Let’s Take a Look at the People’s Bank of China

September 29, 2013

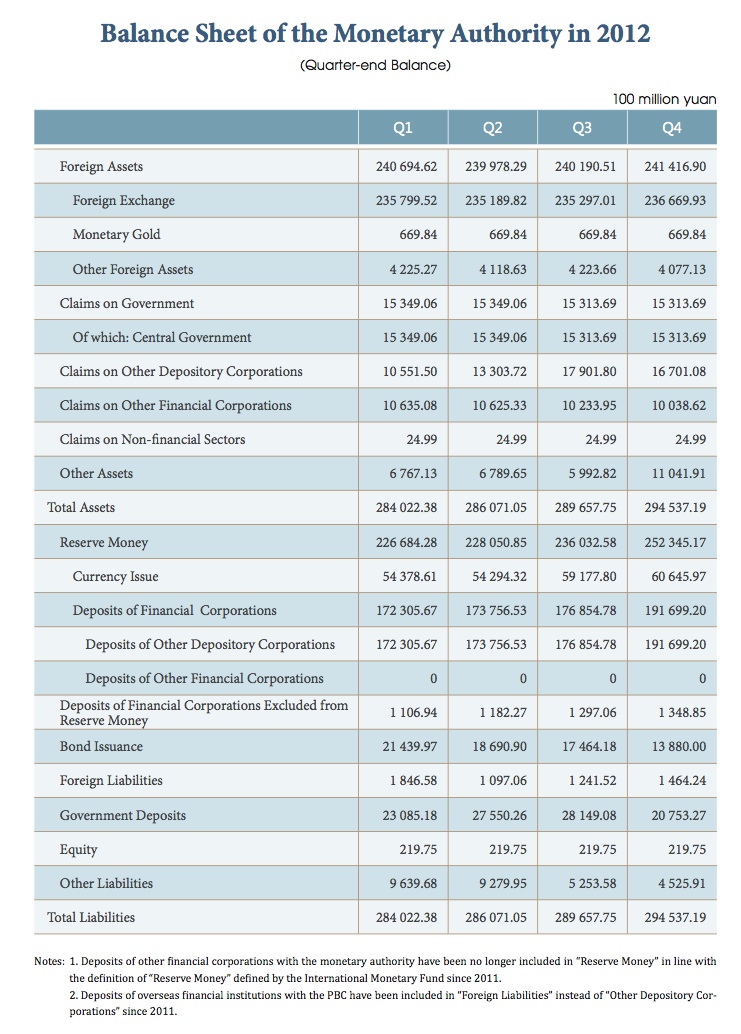

I thought I’d take a look at the balance sheet of the central bank of China, the People’s Bank of China. This is from their 2012 Annual Report.

http://www.pbc.gov.cn /image_public/UserFiles/english/upload/File/20130828-2012年报英文最终 8.8.pdf

Here it is:

What do we see here?

First, the reserve assets are almost entirely foreign assets. There are some government bonds (and perhaps direct lending), although this is actually less than domestic lending to financial institutions.

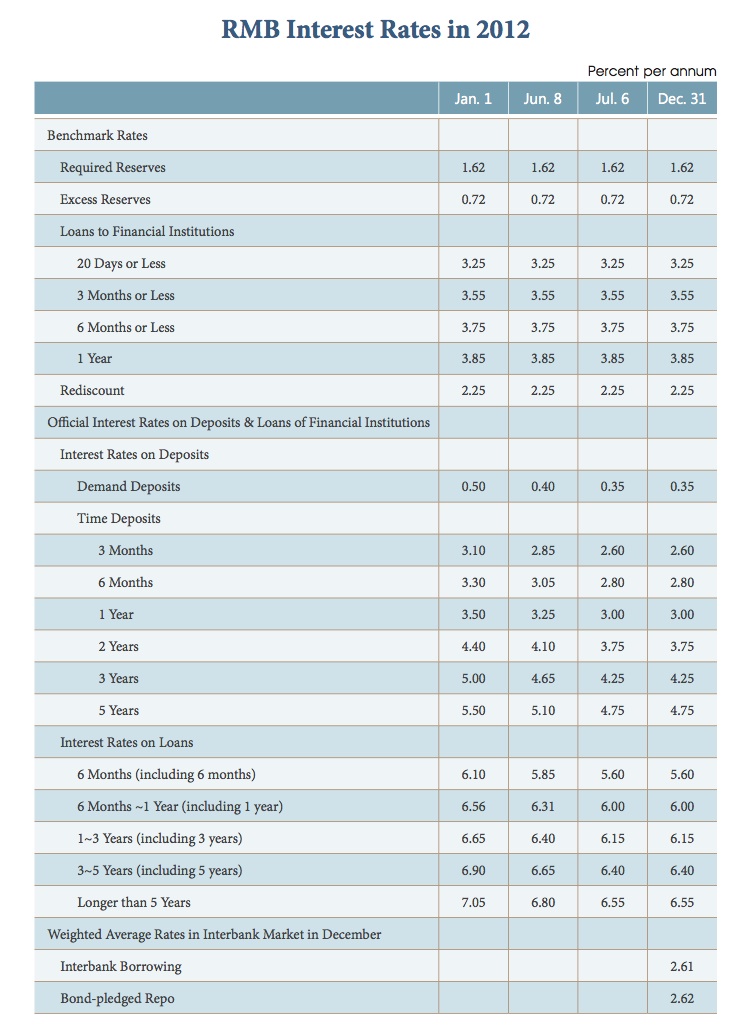

On the liabilities side, we see that the great majority of liabilities are the deposits of financial corporations. These are “bank reserves,” a form of base money, although it is possible that they pay interest here. Indeed, it appears that is the case. The interest rate on “required reserves” was 1.62% at the end of 2012, and 0.72% on “excess reserves.” Both are above the rate on deposits (0.35%), so the banks have a positive spread on holding deposits at the central bank, with no risk. Also, the rate on interbank lending is rather high (about 3.50%), so banks would rather not have to resort to that option for liquidity.

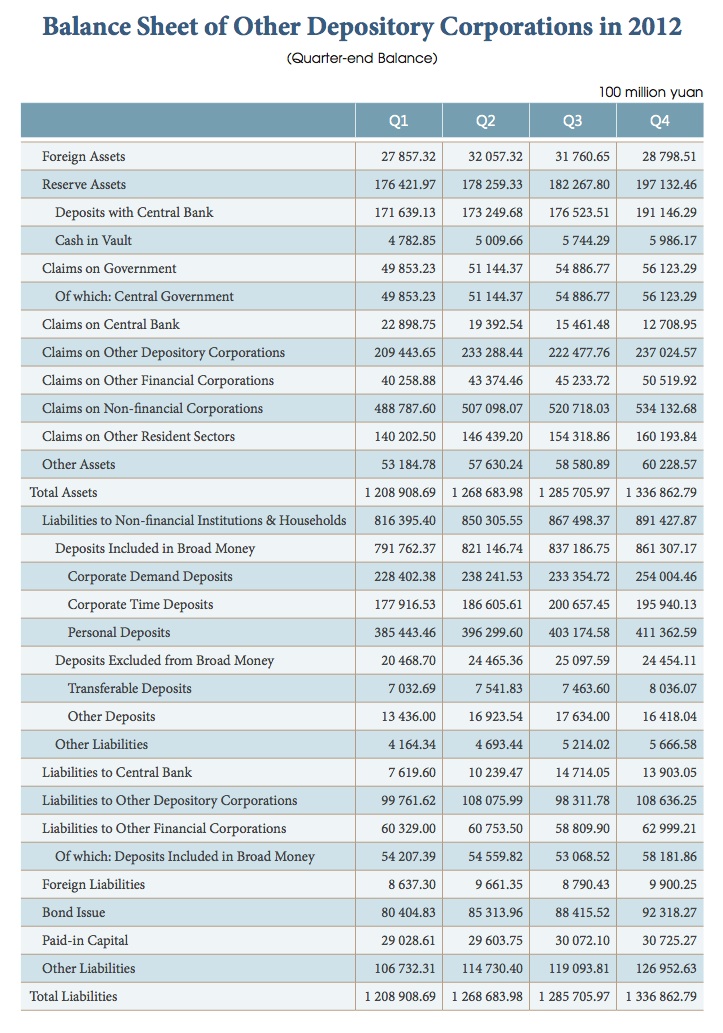

A look at commercial banks’ balance sheet shows that reserves (at the PBOC) are about 15% of total assets. This is a high number, but not a silly one.

China’s central bank does a lot of maneuvering with the reserve requirement ratio, which was 20% for commercial banks in May 2012. This is probably 20% of lending, not 20% of total assets. As a percentage of lending, reserves were 20.08% of lending (i.e. “claims on depository/other financial/non-financial/other resident sectors”) as of the end of 2012.

All in all, an interesting way of doing things.