How the Fed Works

September 1, 2008

This is a topic I’ve been putting off for a while, because I’m not really an expert on the Fed. In general terms, fine, but not on the daily nitty gritty. My experience with central bank daily operations was mostly with the BOJ. Nevertheless, we have to start sometime, so we can consider this a Version 1 attempt. Nobody else is going to do it but me, apparently.

The Fed, as a currency manager, is primarily engaged in one thing — adjusting the supply of base money. This was not its original purpose, when it was created in 1913, but one that it adopted as a result of monopolizing the currency in the 1920s-1930s. At first, the Fed operated roughly within the confines of the gold standard. However, when this obligation was lifted in 1971, the Fed became the Fed we know today, the manager of a floating currency.

The Fed’s operations are generally pretty simple:

1) It buys assets, typically government securities, and issues base money in return. This expands the monetary base.

2) It sells assets, typically government securities, and takes base money in payment, which is then effectively cancelled. This contracts the monetary base.

In practice, it can buy or sell any sort of asset. This includes foreign bonds, stocks, making loans to banks (the same as “buying a bond from a bank”), etc.

The assets held by the Fed are listed at the Fed’s website.

http://www.federalreserve.gov/pubs/supplement/2008/08/table1_18.htm

However, due to the various complexities introduced by the Fed’s “swap till you drop” activities of late, let’s use an earlier list of assets, such as this one from 2005:

http://www.federalreserve.gov/pubs/supplement/2006/01/table1_18.htm

We see that the Fed had a total of $826 billion in assets as of September 28, 2005, the leftmost and easiest-to-read column in the table. Of that, $736 billion was U.S. Treasury securities, and the rest was bits and pieces.

In the Liabilities column, we find $732 billion of banknotes, and some other bits and pieces, for a total of $799 billion. The most interesting among the other bits and pieces are the government’s deposits. The Fed is the government’s bank — where, for example, the government puts its money when taxes are paid. Depository institutions also maintain some deposits with the Fed — these may be the “clearing balances” used for payments between banks, a form of bank reserves.

Actually, there are $890 billion of Federal Reserve Notes outstanding, as shown lower down, due to odd accounting of notes held in Fed depository institutions. I’m not exactly sure what the status is of these notes held by depository institutions is — it appears that, although they are located at the depository banks, they are still owned by the Fed, ready to be sold to the banks if necessary. This makes sense: if there was a need for paper money, you would want to have it in the banks, and not in a vault in Washington DC, from where it would have to be trucked in.

Bank reserves are noted here:

http://www.federalreserve.gov/pubs/supplement/2006/01/table1_12.htm

Most of the reserves held by banks are vault cash, in other words paper money.

So, we’ve seen that the Fed holds mostly government securities, and issues base money, which is mostly paper money with a bit of bank reserves. That is the monetary system — at least the supply aspect. Note that the Fed normally doesn’t make loans to banks or anyone else, although we are in an exceptional period right now as far as that is concerned.

Another description of the monetary base is here:

http://www.federalreserve.gov/pubs/supplement/2006/01/table1_20.htm

You can see from the tables that the numbers change, which shows that the Fed’s adjustment of base money is continuous. A more detailed description of the Fed’s operations can be seen here:

http://www.federalreserve.gov/pubs/supplement/2006/01/table1_17.htm

Here is an even more detailed look at the Fed’s operations:

http://www.federalreserve.gov/releases/h41/Current/

This has a funny note, with $29 billion of “net portfolio holdings of Maiden Lane LLC”. Maiden Lane is the street that the New York Fed is located on in Lower Manhattan. This is apparently a relatively new entity, as it is an LLC, a corporate structure that did not exist a few decades ago. I wonder what they are doing? What does “net portfolio holdings” mean? What are the gross portfolio holdings?

It all comes down to the same thing: the Fed is adjusting the size of the monetary base. In lay terms, this is “printing money” (expanding the base), and “unprinting money” (contracting the base). You will notice that, although the general tendency is for base money to rise, in the shorter term there are expansions and contractions. These contractions can be larger and longer-lasting, if the situation demands it.

Now, we see from this that the Fed is not “controlling interest rates.” It is adjusting the monetary base in response to an interest-rate target. We’ll talk more about that, and how it works, at some future date.

Probably the point here is that the Fed is not a mysterious black box. We can lift the hood and see what it is doing. We see that money — base money — is created and dis-created every day. However, many people get confused here, because looking at what the Fed is doing is not very helpful, once you understand basically how it works. That’s why I don’t actually follow Fed operations that much — there isn’t much value in it (not to say that there isn’t any value at all, just not much). I follow base money growth rates intermittently. Money aggregates (which are really credit measures) are not that useful. The important thing is the value of the currency, which is not found in the Fed’s operating statistics.

* * *

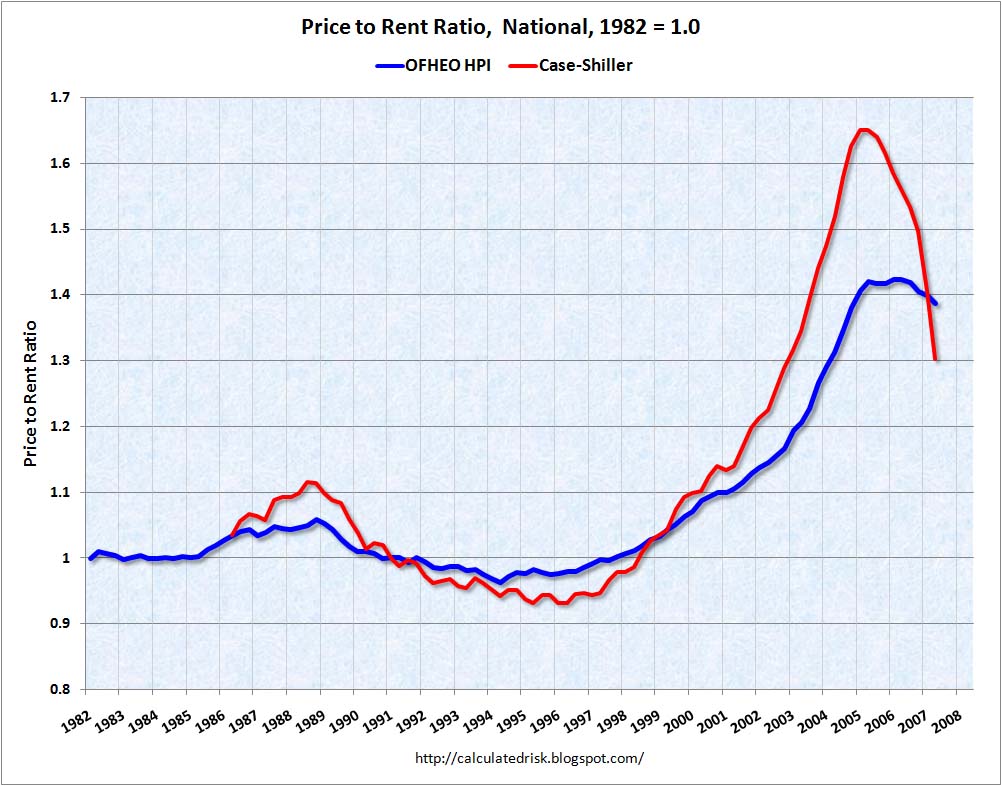

This is from CalculatedRisk:

Remember, I think that the rent/price ratio is THE most important measure of real estate valuation. I wrote about this in past years:

April 9, 2007: How Far Down for Housing Values?

March 19, 2006: How to Value Real Estate

Unfortunately, rent/price ratios are hard to come by, because they vary with each individual property. Thus, it is nice to have some sort of standardized rent/price ratio, here offered by the OFHEO and Case-Schiller. At least, it should be comparable to itself on a historical basis.

As you can see from this chart, we have a LONG way down to go before hitting average ratios around 1.0. Rent/price ratios will probably fall well below the 1995 lows, I think.

* * *

I think Obama is backing off some of his tax hike threats. He should pump up his tax cut plan, extending his “$50,000 tax free” plan for seniors to everybody. Here is some recent commentary on the candidates’ tax plans:

http://www.taxpolicycenter.org/UploadedPDF/411749_update_candidates.pdf

* * *

Winter is coming, and many people in the colder states are wondering how they can prepare their residences so that they consume less fuel in the process of heating. One of the cheapest/highest return on investment things you can do is to use thermal paint. Not many people know about this. Thermal paint uses tiny glass spheres, which reflect infrared heat, much like aluminum foil. Infrared reflectivity for thermal paint can be as high as 90%. However, it looks like normal paint. In fact, you can buy just the spheres and add it to normal paint in the designer color of your choice. Here’s a source:

This costs a whopping $12 for a gallon’s worth, and less in larger quantities. Some people report that using thermal paint reduced their heating fuel usage by up to 30%! It is especially good if you have a radiant thermal source, like a wood stove (as opposed to heated air for example).