(This item originally appeared at Forbes.com on April 26, 2019.)

For a long time, I’ve said that the issues addressed by Democrats are largely valid; the problem is their solutions. A typical Republican pattern has been to assert that the problems don’t actually exist. This has some merit (often the claims are exaggerated), but it has left a large political constituency underserved. I’ve noticed a promising new trend among conservatives, to offer conservative solutions to various concerns of the Left; or, to put it in terms of political strategy, to lay claim to the Democrats’ base.

Recently, I’ve been asked several questions about “income inequality.” The Left has been pushing this notion, from Thomas Piketty to Elizabeth Warren; it was a central argument of Communistic movements in the late nineteenth century. But we spent the last century experimenting with Leftist “solutions” to this — basically, since Russia’s Communist Revolution in 1917, which was mirrored, in the Capitalist world, with the introduction of income taxes with very high top rates above 50% during World War I.

We know now from hard experience that centrally-planned Communist approaches don’t work. There is no alternative to the free-market economy based on private property. We also discovered that high income tax rates on upper incomes, above 40%, don’t work. Throughout U.S. history, from the introduction of the income tax in 1913 to the present, the same pattern has emerged: the high tax rates aren’t paid. They generate no additional revenue, compared to what is achieved with lower rates, such as the 28% top U.S. Federal income tax rate of 1989. Obviously, if there is no revenue, you cannot “redistribute” that non-existent revenue; and indeed, no such “redistribution” has taken place.

These high tax rates do come at considerable cost, however, in the form of economic underperformance. Those who suffer the most from economic underperformance are those in the lower 50% of society. Between 1964 and 1986, the top Federal income tax rate in the United States fell from 91% to 28%. This entire movement was supported by the Democrats, who understood, in those days, that the working class cannot prosper with a weak economy; and a weak economy is the result of stultifying taxes. The first move, which reduced the top income tax rate to 70% (and all other rates reduced alongside) came in 1964, the “Kennedy tax cut.” The next move came in 1981, which reduced the top rate to 50%. This “first Reagan tax cut” passed the House with a vote of 113:93 in favor among Democrats. The “second Reagan tax cut” of 1986, which reduced the top Federal rate to 28%, passed the Senate 97-3, obviously including nearly all Democrats. Income tax increases since then, strangely, have been promoted by Republicans. The Bush tax increase of 1991 was followed by the Clinton tax increase of 1993. Clinton promised a “middle class tax cut” in the 1992 election — not a bad idea given the recession at the time. His turnabout, leading to a tax increase in 1993, has been blamed on the influence of Alan Greenspan, a long-time Republican deficit hawk (someone in favor of higher taxes to reduce deficits) who was then the Chairman of the Federal Reserve.

The average top marginal combined (payroll and income tax together, including State and Local taxes) income tax rate among OECD developed countries, was 46.6% in 2018 according to the OECD. The rate in the U.S., according to the OECD, is 46.0% (taking an average of State and Local taxes). It is true that the “tax burden,” or tax revenue/GDP ratio, is much higher in some European countries, but that is achieved with high VAT and payroll taxes — taxes largely on the middle class — and the revenue is not “redistributed” but rather goes toward government services. European governments, despite their high-tax reputation, actually have lower taxes on wealth and capital than the U.S. Until recently, corporate income tax rates were lower than the U.S., while taxes on dividends, interest income, capital gains, overseas income and inheritances were also generally lower. This advantageous treatment of business and capital, in Europe, helps ameliorate the economic effects of high VAT and payroll taxes.

Some have suggested taking this principle to its natural conclusion: to eliminate all income taxes, and rely entirely upon consumption-related taxes. This is the idea of the “FairTax,” a Federal sales tax that would replace all existing income and payroll taxes. I think it is a good idea in principle, although it would be a leap politically. In effect, it would be a return to a pre-1913 strategy, when the Federal government was funded with tariffs and excises, which are forms of sales taxes.

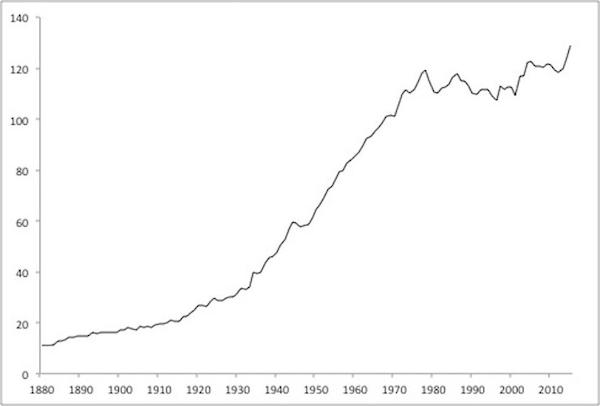

Anthropologists have found that every human society, beyond the simplest band of hunter-gatherers, has rich and poor. Just one step up in social development, we find the primitive “big man” tribes of the Pacific Northwest, where the wealthy competed by literally burning piles of blankets and other valuable resources in a fire, in a public display of “conspicuous consumption.” Even the poorest societies today, such as Haiti, have wealthy families; even Communist countries like the Soviet Union had winners and losers. The warlords of Somalia enjoy women and luxuries. George Washington was wealthy. Throughout the United States’ long rise from subsistence farming to industrial prosperity in the 1960s, successful businesses produced wealthy business owners. This used to be called “The American Dream.” A successful society inevitably includes a few extremely successful individuals. The problem is not today’s wealthy, but the main mass of Americans below the top 10% in income. Even by the government’s heavily-airbrushed statistics, median incomes in the U.S. have stagnated since about 1970. This is a real problem.

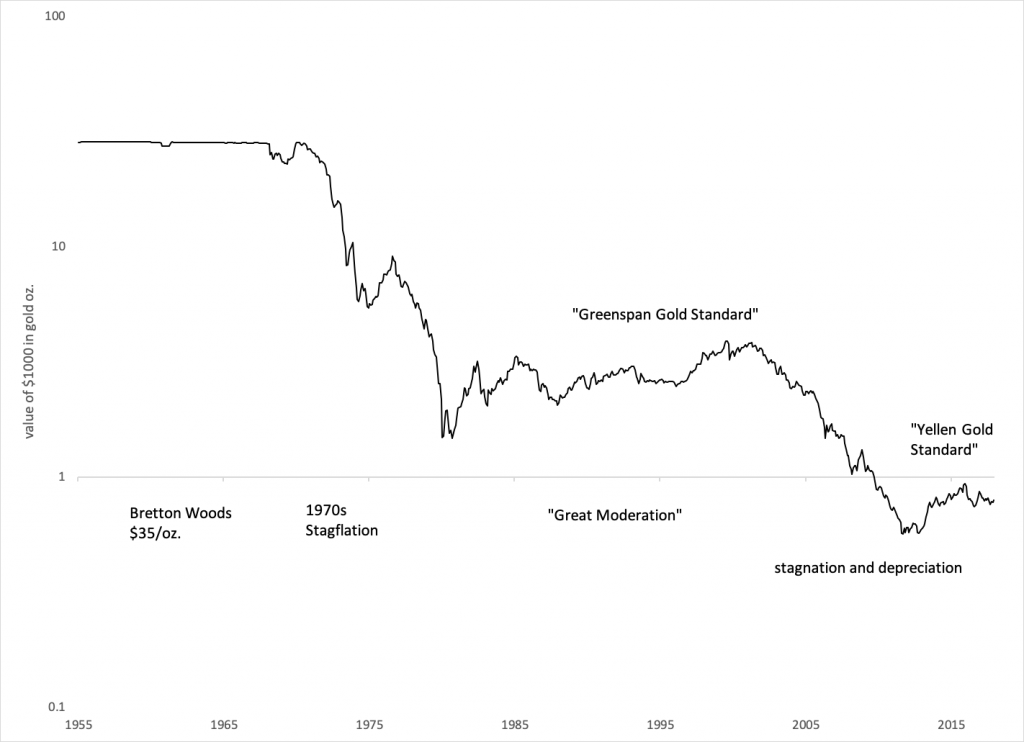

The solution must include what I call “the magic formula,” and which is the focus of my latest book, The Magic Formula. The “magic formula” is: Low Taxes and Stable Money. It is actually the same strategy that was pursued by John F. Kennedy (who, in addition to his tax reform plan, also supported the Bretton Woods gold standard peg at $35/oz.), and also Ronald Reagan in the 1980s. During the 1980s and 1990s, the “stable money” aspect was provided by the Carter-appointed Paul Volcker, who was succeeded in 1987 by Alan Greenspan, a long-time gold standard advocate. The value of the dollar was “strangely” stable vs. gold during his seventeen-year tenure. Greenspan himself has said that this was on purpose — I’ve called it the “Greenspan gold standard.” President Clinton, a Democrat who knew a good thing when he saw it, reappointed him twice.

If we look at what changed around 1970, that interrupted the nearly two-century rise in the income of the U.S. middle class, it was primarily Unstable Money. On August 15, 1971, the U.S. left the gold standard, the Stable Money principle that it had embraced for most of the previous 182 years. The value of the dollar fell from is official parity of $35 per ounce of gold in 1970 to a plateau around $350/oz. in the 1980s and 1990s, one-tenth of its previous value. It then fell again in the 2000s, and today is worth less than a thirtieth of its value during the Kennedy administration. This has consequences. Obviously, nominal wages would have to rise more than thirty times just to break even; and this hasn’t happened. Taxes today are, arguably, not much worse than during the prosperous 1960s, but we still haven’t returned to Stable Money.

You can get a lot of other things right, but if you don’t have the Magic Formula, it won’t matter.

I am going to differ with some of my friends whose enthusiasm for “free markets” extends to open borders. I think that immigration, both legal and illegal, has led to substantial new “supply” of labor especially at the lower levels; and the natural result of this is lower wages and a more difficult environment for the lower 50% of native-born Americans. Mexico has always lain to the south of the U.S.; indeed, much of the West was claimed by Mexico until the 1840s. But immigration from Latin America was always minor until the Immigration Act of 1965 opened the doors. These legal changes have been accompanied by a wave of illegal immigrants on top of that. One thing we know for certain is that the lettuce growing in California will be harvested; no giant agribusiness is going to let it rot in the fields. But, it might cost more to get an American citizen to do it. In other words: higher wages, and higher employment of American citizens. Is life hard in Latin America? Probably. My suggestion for Mexicans is: Make Mexico Great Again. If El Salvador embraced capitalist principles and became as wealthy as Singapore, I would cheer. I would even volunteer to tell them how to do it (hint: The Magic Formula).

Higher up on the pay scale, the only rationale for the flood of foreign computer programmers and tech experts on H1-B visas has been their lower cost. Claims that U.S. universities and technical schools could not meet the demand for computer programmers, out of a population of 330 million, are absurd. But, you would probably have to pay them more.

Today’s very low savings rate, and high consumer indebtedness, is also a problem. Savings rates are an average: some people with much higher savings rates are matched against those with “negative savings,” or increasing consumer debt. Efforts to make housing “affordable” via oversized mortgages for oversized houses, and the recent explosion of Federally-promoted student loans, have left large swathes of the population buried in debt. Before 1970, many States had laws banning interest rates above 10%; this helped subdue abusive use of credit cards, and eliminated usurious “payroll” lending. Some States today may wish to introduce laws that require minimum credit card payments to amortize existing balances within twelve months.

Here we might have something to learn from Mexico. Mexican homes are modest in size; but, with little access to easy mortgages, the homeownership rate in Mexico is 80%, and only 13% of those homes have mortgages. The homeownership rate in India is 87%.

When we look at promising ways to increase the prosperity of the American middle class, and less-than-middle class, we find that they are the same ways that created U.S. prosperity for nearly two centuries before 1970. Mostly, this is the Magic Formula: Keep taxes low, and money stable in value. “The chief business of the American people is business,” said President Calvin Coolidge in 1925; he reduced the top income tax rate from 50% to 25%. It is still business today. Once we get that right, we can add more as well. In the century since 1913, we proved that the typical Leftist program of higher taxes, money manipulation and socialist control doesn’t work. It won’t work in the future, either; and I hope we are not so stupid that we will require another century of failure to prove it, again.