I’ve been setting up a discussion of Milton Friedman’s version of the 1920s and 1930s, as expressed in his book A Monetary History of the United States, 1867-1960 (1963). It has been very influential over the years. A more recent update of basically the same theory is in Allan Meltzer’s History of the Federal Reserve, Volume 1 (2004).

June 5, 2016: Irving Fisher and “Debt Deflation”

May 14, 2016: Credit Expansion And Contraction Of The 1920s and 1930s #2: Paying Off Debt

April 3, 2016: Credit Expansion and Contraction in the 1920s and 1930s

February 7, 2016: Blame Benjamin Strong 2: So Obvious It’s Hard To Believe

January 31, 2016: Blame Benjamin Strong

I think it is incorrect. It is a testament to the very poor understanding of economics today that more people do not call it so.

The book basically blames the Federal Reserve for essentially all of the Great Depression, as it does not make mention of any other factors. Supposedly, the Federal Reserve caused a great “deflation.” The word “deflation” has no specific meaning, but is applied to a great many entirely different situations. The fuzzy use of the word typically indicates fuzzy understanding by the people who use it.

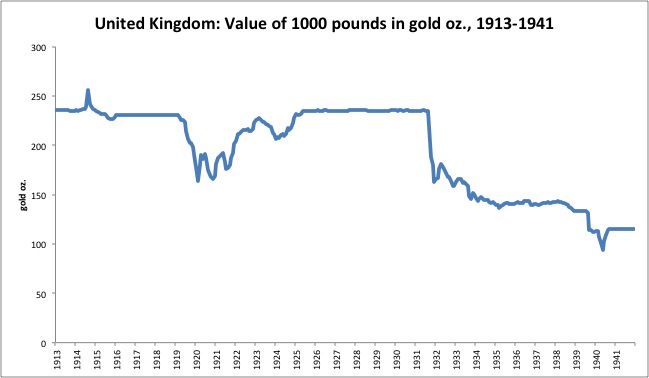

One situation is where the value of the currency rises. This has recessionary effects. Historically, this has been the case mostly after a wartime depreciation, when the currency is returned to its prewar gold parity. This happened in Britain 1815-1821, the U.S. 1865-1879, and Britain 1919-1925. Similar, but more minor events happened in the U.S. 1816-1820, U.S. 1919-1922, and the U.S. 1951-1953. In all of these cases, the value of the currency rose, vs. gold and other currencies. Some of them involved a contraction of the monetary base, and some did not. Meaningful deflation has been rarer in the floating currency era after 1971, but it did occur in the U.S. 1980-1982, U.S. 1997-2000, and Japan 1990-2000.

So, we know what that is, and what it looks like. Let’s call that Situation A.

Another situation, or genre, is a wide variety of conditions in which the economy is doing poorly, and nominal prices are generally falling, but the currency’s value is not changing. These can be Situation B.

The British “deflation” of 1919-1925 involved raising the value of the British pound back to its prewar parity. Situation A.

The word “deflation” also gets thrown around for no reason at all, basically because it seems to add a bit of street-cred to the user. Thus, we get “deflation in the cost of computer memory,” and that sort of thing. They mean that prices are going down. They could call it a “decline in the price of computer memory,” but that would be a little too obvious, I guess.

Now, obviously, a currency whose value is linked to gold is not rising, at least vs. gold. You could argue that the value of gold itself rose by some meaningful amount, thus leading to a rise in the value of currencies linked to gold, but Friedman does not make this claim. Thus, Friedman’s “deflation” is not a Situation A, but rather a Situation B. A gold standard system has many mechanisms to prevent a rise in currency value (Situation A), by increasing the monetary base by as much as is necessary. So you can’t really claim that the monetary base (“money supply”) was somehow insufficient, because there are many mechanisms to make sure that it is sufficient. The primary one is gold convertibility. If the value of the dollar was 1/19th of an ounce of gold (1.6922 grams) , while the parity value was 1/20.67th (1.5555 grams), then the Federal Reserve would be the highest bidder for gold. The Federal Reserve would be paying $20.67 for an ounce while all the other buyers were at $19.00. Obviously, this would cause all the gold for sale in the world to be sold to the Federal Reserve, and the Federal Reserve would experience gold inflows and an increase in the monetary base, until the value of the dollar fell back to the $20.67/oz. parity. This is why even this 5%-or-so discrepancy in price from the parity value never occurs. It would be corrected far before that time.

A similar thing happens in reverse, when the value of the currency is too low. Thus, the monetary base is, in effect, a residual — it is the amount that causes the currency to be at its parity gold value.

This is pretty easy to see in a situation where the currency manager only transacts in one asset — whether it be gold bullion in a gold standard system, or perhaps a foreign target currency in a currency board system today.

However, things were a little more complicated in those days. The Federal Reserve, and other central banks loosely modeled on the Bank of England, engaged in a wide variety of other transactions. Primarily, these were a) discounting and direct lending; b) open-market operations in securities, usually government debt; c) foreign-exchange operations.

Now, the thing to see here is that, whatever these other actions may have been, the result would be the same. The monetary base would be essentially unchanged, because the monetary base is the amount necessary to produce the gold parity value. Thus, if discounting increased by $500 million, but the monetary base necessary to produce the parity value was unchanged, then $500 million would have to be removed by some other mechanism. If no other mechanism were present, this would be gold convertibility. $500 million of gold would flow out.

Sometimes, open-market operations and discounting interacted with each other. If large purchases were made via open-market operations, this would tend to depress the overnight interest rate. This in turn would tend to reduce loans and discounting. So, the cancellation could occur that way too.

Foreign-exchange operations would act as basically a proxy for gold. It was easier and cheaper to transact in foreign currencies than in gold bullion. Plus, it would result in the acquisition of interest-bearing foreign debt securities, rather than gold. So, purchases and sales of foreign exchange–with an international gold-based currency like the British pound–would be made to keep the currency in line. This was common practice, both before and after 1914, for almost all central banks outside of the “big four” reserve currencies — the U.S., France, Britain, and, before 1914, Germany. Even Germany did a little with foreign exchange before 1914.

By the 1920s, central bankers and academic economists were already pretty fuzzy about all these things. Discounting and open market operations in debt were highly discretionary by the central bank. They didn’t really understand that they couldn’t really alter the monetary base — that any discretionary action would be cancelled out, mostly by gold conversion, to produce the same result, namely, the monetary base quantity necessary to produce the gold parity value. They saw gold inflows and outflows as a somewhat mysterious effect, somehow related to the “balance of payments” perhaps via a “price-specie flow mechanism,” or differences in interest rates, all of which was fallacious nonsense.

Friedman’s basic rhetorical trick was to imply and suggest that a Situation B was really a Situation A. This was done by creating a measure of “money” that did not have anything to do with either the supply or value of the actual currency — base money — but rather with measures of credit, especially bank deposits. In effect, Friedman took Irving Fischer’s “debt-deflation” effect, and instead of looking at the asset side of the bank balance sheet (loans), he looked at the liabilities side (deposits). By implying and suggesting that this was a monetary effect — when it was really a nonmonetary one — he was then able to blame the monetary managers, the Federal Reserve, for supposedly causing this disaster.

I hope you can see how simple and obvious this really is. You don’t really have to peer into statistical details, or follow intricate twists of history.

Before Friedman, it was already conventional wisdom that the onset of the Great Depression (before the British devaluation of September 1931) was basically nonmonetary in nature. Central banks were thought to be somewhat powerless to address a dramatic downturn that came from mysterious, unidentified nonmonetary sources. The Keynesians argued that, although the source was nonmonetary (they called it an “autonomous decline in aggregate demand,” which means: “we have no idea”), that central banks could nevertheless attempt to mitigate the problem with some kind of monetary response, which involved devaluation and some sort of lower interest rates.

Friedman basically argued the same thing, but couched it in somewhat monetary terms. Instead of an “autonomous decline in aggregate demand,” we have what amounts to an “autonomous decline in bank deposits,” which is Irving Fischer’s “debt-deflation” observation. Remember that Fischer himself didn’t really identify why things were spinning into disaster. It was more of a symptom than a cause.

June 5, 2016: Irving Fisher and “Debt Deflation”

By way of suggestion and implication, Friedman argued that this decline in “money” (bank deposits) was the Federal Reserve’s responsibility. This is actually almost indistinguishable from the Keynesian view — it amounts to a monetary response to a nonmonetary problem — with a layer of rhetoric that basically puts more responsibility on the Federal Reserve, as if it was negligent in its duties. The Keynesians didn’t really regard the Federal Reserve, or other central banks, as being negligent. They regarded the gold standard as “golden fetters,” to use the phrase introduced by Keynes in 1931 and later the title of a 1996 book by Barry Eichengreen, that prevented central banks from taking the activist policy (devaluation, basically) that they felt the situation warranted.

The Federal Reserve actually did its duties rather well — which were to maintain the value of the currency at the gold parity value, and also resolve any “liquidity shortage” issues, in the 19th century meaning of the term, which meant systemically high interbank lending rates between banks of high solvency. The Federal Reserve was never supposed to “bail out” insolvent banks, and in fact there were several explicit provisions to prevent it from doing exactly that.

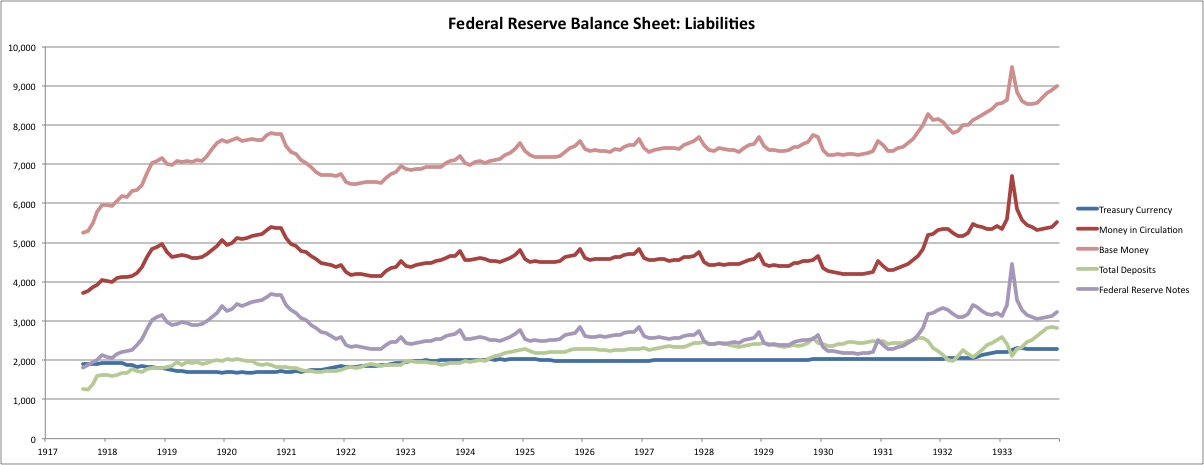

Here we see the Federal Reserve’s liabilities. The most important one is the top line, which is total base money. As you can see, it did not contract in the early 1930s, it rose. Remember, this was not a “discretionary” expansion, it was the automatic outcome of the gold parity mechanism. However, you can’t accuse the Fed of not expanding when it should have. It did expand, when it should have.

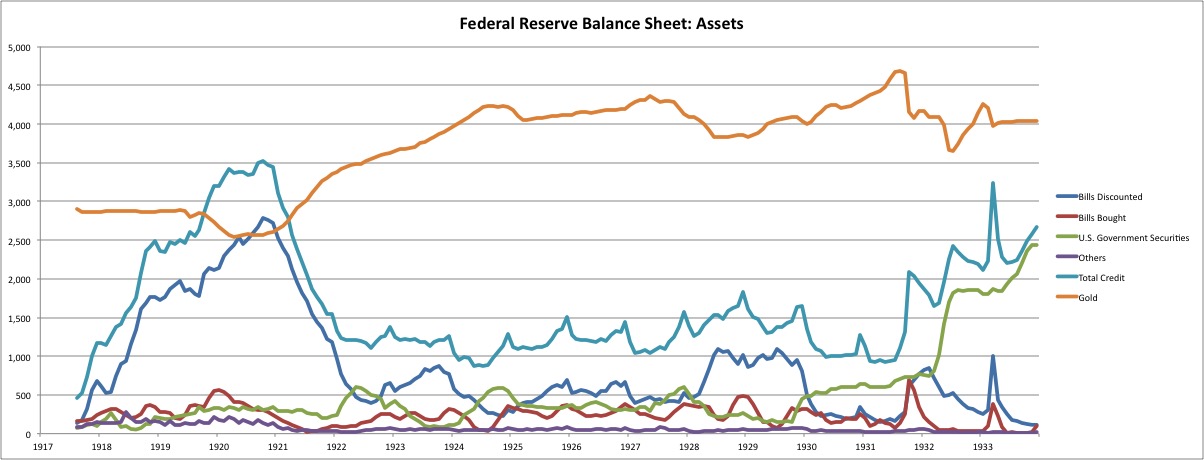

In 1932, the Federal Reserve came under a lot of political pressure, from Congress and elsewhere, to “do something” about the great problems of the day. The Federal Reserve, just to show that it was absolutely doing all that it could, undertook a $1,000 million expansion in its government securities holdings via open-market purchases. The result of this was, first, that the expansion caused a decline in the overnight rate, which in turn resulted in a decline in discounting. Second, there was a substantial gold outflow. The expansion of the monetary base, from open-market purchases, led to an incipient decline in the dollar’s value, which caused gold redemption, thus cancelling out the expansion. The net result was $1,000 million in purchases, offset by a $400 million decline in discounting and a $500 million decline in gold, for $100 million of net expansion — expansion that would have happened anyway. If the Federal Reserve had purchased another $1,000 million of government bonds, there would have been another $1,000 million of gold outflows (since discounting had already contracted about as much as possible). Actually, there probably would have been more than $1,000 million of additional gold outflows, because people would have started to panic by then, and would have started dumping dollars.

The point is: the Federal Reserve really could do nothing meaningful, while it remained on the gold standard. Base money is basically a residual. The Federal Reserve can change the asset mix, by purchasing government bonds and experiencing reductions in holdings of gold and discounts. But, the overall base money does not change. Look at base money for 1932. It is a smooth upward trend, without even a ripple caused by the $1,000 million in open-market purchases.

Friedman’s arguments served a sort of political role. By the 1960s, the Keynesian idea that Great Depressions just happened for no good reason, was making people uncomfortable. It was like an asteroid struck the Earth … but they couldn’t even identify the asteroid. Peter Temin, in his 1976 book Did Monetary Forces Cause the Great Depression?, neatly laid out the two general categories of explanatory narrative: one, which I am calling “Keynesian,” which was basically nonmonetary in nature, and the other, the “Monetarist,” in which a monetary cause is implied (but never proved or identified). Temin concluded that the “Monetarist” explanation was unsatisfactory, and that he favored the “Keynesian” version. However, by his 1989 book Lessons From the Great Depression, he basically switched sides.

Another political role was to allow a way out for those economists, mostly conservative-leaning, to basically adopt the Keynesian standpoint. Since nobody had been able to identify any particular cause of the Great Depression, the conservative economists, if they rejected the Keynesian money-manipulation strategy, basically had nothing left to offer except for “do nothing.” Well, “do nothing” in the face of such an epic economic collapse was not really tenable, in 1931 or in 1962.

The idea that economies just collapsed for no good reason bothered the conservative-leaning economists. The natural conclusion — embraced by a wide variety of Keynesians — was centrally-planned state control. But, if we could blame some kind of “government error,” (to the extent that the Federal Reserve represented a government agency), then we would avoid the conclusion of communistic central planning, and also, in a roundabout way, also vaguely blame something like government intervention, or at least government incompetence, which is always popular among small-government conservatives, as Milton Friedman was in virtually all aspects except for monetary affairs.

The intellectual path out of all of this had to wait until the 1970s, with the “supply side” branch of Classical economics. The supply-siders focused on the importance of nonmonetary factors — especially taxes, tariffs, regulation and so forth — on economic outcomes. The idea that “nonmonetary factors might be a big deal” is so obvious that you might think it is hardly worth making mention of. The great Classical economists from before 1870 or so — Mill, Ricardo, Smith — always considered nonmonetary topics, if sometimes in a haphazard way. However, after roughly 1870, around the time of Carl Menger, economists had narrowed their field of vision to topics involving money, interest rates, and prices. These lend themselves nicely to quantification, and thus to “general theories” of “equilibrium” loosely mimicking the mathematial constructs that were revolutionizing engineering and chemistry of the time. Something like a tax system is not quantifiable in any way, so they just left it out. Fiscal policy tends to be reduced to a simple quantity of “spending.” It probably sounds absurd that economists would be basically unaware of all nonmonetary factors for a hundred years — in fact, it is absurd — but, as we know by now, people really are rather dumb, and that is what they did.

By identifying nonmonetary factors — basically tariffs and domestic taxes, plus a variety of new statist regulations — for the onset of the Great Depression, we don’t have to embrace either the Keynesian “autonomous decline in aggregate demand” (“it just happened for no good reason”), or any of the dozens of fallacious monetary theories including those of Milton Friedman, or the “blame France” variations, or any others. Our policy prescription is not “do nothing”, but rather: first, don’t do the many stupid things that were done, and then, either correct those errors or engage in new beneficial nonmonetary policies.

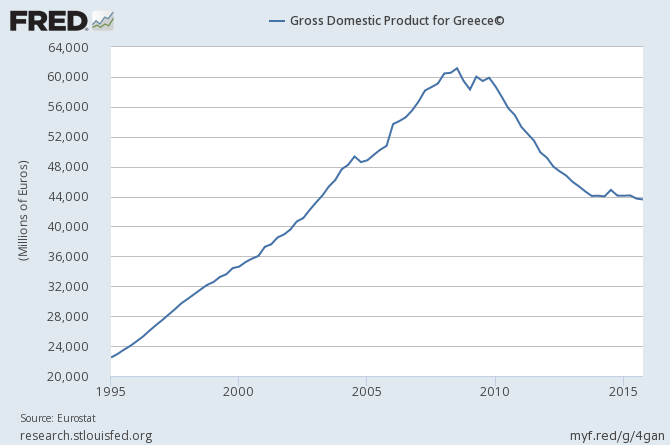

Between 2010 and 2015, the nominal GDP of Greece fell by 25%. This was basically due to “austerity” tax increases — not even including bank default, tariff wars, sovereign default, capital controls, a simultaneous downturn worldwide, “beggar thy neighbor” devaluations, or any of the many other negative factors at work during the Great Depression. A sensible solution, which I made many times, would be something like a flat-tax reform for Greece, mirroring that of neighboring Bulgaria.

July 12, 2015: Greece Is On The Brink Of Disaster — Or Raging Success

June 25, 2015: Greece: Planning The Bank Holiday

June 5, 2015: Greece: It’s Time For Your Default and Debt Restructuring

May 28, 2015: Greece’s 1-2-3 Plan For Default and Amazing Recovery

April 3, 2015: The Greek Government’s Revenue Would Rise — Immediately — After Tax Reform

March 26, 2015: Greece Needs the Magic Formula to Become the Wealthiest Country in the Eurozone

March 19, 2015: Greece Could Rise To Greatness, Or Become The Next Venezuela

March 12, 2015: Greece’s Syriza Could Launch a Libertarian Revolution

When I make this recommendation for Greece, it probably seems simple and obvious. The idea that the same basic cause, and the same basic solution, could have been effective in the Great Depression is probably harder to embrace, simply because we have eighty years of faulty economic opinion to clear away. Most people are uncomfortable being that far out of consensus.

Not surprisingly, bank liabilities declined also.

Many economists have argued that Greece should leave the eurozone and devalue. This is basically a rehash of the Great Depression strategy for a lot of countries. The common currency of the eurozone, they say, is something like the gold standard of the 1920s–“golden fetters” preventing a monetary response. But, I think that almost nobody would claim that Greece’s problems are monetary in nature. Germany has been doing well enough, with the same currency. (Pre-1931, France was doing fine with the same gold-based currency, even as tax-hiking Britain, U.S. and Germany spiraled into disaster.)

I think that is all I will say about Friedman today. There might be more later.