We have been talking about E. C. Harwood‘s views of the Great Depression. These were expressed in his 1932 book Cause and Control of the Business Cycle. This is an interesting book for a number of reasons; among them, it was written in 1932, and thus represents what people were thinking at that time. Second, Harwood was not a “professional” academically-anointed economist, but a professor of Military Science and Tactics who naturally became interested in the economic problems of the time. He probably perceived that the so-called “experts” were failing horribly (which was true), and set about trying to discover their errors. There was an interesting comment I found from an academic economist from a meeting around 1932 or 1933, who said, basically, that the most dramatic events imaginable were happening all around them, and the economics profession didn’t have anything to say about them at all. The academics were still just shuffling around in their same old academic pedantery, just as they had been doing in 1928. If I come across that again, I’ll be sure to keep it.

February 28, 2021: E. C. Harwood on the Great Depression

March 7, 2021: E. C. Harwood on the Great Depression #2: Banks and Money

In 1933, with the encouragement of Vannevar Bush, vice-president of MIT, he founded the American Institute for Economic Research, which continues today. This was an organization independent of academia, which could, with its own independent genius, investigate the gigantic problems happening at that time — certainly a necessary thing for that time, and also today, where the basic idea continues with various “think tanks” such as the Cato Institute or Heritage Foundation. AIER itself continues its activities today, and has been at times a supporter of monetary reform including a gold standard. Recently, it has become the home of the Sound Money Project.

Today, I am responding only to this 1932 book, from the beginning of Harwood’s investigations, and not to his later books and writings. Probably, his thinking became considerably more sophisticated over time, possibly for the better, or for the worse. After 1933, he became an advocate for the gold standard and against devaluation, contrary to the many pro-devaluation and pro-floating currency economists of that time.

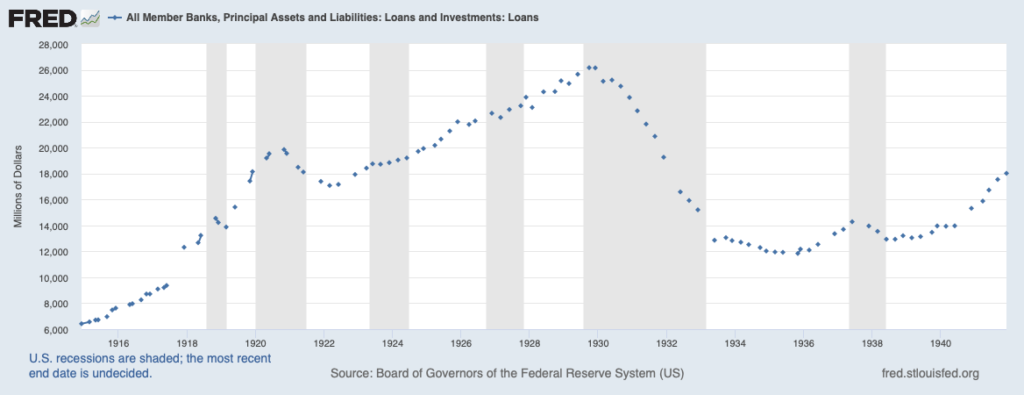

I said earlier that the Austrians, which were much more mainstream in the 1920s and represented common views in academia as well, had a great confusion between money and credit. This was not surprising, since in those days, commercial banks really did issue currency. I have not found anything particularly odd happening in terms of Money during the 1920s and early 1930s (before 1933 in the U.S.), when the gold standard was administered effectively, although even then it was troubled by various clumsy attempts to apply some kind of “discretionary policy.” There was an enormous contraction of Credit from 1929 to 1932, which certainly deserves attention — more attention, I think, than it has gotten. But, I have not found that this enormous contraction was preceded, caused by, or the natural outcome of, some enormous and unhealthy expansion of credit. Lending during the 1920s looks much the same as it did during the 1950s and 1960s, expanding gently in line with economic growth as a whole, and at much lower levels than we have become accustomed to today. There was a short but harsh recession in 1920-1921 that effectively cleared out any weak credits, including those related to wartime activities and the later demobilization. So, there was really only a rather brief window for new credit excess to form. Certainly there was some excess, including margin lending for stocks, and speculative real estate in Florida, but this was relatively minor.

Although Harwood’s book expresses the confusion between Money and Credit common at that time, it is, I would say, somewhat less confused than most. He concentrates almost entirely upon Credit, a worthy topic since, as I have said, it has been underexamined then and even today, and was the primary characteristic of the awesome economic collapse of 1929-1932. It is, as Ray Dalio has recently expressed, a common element of “business cycles” in general.

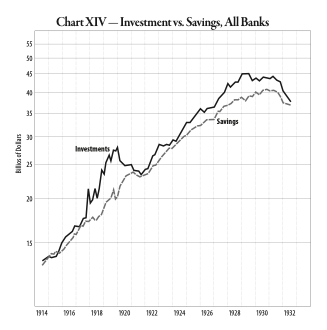

Unfortunately, after this promising start, Harwood concentrated solely upon a single topic, in which I don’t find much validity. As I understand it, Harwood’s basic assertion is that banks have two types of lending, and two types of financing (borrowing, or deposits): long-term “investment” lending, and short-term “trade finance” lending; and long term time deposits (called “savings”), and short-term demand deposits (considered “money”). Harwood says that banks should keep these in balance: that time deposits should be in line with “investment” lending, and demand deposits should be in line with “trade finance” lending. The problem of duration-matching in banks is a recurring theme throughout history which again takes center stage whenever banks fail. Harwood then takes these “imbalances” and implies that they later lead to all kinds of disasters. I don’t think there is any real “imbalance.” Banks’ assets and liabilities are always in balance. This is expressed on the “balance sheet.” Today, banks do not concern themselves overly much with duration-matching of assets and liabilities.

Here is the gist of Harwood’s argument: That “investments” (long-term loans) get ahead of “savings” (time deposits) during booms, and then contract during busts. From this, he soon argues that this correlation represents causation (through various arguments). There is not much more to it than that.

This argument is characteristic of economic thinking of that time, or what I have called the “Prices, Money, Interest Box.” “Interest” (the price of credit) can be expanded to “Credit” (the volume of credit). Economic thinking at that time was very mechanistic, as economists actively emulated the methods of physics and engineering. They talked of economies the way engineers talked of engines and electricity, in terms of unchanging absolute principles, devoid of any historical context. The “business cycle,” a hot topic in those days, is always conceived to be a sort of cyclic malfuctioning of an engineering process, like a steam engine that doesn’t run smoothly. (Apparently, this was an actual problem with steam engines and internal combustion engines, which was eventually solved.)

Harwood here refers to two “business cycles,” 1921 and 1932, with a brief historical look at previous cycles as well. But, his descriptions barely deviate from the Chart XIV above. They are devoid of historical context. Like …. World War I? He doesn’t mention it. How about the imposition of the income tax in 1913, and its rise during WWI in the U.S. from a top rate of 7% to 77%? How about the departure from the gold standard, in the U.S. and throughout the world during WWI, and the U.S.’s effective return to gold in 1919-1920? How about the postwar demobilization, which put millions of soldiers out of work? How about the socialistic policies of the Wilson administration, which continued wartime centralized control of industry after the war ended? How about the victory of Warren Harding in 1920, who promised a “return to normalcy,” discarding the central planning methods of the Wilsonites, and reducing taxes by huge amounts, which took the top income tax rate to 25% in 1925? None of this apparently matters. What matters is the squiggly lines in Chart XIV — in other words, the degree to which banks financed lending with time deposits rather than demand deposits. Eh?

James Grant wrote a pretty good book about the 1921 recession, which goes into a lot of these details. It is necessary reading, if you are interested in that time. Since Harwood actually lived through it, and actually voted in the 1920 election (presumably for Harding), he would know all about it.

I don’t want to bash on Harwood too much here, since this was common at that time, and remained common through the 20th century. Milton Friedman, with the advantage of 30 years of hindsight, did not do much better, blaming the entirety of the Great Depression on a reduction in banks’ demand deposits (since base money did not contract, but actually expanded). This was basically the Credit Contraction that I mentioned, looked at from the liabilities side of banks’ balance sheets (which must balance), as opposed to the asset side (the lending).

Also in the 1960s, Murray Rothbard revived common Austrian arguments from the 1920s and 1930s, blaming the process essentially on a big expansion of credit (which I have found no evidence for) which then led to a big collapse of credit (which certainly did happen), in the process also confusing a lot of Monetary arguments which have no basis in reality. This basic argument was, like Friedman, also in the “Prices, Interest, Money” Box. However, Rothbard, being also a good historian, could sense the inadequacy of this alone. Most of his book America’s Great Depression (1962) consists of a pretty good investigation of many of these other factors, especially the bad policies of the Hoover administration. However, although Rothbard mentions all these things that he senses were relevant, he was not able to integrate them into a coherent narrative or theory, and instead stuck with his “credit bubble” theory, which was really the revival of the arguments of the 1920s and 1930s Austrians.

It would be fun to write a book about the Great Depression sometime, since I have never found a good one, and the errors of that time, both in policy and historical interpretation, have led to the errors of today. But, that would take me at least three years of full-time work, so I will have to leave it alone for now.

In the meantime, George Selgin has written a pretty good account of the New Deal period. I disagree with some points, but I think he gets a lot of it right.