landmark, although few today remember why. Basically, it is this: The dollar today is worth about a penny in 1930.

From 1834 to the devaluation of 1933, the dollar’s official value was 23.2 troy grains of gold. Since there are 480 troy grains in a troy ounce, this means the dollar was worth 1/20.67th of an ounce, or $20.67 per oz. These ancient measures are a little confusing. The “grain” was the weight of a common grain of barley. 23.2 troy grains is equivalent to 1503 milligrams.

Prior to 1834, according to the Coinage Act of 1792, the gold value of the dollar was 24.75 grains; or 371.25 grains of silver. This was based on the average weight of Spanish silver dollars used in the American Colonies. In 1834, the gold value was adjusted to make the ratios closer to market values. The dollar’s value in silver was unchanged. The effect was to make gold the premier basis of the dollar, instead of silver. This was formalized in the Gold Standard Act of 1900, which officially replaced the previous bimetallic system.

The United States did not always stick to its official gold standard policy. There was an era of floating paper money in the Civil War, and smaller but still significant deviations in both World Wars. But, these were corrected after the wars’ end.

As we noted in our recent book Inflation: What It Is, Why It’s Bad, and How to Fix It, as long as the United States stuck to its Stable Value policy, in practice a gold standard system, there was never an “inflation” problem. Prices still went up and down, for all kinds of reasons, but there was not the long-term deterioration in currency value that we have experienced since we abandoned the Stable Money principle, and the gold standard, in 1971.

This policy was gigantically successful. The United States became an industrial, financial, and military superpower. This was no surprise to the Founders, who understood that the most successful countries were those that followed what I called The Magic Formula: Low Taxes, and Stable Money. Both are explicitly laid out in the Constitution.

“No State shall … make anything but gold and silver coin a tender in payments of debts,” it says in Article I Section 10.

This leaves out the Federal government. Congress was “To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;” according to Article I Section 8.

There is a whole club of “Constitutional scholars” who basically spend all their waking hours arguing that the Constitution says that they can do whatever happens to be the fashionable argument of the day; or, perhaps more practically, whatever they are paid to argue. In terms of currency, they will argue that this allows Congress (and the Federal Reserve, as delegated by Congress) to do whatever they like, whenever they like, within the floating fiat arrangement that emerged by accident in 1971.

But, the Coinage Act of 1792 shows what the Founders really thought. The Federal government was to keep the value of the dollar (in terms of gold and silver) rigorously unchanged, just like other Weights and Measures.

SEC. 19. And be it further enacted, That if any of the gold or silver coins which shall be struck or coined at the said Mint shall be debased or made worse as to the proportion of fine gold or fine silver therein contained, or shall be of less weight or value than the same ought to be pursuant to connivance of any of the officers or persons who shall be employed at the said Mint, for the purpose of profit or gain, officers or persons shall embezzle any of the metals which shall at any time be committed to their charge for the purpose of being coined at the said Mint, every such officer or person who shall commit any or either of the said offences, shall be deemed guilty of felony, and shall suffer death.

In other words, Stable Money, just as the United States had until 1971.

The basic reason that things cost more today than they did in 1930, or 1965, is the decline in the value of the dollar since then.

Today, the dollar is worth about as little as it has ever been, against its old benchmark, gold. In coming years, it might be worth a lot less even than that.

This 100:1 decline in dollar value actually has not been due to “money printing” and direct government finance, for the most part. There was little base money creation during the devaluation of 1933, the inflationary decade of the 1970s, or another period of declining dollar value in the 2000s.

But we might be entering a new period, where direct government finance, or bond market support, might become an important new factor. The Federal Reserve itself calls this “fiscal dominance.”

When you look at the “price of gold” today, remember that, if not for all the various devaluations and depreciations over the years, the dollar today would still be worth 23.2 grains of gold, or $20.67/oz. You can keep the same currency value for centuries; and that was the original intent. The Spanish silver dollar itself, in 1792, had been unchanged in value for about 300 years; and it continued unchanged until abandoned in the 20th century.

That is how it is supposed to work.

Perhaps, in the not-too-distant future, we will be paying each other with smartphone apps based on grams of gold. This is already happening in Russia and throughout the BRICs sphere, where I hear that “checking accounts based on gold” have become common just in the past year or so.

In 1927 — the dollar was still worth $20.67/oz. at the time — George Bernard Shaw could see where the next century was leading us; and what the eventual solution would be.

The most important thing about money is to maintain its stability … You have to choose between trusting the natural stability of gold and the honesty and intelligence of members of government. With due respect for these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold.

We spent the last century proving Shaw right.