(This item originally appeared at Forbes.com on January 25, 2019.)

“Stable Money” is one of the two components of what I’ve called the “magic formula” — the other is Low Taxes. Get these two things right, and a country often finds itself going from one success to another. Get them wrong, and a country often finds itself in stagnation and decline, no matter what other advantages it may possess. “In Money We Trust?” is a new documentary for U.S. public television that should help bring the topic of Stable Money to a much broader audience. It is expected to run over a thousand times on public television stations; but if you don’t want to wait for it to show on your local station, you can also watch it online.

This must be the Golden Age of documentaries. The History Channel, the Discovery Channel, National Geographic and other such outlets require a constant flow of new material, which can later be found in the archives of Netflix or YouTube. Virtually any subject, from the development of submarines to the migration of monarch butterflies to the Battle of Hastings can be found explicated in beautiful, professionally-produced detail. The topic of money, however — one that is far more central to our lives than the mating dances of birds in Papua New Guinea, or the possibility that the Great Pyramid was built by extraterrestrials — has barely been touched. The only other documentary I can think of is Bill Still’s “The Money Masters” from 1996. Only 23 years ago. “In Money We Trust?” is based loosely on Money: How The Destruction of the Dollar Threatens The Global Economy — And What We Can Do About It (2014) by Steve Forbes and Elizabeth Ames. Ames also took part in writing this documentary, and I am happy to say that she did an excellent job with a tricky subject.

The talent assembled for this project is very impressive — enough to easily fill a ten-part series. I wish there was time to let people like Paul Volcker, Art Laffer, Mervyn King, Judy Shelton, Alan Greenspan, Jim Grant, Barry Eichengreen and Steve Forbes talk at length on these topics. (I had a small role in the project myself.) The United States’, and the world’s, history with gold-based money before 1971 is beautifully presented. It had taken World War I, a Great Depression, and World War II to break up the world gold standard of the past. The results were so unpleasant that the world’s leaders soon rushed to put things back together again each time. But in 1971 it dissolved, to general horror, in the middle of blue-sky prosperity and eager international cooperation. The results were, as before, unpleasant: the “stagflation” of the 1970s, followed by many dubious outcomes since then described in the documentary. We haven’t been the same since. In the past, people fixed the problem; and when the problem was fixed, things got better. Today, we seem content to mill around aimlessly and suffer what, it seems, we have decided we must suffer.

I think the documentary ends on a little bit of a weak note. This reflects our present situation. We have had a very strange situation regarding bond yields for some time now (negative interest rates!), and various other sorts of oddities roundly ascribed to central banks. The path back to “normalcy” might not be an easy one. But, nevertheless, there have not been a lot of complaints about either “inflation” or “deflation” in the last few years. These kinds of monetary concerns are not front-and-center at this time.

The dollar was not destroyed, as Forbes’ 2014 book warned might happen. But you have to remember what things were like then. The dollar’s value had fallen from around $270 per ounce of gold (or 1/270th of an ounce of gold) in 2001 to around $1900 in 2011, and it looked like it was ready to fall further. Along the way, the price of oil rose from $20 a barrel to $140, copper rose from $0.70 per pound to $4.50, and the housing market bubbled and went bust. The Federal Reserve had had zero percent interest rates for years, and in late 2012 began a third round of “quantitative easing,” its most aggressive yet. The first two rounds, “QE1” and “QE2,” in 2009-2011, resulted in big declines in dollar value.

Instead, I think warnings like those from Forbes were heeded. I myself, in 2011 and 2012 especially, was invited to speak at the kind of mainstream venues in Washington D.C. that rarely give a space to gold standard fans. The grownups in Washington knew things couldn’t go on as they had, or there would be big trouble. The result of this, as I see it, was the “Yellen gold standard.” The dollar was stabilized vs. gold, around $1250/oz. That this was accomplished alongside “QE3” and interest rates at zero is, perhaps, a testament to advances in central banks’ ability to influence market prices.

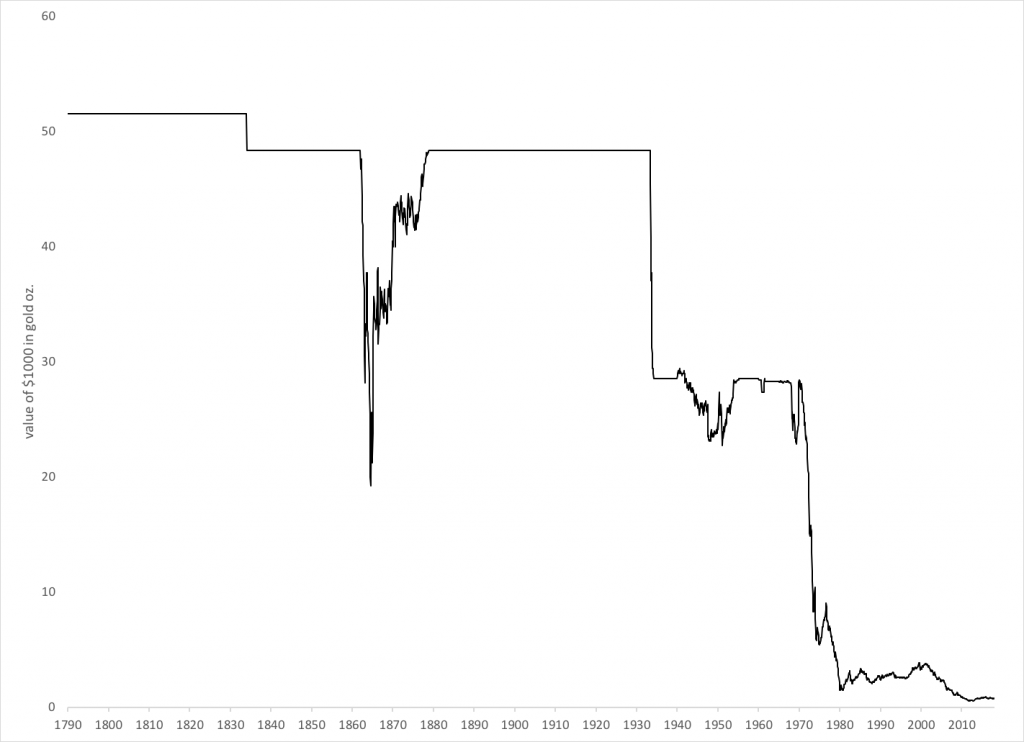

But this too shall pass. We’ve had periods of stability before — such as the “Greenspan gold standard” in the 1990s — but as we deal with the hangover from our low-interest-rate binge, along with longstanding issues regarding debt, deficits, entitlement programs and the like, another period of currency decline may commence. In 1970, the dollar was worth $35/oz. (1/35th of an ounce) within the context of the Bretton Woods gold standard system. Today, it is worth less than a thirtieth of that, and only about a sixtieth of its value ($20.67/oz) in 1930. If the next fifty years are no better than the last, the dollar will be worth less than a thousandth of the value vs. gold that it had during the Johnson administration. In the process, we would no doubt prove, once again, that “you can’t devalue yourself to prosperity.” No country ever has.

It’s time to learn about these things now, so that if we find ourselves again in the midst of crisis, we are not running around like brainless idiots blaming Arabs, as happened in the 1970s. For nearly two centuries, until 1971, the U.S. had Stable Money based on gold, and became not only the most successful country in the world, but perhaps the most successful country of all time. Now we wish we could be great again. We can — once we know how. “In Money We Trust?” helps to show the way.