I have been reading Turroni a little bit. I’ve had this for a long time, but haven’t read it until now. Among his worthwhile data, he has info on the German stock market during the hyperinflationary period. Let’s take a look.

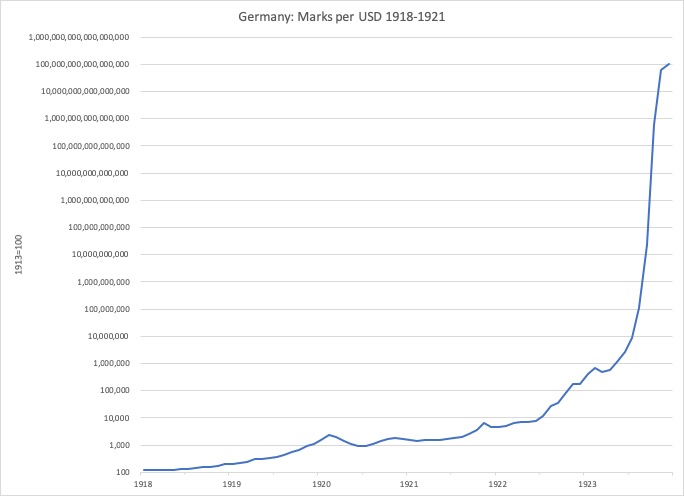

This is the foreign exchange value of the German mark, compared to the dollar; or, how many marks it took to buy a dollar. This is normalized at 1913=100. During the first half of 1918, the mark was trading at about 125 on this chart. In other words, just a bit lower than the 1913 gold parity level of 100. Surprisingly perhaps, Germany went through the war without much decline in currency value. Germany was basically winning the war, and advancing on Paris. But, in mid-1918, internal disruption in Germany (basically it was a sort of communist revolution) prevented supplies from reaching soldiers in the front lines. The army was incapacitated.

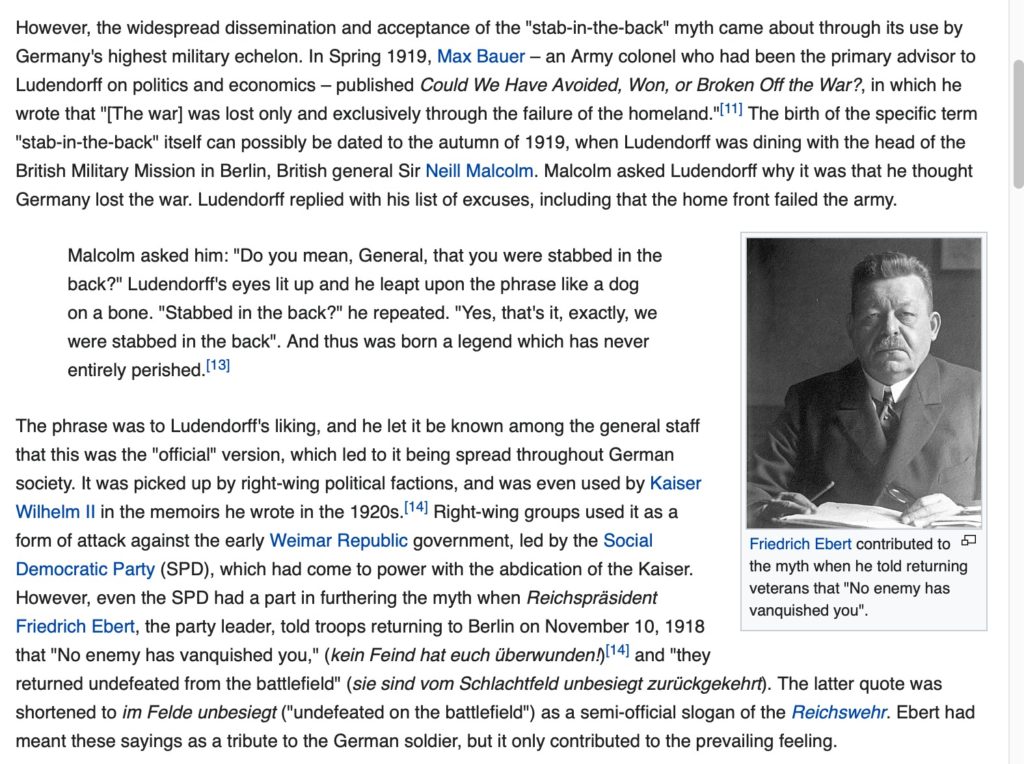

This is the “stab in the back” by communists that Hitler often referred to, but which is now denied by modern historians, although historians admit that communist strikes at ammunition plants and elsewhere did impair production. This led to the German Revolution in October 1918, and on November 9, 1918, the government of Kaiser Wilhelm II collapsed and was replaced by the German Republic (Weimar Republic), which was dominated by the socialist Social Democratic Party (SPD). Hostilities ended two days later, on Armistice Day, November 11, 1918.

Wikipedia on the German Revolution of 1918-1919

Wikipedia on the “Stab in the Back” story

Let’s see what General Ludendorff, supreme commander of the German military, said about it:

I should mention that the USD itself lost some value during this time, although we don’t have a good measure of that. The USD’s link to gold was restored in the second half of 1919, which also put a lot of pressure on foreign exchange rates around the world as the dollar rose back to its pre-1914 gold parity value. So, everything from about January 1920 onwards is more-or-less equivalent to the German mark’s value vs. gold.

Then, there was a time of some currency stability, 1920 and 1921, albeit at levels of about a 15:1 devaluation compared to 1913 and a 10:1 devaluation compared to mid-1918. There was another breakdown in the mark in late 1921, with its value falling to about 100:1 vs. 1913. Then, the “final clownshow” of billion-mark banknote silliness began around the middle of 1922.

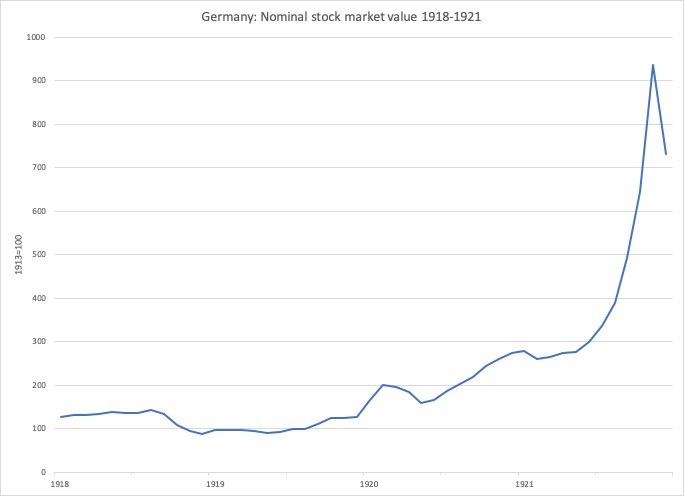

Now, let’s look at the German stock market.

This is the German stock market, in nominal mark terms, during 1918-1921. I am leaving off the further devaluations of 1922-1923 since obviously we get very large numbers, and who cares really. The interesting thing here is that the stock market was actually about the same level in 1918 as it was in 1913! Just as the currency didn’t lose much value during the Great War, so too the stock market didn’t lose much value. In early 1918, Germany was largely intact (the war had been fought in France and Belgium), and things were going pretty well for Germany. As the value of the German mark fell in latter 1918 and especially in 1919, the real value of the stock market fell of course, but the nominal value didn’t change much, either up or down, which is interesting. In 1920 and 1921, the stock market rose a lot in nominal terms, probably because the currency had been stabilized and things were looking a bit better. The currency value was much less, so there was a big loss in real terms. But, for many Germans, there was a bullish and euphoric tone to the stock market, which basically tripled in nominal terms. People who had their wealth in bank savings accounts and government bonds (the great majority in those days) did not get any such advantage. Then, in late 1921, as the currency broke down again, the stock market served as a store of value, again rising in nominal terms.

Here is the value of the German stock market in terms of dollars, obviously adjusting for the mark/dollar exchange rate. Because the dollar was linked to gold after 1920, this also represents the stock market vs. gold.

Again, we see that the USD value of the German stock market in early 1918 was not much different than that of 1913 (=100). There was a big plunge in the second half of 1918, and through 1919 including the Treaty of Versailles in June 1919. The market recovers in 1920 and 1921, again related to the stabilization of the mark. It was now down about 85% from its 1913/1918 level. As the hyperinflation intensified in 1922, the stock market crashed to abysmal levels, with the lowest level on this chart of 2.72 on October 1922. Yes, 2.72, compared to 1913=100. A 97% decline. Then there is some recovery in 1923, since German industry was not quite that worthless, and even a boom toward the end in 1923 perhaps reflecting a final flight into hard assets among German people.

From this we can see a few things. Stock markets, as a sort of hard asset, did provide some element of escape from the depreciation of the currency. But, unless you like a 97% decline, not so much of a safehaven as we might like. We can admit that, during the 1920s after the mark was returned to gold, markets regained much of their decline. So, “in the long term,” there was a much more substantial recovery of real value.

But, among Germans, the general mood was not despair at a 90%+ decline in real value. Rather, it was reportedly euphoria at big nominal gains, which were far better than getting devalued into oblivion in bonds and savings accounts. Obviously, the very best outcome was enjoyed by those who got into gold or dollars in 1918, and back into German stocks when they were supercheap in 1922.