We were chatting about The Triumph of Gold (1952), by Charles Rist.

January 8, 2017: The Triumph of Gold (1952), by Charles Rist

Since I didn’t really get past the introduction, by Philip Cortney, I thought we should at least give Rist a chance to speak. You can tell a lot about how people think from just a few paragraphs.

This has been of interest to me not only because of the similarity to the positions held later by Robert Mundell and Clark Johnson, but also as a thread of ideas commonly held among supposed gold-standard advocates during the Bretton Woods years. The intellectual rot was everywhere during that time, including the gold standard advocates themselves. Since one of our tasks — yours and mine together — for our time is to fix that rot, we need to find out where it lies.

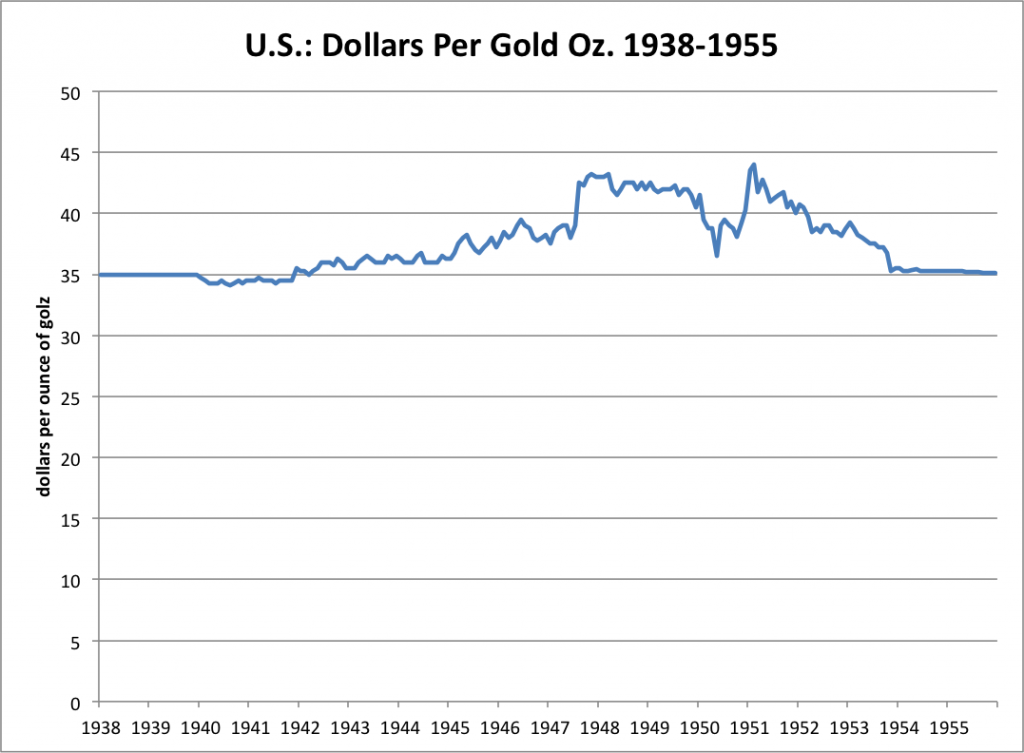

The book is a series of shorter essays. I thought I would focus on one of the later ones, in part because it reflects a bit of maturation of his ideas. This one, “How to evaluate the new price of gold”, is from October 1952. I think we should give him a little slack, because the Bretton Woods arrangement was still pretty fresh in those days. There was a lot of turmoil in the 1944-1949 period, including a big devaluation by Britain and also most other currencies in 1949. Also, there were still a lot of capital controls. The dollar itself had been drifting pretty far from its $35/oz. parity. The Fed Accord of 1951 gave the Fed the ability to return to the $35/oz. parity without pressure from the Treasury to do this and that, but that wasn’t accomplished until 1953.

My comments are in red. Here’s Rist:

It is perhaps to abuse the patience of readers of this journal to speak to them again about the price of gold. However, it is not needless to recall again how the problem presents itself from the point of view of economic logic. That is what I shall try to do here, while excusing myself in advance for the rather austere character of these considerations.

When gold serves as a monetary standard and the paper in circulation is freely convertible into metal, the rate of exchange of gold against commodities establishes itself in the simplest manner. Any increase in the production of gold sold to the bank of issue automatically increases the amount of paper money. By a well-known process, this increase tends to raise the level of prices of merchandise. In other words, the purchasing power of gold, like that of the convertible paper, decreases.

On the contrary, when the production of merchandise increases at a more rapid rate than the increase in the production of gold, we see a decline in the general level of prices, that is, a rise in the purchasing power of gold.

This is a variant of the “money chases goods” argument. Money doesn’t chase goods. Goods don’t demand money. Only people demand (i.e., wish to hold) money. “Money,” rather than actual base money, is here assumed to be mining production, which itself is not at all the same as aboveground gold. A lot of fallacious ideas in one line here.

These formulae that contain what is wrongly called the quantitative theory of money, appear obsolete today to a great number of economists, who are startled by its mere mention. I believe, however, that they have been confirmed by the entire history of prices in the nineteenth and the beginning of the twentieth centuries.

Besides, they were confirmed when the formidable influx of merchandises in the world markets, after 1930, brought about what is called “the great depression.” The interpretation of this crisis, far from being a sort of mystery, is, on the contrary, most simple and conforms perfectly to the data of economic experience.

There was no increase in production of goods after 1930. Production declined. But, demand declined much more — a recession — leading to a glut of goods. At least he is acknowledging here that the decline in prices was not wholly monetary, but had to do with the “glut” of goods.

It is quite different when the paper in circulation is no longer convertible into gold, but constitutes itself the monetary standard. Gold, whether coined or not, has henceforth a variable price in paper money, like that of merchandise. It has itself become a commodity that may be bought and is sold in the market, like any other commodity.

As for commodities, their prices are no longer in relation to the gold produced, but in relation to the paper money issued. There is no longer any relation between the production of gold and the prices of commodities. Another relation arises, between the issue of paper money and the price of merchandises, gold included.

This accounts for the lack of equilibrium which we note today and to which is added a supplementary imbalance. While the price of commodities expressed in dollars in the United States has practically doubled, that of the gold sold at the Treasury has remained the same. Why? Because we are dealing with a single buyer, a monopolist who arbitrarily fixes the price of gold, all, or nearly all, the other outlets having been closed by the prohibition of the free sale. There results this paradoxical consequence that the same weight of gold, transformed into dollars by the Treasury, can now buy only half of what it bought formerly. The purchasing power of gold has been practically reduced by half, exactly as if the amount of gold produced annually in the world had been greatly increased, whereas it has remained identically the same.

When it is proposed to increase the price of gold expressed in dollars, we propose, in reality to bring the purchasing power of gold closer to what it would have been if gold, instead of paper money, had been increased in quantity. In other words, one tries to come closer to what might have been if the paper money in circulation had evidenced an increase in the production of gold, which, in fact, has not been the case.

The basic argument here seems to be that since “prices” had doubled since 1940, and also because the monetary base expanded quite a bit during the war, the “real value” of the dollar was around $70/oz., not $35/oz. He seems to treat the $35/oz. price as basically a fiction. This had some sense, actually. The original Bretton Woods currency parities apparently were somewhat arbitrary. They were decided on at a time (1945) when everything was locked down with capital controls due to wartime, and I think people had only a vague notion of the “real market value” of major currencies. The devaluations of 1949 not only reflected some “easy money” ambitions among Britain and others, but also an adjustment to the real values of currencies. The idea seems to be that the value of the dollar was already at $70/oz., but this was being hidden, something like we have occasionally in naughty Latin American countries where there is an “official” exchange rate that only tourists pay, and a black market rate that is very different. This was exacerbated by the fact that the dollar really did deviate from its $35/oz. parity somewhat at the time, as I mentioned, so there really was a discrepancy between the “real value” of the dollar and the gold parity. I don’t think this was very much — my data shows a couple dollars — but I can see how one might make such an argument.

One can imagine another procedure which, on the contrary, would consist in bringing the price of merchandises closer to what it would have been if the production of gold had continued to remain stable in the face of a rapidly increasing amount of commodities. This is the phenomenon we witnessed between 1875 and 1895, a long period of continuous decline in prices. In this case, in order that the prices of commodities might meet the rising purchasing power of gold, it would evidently be necessary that the level of prices be lowered to a point where this increased purchasing power would be sufficient to restore the equilibrium.

The idea here is that if the dollar was “really” at $70/oz., and then it was returned to $35/oz., the value would basically have to double, which would cause a big recession. As I’ve said, this was not entirely silly, and something quite like that actually happened in 1919-1922 even though the “official” value of the dollar remained at $20.67/oz. throughout that time. By 1952, I think it was probably clear that this was not really an issue, but I suspect that Rist got this idea perhaps around 1944 and just stuck with it.

However, this last solution, the one which consists in allowing all the prices to fall, meets with violent opposition, withal justified, on the part of all governments. This is the phenomenon we have witnessed since 1929, which in economic history is called by the name “great depression.” Such a decline in prices carries with it a dangerous reduction in economic activity, unemployment, and loss of earnings so fatal to the well-being of the most impoverished classes, that no one can think for a moment of deliberately accepting a policy that would lead to it.

There is, therefore, no other way of constituting a solid base for the paper money and an international monetary standard, than that which consists in adjusting the value of gold to the new value of the dollar in merchandise. The point is, in fact, to recreate a new unity of prices in gold, having no reference to the old unity.

How can we solve the problem?

On the one hand, the production of gold having remained the same, there is no reason that its real purchasing power should have varied since 1940. An ounce of gold continues to be worth the same quantity of merchandise and of services as in 1940. (There are even reasons to believe that it is worth more, given the enormous increase of commodities.) However, at the same time, the amount of paper dollars in circulation has increased in such a way that one dollar buys only half the merchandise and services which it bought in 1940. Therefore, a paper dollar does not represent more than half the gold it represented formerly. If one wishes to render it convertible into gold, one must fix its price in gold at half of its former price—and, consequently double the price of thirty-five dollars per ounce, which amounts to fixing the dollar at 1/70th instead of l/35th of an ounce.

This calculation, one may say, is rather rough. I only give it in order to show concretely the reasoning by which one arrives at the inevitable conclusion that the price of the gold in dollars must be increased.

One may present the problem under another form and ask by how much the physical quantity of monetized gold should have been increased to cause the doubling of prices which we have seen. As this physical increase is not possible, it suffices, in order to obtain the same result, to multiply by a certain coefficient the value, expressed in dollars, of the existing gold.

Can we base ourselves on previous experiences? Can we calculate what should have been the increase in the quantity of gold so that the purchasing power of the dollar would fall to its present level and, in consequence, apply this percentage of increase to the quantity of gold existing today?

The only example that we have is the considerable increase in the quantity of gold produced after 1900, which had for effect the important rise of world prices between 1900 and 1912. But it is dangerous to lean upon historic precedents in a matter in which all the circumstances, technical, financial, psychological, have undergone changes as profound as those we have witnessed since the First World War.

Another example is the devaluation of the dollar in 1933. There is no doubt that this devaluation, so criticized and attacked still today, in the United States, has however had the result of arresting the depression of 1929 and setting this great country back on the road to prosperity. The devaluation at that time was 35 per cent. It certainly helped to control the decline of prices and restore to the American economy its power of expansion.

In any case, and whatever may be the methods adopted to arrive at how much one should devalue the dollar, or, more exactly, what weight in gold one should assign to the new dollar, there will necessarily be some uncertainty and chance in this operation.

It is understood, under these conditions, that responsible governments hesitate and fear the hazards in all such decisions.

It remains no less true, however, that the present situation is contrary to all monetary logic and that it tends to perpetuate the insecurity in international commerce, and the lack of equilibrium in the balances of payments, with all the grave inconveniences which this lack of equilibrium entails.

There is more. If, as many signs indicate, the entire world is headed toward a period of decline in prices, the only way that we can see to prevent this decline from becoming catastrophic is precisely by increasing the production of gold to a point where it will suffice to sustain the prices at the level where the results of the war and the universal creation of paper money have unfortunately brought them.

The world, of course, was not heading toward “a period of decline in prices,” nor did it take any special increase in gold production to “prevent this decline from becoming catastrophic.” Instead, the world would enjoy two pretty nice decades, with a whiff of inflation. We can excuse Rist — a little, although wrong is wrong — but we cannot excuse his followers, who apparently felt the need to repeat Rist’s line, including the devaluation of the dollar to $70/oz., even after his death, and even after it should have been apparent that this was mistaken.

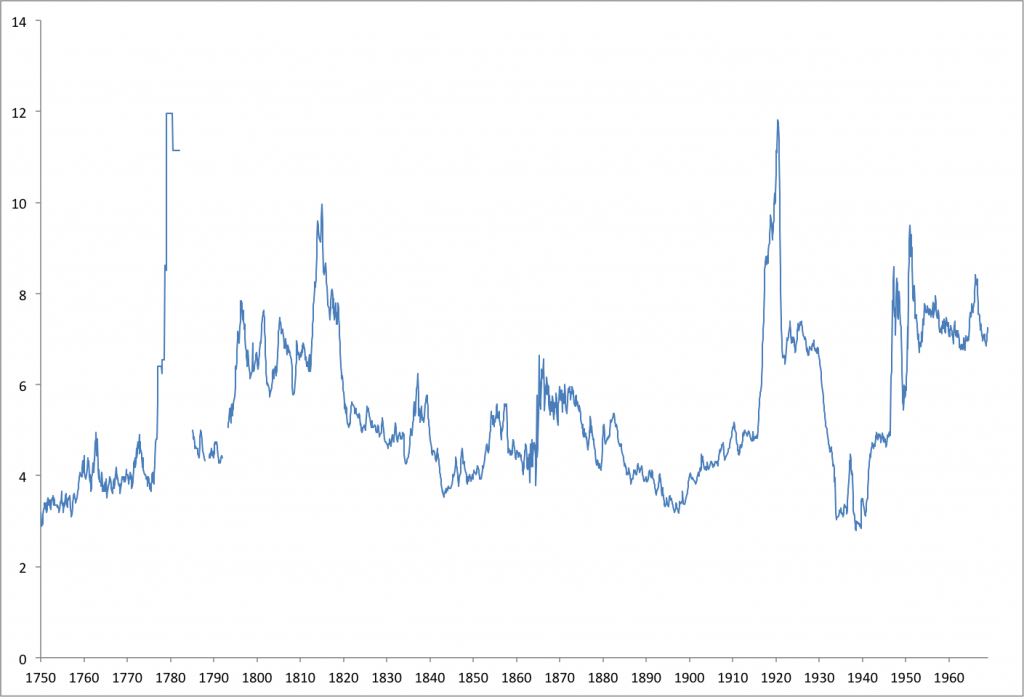

Here is my data on the market price of gold in dollars, or, in other words, the market deviation of the dollar from its $35/oz. parity. At the time Rist was writing, the dollar was around $38/oz. instead of $35. But, it returned to $35/oz. in 1953, and everything was fine afterwards. With the benefit of hindsight, I think it is clear that the value of the dollar was not “really” $70/oz. in 1952.

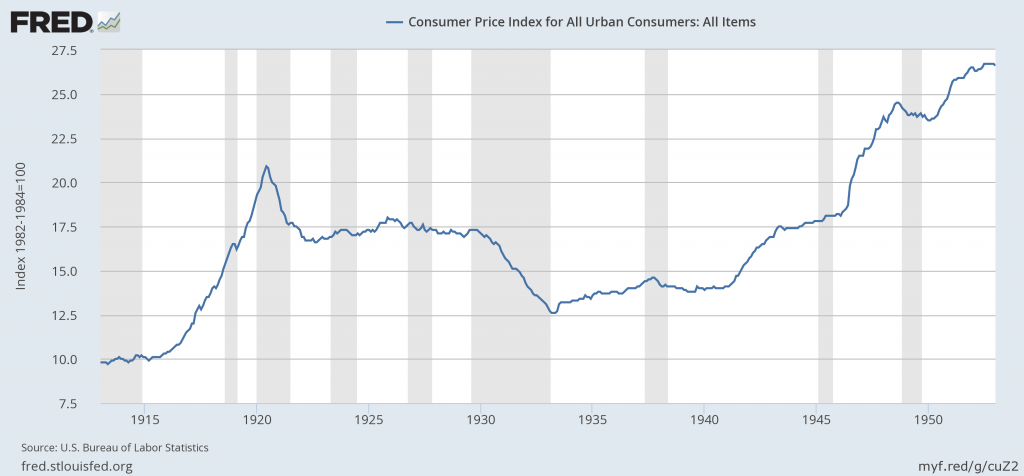

Here is the official “consumer price index” for the time. It is actually a lot different from our CPI today, nearly a commodity index in the 1930s.

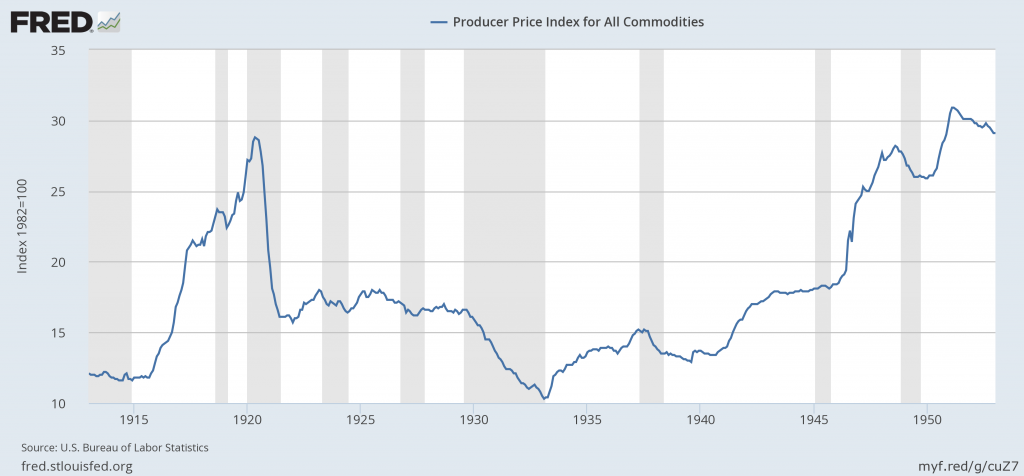

To show what I mean, here is the producer price index for the same time. This is a “broad” commodity index. It is nearly the same.

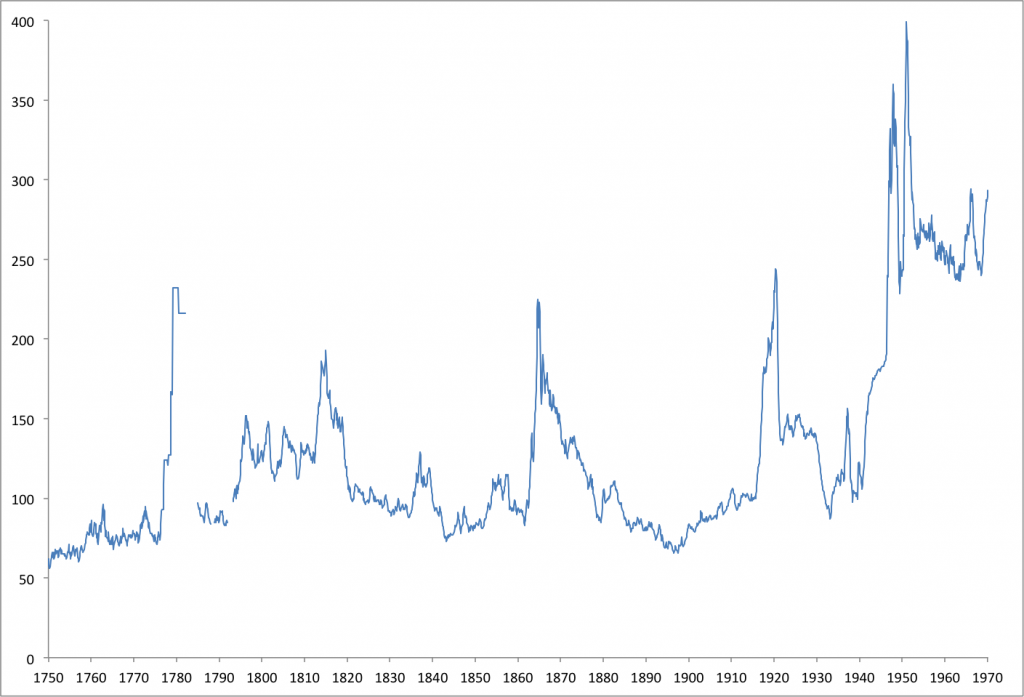

Unfortunately, I don’t have a continuous commodity index series for this time. Below is a composite of the Warren-Pearson index to 1930, the BLS WPI to 1936, the BLS Raw Commodity index 1936-1947, and the CRB Commodities index after 1947.

Here, we can see the big rise in commodity prices between 1940 and 1952, just as Rist indicated. One thing we can see from all these price indices is that commodity prices were quite low in 1940. These are nominal prices, which didn’t even rise much from the 1933 lows even despite the devaluation of the dollar from $20.67/oz. to $35/oz. that year. Here is what it looks like when compared to gold:

Now we can see that the 1940 lows, when taking the devaluation into account, were really quite low. The prices of the 1950s were not much different than the 1920s — a high level historically, but not all that high, and not without precedent. Commodity prices in the 1920s were high because the economy was booming, and a lot of commodity production capability had been destroyed in the war. Much the same was true in the 1950s, and the result was also much the same. We see that these high commodity prices, compared to gold, persisted through the 1960s.

So, some of the confusion in Rist comes, I think, from insisting that 1940 is the reference point for all things. It was, by this chart, the lowest commodity prices relative to gold in the history of the U.S. up to that point.

As I’ve indicated, Rist’s ideas were somewhat confused, but not so strange considering what was known in 1952. However, certainly by 1960, these errors should have been cleaned up. As is so often the case, people just go on repeating dogma year after year and decade after decade.