From the beginning of industrialization, in the late 18th century, people have complained that “automation” and other productivity-enhancing developments have also led to job losses. This is true. So, what do we do about it?

Greater productivity = greater wealth. If you want to consume more, you have to make more. If you want to live in a bigger house, you have to build a bigger house.

This “greater productivity” has taken many forms, but a core element, over the decades, has been some kind of “automation.” Today, people are worried about being replaced by robots and artificial intelligence, but in the past they were replaced by steam-powered looms and motorized tractors.

In the past, about 70% of all people worked in agriculture. Today, the figure for the U.S. is about 2%.

And yet, nobody is hungry. This is because of gigantic increases in agricultural productivity. Not many people today want to go back to the ways of 1830, except perhaps with a 21st century theme (“permaculture”). But, along the way, 68% of Americans lost their agricultural jobs, more or less.

Every productivity improvement means doing more with less labor. Less labor means, in the first instance, someone loses their job. This is good, because that unused labor can now be used to create some new good or service. While before we only had Good A, we can now have Good A and Good B. Think of all the things now produced by that 68% of the U.S. working population that used to be involved in making food.

A “productivity improvement” means a capital investment. You have to buy the new steam-powered spinning loom, or the new information technology system that keeps track of inventory. There are also intangible forms of capital investments. For example, a large corporation might try a restructuring of management hierarchies, to reduce managerial bloat while also producing better managerial outcomes. This mostly just means people switch desks, and get new business cards. But, there is risk and effort involved. It takes time and effort. It might not work. Something is invested (time and effort, which means money), there is risk, and there is a potential reward. These “big machinery” examples are helpful thought exercises, but real “capital investment” in the economy takes many different forms. (In accounting terms, a lot of this capital expenditure is categorized as expenses.)

We can see that we don’t really need any new capital investment to keep doing what we have been doing. We need capital replacement, of things that wear out. In accounting terms, this is sustaining capex that offsets depreciation. Machinery eventually wears out, or a retail store eventually needs to be remodeled. This process does not create any new jobs. We just keep the same workers doing the same thing. Probably, over time, there are incremental improvements that allow us to do the same things with fewer workers. No corporation ever intentionally increased their number of employees to do the same amount of work.

Thus, we see that to create a new job requires capital investment. If a restaurant chain expands from 100 sites to 200 sites, then it must hire employees to work at the 100 new restaurants. Maybe a whole new business will be created. Maybe an existing business will offer new products or services. The hotel chain expands into monthly furnished apartment rentals.

We tend to focus too much on “entrepreneurialism,” which typically means a whole new company starting from scratch. This is nice, but most of the time, economic expansion and capital investment takes the form of a company expanding in its existing line of business, or expanding into a new line of business (typically closely related to their existing business). Whatever form it takes, the result is more goods and services sold, higher revenues, new capex and more employees.

Capital investment is risky. You are doing something new. It might not be very new — when a retail chain like WalMart goes from 857 stores to 858, that is not a big new risk. But, that one incremental new store might be a flop. It happens all the time. It is something new, and it is risky — just like an “entrepreneur” going from zero stores to one. WalMart going from 857 stores to 858, or offering a new service like eyeglasses in some of its existing stores, is “entrepreneurialism” just the same as a whole new business. It requires capital, and it produces jobs. Someone has to work at Store #858.

Thus, we see that, in the first instance, capital investment “increases productivity,” “saves labor,” and “destroys jobs,” but also, capital investment “creates jobs.”

WalMart might also introduce some kind of new information system that allows it to run its existing 857 stores with fewer employees. Now, the capital expenditure results in higher productivity, and fewer employees.

When we look at big business as a whole, we find that it is mostly pretty stagnant. The S&P500 stock index includes the largest companies in each major industry. The largest companies in an industry typically don’t grow much, because they already dominate the market, and the markets for most things don’t grow much more than GDP — probably less, actually.

Nominal GDP is growing about 4% a year, and “real” GDP has been growing less than this. Since Nominal GDP is basically equivalent to the sales of final products, and the sales of final products mostly consists of the output of the largest companies, we can see that big companies as a whole don’t grow much. There might be a few that are both big and growing quickly, but these are offset by other companies that are big and shrinking. However, these big companies are always looking for ways to do what they have been doing with lower cost, which usually means fewer employees. Thus, the general pattern for the biggest companies is that their incremental improvements (=capex) result in job losses. The growth in the economy comes from smaller companies that are getting larger, and which are absorbing the labor being freed up by productivity improvements in the large companies.

You can go around with these examples in your head for some time. But, we can come to some conclusions:

Productivity growth comes from capital expenditure (broadly conceived).

Productivity growth produces job losses.

But, capital expenditure is also necessary for new investments, which lead to more employment.

Thus, we need a lot of capital expenditure (investment in new business expansion), because some of the capital expenditure will lead to job losses; so we need more, on top of that, to absorb the labor that is being freed up by these productivity improvements.

In the emerging markets, which often develop very quickly, this has been called the “bicycle economy.” You have to keep pedaling! Industrialization in places like South Korea or Indonesia have meant that millions and millions of people that used to be engaged in agriculture and low-productivity industry (digging ditches with hand tools) are now freed up to do other things. But, they must have other things to do. After capex in motorized tractors and heavy equipment to dig ditches, which frees up millions of people to do other things, you need more capex to absorb the new unused labor. So, you build a steel factory and a factory for consumer products.

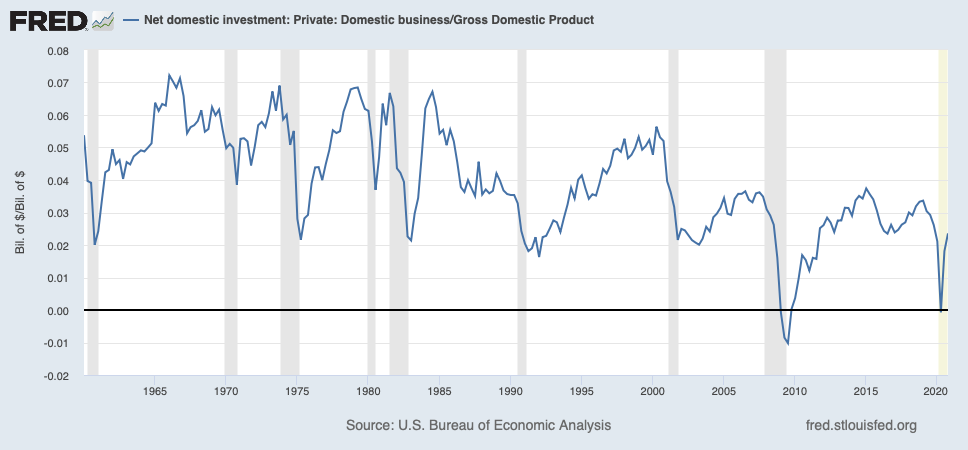

In the U.S., we have been doing this badly for a long time — basically, since the 1960s. Here is Net Domestic Investment by corporations, as a percentage of GDP. This is investment (capital expenditure) in excess of depreciation, or replacement capital.

We can see the high levels of domestic investment in the 1960s. Today, we are at about half of those levels. But, in the 1960s immigration was restricted, so the supply of Labor was limited. Today, we have had increasing Labor due to immigration as well. So, Capital is scarce and Labor is in excess.