Ronan Manly, of BullionStar, wrote a very detailed and interesting roundup of the development of a new major gold bullion market in Moscow.

So far, this falls short of a “new gold standard,” or, fixing the value of currencies to gold — either existing currencies, such as the Russian ruble, or some new currency-type system.

But, it is a necessary part of that system. Probably, a new functioning system will need some way to actually transfer gold bullion, in large size in a deep and liquid market. Given the present situation, Russia, or China or India, does not want to use existing infrastructure mostly centered around London (LBMA) or New York (Comex), or the paper derivatives markets built upon these systems.

There are some hints that an actual gold-based currency of some sort (probably an electronic format, similar to GoldMoney) is in the works. This is from a Russian news site:

According to a EEC spokesman – ‘On July 11, Sergey Glazyev, Minister for Integration and Macroeconomics of the Eurasian Economic Commission, held a meeting to discuss a proposal to create an international standard for the precious metals market as an alternative to the London Bullion Market Association (LBMA) and infrastructure for the circulation of tokenized gold and precious metals.

The meeting with Glazyev was attended by experts from the ministries of finance and central banks, national exchanges, producers of precious metals, as well as other interested organizations of the EAEU states.

There was some material (in Manley’s article) about more ambitious steps toward a gold-based system, expressed by leading intellectual Sergey Glazyev.

On a ‘Eurasian standard”, Glazyev says that:

“this Eurasian standard must first be agreed with our partners, for example, in the SCO.” Russian gold will be quite liquid on the Asian and global markets in general, regardless of the position of Western countries.

At the same time, we could introduce a new international payment and settlement instrument – a stablecoin pegged to gold – and offer it to all Asian countries.

In the future, other commodities produced in the SCO countries can be added to gold as collateral for the new world settlement currency.

Together with a pool of their foreign exchange reserves, this would become the basis for creating a very stable and reliable payment instrument, an alternative to the current ones.”

The reference by Glazyez here to ‘stablecoin’ resonates with the reference by the EEC spokesman to Glazyez’s 11 July meeting where they also discussed “infrastructure for the circulation of tokenized gold and precious metals.”

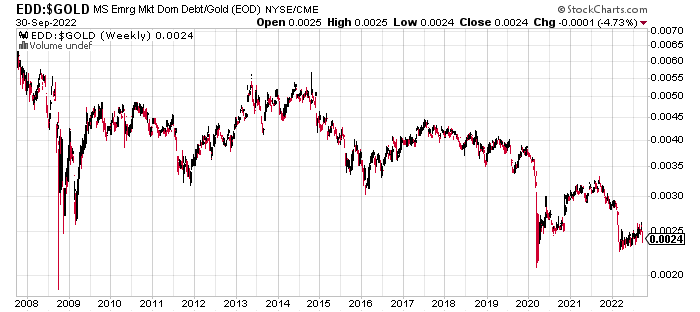

Glazyev is still pushing the “fruit salad” approach for some kind of international trading unit, some kind of basket of floating fiat currencies of participating members, plus a broad commodity basket. I do not like this idea much. If you take a bunch of low-quality fiat currencies (Russian ruble, Indian rupee, Brazilian real, etc.) and put them in a box, you get a box of low-quality fiat currencies. A real-world example of this is the Morgan Stanley Emerging Market Domestic Debt Fund (EDD):

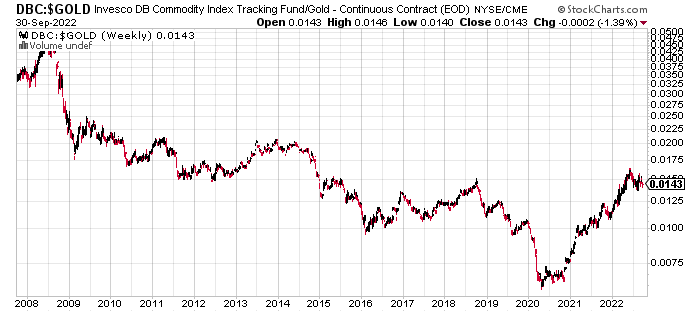

Here is the same, compared to gold:

Not really my idea of a good time.

I generally agree with the idea that “diversification” among various individual industrial commodities will produce a more reliable standard of value than any one item alone. If you are making a standard of value, one that contains copper, lead, tin and aluminum would be better than using any one single base metal as the standard. However, gold is better than any such commodity basket, and also, better than any box of floating fiat currencies.

The same holds for junky, low quality currencies. On balance, a basket of these, as a standard of value or some basis of commerce, would be more desirable than any single currency that is in the basket, if they are all of roughly the same quality. However, a single currency of high quality — let’s say, the euro, excepting some recent performance — would probably be more desirable than any basket of low-quality currencies — let’s say, an equal-weighted basket of all the currencies of Latin America. But, gold would be better than this basket; and also, better than any of today’s floating fiat currencies.

Plus, who is going to manage this? Would it be some kind of “international organization” like the ECB? Or would it be a national organization? Either could be problematic. One reason for the interest in the “fruit salad of junky low quality currencies” is that there is an existing supply of bonds denominated in those currencies, which could be used as a reserve asset. If you were to have a currency based on gold alone, you would want a large liquid market in gold-based bonds to serve as reserve assets. But, it seems to me that it would be pretty easy to develop such a market. For example, Russia’s government, as it refinances its existing debt, could refinance into gold-based bonds. They would probably have a yield around 5%, instead of the 11%+ that Russia is now paying on ruble-based bonds, which would be a nice thing.

The easy way forward, it seems to me, is just to do this, that and the other. You could develop a “currency basket” currency pretty easily. Just set that up. It could be entirely in electronic form, thus eliminating the need for a new series of banknotes. Then, you could set up a “commodity basket index” type system. Then, you could offer some kind of mix of the two. And of course, you could offer a gold-based system.

The main issue, it seems to me, is: What denomination do you want to finance in? There are a lot of bonds out there, in junky domestic currencies, and also international currencies including USD and EUR. These will have to be refinanced in time. Do borrowers and lenders wish to hold currency-basket bonds, commodity-basket bonds, or gold bonds? I think gold would be the most popular.

I get a strong sense of “feeling your way in the dark” from these missives. Clearly, even Glazyev, the “fruit salad” guy, also senses the need for a gold-only vehicle of some sort. He mentioned several times a system of “tokenized gold and precious metals.”

As it is, the Russian Ruble has been bouncing around at 2019 levels vs. gold. That is not a bad place to be. I would not want the ruble to rise much beyond this, as that could create problems generally known as “monetary deflation.”

This is around 3000 rubles/gram. If the Russian government wanted to stabilize the ruble at 3000/gram, here’s how you do it:

- Offer to buy gold at 3000 rubles/gram. Obviously, if the value of the ruble is above 3000/gram, let’s say 2900/gram, then everyone with gold to sell would sell it to the central bank (or other currency issuer). The central bank would be the highest bidder. The central bank creates new base money to fund these purchases, thus increasing the base money supply and causing the market value of the ruble to fall to the 3000/gram target. This is basically how stablecoins like USDT Tether work, and also currency boards.

- If the ruble’s value is below 3000/gram, let’s say 3300/gram, then sell assets such as domestic government bonds, foreign reserves, etc. and receive rubles in payment. These rubles disappear, thus shrinking the monetary base by an equivalent amount. The shrinkage of the monetary base supports the currency.

As we can see here, we have a system were we cap the ruble’s rise by buying gold, and support the ruble’s value by selling non-gold assets. This will, on balance, cause a rising gold reserve, which is presumably a goal at this time. Later, when gold reserves are deemed adequate, you can have two-way trade in gold bullion.

I described this basic process in much more detail here:

How Russia Can Go To A Gold Ruble Series

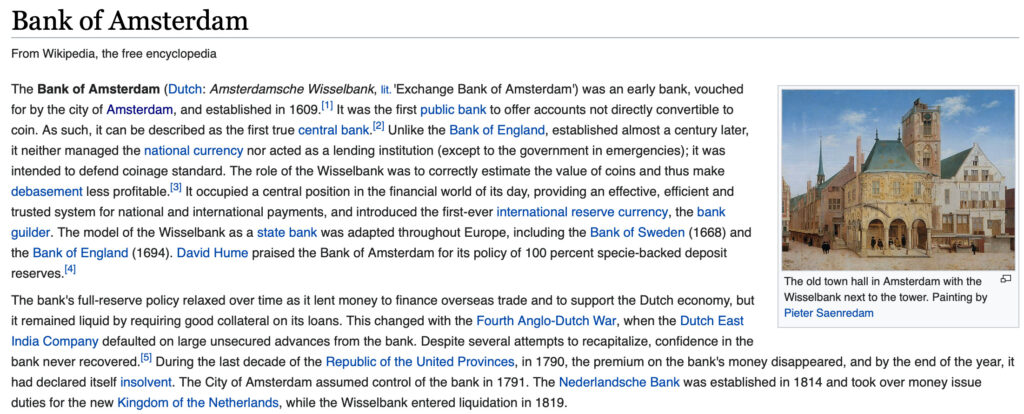

However, you can also set up a separate system, independent of the existing ruble for now. For example, it appears that major Russian banks already have “gold savings accounts.” It would be easy for Russian banks to also set up “gold checking accounts,” which allow transfers between account holders. This is basically the system used by GoldMoney, although perhaps not the 100% reserve aspect. It is also the system used by the Bank of Amsterdam in the 17th century. So, it has been around a very, very long time.

As I said, you don’t need to have a “100% reserve” system. The Bank of England never did. Did you get the part about “providing an effective, efficient and trusted system for national and international payments, and introduced the first-ever international reserve currency”? We’ve done all this before. It would be embarrassing if we, today, can’t do it as well as the Dutch of the 17th century.

The Bank of Amsterdam had no banknotes or coins. It was an entirely “digital” system, although in those days that meant numbers in a ledger kept in pen and ink.

Once you have the ability to make payments using these “gold checking accounts,” you can have contracts or bonds denominated in gold. You would actually make payments in these gold checking accounts, so nobody would actually touch gold bullion, most of the time. But, these checking accounts should be “redeemable” (“withdrawable”?) in gold bullion. I suggest a choice between 1kg bars, or 10 gram coins.

It would be good to have a regular circulating gold coinage. This should not have a “denomination” in rubles or etc., but just be a reliable coin. If you are using grams as a basis, instead of troy oz., then the 10 gram coin seems about right. This is just about the same as the British gold sovereign coin, worth one British pound, that was common in the days of Queen Victoria. (It contained 7.32 grams of pure gold. The total weight was 7.98 grams of 91.7% gold alloyed with copper.)

Of course, you should also remove all taxation and other impediments to transferring gold, or gold-based vehicles such as “gold checking accounts.”

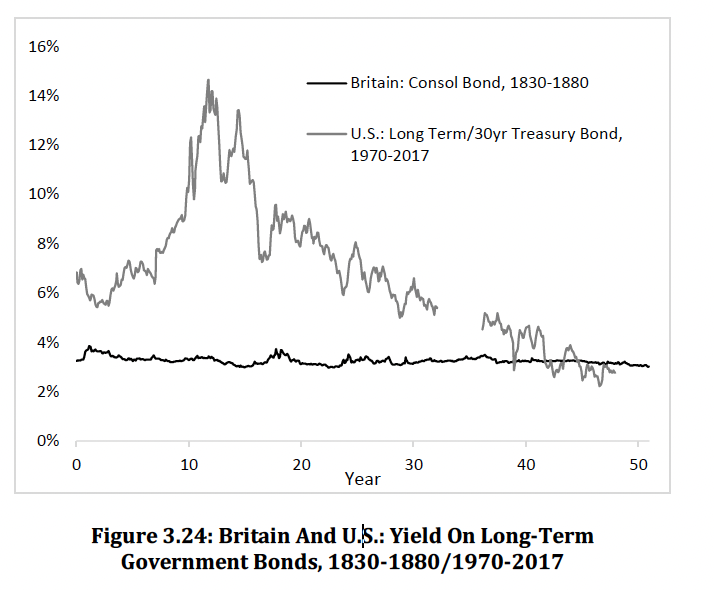

The main thing now is developing both a payments system, and also, a basis for finance — loans and bonds. We have thousands of years of history of interest rates on gold-based loans.

Yields on gold-based bonds are very stable and reliable. There is no possible way that any “fruit salad” system is going to produce a better result. It has never been done, because it cannot be done.

But, in the interests of variety, we can also set up “checking accounts” in some currency-basket system. It is not really that hard. Think of a short-term bond mutual fund that holds bonds in five different currencies: USD, EUR, GBP, JPY and SFR. (This would be unhedged of course.) That is basically a “currency basket.” Or, it is a “savings account in a currency basket.” By that I mean that it is investible (you can own it, buy it and sell it), but not transferable (you only transact with the mutual fund company itself). Then, make it transferable, or a “checking account in a currency basket.” This is very easy to do, and any major bank that already runs checking accounts and mutual funds can probably get something up and running in a month or two.

Eventually, you can develop an app similar to Venmo or Zelle that allows easy small-scale payments.

A “commodity basket checking account” would be a little more difficult, since it is not easy to store or transfer industrial commodities. The equivalent today would be some kind of futures-hedged vehicle like the Invesco DB Commodity Index Tracking Fund, an ETF with the ticker DBC. This fund owns no physical commodities. Obviously, if you are going to somehow integrate payment in physical commodities, or set things up without using existing US/UK/Europe-based commodities futures markets, it would be a lot more complicated. So, I would recommend setting up a gold-based and foreign-currency-basket-based alternatives first, and get to the commodities stuff later if you want to.

Here is DBC compared to gold:

Later on, if you really want to, you can swirl these three systems — gold, currency basket, commodity basket — into some combined form. I don’t recommend it. But, people could even do that spontaneously. If someone wants to issue a bond deliverable in 50% gold and 50% commodity baskets, why not? Let people be creative.