Oil Continues to Rise Because the Dollar Continues to Fall

March 1, 2012

(This item originally appeared at Forbes.com on March 1, 2012.)

http://www.forbes.com/sites/nathanlewis/2012/03/01/oil-continues-to-rise-because-the-dollar-continues-to-fall/

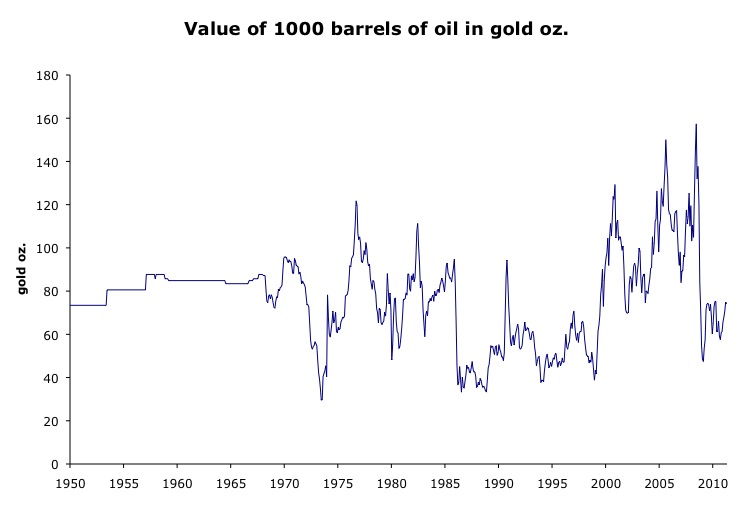

The primary reason that crude oil today – Brent is at $123 per barrel – is higher than its prior average around $20 in the 1990s, or the $3.00 of the 1960s, is that the dollar has lost value over that time. It doesn’t have much to do with crude oil itself. Today, an ounce of gold would buy about 14 barrels of oil. In the 1960s, it would buy about twelve barrels.

In 1960 dollars, which were worth 1/35th of an ounce of gold as per the Bretton Woods gold standard system, today’s oil would cost $2.51. It appears that oil is actually cheaper today than it was in the 1960s. In 1925 dollars, which were worth 1/20.67th of an ounce, it would cost $1.48.

I’m not just hypothesizing. If you own a 1925 $20 Saint Gaudens gold coin, a regular part of the U.S. currency system in those days, in normal worn condition, you can actually trade it for about 14 barrels of oil today. The coin contains just short of an ounce of gold.

I’m happy to report that many people today are keenly aware of this notion. We have come a long way from the 1970s era “running out of everything” silliness, when oil’s rise from $3 to $40 was universally blamed on evil Arabs.

Actually, I give considerable credence to the “peak oil” theorists, who argue that world oil production will begin to drop off in coming years. This might become an issue in the future. However, the gold:oil ratio today shows that it is not yet a major factor for prices.

Oil takes on an outsized importance for a few reasons. Often, the negative aspects of currency devaluation are not felt directly at first. The currency might go from $1000/oz. of gold to $2000/oz. (a 50% devaluation), and it might feel great. The economy might have a noticeable pickup, unemployment could decline, and stocks might rise. With today’s level of general ignorance, nobody particularly cares what the dollar/gold ratio is.

This is the effect much loved by the Keynesian money-manipulators, which is why governments have experimented with manipulable floating currencies for literally millennia.

The negative aspects of the devaluation are generally felt first in commodities prices, and interest rates.

From this you might conclude that a government that wishes to engage in an “easy money” monetary policy, of the sort that leads to a decline in currency value, would take many steps to suppress the negative effects of their policy, in commodity prices and interest rates. Then, they would enjoy much of the apparent benefit (possibly a more ebullient economy) without the apparent disadvantages. In Nixon’s day, this was done with price controls. Things are a little more subtle today, although you could call the Fed’s action in the U.S. Treasury market to be akin to price controls.

Most people don’t feel “commodity prices” directly. When was the last time you bought bulk copper? Even foodstuffs, like wheat, are generally not purchased in that form by citizens. They go into processed foods like breakfast cereal. (People in emerging markets have a more direct relationship, as much of their diet can consist of cornmeal, plain flour and cooking oil.)

I think we have all been noticing the rising prices and shrinking package size in the supermarket. However, it is hard to have a discussion about it. The price of Wheaties is not enough of a shared experience, and too variable due to all sorts of extraneous factors, to be used as a benchmark for anything.

Thus, our political discussions tend to focus on that one commodity that we all use daily, and which is standardized across the country – gasoline. This serves as a proxy for all of our commodity-related expenses such as food and fuel, and, as the effects of currency devaluation spread, rising prices for all sorts of goods and services.

The fact of the matter is, currency devaluation makes people poorer. If a currency declines in value by 50%, and your wages do not rise by a corresponding 100%, then you are obviously getting paid less. However, it is usually not so apparent at first that this is the case. The way in which we get poorer is by rising prices such as those for gasoline, and a broad economic deterioration which is quite difficult to put your finger on exactly. It is obvious to anyone with their eyes open, though. Just compare New York in the 1960s (think of Audrey Hepburn in “Breakfast at Tiffany’s”) to the New York of 1980, when SoHo was a slum. Think of what cars looked like in 1965, compared to 1981.

People generally don’t complain about “rising prices,” when the reason for the rise is not currency devaluation, but rather the increasing prosperity and wealth of a country. People as a whole know that they are being slowly devalued into poverty by the Federal Reserve’s “easy money” policy. However, this topic is much too complex for most individuals, so they focus on something – gas prices – which seems more direct.

Before this is all over, I expect to see oil prices north of $1000 per barrel – perhaps in 5-8 years.

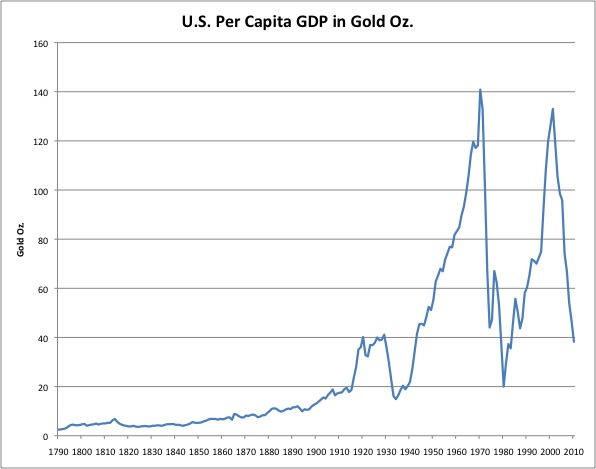

Our four-decade experiment with funny money, since leaving the gold standard in 1971, is producing all the expected results. It will probably get worse. Ideally, we will rediscover why the Founding Fathers of this country insisted that the currency be linked to gold. The U.S. followed that policy for 182 years, and became the wealthiest and most influential country in the world.

Stable money works. The floating currency experiment will eventually be revealed for what it is: smoke and mirrors, obfuscating our long downward trek into poverty.