Alan Greenspan is a gold guy. His 1966 essay “Gold and Economic Freedom” remains a popular touchstone.

But how many people actually read it? Click on the link and give it a try. Actually, it is a hodgepodge of confusion. I would say that Greenspan, like a great many other gold standard advocates, did not quite understand exactly what it was that he was an advocate for. For example, he doesn’t say anywhere that gold’s primary virtue as a monetary benchmark is that it is stable in value. He knew that a “gold standard” meant keeping a “stable price of gold,” which is to say, the ratio between the currency and gold. But, I would say that this was something in the nature of a tradition, almost a superstition, that was not properly understood.

Here is a link to Greenspan’s 1981 WSJ article, “Can the U.S. Return to a Gold Standard?”

CAN THE U.S. RETURN TO A GOLD STANDARD?

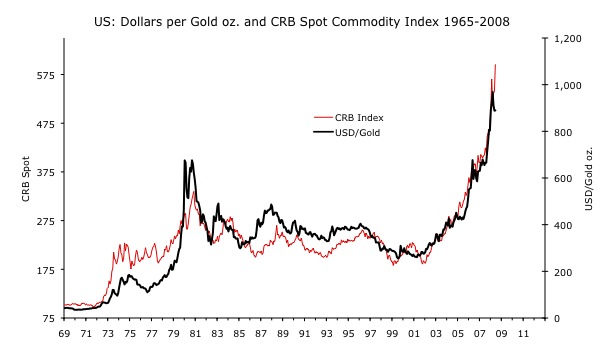

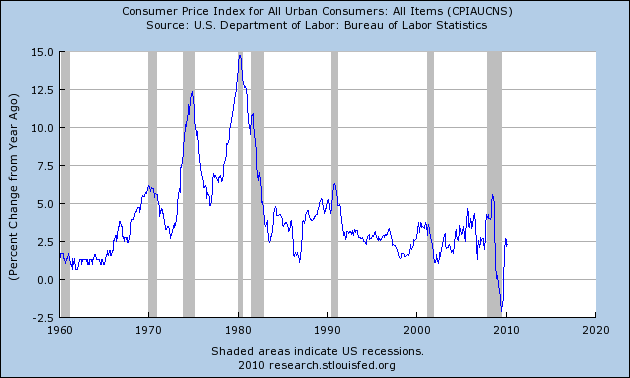

This is 1981 now. Between 1966 and 1981 we saw the introduction of the floating currency system, and an enormous inflationary event in which the dollar’s value slid from 1/35th oz. of gold to less than 1/800th at its nadir.

Click on the link and read the essay. It is quite clear that Greenspan still has no idea how exactly to operate a gold standard, or really what it is for. He still advocates a gold standard, but doesn’t understand exactly what it is that he is an advocate of.

For example, by now, after ceaseless repetition (always the best way), you should know that a gold standard — i.e. the process of pegging an otherwise-worthless paper currency to gold — is accomplished by the adjustment of the supply of paper currency.

January 3, 2010: The GLD Standard

What does Greenspan have to say about this?

Yet even those of us who are attracted to the prospect of gold convertibility are confronted with a seemingly impossible obstacle: the latest claims to gold represented by the huge world overhang of fiat currency, many dollars.

[There are always more paper chits than gold reserves . This was true of the Bank of England in the 1780s, and it is true today. It is only a “seemingly impossible obstacle” if you don’t know what you are doing.]February 28, 2010: A Gold Standard is a Value Peg

The immediate problem of restoring a gold standard is fixing a gold price that is consistent with market forces. Obviously if the offering price by the Treasury is too low, or subsequently proves to be too low, heavy demand at the offering price could quickly deplete the total U.S. government stock of gold, as well as any gold borrowed to thwart the assault. At that point, with no additional gold available, the U.S. would be off the gold standard and likely to remain off for decades.

Alternatively, if the gold price is initially set too high, or subsequently becomes too high, the Treasury would be inundated with gold offerings. The payments the gold drawn on the Treasury’s account at the Federal Reserve would add substantially to commercial bank reserves and probably act, at least temporarily, to expand the money supply with all the inflationary implications thereof.

[No mention at all of managing the value of the paper currency — by supply adjustment or any other method — to keep it in line with gold. This gold standard system is maintained by prayer.]Monetary offsets to neutralize or “earmark” gold are, of course, possible in the short run. But as the West Germany authorities soon learned from their past endeavors to support the dollar, there are limits to monetary countermeasures.

The only seeming solution is for the U.S. to create a fiscal and monetary environment which in effect makes the dollar as good as gold, i.e., stabilizes the general price level and by inference the dollar price of gold bullion itself. Then a modest reserve of bullion could reduce the narrow gold price fluctuations effectively to zero, allowing any changes in gold supply and demand to be absorbed in fluctuations in the Treasury’s inventory.

[Now we come to the crux of the matter. Greenspan proposes that the Fed and U.S. government’s job is to roughly approximate stability, and then to jimmy the dollar/gold market into place with what amounts to forex intervention.]

What the above suggests is that a necessary condition of returning to a gold standard is the financial environment which the gold standard itself is presumed to create. But, if we restored financial stability, what purpose is then served by return to a gold standard?[This is a strange and cryptic remark by someone who is a gold standard advocate. But, look at his position. He doesn’t know how to operate a gold standard. The natural result of that is fear of failure. That’s what the first couple paragraphs are about.]

What did Greenspan learn in the interval between 1966 and 1981 — a time of great upheaval in the gold market, in the value of the dollar, and thus, great discussion about related topics?

Apparently, nothing. Not much learning going on here. His ideas don’t seem to change much.

Greenspan became chairman of the Fed in August 1987.

Septenber 23, 2007: The Greenspan Gold Standard

Greenspan was initially rather doveish in the summer of 1987, but turned hawkish with the events of October 1987. This began a fairly aggressive period of rather hawkish Fed policy that lasted into about 1990.

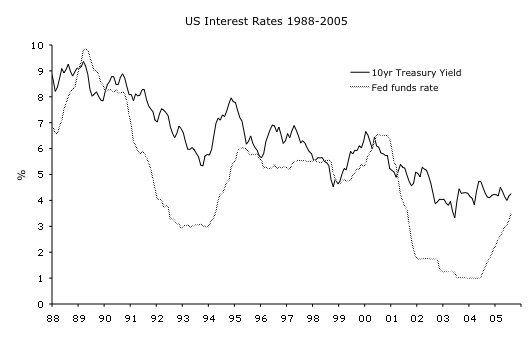

Here we can see how hawkish Greenspan pushed the Fed funds rate to 10% in early 1989, to counter the move in the dollar to $500/oz. of gold. You can read more about the history of that period in my book.

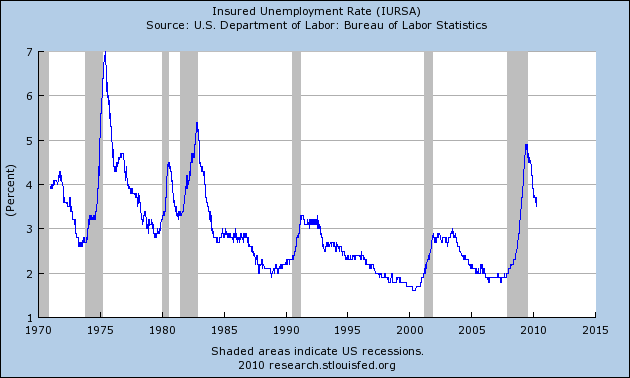

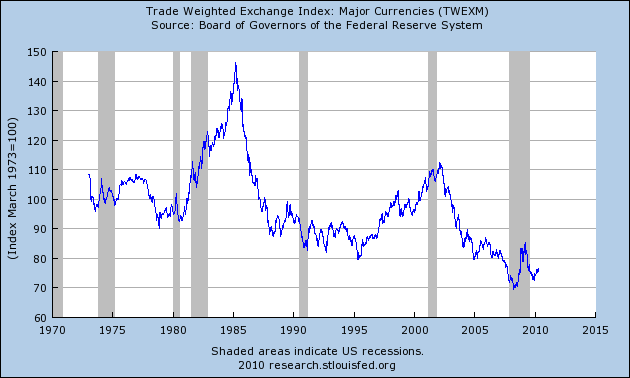

See how the dollar was breaking down badly in 1987? Greenspan’s turn toward hawkishness at the end of 1987 helped turn the tide. He eventually lowered the Fed funds rate to 3.0% during the 1990-1993 recession, but that was rather delayed. Three percent was considered a very low figure for that time. It was the lowest since 1970. However, this was later, in 1992 and 1993. The meat of the recession was in 1990 and early 1991, as marked by the grey bars in this graph of unemployment.

Greenspan spent most of 1990 — the recession year — with a Fed funds rate of around 8%. Pretty hawkish. Greenspan was taking a lot of flak at the time from the Bush I administration to cut rates. Even after some cuts, it didn’t go below 4% until 1992.

Note that in 1990, the dollar’s value relative to gold was quite volatile, with a tendency to spike upwards. I think Greenspan was trying to keep the dollar supported, which skewed his approach toward hawkishness. It wasn’t until 1991 that the dollar calms down somewhat. There is another spike in 1993, which I think is related to the Clinton tax hike passed that year (tax hikes tend to lead to currency weakness).

September 30, 2007: Taxes and Money

Then, there is a rather odd period from 1994 to 1996 where there is almost no change in the dolar/gold ratio. This is then followed by a dollar move higher in 1997 and 1998.

I talked about some of Greenspan’s actions during the 1990s here:

August 5, 2007: What Happened to the Greenspan Put?

February 4, 2006: Was Greenspan Any Good?

Over the period of his tenure, 1987 to the end of 2005, the dollar’s value was indeed relatively stable versus gold. Greenspan began with the dollar around $460/oz. of gold in August 1987, and he ended around $510/oz. of gold at the end of 2005. Of course there were a lot of ups and downs in between, but the overall result was pretty good for over seventeen years of a floating fiat currency. During the 1989-1996 period, the dollar was more stable than this, fluctuating in the $350-$400/oz. band. That is quite a narrow range for a seven year period. It is +-7% from a central point around $375/oz.

To make a long story short: Greenspan was doing, in the 1989-1996 period, exactly what he said he would do in his 1981 op-ed. He was sort of, kind of, keeping monetary and fiscal policies in line (he was rather influential in fiscal policies during the time), and — maybe — he, the Fed, and the Treasury were using surreptitious intervention to jimmy the dollar/gold market into stability.

That period 1989-1996 is a little too stable. Markets go up and down. They may end up at the same place they began after ten years, but they don’t just flatline. During the era of floating currencies beginning in 1971, the dollar went up and down, and the dollar price of gold and down and up. There were huge swings in the 1980s. All of this calms down rather suspiciously in 1989-1996, under Greenspan’s watch.

Here is Greenspan from August 5, 1993. Note the big spike upwards in the dollar/gold price beginning at that time, which hits a wall at $400/oz.

I have one other issue I’d like to throw on the table. I hesitate to do it, but let me tell you some of the issues that are involved here. If we are dealing with psychology, then the thermometers one uses to measure it have an effect. I was raising the question on the side with Governor Mullins of what would happen if the Treasury sold a little gold in this market. There’s an interesting question here because if the gold price broke in that context, the thermometer would not be just a measuring tool. It would basically affect the underlying psychology.

Here Greenspan himself considers direct intervention in the gold market, and it is clearly about gold sales for the purpose of influencing price. It is not about sales for other purposes (such as managing the reserves), which are announced publicly as reasons for gold sales by the Federal Reserve.

Read “Greenspan suggested gold price suppression in 1993” by Dimitry Speck

Note how bond yields also spiked higher along with gold in late 1993 and early 1994. This spike higher in bond yields — to 8% on the ten-year Treasury bond, from around 5.5% in mid-1993 — blew up Orange County, California, which was experimenting with interest rate derivatives. It also killed Kidder Peabody, a major Wall Street investment bank. Certainly, President Clinton didn’t want a burst higher in yields to derail the economic recovery at the time, which was weak because the economy was loaded down with the new Clinton tax hikes. Banks were stuffed with bad debt from busted real estate, which wouldn’t be helped by higher mortgage rates. So Greenspan wasn’t just scratching his chin. He was dealing with a crisis.

This period coincides with another funny happening, the publishing of Larry Summers’s paper “Gibson’s Paradox and the Gold Standard,” in June 1988.

Read “Gibson’s Paradox and the Gold Standard”

The paper is of course a bunch of gobbledygook. Which should tell you something about Larry Summers’ brain.

Fortunately, we have some pretty good summaries of the relevant bits, including how the conclusions of the paper translate into real world action.

Read “Gibson’s Paradox Revisited: Professor Summers Analyzes Gold Prices”

This essay is mostly gobbledygook too, but at least it is shorter and to the point.

Note how much Larry Summers talks about gold in the paper. Gold gold gold. All the time gold. He may like to give the public impression that it’s of no concern to him, that he is oblivious to gold like most mainstream economists, but obviously he has a bit of history in this matter.

To translate into fairly clear language, people made the basic observation that bond markets didn’t like a rising gold price (as this would imply a falling dollar value, and that you would get paid back in devalued dollars on your bonds). The Clinton administration in particular was very aware of the benefits of declining interest rates, and indeed Greenspan had some influence there. So, they figured that if they put a lid on the “gold price,” which is to say, they supported the dollar’s value — a “Strong Dollar Policy” — the result would be lower interest rates. And indeed, as we see on the preceding chart of U.S. Treasury rates, they were right.

You can see how Summers and Greenspan could get to be good buddies. They would have so much to talk about. Even when Robert Rubin was the official Treasury Secretary, it was widely known that Summers was the go-to guy for all kinds of technical matters.

Rubin is a bit of an interesting character too, since he apparently oversaw Goldman Sachs’ gold trading desk in the late 1970s.

Before he was CEO of Goldman Sachs and then US Treasury Secretary, Robert Rubin worked in London for Goldman Sachs. One of his duties was to oversee their gold trading operations. We know this because the CEO of Kirkland Lake Gold, Brian Hinchcliffe, a staunch GATA supporter, worked in London back then for Goldman Sachs and reported directly to Robert Rubin.

This was many years ago and interest rates in the US were very high, say from 6 to 12%. Rubin had Goldman Sachs borrow gold from the central banks to fund their basic operations. They could do so at about a 1 % interest rate. This was like FREE money, as long as the price of gold did not rise to any sustained degree for any length of time.

Read “Gold Cartel suppressing, manipulating gold price” by Bill Murphy

What about that funny rise in the dollar (decline in the dollar/gold price) in 1997 and 1998?

The ability of the government to dictate a dollar/gold ratio through intervention and coercion alone is limited. Greenspan envisoned that the fiscal and monetary conditions would be roughly correct (i.e. nothing highly inflationary), and then they could perform a bit of elbow grease via dollar/gold intervention to pretty up the final result. The wild swings in dollar value during the 1980s were exhausting.

Thus, I think the dollar’s rise in the 1997-1998 period had a fundamental component, namely the 1997 capital gains tax cut (tax cuts tend to lead to a rising currency). However, this trend was helped along by a policy of cramming the dollar/gold price lower through a variety of coercive techniques. This dollar rise produced the Asian Crisis in 1997-1998. The Asian governments had pegged their currencies to the dollar in the early 1990s, after Greenspan had managed to stabilize the dollar vs. gold. This produced an economic boom, in large part because stable exchange rates enabled trade and financing. However, the Asian governments mostly did not have much of a method to keep their currencies in line. They had some small-scale intervention, but nothing in the nature of a currency board (except for Hong Kong and Singapore). This arrangement worked OK when the dollar itself was stable, but when the dollar began to rise, the Asian governments had no technique to cause their currencies to rise alongside. As a result, their currencies fell against the dollar, creating all kinds of chaos since by then people had become accustomed to pegged exchange rates and had lots of foreign currency denominated debt. (The proper solution would have been to have a Hong Kong-style currency board.)

You can read more about that period in my book too.

Thus, I am proposing that the dollar’s rise in 1997-1998 was a result of fundamental factors (the capgains tax cut), and also interventional factors. You can read some of the GATA stuff regarding the organization of forward sales of gold by Barrick — thought to be “Wall Street’s gold mining company” — and others, suppressing the dollar price of gold. (Apparently, “Barrick” means something like “fuck you” in Hungarian. CEO Peter Munk grew up in Budapest, so he would know that.)

Read “To Barrick or to Be Barricked, that is the question” by Antal Fekete

This paper also has some good descriptions of the Barrick-led policy of forward sales and hedging, widely thought to have suppressed the dollar price of gold (supported the dollar) during the 1997-2001 period.

As I mentioned a couple weeks ago, I regard gold’s value to be essentially stable, even when the dollar/gold market is subject to all sorts of manipulation and intervention. The net effect of this intervention is to alter the value of the fiat currency compared to gold, while having relatively little effect on gold itself. Thus, “gold suppression” amounts to “dollar support.”

April 11, 2010: Interpreting Gold and Currencies in an Environment of Official Intervention

We can see quite clearly that the dollar rose against other currencies. Also, commodity prices declined in dollar terms.

A “strong dollar policy” combined with “gold price suppression” makes sense when the dollar is at $500/oz., as it was at the beginning of Greenspan’s tenure. It makes sense when the dollar is at $400/oz. and bond yields are bursting higher, as in 1993-1994. But it doesn’t make much sense when the dollar is at $325/oz. and rising to around $255/oz. in 2001.

However, Greenspan seemed to feel that pounding gold lower/the dollar higher was a good thing.

“Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.”

What is notable about this comment is that he refers to the leasing of gold as an instrument for influencing price. Admittedly Greenspan made the comment in a different context (discussions about regulation); the discussion was not about the framework in which intervention should actually take place.

This comment dates from July 30, 1998. The dollar price of gold was $290/oz., about the lowest it had been since August 1979. Wasn’t that low enough?

For a long time I didn’t really get this. How is it that GATA and others were accusing Greenspan of pushing gold lower/the dollar higher, via central bank “leases” (this amounts to a fancy term for unofficial sales), gold producer hedging and the like, when there seems like no reason at all for Greenspan to engage in this at the time?

I’ve concluded that Greenspan doesn’t really see gold the way we do, as a stable measure of value, against which a currency’s value is compared. A “low price of gold” can cause problems (rising currency, monetary deflation) just as a “high price of gold” can (falling currency, monetary inflation). It certainly was causing problems in the 1997-1998 period, in the form of the Asian Crisis. However, Greenspan apparently sees gold as an “inflation indicator.” Lower gold means lower inflation. That’s a good thing, right? Especially if it leads to lower bond yields. Bond yields did indeed head lower in 1997-1998, to their lowest level since 1965! It was a big success! Greenspan, Summers and Clinton could slap each other on the back in celebration. It all worked just like Summers’s 1988 paper said it would.

Also, gold is sometimes seen as a “go to asset in times of crisis.” Certainly there was a crisis in the summer of 1998, with sovereign defaults by Brazil and Russia adding to the chaos in Asia. If the dollar/gold price was held down, maybe people would be less apt to panic.

Remember Greenspan’s “irrational exuberance” comment:

Wikipedia on the “irrational exuberance” remark

It actually dates from December 5, 1996 — almost exactly at the start of the move higher in the dollar and the move lower in dollar/gold prices.

Here’s a closer look at the timing:

“Bubbles” are sometimes associated with “inflation.” So, if you were worried about “irrational exuberance” and a stock market “bubble,” you might take some sort of counter-inflation measure. A higher dollar/lower gold price accomplishes that, without the politically difficult (and economically destructive) step of raising the Fed’s target rate from the 5.25% level it was already at during that time.

But Greenspan had already become known for having a bit of a blind spot regarding the potential negative effects of a rising dollar.

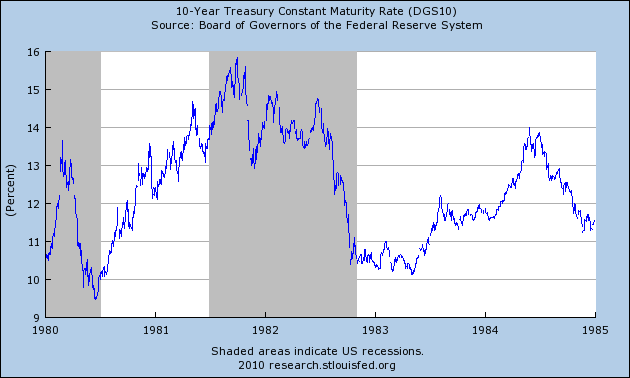

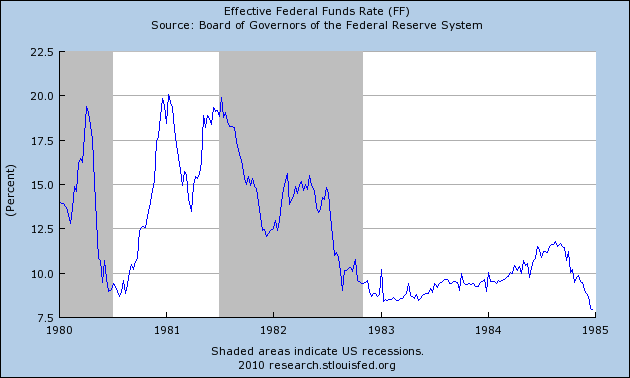

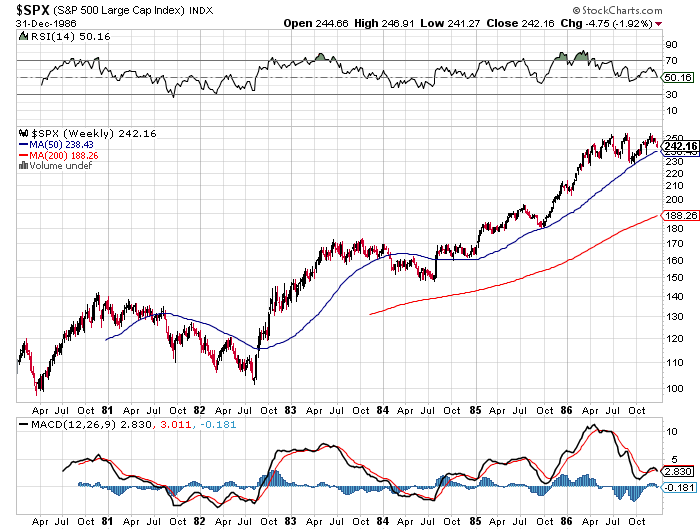

Let’s go back to 1982. Greenspan is not at the Fed yet, he is an independent economic analyst. He has a history of involvement in gold-related affairs, including his participation in the Congressional Gold Commission in 1981. Reagan was elected in November 1980, and he had a lot of gold-friendly people on board, among the “supply-side economists.” However, the great Reagan boom had not yet begun. Instead, Volcker’s tight money had driven interest rates to eye-popping levels. The stock market was still in the toilet after a seventeen-year bear market. The 1982 recession was being called the worst since the Great Depression. Reagan himself had been forced to renege on some of his tax cut promises, and signed a corporate tax hike into law that summer. It was a crisis time for the new Reagan administration.

Among Reagan’s “supply siders,” a debate was going on. The dollar bottomed in early 1980, and by 1982 — as a result of Volcker’s tight money and Reagan’s tax cut promises — it was was rising, rising rising. In mid-1982, the dollar rose to $300/oz., from its $850/oz. nadir in 1980. That is nearly a tripling of dollar value! The official CPI inflation rate was falling quickly, but it was still rather high around 6.0%. Some supply-siders argued that the huge rise in dollar value was causing a deflationary recession, even though the CPI was rising in reflection of the 1970s inflation. However, Greenspan (and the Monetarists) saw it differently. The lower price of gold meant less inflation, and since 6% was still rather high, and certainly the 10 year Treasury bond yield was much too high around 14%, less inflation was a good thing no?

With the economy apparently being squeezed by a dollar that had risen too far, too fast — with all the attendant difficulties including exploding debt defaults and an emerging markets currency crisis just like 1998 — some supply-siders wanted a monetary ease. Paul Volcker, until then a super-hawk, was eventually swayed by their arguments and changed course. The Fed didn’t have a Fed funds target in those days. It was the middle of the Monetarist Experiment. So, the ease took the form of the Fed buying $600 million of dollar-denominated Mexican sovereign debt in August 1982, and monetizing it. (The number might be as high as $3 billion.) This also managed to bail out the big U.S. banks on their huge losses on emerging market debt. (The Fed has been bailing out the big banks for a long time.) When all this “fresh liquidity” — the new base money created by the monetization of the Mexican debt — hit the banks and the money market, the overnight money market rate plunged lower. The dollar also headed lower, relieving the monetary deflation on the economy with a “reflation.” Lower interest rates and a lower dollar, plus the promise of upcoming Reagan tax cuts, lit a fire under the U.S. stock market and the Great Bull Market began. Reagan became a big hero.

So you see, the supply siders in favor of monetary ease were right in 1982, and Greenspan was wrong.

This little narrative is not just something I made up. If you want more detail, read William Greider’s book, The Secrets of the Temple, which runs to 800 pages of details about “The Turn” of August 1982 and the period following. It’s all there.

Buy The Secrets of the Temple from Amazon.com

Thus, with that in context, we can get a little idea of Greenspan’s thinking process, and why he would try to push the dollar higher/gold lower even in 1998.

Here is an account by one of the Reagan “supply siders” who wanted monetary ease in 1982, and how that was similar to the situation in 1998:

Read it.

So you see, Greenspan was stuck in the same “lower gold price is good” mindset in 1998 as he was in 1982!

Greenspan held the same stance as the dollar again rose to $300/oz. in 1985, setting off deflationary consequences. According to Greenspan, a lower gold price just meant less inflation, a good thing. Once again, Greenspan was ignored (he was not yet Fed Chairman), and the dollar’s value was pushed lower beginning with the Plaza Accord in September 1985. (You can see the stock market began a new leg higher right at that time, continuing the Great Bull Market.)

Greenspan wrong again. Indeed, a commentary upon Greenspan’s appointment as Fed chairman dating from August 1987 identified exactly these two events (1982 and 1985) as identifying a potential problem with the new chairman. He just didn’t know when to stop regarding a strong dollar/lower gold price. (Unfortunately, I can’t provide a link to that 1987 report.)

Greenspan wasn’t the only gold guy on the FOMC in those days. He was paired with Wayne Angell, who was on the FOMC from February 1986 to February 1994. I mentioned Angell in my book because he traveled to the Soviet Union in 1989 to recommend a gold standard for that country. Angell was a tempering influence on Greenspan at the Fed, and may have prevented Greenspan from adopting an aggressively strong dollar/lower gold/deflationary policy during that period.

Thus, we come to another interesting aspect of the Greenspan/Summers strong dollar/gold manipulation/lower interest rates story, the introduction of the fake tungsten gold bars around 1997 and 1998.

The “Genesis of the Gold-Tungsten: the Rest of the Story” by Rob Kirby

The tungsten slugs came from Eastern Europe – most likely a former strategic stockpile, a remnant of the failed Soviet Empire – which was “acquired” as spoils of Cold War victory during the reign of Bush I circa 1991-92. Between 1.3 and 1.5 million 400 oz tungsten blanks were actually produced in an Eastern European country [not the U.S. as I originally reported]. These tungsten blanks were shipped to Latin America [Panama] and then air-lifted on to Mena, Arkansas. From Mena, Arkansas, the tungsten blanks were shipped via truck [Brinks and Purolator] – 2 trucks at a time to a refinery in Southern California where they received their gold plating and stamping. …

Tungsten / gold bars destined for Ft. Knox were allegedly trucked direct to Kentucky for exchange with “what ever was left” in the depository which was stolen outright – but bringing the outstanding in Ft. Knox up to 640 thousand – 400 oz tungsten bars which are there now.

10,000 metric tonnes of fake gold bars earmarked for the intl. markets were supposedly hallmarked and “papered” as going through a holding facility of Engelhard [Vancouver] and trucked back to Mena, Arkansas and then on to Panama – TO SIT – awaiting distribution into the intl. market.

The big questions beside “greed” – is “why” and “how” does one feed 10,000 metric tonnes of fake gold into the international market?

The Motive

Take a look at when Rubin / Summers instituted their “Strong Dollar Policy”: Understand, weakness [capping] of the price of gold along with stimulative and arbitrarily low interest rates [to give the U.S. economy a false, bolstered illusion of health]. …

The Cover

By establishing and promoting an active, international gold hedging market – enough traffic / movement, or ‘cover’ if you will, of a formerly static asset was created where fake gold bricks could be merged into the “flow” without arousing undue suspicion of willing, dupe buyers who DID NOT ASSAY GOLD when they purchased it.

One can imagine that merging 10,000 metric tonnes of fake gold bricks into the global market place would pose logistical challenges. If one were intent on doing so – it could NEVER be done ALL AT ONCE. It would necessarily have to be done over time. With gold bullion being a formerly “static” asset which sat in the vaults of Central Banks – any sudden large scale movements of bullion might draw unwanted attention. So, one would want to create a credible vehicle where large amounts of gold were seen to be “on the move” – in good amounts on a regular basis – like a viable gold lending / leasing / swap market. Also, to give the fake gold bricks a patina of authenticity – one could imagine the desire to have a “market leader” involved – tacitly endorsing the procedure, surrounding the fake bricks and the conduit through which they would travel with highly credible individuals – like former world leaders – whose actions and motives would NEVER be questioned.

It was back in May, 1995 when Barrick Gold’s Peter Munk established his International Advisory Board – chaired by none other than George H. W. Bush [and other opportunistic former world leaders] and with representation of Mr. Clinton through his White House legal counsel, Vernon Jordan.

Read the whole paper. It appears that the tungsten fakes were fed into the market via the “central bank leasing” and “Barrick-led hedging” avenue, in the 1997-2000 time period, as part of a Greenspan/Summers-led “strong dollar policy” with the aim of lowering interest rates.

Within the context of what we have reviewed, I am particularly struck by this comment by Greenspan at the end of his tenure, on July 20, 2005:

And, indeed, since the late ’70s, central bankers generally have behaved as though we were on the gold standard.

And, indeed, the extent of liquidity contraction that has occurred as a consequence of the various different efforts on the part of monetary authorities is a clear indication that we recognize that excessive creation of liquidity creates inflation which, in turn, undermines economic growth.

So that the question is: Would there be any advantage, at this particular stage, in going back to the gold standard?

And the answer is: I don’t think so, because we’re acting as though we were there.

All of which brings us to today. To summarize:

1) That Greenspan, from 1981 if not earlier, envisioned a regime in which the fiscal and monetary conditions would be kept in what was perceived as a roughly stable fashion, and then the dollar/gold market would be jammed into place via official intervention.

2) That this policy was apparently in use during the 1989-2000 period if not earlier.

3) That this policy aligned with Summers’ arguments that a stable or lower gold price, aka “strong dollar policy” would result in lower U.S. Treasury yields, which indeed was the case, much to the Clinton administration’s delight.

4) That this program was conceived in part because Greenspan and Summers wanted the benefits of a gold standard system (low interest rates, currency stability and macroeconomic stability) but they didn’t know how to operate a real gold standard.

5) In the absence of proper operating mechanisms involving the adjustment of the supply of money (base money), a regime of surreptitious gold sales/leases/hedging was implemented. This ran down the government’s gold supplies.

6) The lack of bullion for use in gold market manipulation caused a reliance on counterfeit tungsten gold bars, plus every sort of fakery including lies from the Comex, LBMA etc.

7) The “gold suppression” (dollar support) schemes today get ever more aggressive, and ever more desperate, as the inherent problems with this program are gradually blowing up in their face.

I just want to give you a sense of the history of it all. This goes back to 1980, and earlier.

How much earlier?

If you look at the above list, it is almost exactly the same as the problem which led to the breakup of the Bretton Woods gold standard in 1971! The U.S. monetary authorities are still using the same old worn-out playbook. When are they going to figure out that it doesn’t work?

Throughout the 1940s, 1950s and 1960s, a similar program was in place. Then too, the Fed did not properly administer a gold standard system by pegging the dollar to gold by a currency-board-like system of direct monetary base adjustment. They just tried to maintain what they felt was “responsible” fiscal and monetary policy, and then jammed the dollar/gold ratio into place with official gold sales. This discipline tended to break down in recessions, however, when Keynesian “easy money” policies were favored, which tended to lead to dollar weakness and more gold outflows. During the Bretton Woods days, the U.S. government had an immense amount of gold, so the dollar support/gold suppression program mostly involved real sales of real U.S. government bullion. Gold futures, ETFs etc had yet to be created. However, the end result was the same. Without a proper operating mechanism, a currency-board-like system to maintain the dollar’s gold peg, the dollar’s value could not be maintained with coercion alone. The London Gold Pool — which in those days was “all the king’s horses and all the king’s men” — could not keep the dollar from the natural consequences of its mismanagement.

Wikipedia on the London Gold Pool

November 11, 2007: The London Gold Pool I and II (and a David Frum-bashing contest!)

November 19, 2007: Bretton Woods II: The Folly of Large Gold Reserves

How far back does this silliness and incompetence go? Before World War II, certainly. The last time the U.S. managed a gold standard with a hint of competence may have been in the 1930s. However, even in those times there were probably some funny games being played, so you would probably have to go back before 1913.

I want to bring this up to give an idea of the long history of incompetence by U.S. authorities and indeed all world governments. Their constant lies and manipulations are rather obnoxious. However, they are trying to produce a good result, without understanding how such a result is created.

I hope that a few people who read this will themselves learn what Greenspan and Summers never learned: how to implement an effective gold standard system. It’s not very hard.

Then we would be spared all the nonsense and chaos that results when knuckleheads are allowed to be in charge.

Let’s remember the example of Britain. Britain remained pegged to gold for over 200 years. The Britain-centric gold standard of the 18th and 19th centuries was not like Bretton Woods, which began to fall apart from its internal contradictions only twenty years after it was created. The British gold standard did not fail due to internal contradicitons, or running out of gold to perform market interventions, but rather due to the outbreak of World War I. Britain quickly put it back together in 1925, but the Great Depression, the rise of Keynesianism, and World War II derailed Britain’s long and brilliant history of monetary leadership.

Britain never had very much gold, and never needed it. The Bank of England did not sell tons and tons of gold in an effort to “suppess gold prices.” It didn’t sell tungsten fakes, or have a futures market to manipulate, or sell ETFs with no real bullion, or tell lies about the inventory at Ft. Knox.

You just have to laugh at these clowns. It’s so silly!

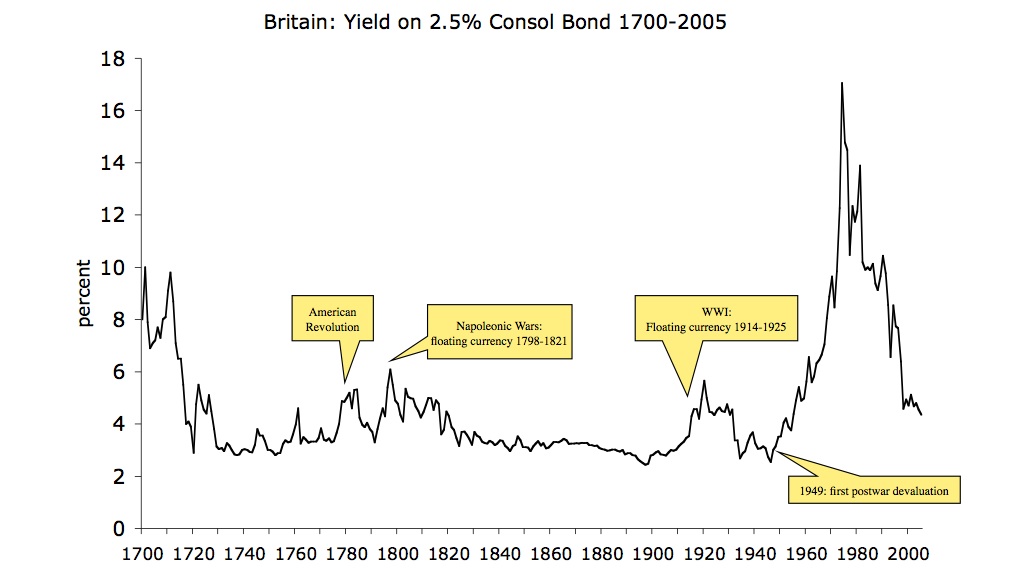

The result of Britain’s expertise was government bond yields that make the best efforts of Summers and Greenspan look like the pathetic childish games they are. (I haven’t even started on the JP Morgan interest rate swap story, another aspect of the effort to hold down bond yields.)

This shows yields on British government debt over three centuries. During the gold standard years, in the 18th and 19th centuries, yields regularly fell to about 3.25% and stayed there for generations on end. This was not a ten year bond. This was not a thirty-year bond. This was a bond of infinite maturity. No government today can even issue such a thing. Nobody would buy it.

That will be something to think about if U.S. Treasury bonds begin a long bear market.

The item “The GLD Standard” was translated into Russian! It begins about 2/3ds of the way down.

http://bankir.ru/publication/article/4887480

Other commentary in this series:

April 11, 2010: Interpreting Gold and Currencies in an Environment of Official Intervention

March 21, 2010: A New Gold Parity

February 28, 2010: A Gold Standard is a Value Peg

January 3, 2010: The GLD Standard

December 20, 2009: Updating Our Commodity Charts

November 6, 2009: A Brief History of the Dollar

October 27, 2009: What If We Abolished the Federal Reserve?

October 9, 2009: New Highs for Gold

September 23, 2009: What $1000+ Gold Means To You

July 6, 2009: How to Establish an International Currency

June 28, 2009: Inflation Vs. Hyperinflation

June 26, 2009: Where’s the Gold?

May 17, 2009: Negative Interest Rates

April 26, 2009: Two Monetary Paradigms

April 5, 2009: A Different Kind of Gold Standard

March 29, 2009: A New World Monetary System

January 4, 2009: Currency Management for Little Countries

December 28, 2008: Currencies are Causes, not Effects

November 30, 2008: Quantitative Easing

November 24, 2008: Russia’s Currency Crisis

November 23, 2008: Redeemability and Reserves

November 16, 2008: How To Stabilize the Ruble

October 27, 2008: Making Currencies that Last

September 21, 2008: The “Lowering Interest Rates” Boondoggle

July 28, 2008: “Why Not the Gold Standard?”

July 2, 2008: The Volcker Myth

June 22, 2008: The Inflationary Adjustment Process

June 2, 2008: World Without Paper Money

May 9, 2008: The Gulf’s Currency Solution

May 6, 2008: The Key to Managing Currencies

January 13, 2008: Valuing Gold

November 24, 2007: “Printing Money”

November 19, 2007: Bretton Woods II: The Folly of Large Gold Reserves

November 11, 2007: The London Gold Pool I and II (and a David Frum-bashing contest!)

October 28, 2007: Can We Still Avoid Inflation?

October 21, 2007: The “Money Multiplier”

September 30, 2007: Taxes and Money

Septenber 23, 2007: The Greenspan Gold Standard

September 2, 2007: Different Kinds of “Money”

August 26, 2007: How To Operate a Gold Standard

August 19, 2007: Gold Standard Fallacies

August 5, 2007: What Happened to the Greenspan Put?

July 22, 2007: Whip Inflation Now

June 24, 2007: The Gold Standard in a Nutshell

May 11, 2007: The Inflation Has Already Begun

April 21, 2007: Weights and Measures

April 15, 2007: The Value of Today’s Dollars in 1854 Dollars

March 25, 2007: The Next Gold Standard

November 5, 2006: Understanding Gold’s Movements

September 4, 2006: The Demonetization of Silver

August 20, 2006: The A B C of Money

July 30, 2006: Growth and Inflation

July 23, 2006: Why Gold?

July 9, 2006: “Fractional Reserve Banking”

July 1, 2006: “Quantitative Tightening”

June 18, 2006: Fixing the Weak Dollar Problem

June 11, 2006: The Nature of Monetary Manipulation

June 3, 2006: Debt and Inflation Part IV

May 28, 2006: Debt Does Not Cause Inflation Part III

May 21, 2006: Debt does not cause inflation part II

May 14, 2006: Guest Lecture: David Ricardo on Gold at $700+!

May 6, 2006: MV=My Butt

April 30, 2006: Value and Quantity

April 15, 2006: Where the Rothbawrordians Went Wrong

April 2, 2006: Inflation or Deflation?

March 4, 2006: Does Debt Creation Cause Inflation?

February 19, 2006: Blowing Bubbles and the Wall of Money

February 4, 2006: Was Greenspan Any Good?

January 29, 2006: Is the Government Budget Deficit a Problem?

January 22, 2006: Does the Current Account Deficit Matter? Part II

December 30, 2005: Is Gold an Investment?

December 17, 2005: The Smoking Gun

December 10, 2005: Ben Bernanke and the Great Depression

December 4, 2005: Interpreting $500 gold

November 26, 2005: The Steering Wheel and Brake Pedal are Disconnected

November 20, 2005: Does “inflation targeting” work?

November 13, 2005: Problems with the Indonesian rupiah