Today we are updating our information about the Bank of Japan and commercial banks’ balance sheets.

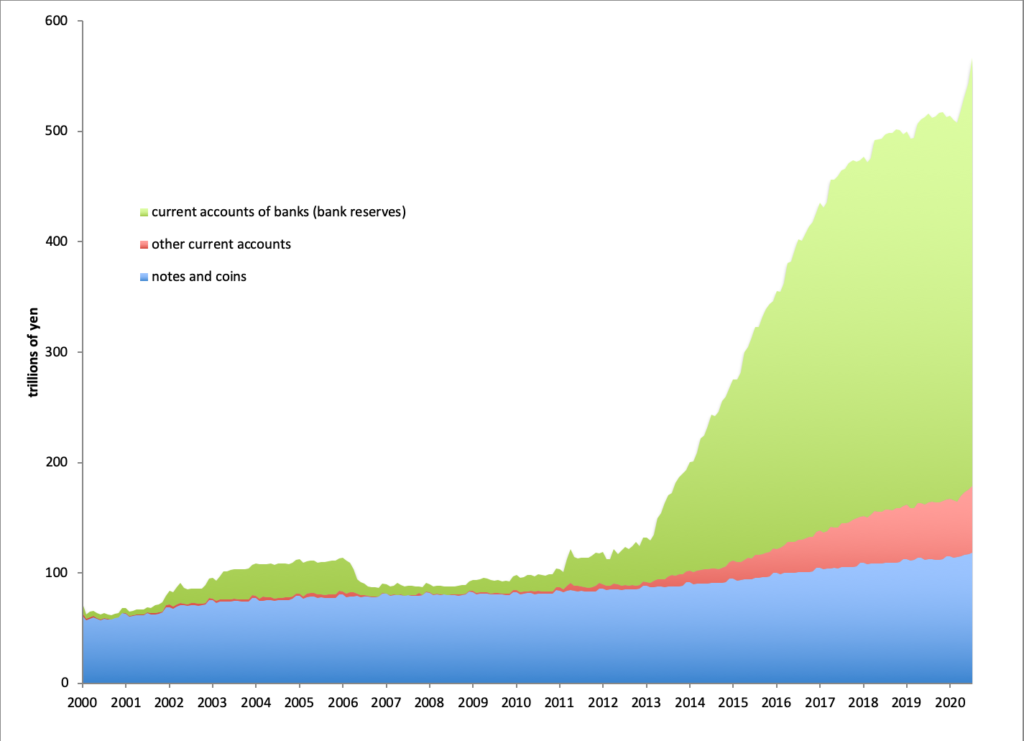

Although there was a lift in the monetary base in 2020, this was not so big as a percentage. This is in part because the balance sheet is so big already. So, the overall situation, odd as it has been already, hasn’t changed much.

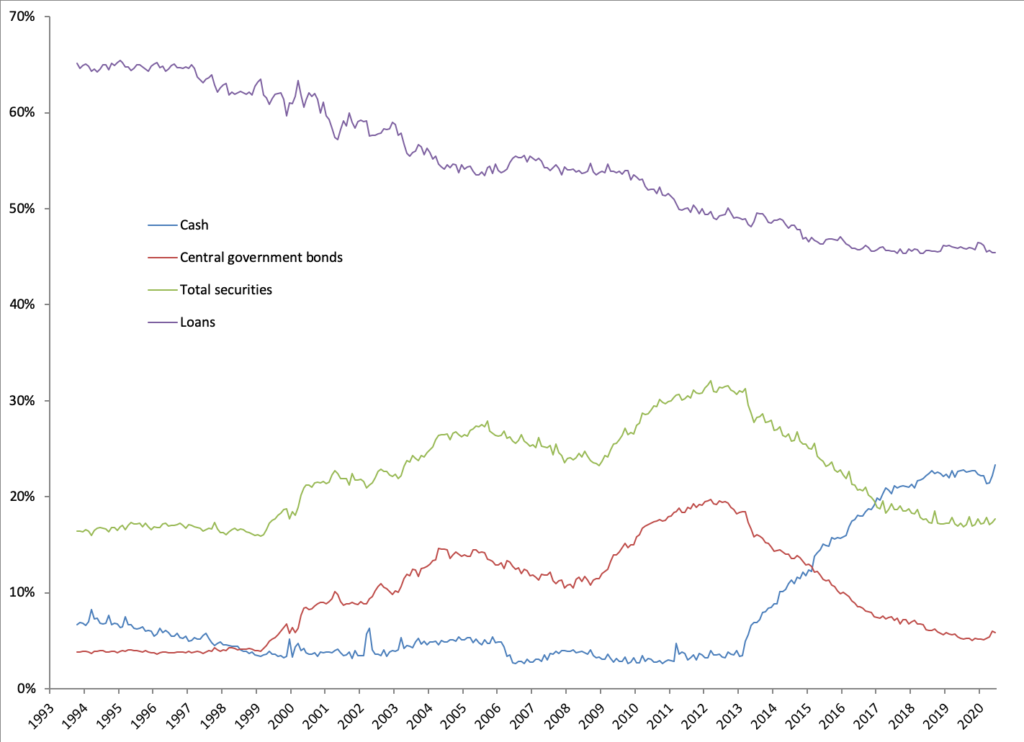

The expansion of the monetary base has led to a little rise in cash assets (as a percentage of total assets) at banks in Japan. But, the situation there hasn’t changed much either. Cash assets are very high here, around 23%, but as we have seen earlier, this has had precedent in times of crisis.

May 10, 2020: Monetary Systems During Crisis

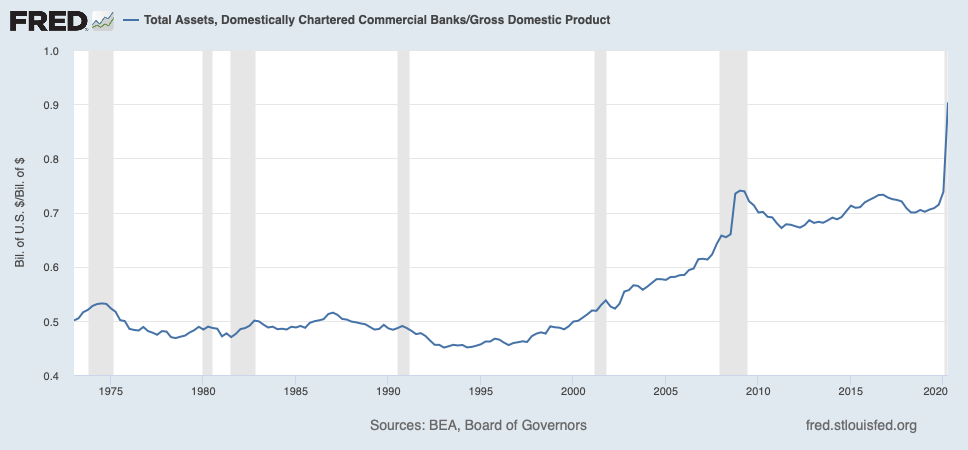

Basically, the Bank of Japan can get away with very high monetary base supply, if it is matched with corresponding demand. This demand has come from banks, in the form of bank deposits at the BOJ. This makes sense from a bank’s perspective: since both BOJ deposits and 10yr JGBs pay about 0.00%, there is not much reason to take JGBs instead of BOJ deposits. The yield is the same, there is much less risk of loss, and BOJ deposits, a form of money, are directly usable to satisfy obligations, while government bonds would have to be sold first. We can see that banks’ holdings of BOJ deposits have been swapped for JGB holdings. The total amount of JGBs held by the BOJ is a reflection of the very large size of banks in Japan, where bank loans are more common than direct finance (corporate bonds, MBS, etc.). It wouldn’t work where banks are smaller, compared to overall GDP, as is the case in the U.S. Even if US banks took on a similar percent of assets as Fed deposits (23%), that would translate to a monetary base that is a much smaller percentage of GDP.

US domestic banks’ assets were recently about 90% of US GDP. This followed a big expansion, due to the PPP loans and so forth orchestrated by the Treasury and Fed, on top of the drawdown of revolvers and so forth by corporations. (GDP, the denominator, also declined.) Previously, it was around 70% and, before 2004, around 50%. Japanese banks’ assets were recently 220% of GDP.

On top of this natural inclination, we have to assume a substantial amount of administrative arm-twisting (“guidance”). All in all, the overall situation hasn’t changed much from where it was two years ago, even after COVID.