We have been discussing how Russia could move to a gold-based ruble today.

March 13, 2022: How Russia Can Go To A Gold Ruble

In that item, I identified four points that suggest that Russia is in a particularly nice situation to make this move.

Reason #1: The present situation stinks. The ruble has been woefully unreliable, impairing economic performance and prosperity. This is the kind of currency behavior you see in “emerging market” countries that never actually “emerge,” but simply grind around at a low level of prosperity. It is certainly not the kind of currency performance we expect of a Great Power, or any country that has aspirations to leadership. Stable Money is one part of the Magic Formula. Often, countries achieve this “stable money” by tying their currencies, tightly or loosely, to a major international currency like the dollar or euro. More than half of all countries today do this, including China. This has a major advantage of facilitating trade with all others within the “dollar bloc” or “euro bloc.” However, such a currency also cannot serve as a meaningful alternative to either the dollar or the euro. Also, it implies a certain level of subordination to US or EU leadership — in the case of the euro, rather formal subordination. Also, while the floating fiat USD has definitely been an impairment to US prosperity over the past several decades, it has been tolerable enough. People do not have a strong urge to overturn existing arrangements and set off on a new and seemingly risky path. In Russia, however, people may be ready to abandon their current failing model, and embrace something new.

The alternative for Russia is some variant of its recent policy, which aims to stabilize the ruble loosely with the USD and EUR, with occasional disasters. We could eliminate the occasional disasters, and stick more closely to some kind of USD/EUR combo, not necessarily formalized as a currency board or currency basket, but maintaining some predictability, similar to the 75/USD level that was maintained for some years previously.

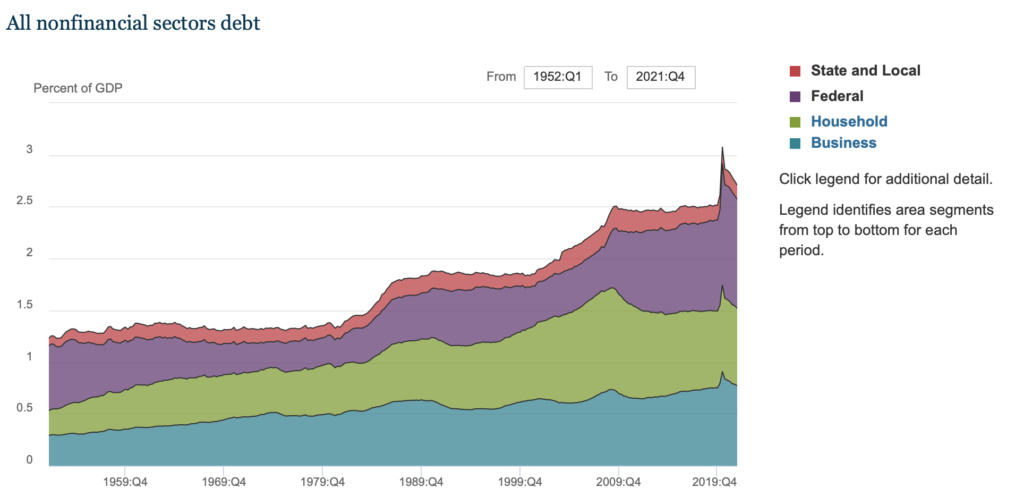

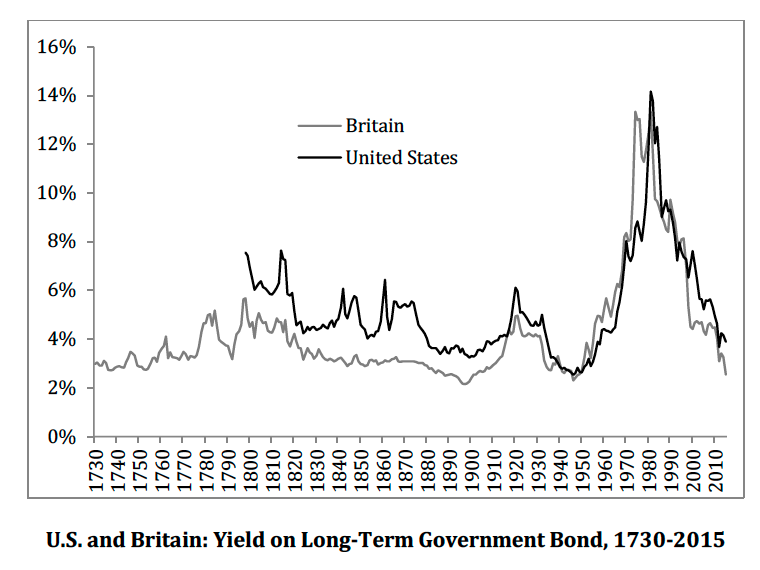

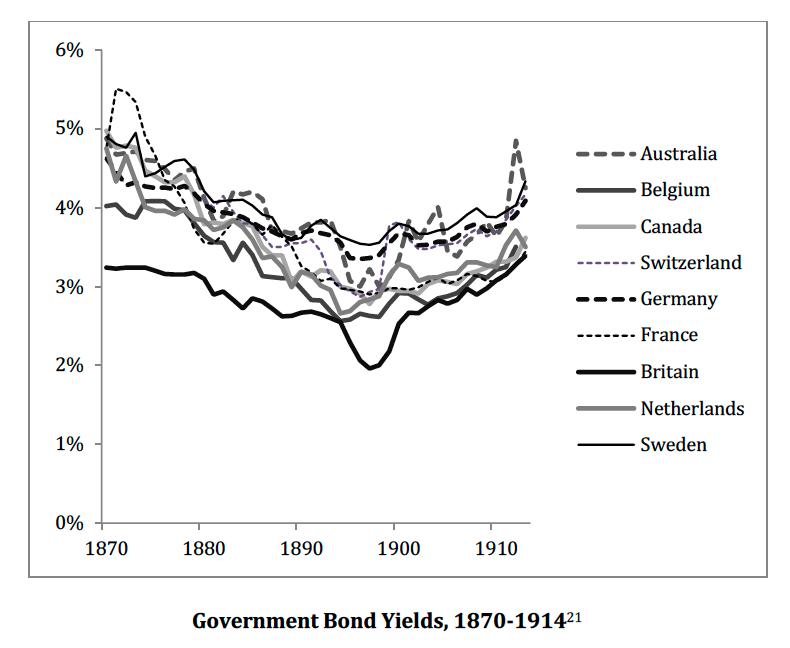

Reason #2: Russia does not have high debt levels. In the rest of the developed world, government debt/GDP, and in fact debt/GDP throughout the economy, is at very high levels. This makes people hesitant to embrace a “sound money” policy that would require them to pay back these debts in a currency that doesn’t lose value. There is an expectation these days that these debts will somehow be “inflated away,” gradually or suddenly. This is in fact what has happened over the last fifty years. The USD today is worth about 1/50th of its Bretton Woods value, vs. gold. In actual practice, the US and others, even Japan, would probably be better off adopting a Stable Money policy (such as a gold standard system), and just paying the debt off gradually and responsibly, as Britain did after 1815, and the US did after 1944. If the nominal amount of debt can be stabilized (government budgets balanced), then the debt/GDP ratio will fall to manageable levels over time as GDP grows. But, this level of discipline is somewhat lacking in the developed world today. Russia does not have this political problem.

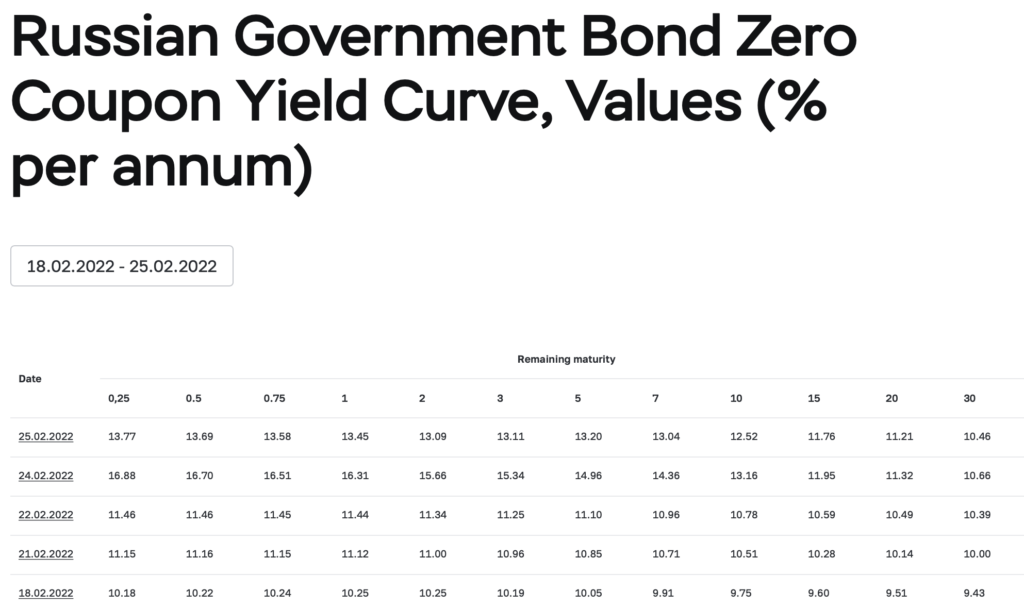

Also, the yield on Russian government bonds is rather high. One major reason why governments have adopted gold-based currencies in the past is because they can issue much more debt at much lower yields that way. The US paid about a 6% yield on its debt early in its history (when it was a risky emerging market country). This fell to about 3% when it was regarded as a top-quality credit later in the nineteenth century. Russia is presently paying about 12% on its debt. Getting paid 12% on a gold-linked government bond, from a government with a debt/GDP ratio of 18%, might be veeeeery interesting to investors.

Reason #3: Russia does not have close economic ties with the West. Trade is greatly facilitated by stable exchange rates. If Russia adopted a gold standard system, then even if gold fully played its historic role as a standard of stable monetary value, thus producing Stable Money in an absolute sense, there would be a lot of exchange rate volatility with the floating fiat dollar or euro. Basically, it would look like the USD/gold price today. However, in recent years due to sanctions, and definitely going forward, Russia will probably have fewer economic ties with the West. Corporations can still finance in USD and EUR if they want to, but USD and EUR lenders might be banned from this going forward. Russia’s chief exports, mostly commodities, have international markets where foreign exchange rates are less relevant. It probably would not take long before there was a “gold bloc” of countries (or individuals) that did business in gold-linked terms. This does not have to take place on the national level. There could be a “parallel gold bloc” of individuals and companies doing business in gold-based terms, buying and selling or borrowing and lending, even as they also do business in USD or EUR with others. This is already common throughout the developing world, including Russia, where it is common for businesses and individuals to do business both in the local domestic currency, and also USD and EUR.

Reason #4: Russia has plenty of gold. Existing official gold reserves are already sufficient to cover about 50% of the monetary base, at the previous 75 rubles/USD rate. (NOTE: Not 80%. See below.) A country like the US can certainly stabilize their currencies against gold, without having a lot of gold in a vault somewhere. However, the less gold they have, the more they need to make up for this with skill in currency management, which is rare these days.

These are all promising conditions. However, Russia has had a rather poor history of currency management recently, including the last few months.

Let’s look at the latest action of the ruble vs. the USD.

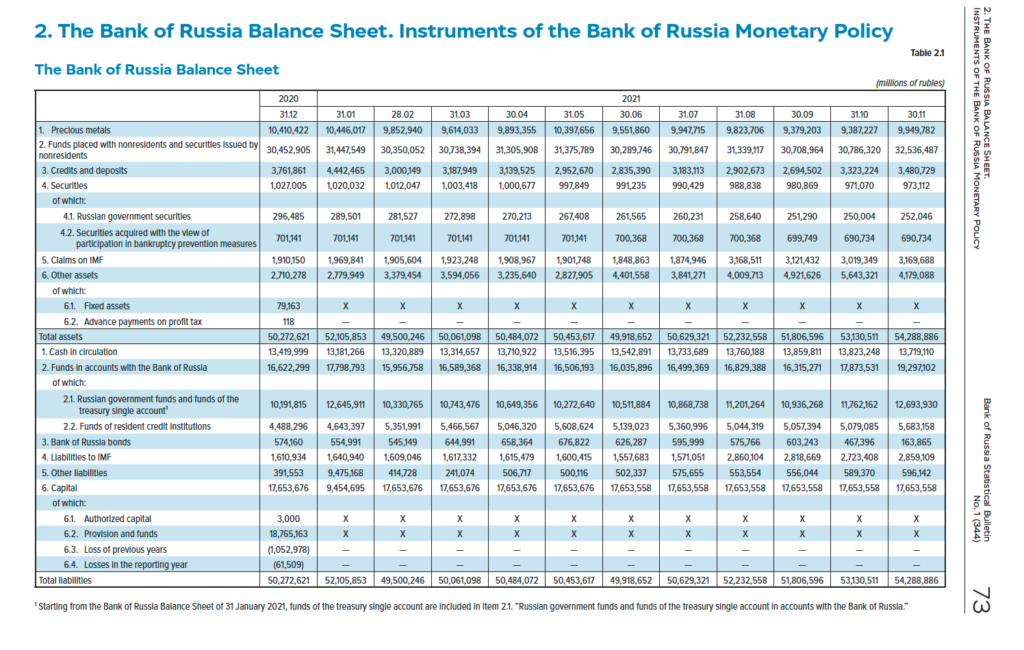

This is not so good. But, it might work out OK if the central bank managed the situation well. Let’s take a look. Here is the Bank of Russia’s balance sheet, as of November 2021.

This is important to get an idea of the terminology used, and how it is broken down on the total balance sheet.

We see that most of the Assets are “2. Funds placed …” which is basically debt denominated in foreign currencies, aka “foreign reserves.” There isn’t much Russian government debt. Also, there are some Claims on IMF, and a rather large 4 trillion rubles of Other Assets. This Other category has had quite a bit of movement, which suggest that it is some kind of tradeable security or market contract like a forward or swap, not a landholding, 100%-owned business or something of that sort. There was also 3.2 trillion of “credits and deposits,” which is the primary debt-based asset outside of the foreign reserves, and which is primarily discount-type lending to banks I would guess — a somewhat old-fashioned, but nevertheless effective way of doing things.

On the Liabilities side, we have 13.7 trillion of Cash in Circulation, which has been quite stable. Then, there is 19 trillion of deposits, mostly the account of the government itself with 12 trillion, and 5.7 trillion of “resident credit institutions” or bank reserves. These government accounts are related to the high foreign reserves, I think. Basically, it is the government’s claims on those excess reserves. It appears that Russia has not transferred to the kind of “high reserves” environment that we see in the US and elsewhere these days, although it is not very low either, as was common before 2008. This has some potential. There are 2.8 trillion of “liabilities to the IMF,” which offsets the 3.2 trillion of “Claims on the IMF.” Probably, these can be netted out.

Capital was a big 17 trillion, which is not too important but nice. This is basically the central bank’s claim on the excess reserves.

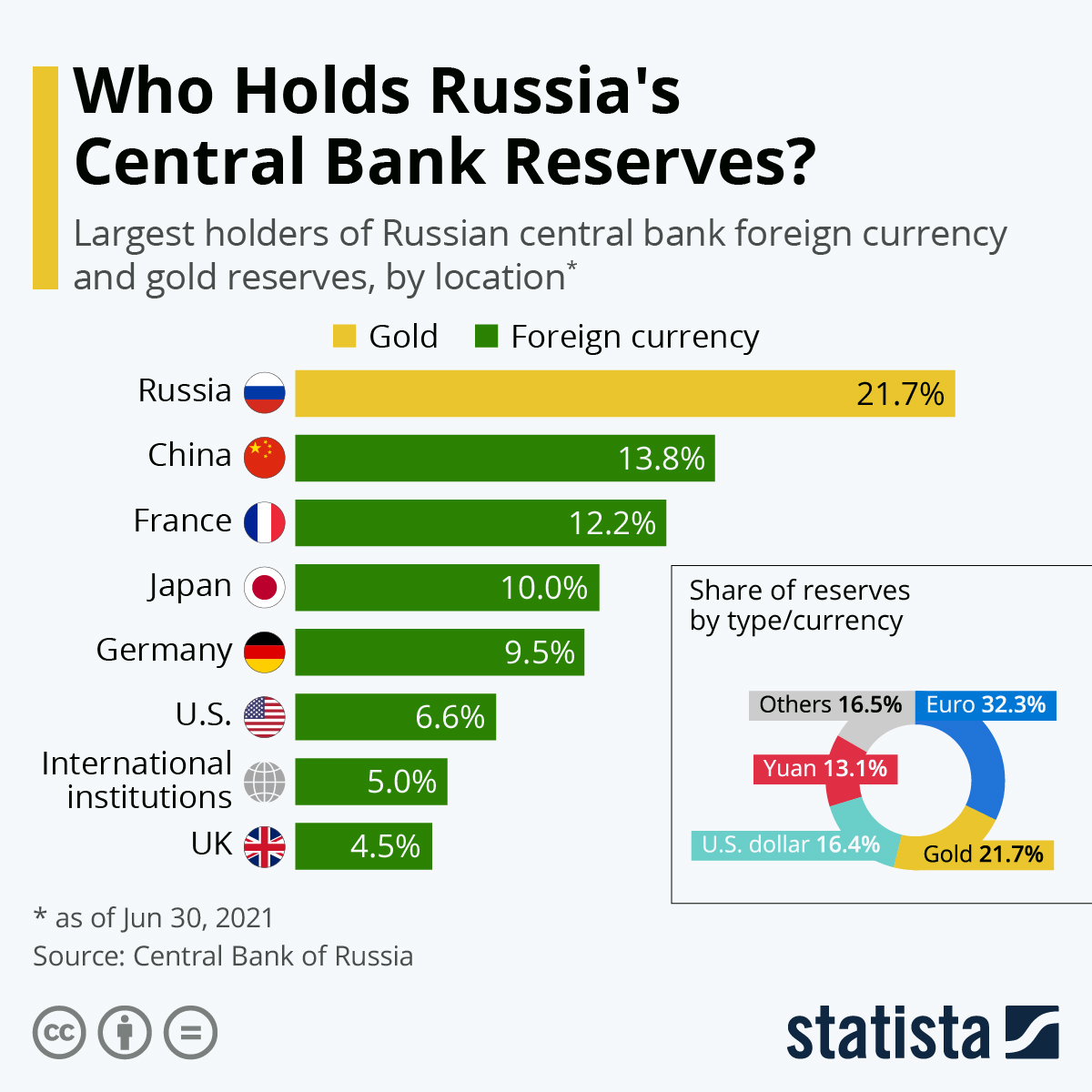

Of course, Russia’s foreign reserves are not so excess now, at least the usable reserves. About 17.6% of foreign currency reserves were held in Chinese yuan, perhaps the only foreign reserves that the Central Bank now has control over. This would be equivalent to about 5.6 trillion rubles.

The main business is the monetary base, which was the 13.8 trillion of currency in circulation, plus the 5.7 trillion of bank reserves. You could add some quantity for the government’s account, but we will use the “narrow” base here. This 13.8+5.7=19.5 trillion, against gold reserves valued at 9.9 trillion, or 51% gold reserve coverage — lower than the 80% I estimated earlier, but still plenty. Total reserve assets including 5.6 trillion of yuan-denominated foreign currency reserves and 3.5 trillion of domestic debt-based reserves comes to 19.0 trillion, which is right in line with the monetary base. Also, there was 4.2 trillion of “other” assets, so it looks like the Central Bank is still “solvent,” which doesn’t really mean much in terms of a central bank, but it does have assets to more than cover all liabilities. It is in a pretty sound situation.

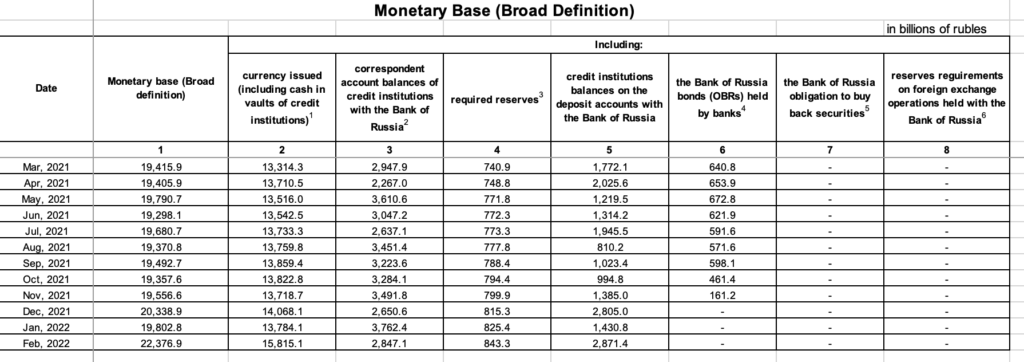

Here we have a little more updated info:

We see a big increase in Currency Issued in February (these are month-end numbers). Bank reserves are roughly stable, or expanding modestly.

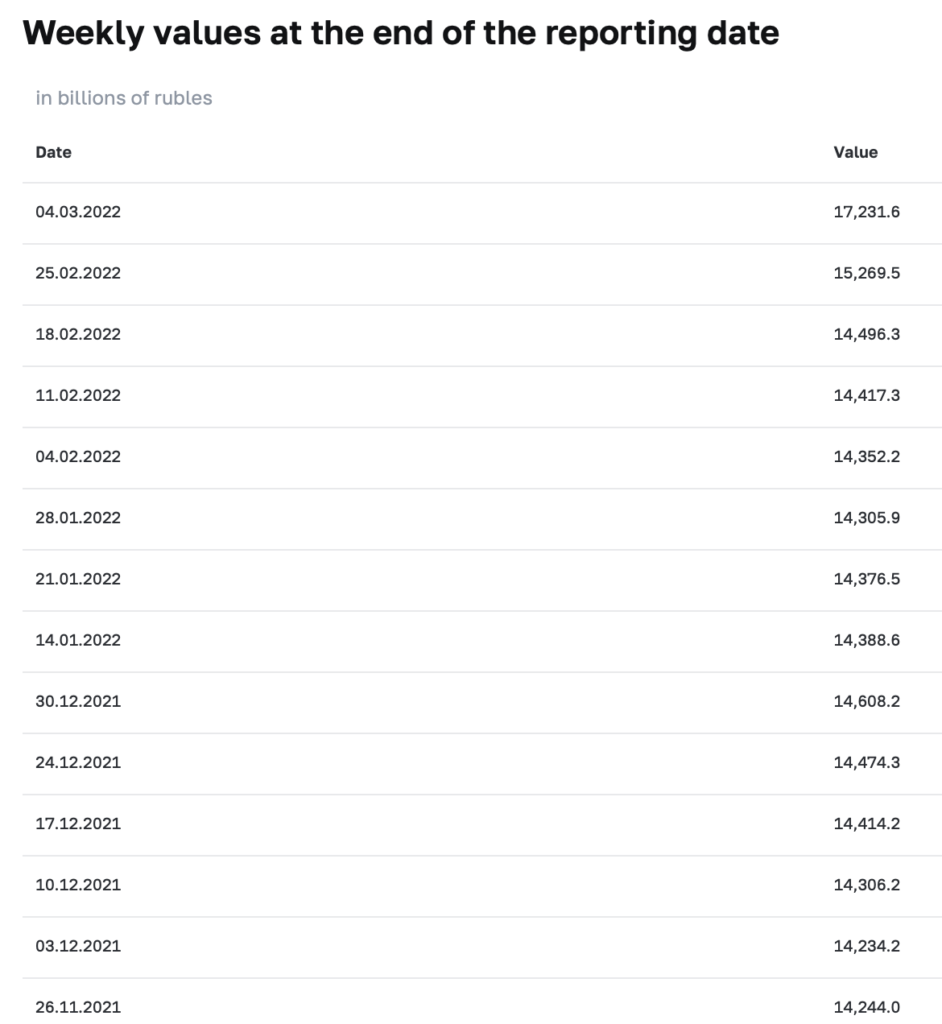

Here we have weekly values for the “Monetary Base Narrow Definition,” which seems to mean: currency in circulation plus “required reserves.” Here we see another big jump for the week of March 4, 2022, which I assume is almost all Currency in Circulation. In just two weeks, this “monetary base narrow definition” rose from 14.496 trillion to 17.231 trillion, or +2.73 trillion (+18.9%). Basically, the central bank has been printing money — literally printing money, since these are almost all “currency in circulation,” actual paper banknotes. When you look at the behavior of the RUB/USD during this time, it is maybe not so surprising. I will get into a detailed discussion of why the central bank has been printing money, and what its alternatives are, soon. But for now, let’s just get more detail on what has been going on.

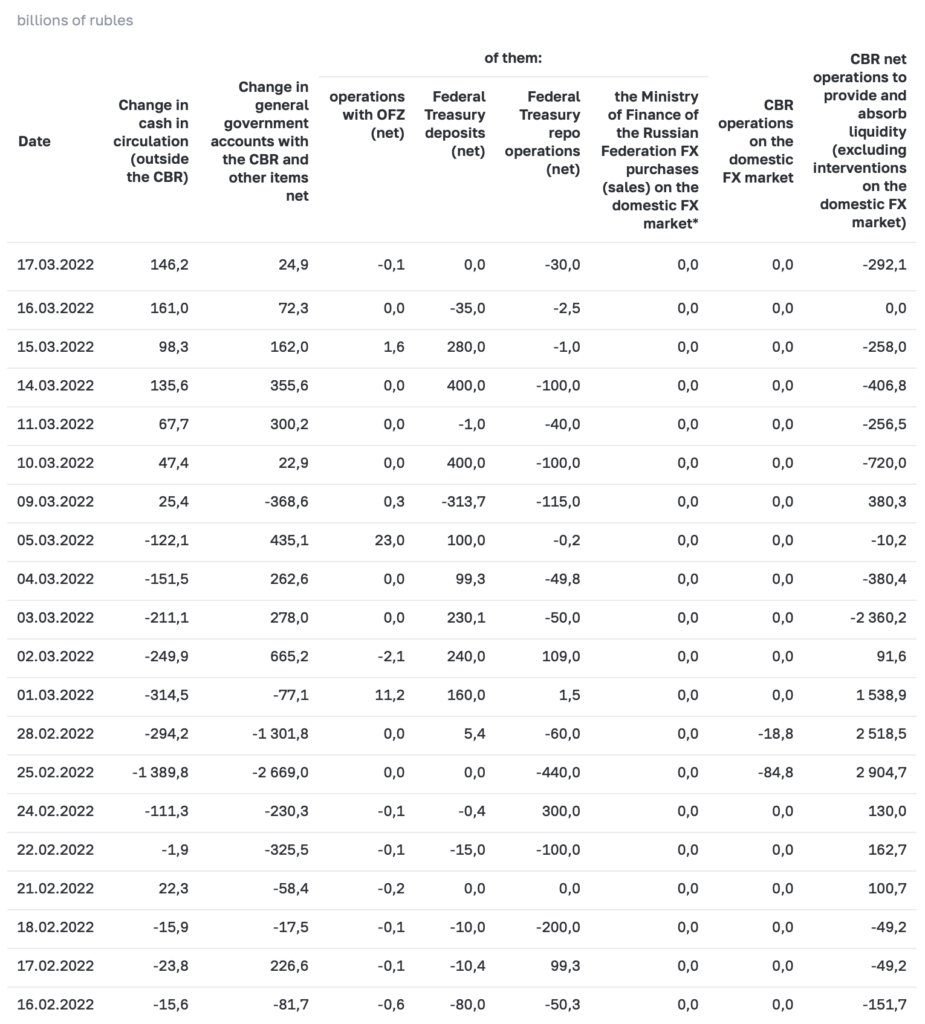

This is the daily “factors affecting banking sector liquidity.” Here, a negative seems to indicate an increase in cash in circulation (since the cash is withdrawn from banks).

There were some big cash withdrawals between February 25 and March 5, but it seems that these have reversed since then. People are putting their cash back in banks. This could be indirect — people are buying something with the cash, and then the seller puts the cash back in the bank. It adds up to 2.6 trillion of new cash being created by March 5, and 680 billion returning since then.

This is good, since it seems like things have stabilized somewhat. But, let’s talk about some of the principles involved.

We had a bit of a banking crisis, which seems to have been accompanied by banks borrowing from the Central Bank, and also, people withdrawing cash from banks. It is important here to distinguish between the liabilities and balance sheet of banks, and that of the central bank — and also, the responsibilities of each.

The responsibility of commercial banks is to meet it liabilities (pay its debts). The primary liability is bank deposits. Here, we have a classic problem of duration: banks borrow short and lend long. If there are withdrawals on banks, especially “systemic” withdrawals (all banks at once, ie, a crisis) they may have to borrow to meet their obligations. Often, this will mean borrowing from the central bank.

If the central bank lends this money, it will increase the monetary base. It is increasing the amount of money in circulation. This might be OK, or it might not be. How can we tell?

People might be withdrawing banknotes from banks, and sticking the banknotes in a shoebox. The demand for currency rises. The central bank can meet this demand by printing new money. This is not a problem (the currency value won’t fall), if the new money simply meets this new demand. People are holding the money, not spending it. The central bank, on the asset side of the balance sheet, has more discount lending (or variants of this) with banks. More assets and more liabilities.

But, if the currency’s value begins to fall with this increase in the base money supply, then the central bank must reduce the base money supply. For example, if it has foreign reserves in USD (a problem here obviously), it could buy RUB in the open market at 75/USD. If people are “panicking into dollars,” then the RUB base money supply would contract as the central bank took rubles in return for USD.

If the central bank continued with this, making new loans to banks and then selling USD, the net effect would be a reduction in USD reserve holdings and an increase in bank lending, or no net change in the monetary base. This could conceivably go on for a while. Banks’ balance sheets would see a reduction in deposits and an increase in borrowing from the central bank.

At some point, the central bank may say: no more. At this point, if banks continue to experience withdrawals, they will have to restrict withdrawals. In other words, banks would have to deal with the problem at their level, and not rely upon central bank money creation or lending.

For the central bank, one of the main reason that people panic out of bank deposits is because the value of the currency is declining. Thus, the central bank must prevent this. Normally, this would mean offering to buy the currency (convert to reserve assets such as USD or perhaps gold) at some price. The monetary base must contract by the amount of the transaction (it would be “unsterilized”).

I am not sure that I am expressing these topics very well here. Actually, these principles are not much different than Walter Bagehot expressed in his 1873 book Lombard Street, which described the workings of the Bank of England. While Bagehot is remembered today for his “central bank should lend freely in a crisis,” this was also tempered by other rules which had to do with maintaining the British pound’s parity with gold. Today, with floating fiat currencies, central banks don’t have that second constraint, so only the first “spew money all over the landscape” is observed. Those central banks that do have a constraint tend to be in the “currency board” model, where the lending function is essentially provided by commercial banks and then central banks of the target currency. This “currency board model” might nevertheless work well with gold, which is a topic that we can discuss later.

For now, Russia’s central bank must cease expanding the monetary base, to support the currency’s value. Ultimately, if there is no new money creation, the currency can only fall so far. Unfortunately, it can still fall quite a ways, even when the monetary base is basically unchanged. Monetary base expansion can be constrained and reversed by reducing lending to banks. However, it might be more effective to reduce the monetary base by selling remaining foreign reserves, primarily Chinese yuan, boosting the ruble to an appropriate level, which I suggest is around the 75/USD level of just a few weeks ago. Another option is, of course, to sell gold — probably at a price around 4500-5000 rubles per gram. Either choice must be “unsterilized,” resulting in a corresponding decrease in the monetary base. Once the reliability of the currency is confirmed, the impetus to sell is reduced. Ultimately, Russians will need to have some amount of currency, to do business with.

There are a number of complicated factors here, which I wanted to begin to discuss although this description so far is really inadequate. Later, we will discuss how to actually implement a gold standard system in Russia right now, with all of the particulars of the present situation.