(This item originally appeared at Forbes.com on July 10, 2020.)

There’s nothing new about “modern monetary theory.” And, actually, a lot of it is true. You can print all the money you like — that is, increase the supply — as long as there is a corresponding increase in demand, and the result will be a currency of stable value. Between 1775 and 1900, the dollar base money supply of the United States increased by an estimated 163 times, but the value (vs. gold) was nearly unchanged. That’s right — a 163-times increase in the quantity of money did not result in any change in the value. But, this was spread over 125 years, a time when the United States experienced enormous economic growth.

Things get tricky when the supply is increased in excess of demand, leading to a decline in currency value. This can come about from two ways: a dramatic increase in supply, or a dramatic decrease in demand. A “dramatic decrease in demand” is sometimes called a “loss of faith,” and commonly happens when a currency loses value (on the foreign exchange market for example), and there is no coherent official response; or, the official response is actually in favor of the decline. Who would want to hold that currency? Obviously, nobody. Thus, demand collapses; and the currency’s value falls. This can happen even when supply is unchanged. This is what happened during the 1933 dollar devaluation in the U.S., or the collapse of the Thai baht in 1997-98. (I look into many such episodes in my book Gold: The Monetary Polaris.)

We have been in a time when there has been a huge increase in the supply of dollar base money by the Federal Reserve; and also, a huge increase in demand, leading to, on balance, a modest decline in currency value, but not too much yet. This “money printing” is basically pure profit for the government and central banks, so of course they are emboldened by this, and are willing to accept whatever arguments are at hand that say that they can do more of this — which we now call “Modern Monetary Theory.”

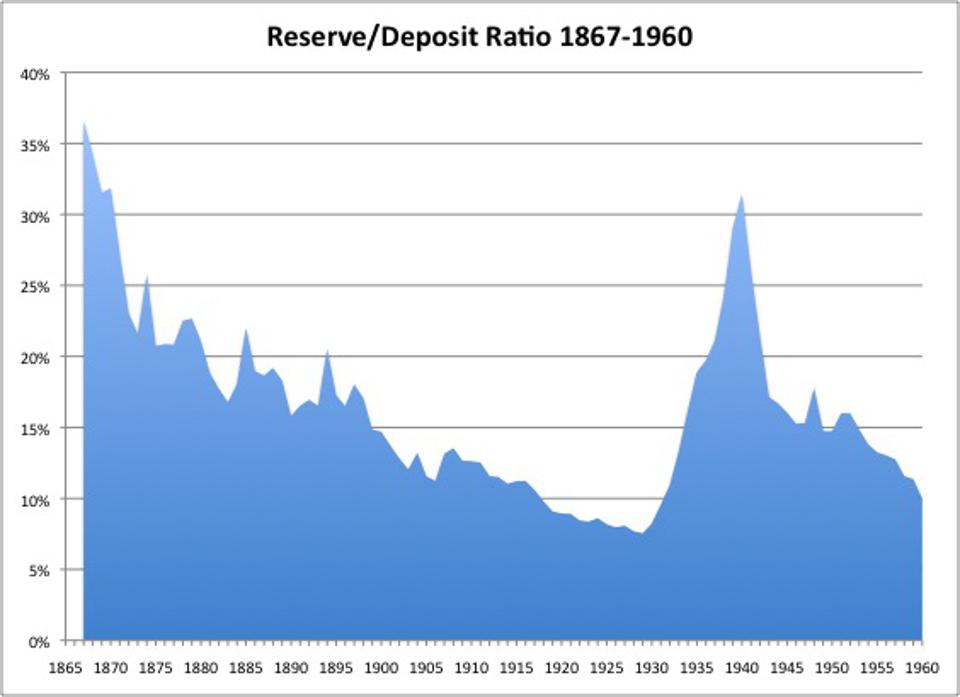

In the past — basically, between 1870 and 1960 — banks used to hold a lot of “cash” on the balance sheet. These were “bank reserves,” or deposits at the Federal Reserve, a form of base money. Commonly, this was about 10% of deposits, rising even to 30% in times of turmoil like World War II. When depositors come to the bank demanding to be repaid, this is what the banks would repay them with.

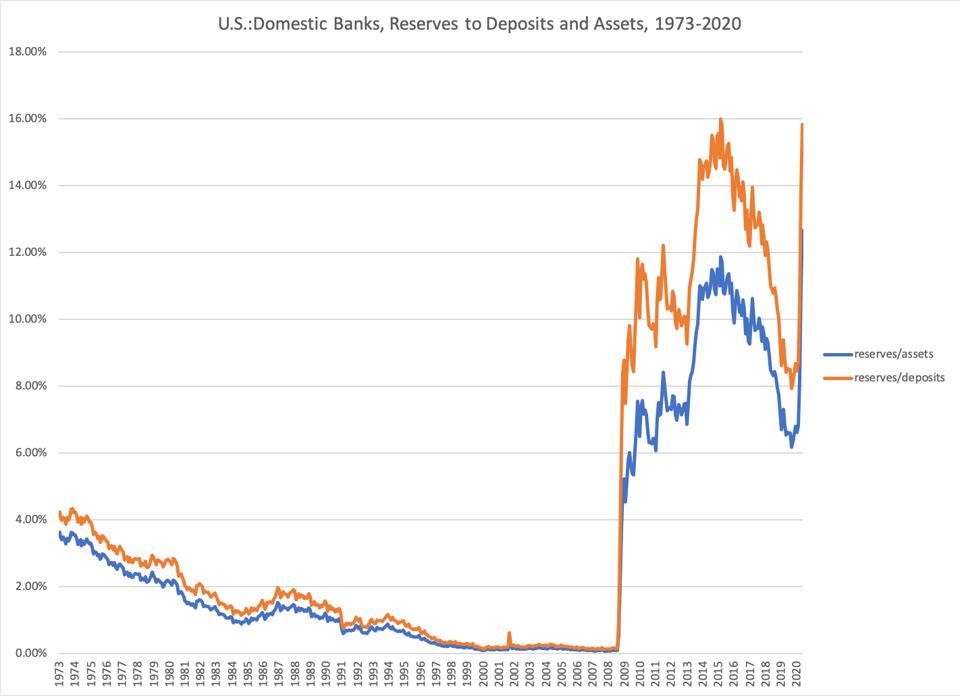

Between 1960 and 2007, banks gradually substituted short-term lending for this “cash” (bank reserves at the Fed), which provides interest income, and increases profitability. This got to the point, in 2007, where banks hardly held any real cash at all. Think of it like having a debit card in your wallet instead of $200 of banknotes. It works — as long as the bank issuing the debit card is willing to make the payments. But, in 2007, this didn’t work anymore. Banks decided that they needed to bulk up on real money, or “bank reserves” at the Fed. At first, in the 2008 financial crisis, bank borrowed this cash directly from the Fed at the “discount window.”

But, this was never intended to be a long-term mechanism, while banks really did intend to adopt their new high-cash policy for the long term. This was codified in the Basel III regulations agreed to in late 2010, and phased in over a series of steps until 2019. This new base money has to come from somewhere, and it came from the Federal Reserve purchasing and monetizing Treasury debt. It looked like the Treasury could just issue debt and it would be bought with the Federal Reserve’s “printing press,” and in fact this is basically what happened. Since most people (I mean 99%+ of economists) don’t really understand the mechanisms involved, they made some hazy new theories to explain this, now known as “Modern Monetary Theory.” The overall result was the value of the dollar went from about $1000 per oz. of gold in mid-2008 to about $1250/oz. in 2013-2018, which is some loss of value vs. gold but not a whole lot.

The point is, we have enjoyed a period of “free money” as the base money supply has expanded (since 2008) to meet the new demand for base money “bank reserves” from banks, which have returned to a conservative 1950s-style balance sheet. This was a one-time historical adjustment.

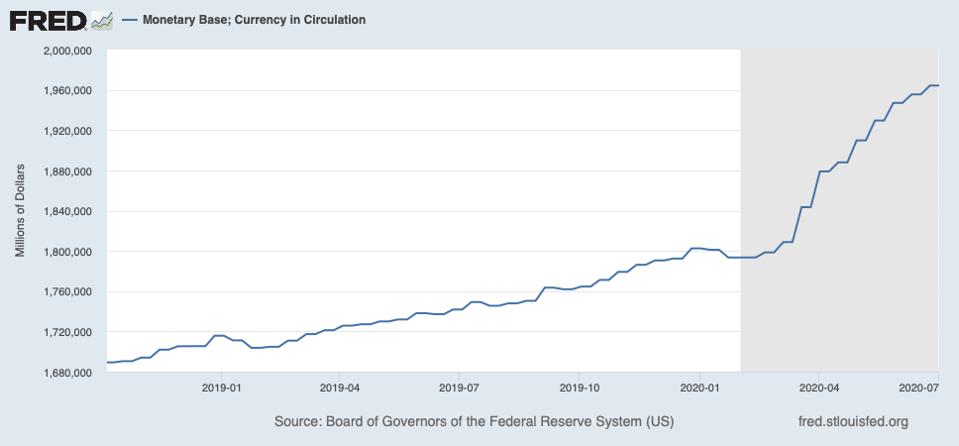

I mentioned earlier that it was typical for banks to hold about 10% of their assets in the form of “cash” (base money in the form of “bank reserve” deposits held at the Federal Reserve) during prosperous times. But, when things get iffy, banks will often wish to hold higher levels of reserves than this. They want safety, not profitability. In extreme cases (Civil War and the Great Depression/World War II), banks have taken their reserve holdings as high as 30% of assets. At the same time, individuals feel the same way about banks: they would rather hold banknotes, rather than a bank deposit which may go kerflooey. So, in a crisis, banknotes in circulation rises.

Once again, we have a rise in demand, this time in response to the crisis conditions; and to meet this increase in demand, the central bank has to increase supply, or “print more money” via the purchase typically of government bonds. Again, it seems like we can print money and get away with it — and in fact this is absolutely true. Actually, if the central bank didn’t meet this increase in demand with an increase in supply, a “shortage” would result, with possibly dire economic consequences. So, they actually have to do this. The “Modern Monetary Theory” people become very popular. To politicians, it seems like there is no longer any constraint on government spending.

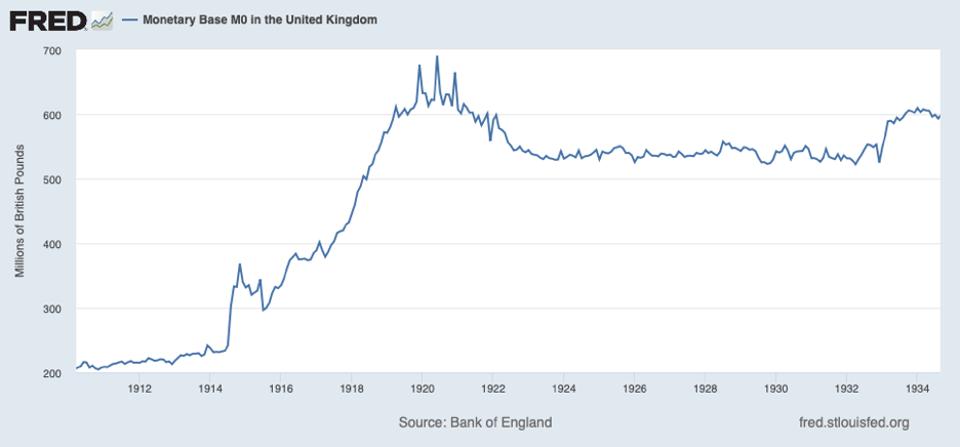

In the past — during World War I in Britain, and the Great Depression/World War II in the U.S. — this crisis-induced increase in base money demand allowed central banks (the Bank of England and the Federal Reserve) to increase the base money supply by about three times (bank reserves from 10% to 30%), without a significant loss in currency value. There was some decline in the (then-floating) pound and dollar, but not enough to bother people very much in a time when they had a lot of other things to worry about.

Today, this tripling would take base money from about $3.6 trillion in 2015-2019 to, potentially, around $10.8 trillion, an increase of $7.2 trillion. (The base money supply was recently around $4.87 trillion.) In other words, printing another $7.2 trillion of free money out of thin air — possibly without a lot of consequences. Woo hoo! Morgan StanleyMS said recently that this figure will likely be hit before the end of 2021, based on present policy expectations.

It is worth noting that these dramatic increases in central bank balance sheets during past crisis periods (World War I and World War II) took place within the context of the gold standard. The value of the currency — British pound and U.S. dollar — was not supposed to change, compared to gold. These kinds of dramatic increases in money supply, to accommodate dramatic increases in demand during crisis periods, is entirely compatible with gold standard principles.

In practice, the British pound and U.S. dollar floated from their golden anchors during this time. But, this was unofficial: neither the British pound or U.S. dollar was “officially” devalued from their gold parities during either of the World Wars. And, at the wars’ conclusions, both currencies were returned to their prewar gold parities, more-or-less as promised. So, people’s “faith” in their currencies turned out to be correct. They did not suffer any permanent devaluation. This “faith” (or really, rational expectation) naturally results in higher “demand”: you are more willing to hold something that you trust.

Not only did Britain and the U.S. both return to the gold standard, at prewar parities, in the 1920s and 1950s. They also dramatically reduced wartime spending, and had budgets that were pretty close to balance. There was no need to “print money” to fund budget deficits.

Look at our conclusions thus far: you can “print out of thin air” potentially $7.2 trillion of fresh new money, with no consequences and even while abiding by a gold standard system, under certain “crisis” conditions, when people’s “faith” (rational expectations) in the currency’s reliability is sound. But, a currency can fall out of bed and crash to a third of its prior value, even with no increase in the supply of currency, when people lose this “faith” (they rationally expect that the currency managers will allow the currency’s value to fall with no support).

This is pretty weird. But, that is what actually happens in the real world.

Now let’s look at where we are today. We have had a COVID-induced crisis which has led to a natural increase in base money (bank reserve and banknote) demand. This increase in demand has allowed central banks to finance a spectacular amount of new spending, with deficits now on the order of 20% of GDP in the U.S. — a lot like wartime, actually. It seems like we can get away with anything now. Hooray for “Modern Monetary Theory”!

But as economic contraction dents tax revenue, while at the same time long-unresolved issues like entitlement expenses or State finances become acute, structural deficits on the order of 5% of GDP loom as far as the eye can see. There will be absolutely no interest in fixing any of this as long as you can get away with making it better by printing more money.

On top of that, a continuing weak economy, plus the sheer thrill of buying votes with printed money, will likely lead to a continuing stream of “stimulus” and economic support programs of one form or another, probably bringing deficits to the 10%+ of GDP range for a number of years.

The kind of discipline that led Britain and the U.S. to return to the gold standard, dramatically reduce spending and run budget surpluses after wartime — the kind of fortitude that made Britain and the U.S. world leaders — is nowhere in sight today. Instead, we have an increasing embrace of willy-nilly printing-press finance, justified by vague “Modern Monetary Theory” notions.

Eventually — I think the process is beginning now — this will lead to a “loss of faith” in the currency. This is when currencies can really implode. The test will come when there is some substantial and notable decline in currency value (vs. gold for example), and there is no corresponding response from the currency managers, to support the currency value via base money contraction for example. This has actually been happening a little bit, but will it continue? This base money contraction would mean putting at least a temporary end to government bond buying, which means no more printing-press finance and also, the bond market will find yields that reflect the real risks today. In other words, budget discipline and higher interest rates.

Smart money is thinking about this and concluding: Not gonna happen.

But their numbers are still small. It is when the broad masses “lose faith” in their currencies that things really start to move. This will likely come about due to the continued embrace of giant deficit spending financed by the printing press, and justified by “Modern Monetary Theory” notions that are just true enough to get people into big trouble.

I am guessing that this will happen in 2021.

But, I am not too concerned about that. Years ago, I figured that this would be the endgame, and there wouldn’t be much anyone could do about it. I am more interested in what comes afterwards, when the political consensus shifts from “printing money is fun!” to “never again!”

Societies do this over and over.

We may eventually conclude that we simply cannot leave money in the hands of “wise men.” Because, we saw where that leads. Ugh.

Then — and not before that time — we will be ready to return to money based on gold. Over centuries of history, the world’s most successful countries have had reliable currencies based on gold and silver. It is the only thing that has had long-term success.

This might come about because we end up in a situation where gold bullion is the only thing that people will accept in large-scale payment. It wouldn’t be the first time: the Ming Dynasty’s paper money scheme finally collapsed (in 17th-century China) when the military would no longer accept anything but bullion coins. For almost four hundred years afterwards, the Chinese refused any more paper fiat money experiments.

There have been three major crisis eras in American history — the Revolutionary War, the Civil War, and the Great Depression/WWII period. In each case, the currency was devalued and floated, even reaching hyperinflation in the Revolutionary period. In each case, the United States returned to a gold standard afterwards; and the long rise of the U.S. to world leadership continued.