Today, I am again taking up the topic of Economic Nationalism, to see what we can make of it. This has been discussed for about two hundred and fifty years, but the level of discussion is very poor. Basically, it amounts to this: on one side are the “free traders,” arising from the time of Adam Smith, who basically argue that lower tariffs are better. Today (though not in Adam Smith’s time), they often argue that “free trade in labor,” or cheap labor via immigration, is also better too. Their arguments basically amount to the idea that people become wealthier when the government isn’t taking some of their money away via taxation — a good principle, generally speaking, but not necessarily a good one in all instances. There is no historicity to it: it is a principle that supposedly applies in all places and at all times. Adam Smith (or David Ricardo) argued that Britain should have more open trade with France. Today, I don’t think that people in the US are particularly concerned about free trade with the EU, Canada or Japan — basically, places where wages are about the same as in the US. They would agree completely that there should be free trade within the United States, and that States should not have tariffs against trade with other States, just as the EU allows free trade in Europe. But, these same people are very concerned with free trade with China or other low-cost labor centers. Why is that? To answer this question, we have to introduce some historicity, or geography. For some reason, China is different than Germany. Japan used to be different (in the 1960s), but now it is not. To simply wave the flag for general principles supposedly applicable at all times and places is just avoidance of the question.

Immigration in the U.S. has always been motivated by industrialists seeking people willing to work for lower wages. Otherwise, why bother? What benefit is there for American citizens? You could make some allowance for a small number of immigrants, perhaps those with demonstrable skills and abilities, or other desirable qualities — and this the U.S. has always done, even in the times when immigration was relatively low. Both Britain and Japan became world-beating economic powers with virtually no immigration at all. Even as late as 1890, almost all the immigration to the US was from Britain, Canada, Ireland, and Germany. (It’s worth noting the close connection between Britain and Germany, since England was populated by the Germanic peoples, the Anglos and the Saxons, after the collapse of Roman power in the fifth century. “England” literally means “Anglo-land,” and “English” is “Anglo-ish.” The native Celtic Britons eventually settled in Wales.) There was a burst of immigration from places like Poland and Russia after 1890, but soon the First World War shut down immigration, and it did not open again until the Immigration Act of 1965, which was basically motivated by the rising wages of that time. The Free Traders tend to be supported by businesses in search of cheap labor, obtained either from immigration or the goods created from cheap labor overseas, and obtained via free trade.

On the other side, we have the Economic Nationalists, who are always talking about the Current Account Deficit. This is a holdover from the Mercantilism of the 17th and 18th centuries. They tend to be in favor of some degree of protectionism (tariffs), and limited immigration.

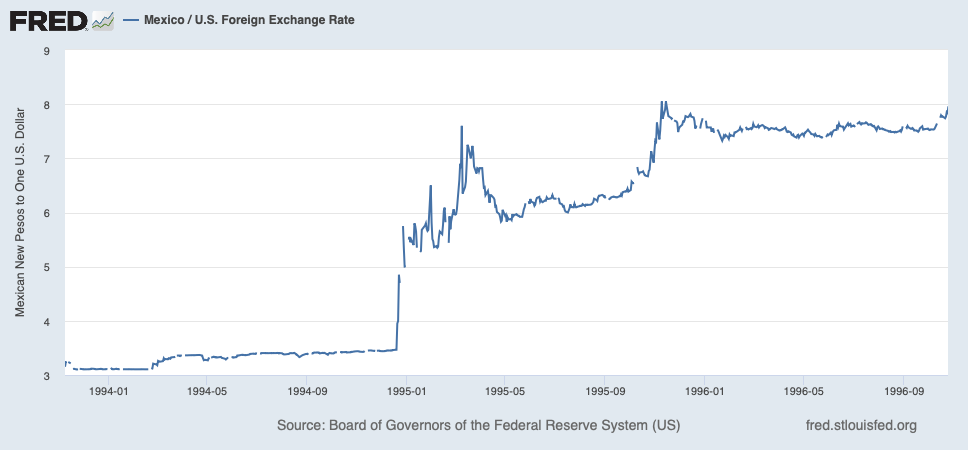

When I was researching Gold: The Final Standard, I came to understand that there really was a monetary issue in those days, which led to fears that gold and silver was leaving the country via trade, in some kind of destructive fashion. Thus, the idea that there was a domestic shortage of gold and silver, and you wanted to sell goods overseas and receive gold and silver at home (this being the only way to obtain gold and silver without mines), had merit. It was rather confused, and is not really relevant to our times, but the fixation with the balance of trade remains to this day. In modern times, a more serious issue is floating currencies, or currency devaluation, which can introduce artificial competitive pressures. This was “beggar thy neighbor devaluation” in the 1930s. More recently, it was the devaluation of the Mexican peso in 1995, which came, rather pointedly, just after trade with Mexico was opened via NAFTA in 1994. The US worker was mutilated. The Mexican worker, whose wages were also devalued along with the currency, was also mutilated, and I can imagine that inspired many of them to seek better conditions in the United States. What a mess.

So, today’s goal is to talk a little about the Balance of Trade, or the Current Account Deficit or Surplus, in a manner that might be instructive especially to the Economic Nationalists.

First, let’s get an idea of what, exactly, we are talking about. All Trade is Balanced, by nature. It is an exchange of one thing for another. It can never be imbalanced, because if someone offered to take something and give nothing in return, the exchange would never happen. In practice, there are also Gifts, and Gifts such as remittances from family members working overseas, or foreign aid, can actually amount to large figures. But, these Gifts are also “balanced” in the sense that there is no unresolved problem that arises from them. Each party is satisfied.

However, this balanced trade may have one part in the Current Accounts (goods and services), and one part in the Capital Accounts (equity and debt). Basically, China sells goods to the US, and takes “dollars” in return. Instead of using these dollars to buy US goods and services, Chinese entities (it is not “China,” or the Chinese government) typically purchases US assets, such as Treasury bonds. So, the trade is balanced, a trade of $1000 of goods for $1000 of Treasury bonds.

This is called a “Trade deficit” or “Current account deficit” that the US has with China (or, the Rest of the World), and China (or the ROW) has a “trade surplus” or “current account surplus” with the US. Let’s just look at the ROW for now, as that makes things a little simpler.

If a current account deficit is bad, and a surplus is good, but you can’t have a surplus without someone else having a deficit, this would imply that all countries are in a competitive battle, in which some can “win” only if others “lose.” It is not the kind of win-win situation, where both parties benefit, that we would like to have in our dealings.

Here there arises a discussion as to whether the current account balance (surplus or deficit) arises from Trade or from Investment. The answer is that it is both. If nobody in the US wanted to buy goods made in China, then Chinese people would not have any dollars. There would be no trade. The Chinese people then choose to buy Treasury bonds (a kind of investment) instead of buying US goods or services. Why do they do this? It is basically saving — they are reducing their consumption (buying US goods and services) in favor of accumulating financial assets.

Let’s look at another example. Until recent years, the US imported a lot of oil from overseas, including Saudi Arabia. Let’s say the price of oil doubled, for some reason. Since the US isn’t going to reduce its consumption of oil suddenly, this means that people in Saudi Arabia would get a lot more dollars. This seems to arise entirely out of trade. It is just the effect of a change in the price of oil, multiplied by the number of barrels of oil imported.

But, the Saudis then have a choice to make. Do they take these dollars and buy yachts built in the US (“consumption”), or perhaps US-made capital goods to invest in their own domestic economy, or do they take US Treasury bonds (“saving”)? Actually, buying a US-made capital good, like a complicated barcode-scanning system used in an automated warehouse, or a gas-turbine-powered electrical power plant, is also a form of investment, as is buying a US Treasury bond. So, either a good or a financial asset could be a form of investment, instead of consumption. They could take their oil profits, and invest in the oil business itself, purchasing a lot of oilfield equipment and services from US companies. This would also be a form of investment. Instead of acquiring a foreign asset (US Treasury bonds) with their “saving,” they have a domestic asset (more valuable equity in a domestic company). But, in our example, they take their dollars and buy bonds. This decision was a decision to “save” (invest in US assets), rather than “spend” (buy US goods and services with the extra dollars obtained by oil sales). So, we can see that the “current account deficit” that the US runs with Saudi Arabia (or the ROW) arose both from “trade” (higher oil prices) and “investment” or “capital flows” (decision to purchase Treasury bonds).

The US current account deficit basically represents domestic use of capital (investment), financed by overseas “saving.” Basically, there is more investment in the US than is financed by domestic capital creation (saving), so the difference has to be made up via the importation of foreign capital. For example, the US government sells its debt to foreigners because US savers alone haven’t saved enough to buy it all. (Actually, it is the balance of all saving and all investment, not just Treasury bonds).

From the standpoint of the US, this is good because it means there is more investment than would be financed by domestic savings alone. More investment means more jobs. It shows that the US remains a business-friendly jurisdiction that is attractive to capital.

However, it also shows that domestic savings, or capital creation, is weak. This is a bad thing. It is made weaker by US government budget deficits, financed by bond sales. This basically takes savings (capital) and, instead of directing it toward a company that would create new productive enterprises and new jobs, it is consumed by the government and basically disappears. Weak capital creation, and capital destruction by the government, are two bad things that are also reflected in the Current Account Deficit.

So, there are a lot of factors, good and bad, that are reflected in the Current Account Balance or Trade Balance. By itself, it is somewhat neutral.

I’ve asked: Would we still be worried about Economic Nationalism, even if the US had a Current Account Surplus? If we had a Surplus, would be still be worried about cheap overseas labor, or cheap imported labor via immigration? We would be selling more overseas than we would be buying, by definition. Although we might buy $1000 of Chinese goods, we would be selling $1200 of US-made goods and services. What then?

This situation would almost certainly be better. It implies a higher level of domestic capital creation. US savings (capital creation) is not only sufficient to fund all domestic opportunities, but there is some left over that seeks out foreign opportunities. Now, we are in the position of the Saudis. We sell US-made goods and services to the ROW, and instead of buying goods from the ROW, we buy assets such as stocks and bonds.

However, there still would be issues. I do not find that this alone would ameliorate all the elements of Economic Nationalism. For example, let’s say that the US ran a Current Account Surplus with the ROW, and capital creation was relatively ample. However, we still had a Mexican devaluation in 1995, right after implementing NAFTA in 1994. Many domestic businesses would be crushed. This is a factor of currency devaluation, but it applies almost the same for a country that is a source of cheap labor, even without the additional factor of currency devaluation. For example, NAFTA alone, without the devaluation.

Buyers of cheap Chinese goods have benefited from lower prices. However, we are concerned with the Bottom 30% of Americans. Have they benefited? We favor them, over workers in China or Mexico, because they are part of our Commonwealth. They vote. We live with them in our neighborhoods. We might be better off with somewhat higher prices for goods, if they were accompanied by much higher wages for the Bottom 30% — in short, less income inequality. We do not particularly care about the Income Inequality between people in the US and people in Sri Lanka. Even Sri Lankans don’t care about that. We care about the Income Inequality among Americans. In fact, we don’t actually care about “income inequality” at all. We don’t care if the rich get richer, if the Bottom 30% is getting higher wages. Ideally, the rich get rich from building businesses that hire people. We want those guys to get rich. But, if they are getting rich on cheap imports and cheap imported labor, while the Bottom 30% gets poorer, the factory closes and they are now competing with immigrants for remaining low-wage jobs, now we have a problem.

“Income inequality” is a natural fact of capitalism, particularly the modern variants where there are big businesses, as opposed to a lot of small independent craftsmen or farmers. A few people get spectacularly wealthy. This “income inequality” theme has been flogged for a long time by the Marxists, basically to promote their program of State Serfdom. So, the real problem is not really as acute as the Marxist-flavored commentariat asserts. Nevertheless, there has been, since about 1970, a tendency for the lower 50% of US society to stagnate or even sink back somewhat. They should also be benefiting from the prosperity of the society as a whole, just as was happening in the 1880s-1910s or 1950s-1960s. This is just grounds for complaint.

To conclude for today: We, in the US, would be much better off if we had higher levels of domestic capital creation (savings), one part of which is capital creation net of the capital destroyed by government deficits. We would also be better off with a more friendly environment for business and capital, which mostly means taxes and regulations. The beneficial effects of this may be enough to reduce the political pressures toward “Economic Nationalism” or “resolving income inequality” today. However, this still leaves many issues, if perhaps ameliorated, nevertheless unresolved.

There are a lot of related topics here, which I aim to look into in time.