We’ve been talking about Economic Nationalism; in particular, tariffs.

July 27, 2024: Economic Nationalism #2: Good and Bad Economic Nationalism

September 8, 2024: Economic Nationalism #3: Bad Economic Nationalism

The basic concept of Economic Nationalism is that a policy is good if it benefits members of the Nation, which basically means the members of commonwealth, or State. If it doesn’t benefit the members of the Nation, then what makes it good?

For example:

Let’s say that there’s an automobile factory in Detroit. But, Ford decides that it would like to build its newest factory in Georgia, not Detroit, for whatever reason.

This might be bad for workers in Detroit. But, it would be good for workers in Georgia. We calculate that, since both Georgia and Detroit are part of the Nation, then it is something of a zero-sum, at worst. Workers in Detroit can even just move to Georgia and work in the new factory. But, competition between Michigan and Georgia is also good, because it tends to lead to better outcomes overall. More factories is good, overall, because it means more productive workers, and more employment, at better wages. The Capital/Labor ratio improves. In terms of Economic Nationalism, it is a positive.

But, let’s say that Ford wants to build a factory in Mexico. Now Mexicans benefit, from more good-paying jobs, and Americans do not benefit, although you could argue that they benefit a little bit from perhaps lower selling prices of Ford automobiles. Unemployed factory workers in Michigan cannot easily migrate to Mexico; nor would they want to, given the low wages in Mexico. However, all economists agree that wealth comes from Production and Productivity, and we have just made Americans less productive, because they no longer have a factory to make cars, and are instead standing around unemployed. Basically, Capital is leaving the US, resulting in a poorer Capital/Labor Ratio.

Thus, if we look at the actual history of the United States, we find that it is based on absolute Free Trade within the Nation (among States), and generally a long history of Protectionism, or Tariffs, with the rest of the world; i.e., other Nations. This makes sense, from the standpoint of Economic Nationalism.

There is nothing in economic theory, of the “general economic principles” variety, that can make sense of the National difference between a factory in Georgia and a factory in Mexico. They just assume that — since Free Trade is very good between the States of the United States, then the same principle applies also for the whole world, because we are too lazy to think if this is actually true or not.

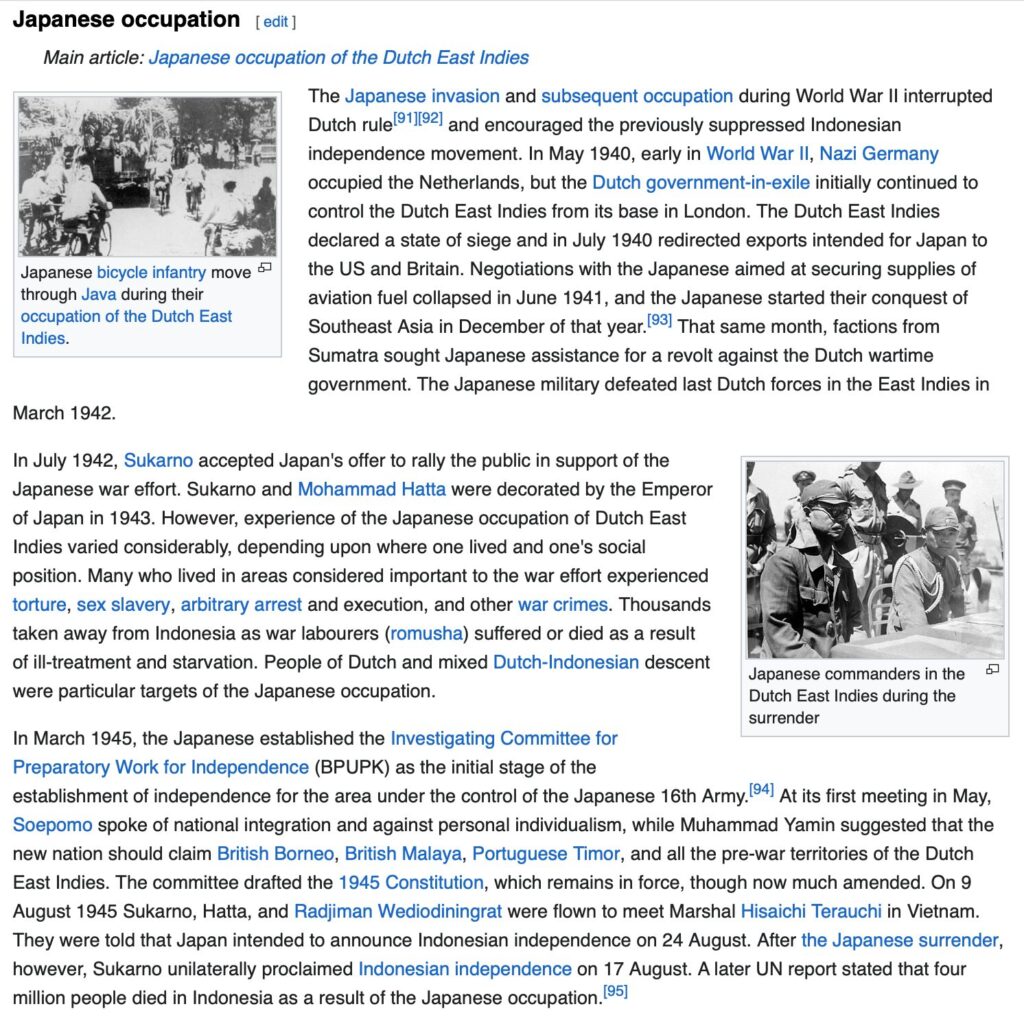

Economic Independence

During the 1960s, there was a fairly strong movement toward Economic Independence, or the idea that a country should try to make goods and services domestically, rather than being dependent on imports. This had a political aspect. If you were completely dependent on fossil fuel imports, and had no domestic sources of energy, then you would be at the total mercy of others exporting fossil fuels to you. This might seem fanciful, but it is exactly what happened to Japan, which was almost totally dependent on imports of petroleum. When imports from Indonesia and elsewhere in Asia were cut off in June 1941, it left Japan completely dependent on imports from the United States. When the US cut off oil exports to Japan in September 1941, Japan had basically been served a death sentence. The reaction was to gain control of the oilfields of Indonesia. Indonesia was then known as the Netherlands East Indies, since it was ruled by the Netherlands. But, “the Netherlands” no longer existed. It was under German military occupation since 1940, and Germany was a defensive ally in the anti-communist Anti-Comintern Pact of 1936. It made sense for Japan to grab the oilfields of the undefended Netherlands East Indies. But, this was blocked by the US Fleet at Subic Bay, in the Philippines, and also Hawaii; and the British outpost at Singapore, which controlled the Strait of Malacca. To secure the shipping lanes between Indonesia and Japan, the Japanese military attacked both the US naval bases in the Philippines and Hawaii, and Singapore.

It is not very well remembered today that the Japanese government actually promoted self-rule for the former European colonies in Asia, including the Netherlands East Indies. Of course it would be something of a “puppet government,” and a friendly posture toward Japan was basically mandatory — the same as Japan itself after WW2. But, it nevertheless would have had a lot of control over domestic conditions.

So we see that securing natural resources, and not being dependent on (potentially unfriendly) foreign sources for key items, has actually been a big deal in the past.

Since that time, we’ve learned that most countries really cannot hope for any meaningful form of economic self-reliance. Most countries have no meaningful fossil fuels, and are dependent on imports. Attempts to create domestic manufacturing industries, or “import substitution” as it was called, have mostly been a failure. People in Honduras, Vietnam, or Morocco are much better off buying an iPhone from Apple than trying to make their own domestic smartphones. People in Mozambique, Portugal or the Philippines are much better off buying an automobile from Ford or Toyota than trying to make their own automobiles. Actually, there has been a trend for international manufacturers to establish domestic factories, such as a Honda plant in Brazil, but even these are commonly dependent on long supply chains from around the world.

Since countries have to pay for these imports somehow, they also have to sell something to the rest of the world. Thus, we get a tendency toward Specialization and Trade, at the national level as well.

While this is almost unavoidable for most countries in the world, which are not very big and cannot have any meaningful hope of “economic self-reliance” in a state of contemporary industrialization, the larger countries, which basically have “superpower” militaries, see things differently. Mostly, this is the US, Russia, China, and Europe, taken as a whole — the EU.

While fossil fuel or automobile or electronics “independence” is hardly realistic for most countries, nearly any country can aspire to generate most or all of its own food. This is, of course, perhaps even more important than fossil fuels, when it comes to avoiding potential means of aggression by foreign governments. Also, although cars and iPhones are modern features, nearly every locality has a centuries-old tradition of local farming. We don’t feel this in the United States so much, but what does it mean for France or Japan to see its domestic agriculture tradition basically disappear, because it is cheaper to import food from Brazil? To see the fields that have been cultivated literally for centuries, become abandoned or built over? What if the Japanese no longer grew rice, not because rice fields don’t exist — they do — but because Thai or California rice was cheaper?

This leads to a natural effort to “protect” local agriculture. Japan has long had a policy that all rice would be domestically grown, with prices rising to the point to make this possible. No rice imports. This of course infuriates California rice growers, but it makes a lot of sense, for Japan. Japan imports more than half of all its food anyway. However, this policy both preserves an ancient tradition, and core component of culture and national identity, and also at least preserves a substantial and meaningful level of food independence, even if Japan falls far short of becoming a net food exporter like the United States.

(If you are wondering, the high inherent cost of growing rice in Japan has led to a tendency toward quality. Japanese rice is very, very good. There are farms in California that attempt to grow rice that is as good as the rice from Japan. As a rice enthusiast, I can say that Japanese rice, and also these super-premium California brands, are far better than the cheaper options, and well worth the extra price, even though they can cost five or ten times as much — about $3 a pound, or $4 for organic — than the 50lb bag at Costco. The super-premium California brands like our personal favorite, Kagayaki, cost the same as Japanese rice.)

Today, the United States, which is not very concerned about food (it is a huge food producer), or fossil fuels, is instead concerned about semiconductor chip supply. “Specialization and Trade” has led to most US chips coming from Taiwan and elsewhere — all of which could be potentially cut off, much as Japan’s oil supply was cut off by the United States in September 1941. This extends not only to chips, but electronics components throughout the supply chain, and also, the very sophisticated robotic machines that today assemble these components into final products. Even if “electronics self-reliance” is perhaps difficult at this time, at least there should be a substantial local industrial base. This not only insures at least some supply, but also, the engineering and managerial knowledge that could ramp up this local supply quickly, if necessary.

The Economic Nationalists see these needs clearly, while the “general economics principles” people have really nothing to go on to make a decision one way or another on this. It would mean violating their “general economics principles,” leaving them often with nothing.

Like most real-world situations, these things also change with time. Taiwan semiconductor supply was not that much of a concern in 2005; and now it is a big concern. Recently:

There are a number of things potentially wrong with this, but also, a number of things potentially right. It certainly would prompt a move toward economic self-reliance, since local industries would have a substantial advantage selling in the local market. Note also that this avoids the terrible item-by-item approach for Broad Flat Tariffs, 20% on everything, and an (additional?) 60% on China.

October 24, 2021: Rationalizing Tariffs

Of course it is not quite so simple. It would make sense for Chinese products to pass through the Philippines, for instance, and be sprinkled with magic fairy dust making them “Philippine products,” for export to the US. But, nevertheless, it could be the start of a good policy — especially combined with tax cuts elsewhere, as Patrick Buchanan argued (he suggested eliminating the corporate income tax), making the overall economic effect (higher tariffs, lower other taxes) a strong positive. During the entire 19th century, the United States had very high tariffs, and no income taxes at all. It was a big success.

We will talk more about Economic Nationalism in the future.