We’ve been looking at various “interpretations” of the Interwar Period, which of course focuses on the Great Depression.

October 23, 2016: Nonmonetary Perspectives on the Great Depression 2: Steindl, Schwartz, and Eichengreen

October 16, 2016: Nonmonetary Perspectives on the Great Depression

Some of the conclusions thus far:

1) You can’t really get a “monetary deflation” unless there is a change in currency value. This can only happen in two ways: a rise in currency value vs. gold, or a rise in the value of gold itself. The first demonstrably did not happen; the second, though plausible, has not really been embraced by very many. We saw earlier that there is a reason for this: it is very hard to come up with any kind of supply/demand causative factor that might result in such a destructive and unprecedented event.

September 25, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s 3: Supply and Demand

September 18, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s 2: Never Happened Before

September 11, 2016: The “Giant Rise in the Value of Gold” Theory of the 1930s

2) Central banks had two complementary objectives at the time: to maintain their gold standard parities, and to prevent any kind of “liquidity shortage crisis” in the nineteenth-century meaning of the term, typically indicated by very high short-term lending rates between banks of high solvency. This they did rather well. People understsood that, which is why they say that there really wasn’t much that central banks could have done, while remaining on a gold standard system. They didn’t identify any kind of “central bank error.”

3) This was the basis of the common Keynesian interpretation, popular until the 1960s and still popular to this day. Keynes and his descendents (such as Peter Temin or Barry Eichengreen) are quite aggressive in suggesting a devaluation and floating fiat currencies, and perhaps interest rate manipulation, in response to the economic problems of the time. However, they did not blame central banks for causing these problems. Instead, they describe the onset as a “decline in aggregate demand,” which doesn’t really mean anything, but is not a monetary cause. They don’t really identify any clear cause at all. After a while, I think they were too scared to look for a cause, because that would invalidate a half-century of supporting a view in which there essentially were no causes.

4) After the 1960s, monetary “causes” become more common, in the model of Milton Friedman and Anna Schwartz. However, this “cause” is still not really a cause, but more of a reframing of the idea that central banks should have addressed the problems of the time with devaluation and floating currencies. Thus, the Monetarists are really not much different than the Keynesians, in the end.

What to make of all this?

I have been summarizing entire books of mostly confusing and fallacious argle-bargle in a few sentences. But, I want to show that these summaries have a basis, and indeed, that they coincide pretty closely with the conclusions of other academics who have also summarized the course of argument spanning decades. I am not really very far out of consensus on these topics. Mostly, I just like to use clear language so you can tell what I am saying.

Maybe you share my disappointment with these supposed “experts,” who complain for decade after decade that the “it just happened and we don’t know why” story is a little skimpy. But, do they then go an try to find some kind of explanation, even a stupid and wrong explanation? Nope. Even Friedman, whose popularity seems to be related to the fact that he satisfied this burning desire for some kind of explanation, doesn’t actually provide anything. Why did M2 decline in the U.S. 1929-1933? Why did M2 decline in Greece in 2010-2015? Friedman’s “explanation” is really more in the nature of a suggested solution, and it is really the same solution as the Keynesians, with a little different verbiage surrounding it. For Friedman too, the downturn is a “deus ex machina, lowered from the rafters.”

The basic problem here, as I see it, is the “Tyranny of Prices, Interest and Money,” which scrubbed all nonmonetary elements of government policy from economists’ models and minds beginning in the 1870s. This was related to the small-government consensus of the day, with no income taxes in the U.S., and a 3% income tax in Britain. Nonmonetary factors really were somewhat minor, in the 1870-1913 period. Once you eliminate nonmonetary factors from your consideration, then if there is a downturn caused by nonmonetary factors, and no particular problem with the money, then you either see “a recession from nowhere” like the Keynesians, or you make up some monetary factors, like the Monetarists and others. The Keynesian view tends to be held by people who like big government in general. The solution to a problem of “capitalism that blows up for no reason” must be some kind of government intrusion. However, if you are more of a small-government person, you are then drawn to the idea that the government was making a mistake, or was somehow too intrusive. Since there was no obvious government intrusion into Prices (such as price controls) or Interest (capital markets), the only option left, when you are in the Prices, Interest and Money box, is money. Thus, some kind of mistake with the Money, caused by government intrusion (“Austrian”) or a government that wasn’t doing its job properly (“Monetarist”).

July 10, 2016: The Tyranny of Prices, Interest, and Money

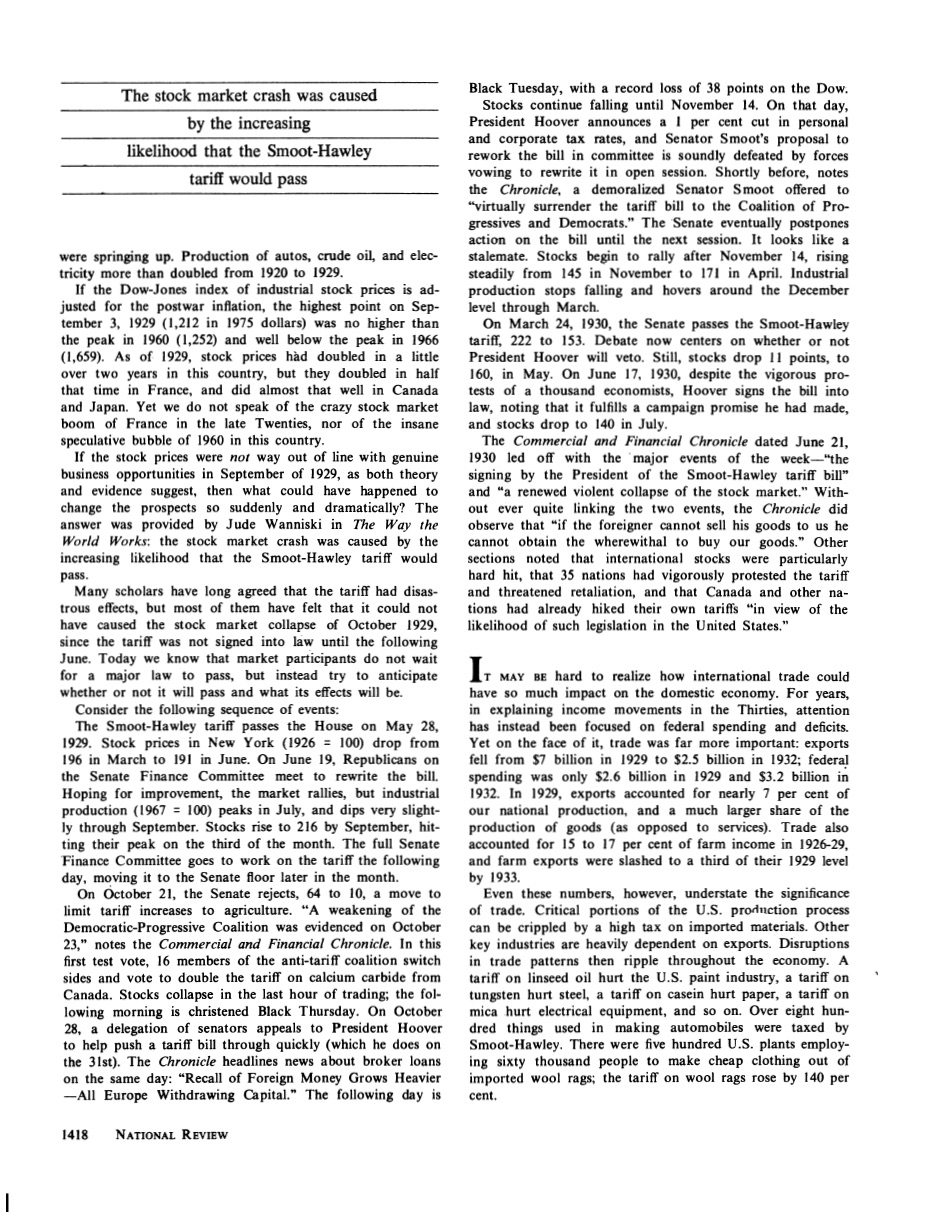

Over 1000 U.S. economists opposed the Smoot-Hawley Tariff, which gained majority support in Congress in September 1929 and was passed in 1930. And yet, when exactly the results they predicted indeed appeared — basically, a recession in 1930 — they sort of forgot about it. Part of the reason why was because the small-government conservatives of the time (the Republican Party) tended to favor a tariff as big-business protectionism, and they also saw protectionism as an appropriate anti-recession tool. The Democrats had been tariff opponents, but the idea that capitalism was “inherently unstable” and had to be tamed by Big Government was an attractive idea at the time, and perhaps not one that they wanted to undermine.

Here is an interesting little account of that letter, the one signed by the 1000+ economists. It includes the full text of the letter.

In the 1970s, the Supply Side group was rallying around the idea that the existing tax policy was a major impediment to economic expansion, and that reforms here could lead to big improvements — ancient wisdom that had become a radical new idea in those dark days of economic confusion. They looked back to the Kennedy 1964 tax cut and the Mellon tax cuts of the 1920s for historical examples. From this, it naturally follows that tax rate increases can be a big economic negative. Looking back, they found the huge tax hikes of the 1930s, not only in terms of tariffs worldwide (a tax on international trade), but also big domestic tax rate increases, especially in the U.S., Britain and Germany, although also around the world among all those countries whose governments followed the policy direction of the U.S., Britain and Germany, just as they do today. We’re not going to investigate the tax policy history of Brazil, Australia, Canada, Mexico, Spain, Italy, Turkey, South Africa or India, but it was probably a lot like Britain, Germany and the U.S., and thus added to the cumulative effect. On top of this were a barrage of business-unfriendly regulations, and a general anti-business tone to government in general, which hardly inspired anyone to invest money. The monetary turmoil that emerged in 1931 added a new factor.

All of this is a topic that is far too large to go into here — especially since I think it needs to be written on a global scale, including fiscal policy in many countries, and also the wave of sovereign defaults and bank breakdowns in 1931. Amity Shlaes’ The Forgotten Man: a New History of the Great Depression (2008), promises to be that in-depth examination, at least as regards the U.S. However, I can’t quite recommend it, because I haven’t read it yet. Maybe I need the comic-book edition.

June 27, 2010: U.S. Tax Hikes of the 1930s

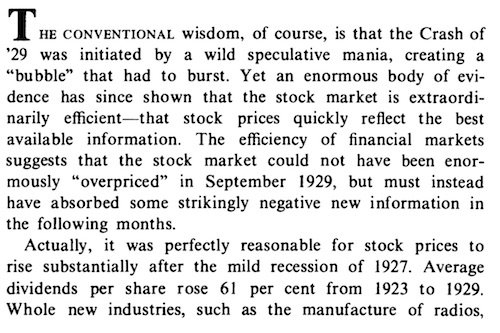

Nevertheless, the coincidence of the 1929 stock market crash and the moment when the Smoot-Hawley Tariff gained a majority in Congress is a historical synchronicity of such rare perfection that it deserves attention. Here is Alan Reynolds on the topic, in 1979 — thirty-seven years ago, if you can believe that.

http://object.cato.org/sites/cato.org/files/articles/reynolds_speech_19791109.pdf

The paper also has many other insights, and I recommend reading all of it.

Well, that is certainly a sufficient cause, at least for the initial downturn (1929-1930) of the Great Depression, and also (combined with the rather excessive margin leverage common at the time) the stock market crash of 1929. As Reynolds said, a great many other policy mistakes followed, plus “systemic issues” such as bank failure and sovereign default, plus the monetary chaos that followed the devaluation of the British pound in 1931. So, it is not about the worldwide tariff war alone. But, that seems to have turned the booming 1920s toward the initial bust.

Finally, nonmonetary factors again enter the picture, after having been scrubbed a hundred years previous. This didn’t make much dent in academia, however. But, academia had always been about repeating received dogma for generation after generation. Temin clearly felt that the Keynesian explanation — the explanation resulting from forty years of repeated dogma — was unsatisfying. But did he try to remedy it … to somehow assuage his dissatisfaction? Not really. Friedman’s assertions somehow attained the status of new dogma, perhaps reflecting the structure of the left-right divide of politics in general: the right needed its own dogma. (This left-right divide is in turn a product of the U.S.’s winner-take-all Congressional representation system, instead of parliamentarian proportional representation.) Yet, this dogma too was repeated for decade after decade, without much interest in probing its obvious inconsistencies.

The Keynesian idea was that there was something like a minor recession, with no clear cause, that somehow “multiplied” itself out of hand. The logical conclusion was that capitalist economies can somehow self-destruct on any sunny day. That this had never happened before didn’t bother them; but, as we know, not very much of anything bothers them. All of Keynesianism was never really a conclusion reached by carefiul reasoning. It was always, from the beginning, a plausible-sounding justification for doing something that people just wanted to do anyway. The natural solution was contant government intervention or “management” to prevent any little thing from snowballing into a disaster. This led to the idea of constant manipulation of currencies and interest rates, not just as an emergency measure during a once-a-century crisis, but at any threat of recession. A similar conclusion was reached, albeit from a different direction, from the Monetarist standpoint. Central banks had to stand ready to “stabilize the money supply,” which was a rhetorical smokescreen for saying: to prevent any contraction in bank credit, which is a common element in any recession. This also required constant central bank intervention, and thus implied a continuous floating currency, not just a one-time devaluation in the midst of disaster.

However, if a once-a-century disaster can be shown to be caused by an identifiable once-a-century cascade of bad economic policy, then we can conclude that capitalist economies are not constantly on the brink of self-destruction. Even if you argued that things had gotten to the point, in 1933 or even 1931, where a devaluation of the dollar was justified (and a return to a gold standard at a devalued rate afterwards, as the U.S. did), this did not naturally lead to the conclusion of constant central bank currency manipulation, and floating currencies.

July 17, 2014: Devaluations of the 1930s Don’t Justify Today’s Funny Money Excess

Also, we don’t have to make up spurious monetary explanations. Once you do that, then not only are you completely ignorant of nonmonetary factors — the Prices Interest Money box — but you have made a mess of your monetary understanding as well. This is dangerously close to being “good for nothing.” At this point, now you couldn’t even establish or manage a Stable Money system (a gold standard system) even if you wanted to. And that was the situation in the 1960s, continuing up to the present. People’s understanding of monetary issues was pretty good in the 1920s and 1930s. It had some flaws, and was clearly on a path of deterioration, but I think they got to the right conclusion: that there was no monetary problem. To later imagine that there was a monetary problem, people had to somehow forget all that they knew earlier — the learning that formed the basis of the gold standard systems of the day.

This is the reason why I have spent so much time this year draining the swamp of “interpretations” of the Great Depression. Until the gold standard advocates can sort through these issues, I think they will tend to have a rather dysfunctional grasp of all things pertaining to money. Also, maybe some Keynesians and Monetarists (who have actually mushed together somewhat) might begin to see that things have really moved on since the dark days of the 1960s (or 1990s). They don’t have to be like Temin or Eichengreen, who grumble that their received Keynesian dogma really is an empty paper bag … but … dogma is dogma, and there doesn’t seem to be anything better, so let’s be dogmatic about it.

I think Temin and Eichengreen both saw enough to understand that Monetarist dogma was even more empty. Temin — correctly, I would say — interpreted Friedman’s “monetary contraction” as something like a banking collapse; in other words, a nonmonetary event. Eichengreen could see that Friedman’s claim that central banks should have done this or that was not really possible, because central banks were committed to a gold standard policy. In the land of the blind, the Keynesians had one eye. So, maybe they will be the first to step out of the Prices Interest Money box.